稳定币——香港 VS 美国下一个“虚拟资产战场”

2024年初,一场数字经济领域的“大战”已悄然拉开。

1 月 11 日凌晨,美国证券交易委员会宣布批准现货比特币ETF,不过就在半个月前,大洋彼岸的香港已经抢先一步,在证监会官网公布《有关证监会认可的涉及虚拟资产的基金的通告》,正式宣布准备接受现货虚拟资产ETF申请,毫无疑问,虽然没有硝烟,但香港和美国之间的“虚拟资产战斗”已经开始。

事实上,虚拟资产ETF只是东西方在虚拟资产市场竞争的一道“前菜”,如今彼此间的“战场”又延展到了一个新领域,那就是:稳定币。

数据概览当前全球稳定币市场

现阶段稳定币市场中,市值占前九位的稳定币项目已占有超过95%以上的份额,而且都是挂钩美元的金融工具,“龙头”两家分别是:

(1)Tether发行的泰达币(USDT/Tether USD)

(2)交易所巨头Coinbase和高盛集团旗下的Circle公司发行的「美元硬币」(USDC/USD Coin)。

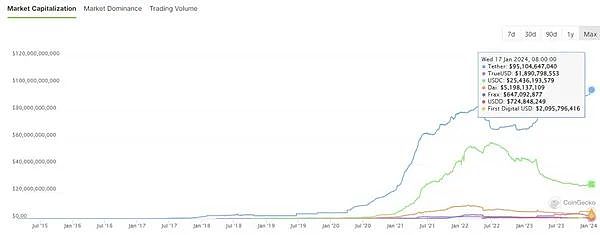

Koala考拉财经获取数据显示,本文撰写时全球稳定币市值大约为1350亿美元区间,而稳定币交易额则在600亿美元左右。目前市值超过10亿美元的稳定币“独角兽”项目有五个,分别是:

1、Tether:95,066,943,726美元

2、USDC:25,452,106,070美元

3、Dai:5,203,031,829美元

4、FDUSD:2,094,810,984美元

5、TUSD:1,887,941,499美元

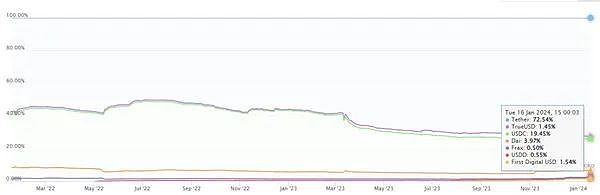

在市场占有率方面,Tether、USDC和DAI三个稳定币“霸榜”,市场份额分别达到72.54%、19.45%、以及3.97%,这三个稳定币的当前市场份额已经超过了稳定币总份额的95%。

稳定币,香港 vs. 美国下一个“虚拟资产战场”

上周四,路透社突然披露稳定币发行商Circle已秘密提交IPO申请,Circle没有透露计划出售的股票数量或新IPO申请的拟议价格范围。该公司表示,预计首次公开募股将在美国证券交易委员会完成审查程序后进行,具体取决于市场和其他条件。

无独有偶,Circle首席执行官Jeremy Allaire在本周二“突然”发声,表示美国今年通过稳定币法律的“机会非常大”,还指出全球范围内加密货币行业的监管发展正在加快,美国比以前更有可能批准稳定币法律,直言“我认为会看到的(出台稳定币法律)是美国财政部、美联储、国会两院的愿望,当然也是两党的愿望”。

就在同一天,香港政府新闻网披露财政司司长陈茂波在瑞士达沃斯参加世界经济论坛年会期间先后与两家分别从事金融科技及人工智能的企业代表会面,其中一家是全球第二大稳定币的发行商,虽然没有公开这家公司的名称,但众所周知,目前全球第二大稳定币发行商很可能就是Circle。陈茂波指出,自前年特区政府公布有关虚拟资产在港发展的政策宣言后,市场反应积极,有多家数字资产及第三代互联网公司已在香港落户。香港正稳慎推进数字资产的发展,并正就规管稳定币展开公众谘询,以订下合适的监管框架,推动有关行业负责任和可持续发展,欢迎以法定货币为基础的稳定币公司来港开展业务,为社会提供更多创新和便捷的金融服务选项。

实际上,为了维持香港国际金融中心的地位,促进香港虚拟资产生态圈可持续和负责任的发展,港府以监管的方式对稳定币的发行进行背书。去年底,香港财经事务及库务局和香港金融管理局联合发表了公众咨询文件,就有关监管稳定币发行人的立法建议开始收集意见。据悉,全球市值最大的稳定币运营商 Tether 尚未对稳定币咨询文件做出回应,但全球第二大稳定币 USDC 的运营商 Circle 表态支持,其背后意义不言而喻。

正如香港金管局局长余伟文所说,稳定币有机会成为传统金融与虚拟资产市场的介面,稳定币是否真正具备“稳定”的条件,就会变得尤为重要。整体来看,美国监管机构似乎一直采用的是“宽进严出”虚拟资产监管模式,也就是市场准入之前并不提供详细的制度说明,先把“口袋”打开,而后利用其执法权对违规行为和机构进行处罚。相比之下,香港监管机构则提供了一套较为完善的准入机制,监管模式也更加清晰、透明,其中不仅概述了对稳定币发行人、交易所和钱包服务提供商的一系列要求,还涵盖了风险管理、审计和投资者保护等方面,继而促进香港金融科技发展并吸引更多数字资产交易。

