Zest——Blast上100%资本效率的稳定币

前言

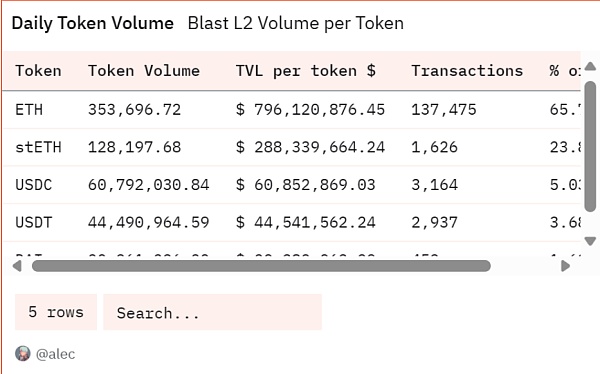

随着Blast宣布测试网上线,50%的空头分发给开发者后,生态会不可避免地面临资金流动性优化的问题。现有的稳定币Case中,在典型的 150% 抵押率下,用户需要价值超过 150 美元的抵押品来购买 100 美元的稳定币,剩下 50 美元未得到充分利用。这种模式代表了严重的低效率。

如何更好地吸引、利用blast链上目前超过十亿美金的流动性,成为了所有crypto世界有野心的开发团队必须要思考的一个问题,而Zest便给出了他们的解决答案。

Zest介绍

与其他链上不同的是,Blast上充足的流动性交给开发者的是一个新的命题——“如何最大化资本效率”,或者再简化一点,那就是怎么帮助用户更好的上杠杆。

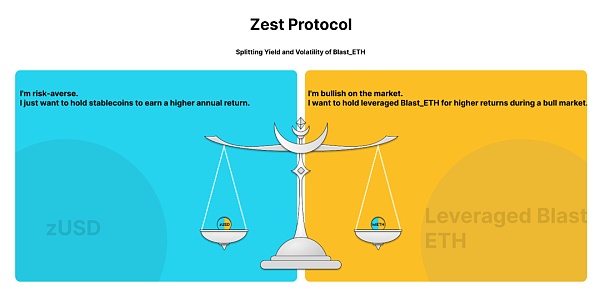

针对这个命题,zest给出的回答是将收益率与波动性分解,实现100%资本利用效率的稳定币。

项目核心机制

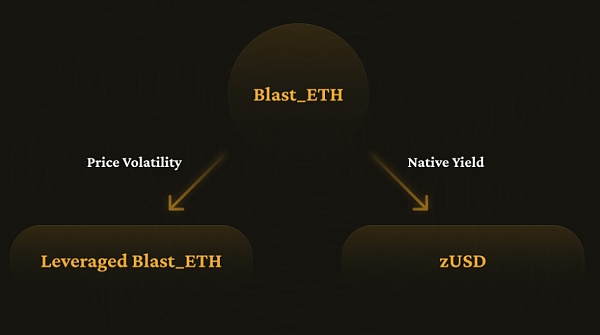

Blast的创新设计之一就是所有Blast网络上的ETH都具有原生收益,在此之上,协议层可以进行各种各样的操作,例如LSDFi。

当用户在Zest中质押价值$150的Blast_ETH后,可以获得价值$100的zUSD,以及$50的Leveraged Blast_ETH。Blast_ETH的收益率由zUSD继承,波动性由Leveraged Blast_ETH继承。具体过程可由如下公式描述

$$1∗BlastETH=k∗zUSD+1∗lBETHk$$

上式中,1个Blast_ETH可以铸造k个zUSD和1个lBETH_k。当 ETH 价格跌至 $k 时,lBETH_k 面临清算。上线后考虑到不同用户的风险偏好,协议会引入多元化的k值。

通过对波动率和收益率的分解,Zest协议可以同时满足两类用户的需要

风险厌恶、追求farming收益用户

由于Blast_ETH的所有波动都被Leveraged Blast_ETH吸收,zUSD具有无风险的杠杆收益。

假设K=1000,ETH价格从1800涨到了3000,Blast_ETH的APR为4.5%,那么有zUSD Stake APR=(3000*4.5%)/(1000*0.5)=27%, 六倍于原生APR(27%/4.5%)

杠杆用户

同样假设ETH价格从1300涨到了3000,K=1000,那么IBETH的价值就会从(1300-1000)增加到(3000-1000),实现接近7倍的收益。

在代币侧Zest还未推出具体设计,这部分留做后续讨论。

总结

由于Blast流动性充裕的特殊性,上面的协议能够更好的聚焦在自身的产品机制和经济模型设计之上,来实现更高的杠杆,更高的资本利用效率。因此我们能够在上面看到更多的优秀设计。

? As Blast introduces a large number of yield-bearing assets, where should these assets go?

Old, uninspired DeFi projects may lack innovative solutions, but Zest is here to provide entirely new and original answers.

Risk-averse or yield-loving users can obtain stablecoins with leverage yield.

Degen or leverage-loving users can access long-term on-chain leveraged derivatives

Foreword With the announcement that the short positions on the test online line are distributed to developers, the ecology will inevitably face the problem of optimizing the liquidity of funds. Under the typical mortgage rate, users need collateral worth more than US dollars to buy the stable currency of US dollars, and the remaining US dollars are not fully utilized. This model represents a serious inefficiency. How to better attract and utilize the liquidity of more than US$ 1 billion in the chain has become a problem that all ambitious development teams in the world must consider. And they gave their solutions. Different from other chains, there is sufficient liquidity in the world, which gives developers a new proposition, how to maximize