总结

稳定币正成为现有金融生态系统的补充,提供了可传输性、连续结算、可追溯性、跨境互操作性等一系列支持,未来香港和美国的稳定币市场发展将取决于监管环境、市场趋势和技术创新等因素,值得我们关注。

香港在发展稳定币监管制度、创新支付方法上有独特而重要的价值,我们应当汲取外地监管稳定币的经验,为对接全球金融体系贡献力量。

At the beginning of the year, a big battle in the field of digital economy has quietly started. In the early morning of March, the US Securities and Exchange Commission announced the approval of spot bitcoin. However, just half a month ago, Hong Kong, on the other side of the ocean, made a preemptive announcement in official website on the fund involving virtual assets approved by the CSRC, and officially announced that it was ready to accept the application for spot virtual assets. Undoubtedly, although there was no smoke, the virtual assets battle between Hong Kong and the United States has begun. In fact, virtual assets are only virtual assets between East and West. A foretaste of market competition, the battlefield between them has now extended to a new field, that is, an overview of stable currency data. At this stage, the stable currency projects with the market value of the top nine in the stable currency market have occupied more than the above share, and they are all leading financial instruments linked to the US dollar. The data obtained by Koala Finance, a giant of TEDA Currency Exchange and a company under Goldman Sachs Group, show that the market value of the global stable currency is about 100 million at the time of writing. In the US dollar range, the transaction volume of the stable currency is around US$ billion. At present, there are five stable currency unicorn projects with a market value of over US$ billion, namely US$ US$ US$ US$ US in terms of market share and the market share of the three stable currencies have reached respectively, and the current market share of these three stable currencies has exceeded the total share of the stable currency. Last Thursday, Reuters suddenly revealed that the issuer of the stable currency had secretly submitted an application and did not disclose the planned sale. The number of shares or the proposed price range of the new application, the company said that it expects the initial public offering to take place after the US Securities and Exchange Commission has completed the review process, depending on the market and other conditions. Coincidentally, the CEO suddenly voiced on Tuesday that the chances of passing the stable currency law in the United States this year are very high, and pointed out that the regulatory development of the cryptocurrency industry in the world is accelerating, and the United States is more likely to approve the stable currency law than before. Frankly speaking, I think it will see the introduction of the stable currency law. It is the wish of the US Treasury, the Federal Reserve and the two houses of Congress, and of course it is also the wish of the two parties. On the same day, the Hong Kong government news network revealed that the Financial Secretary Chen Maobo met with representatives of two companies engaged in financial technology and artificial intelligence respectively during his annual meeting in Davos, Switzerland. One of them is the second largest issuer of stable currency in the world. Although the name of this company has not been disclosed, it is well known that Chen Maobo is probably the second largest issuer of stable currency in the world at present. After the SAR Government announced the policy declaration on the development of virtual assets in Hong Kong, the market responded positively. A number of digital assets and third-generation Internet companies have settled in Hong Kong. Hong Kong is steadily and cautiously promoting the development of digital assets, and is conducting public consultation on the regulation of stable currency to set a suitable regulatory framework to promote the responsible and sustainable development of relevant industries. Welcome stable currency companies based on legal tender to come to Hong Kong to conduct business and provide more innovative and convenient financial service options for the society. In fact, in order to maintain. International finance centre's position promotes the sustainable and responsible development of Hong Kong's virtual asset ecosystem. The Hong Kong government endorsed the issuance of stable currency in a regulatory manner. At the end of last year, the Hong Kong Financial Services and the Treasury Bureau and the Hong Kong Monetary Authority jointly issued a public consultation document, and began to collect opinions on the legislative proposal on regulating the issuer of stable currency. It is reported that the operator of stable currency with the largest market value in the world has not responded to the consultation document of stable currency, but the operator of the second largest stable currency in the world has expressed its support. The significance behind it is self-evident. As Raymond Yue, director of the Hong Kong Monetary Authority, said, the stable currency has the opportunity to become the interface between traditional finance and the virtual asset market. Whether the stable currency really has stable conditions will become particularly important. On the whole, it seems that American regulators have always adopted the supervision mode of lenient entry and strict exit of virtual assets, that is, they did not provide detailed institutional instructions before market access, and then used their law enforcement power to punish violations and institutions. In contrast, Hong Kong supervision. The institution provides a relatively complete access mechanism, and the supervision mode is more clear and transparent, which not only outlines a series of requirements for stable currency issuers, exchanges and wallet service providers, but also covers risk management, auditing and investor protection, and then promotes the development of financial technology in Hong Kong and attracts more digital asset transactions. It is concluded that stable currency is becoming a supplement to the existing financial ecosystem, providing a series of support for the future of Hong Kong. And the development of the stable currency market in the United States will depend on the regulatory environment, market trends and technological innovation, and other factors deserve our attention. Hong Kong has unique and important value in developing the stable currency regulatory system and innovating payment methods. We should learn from the experience of foreign countries in regulating stable currencies and contribute to docking the global financial system. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。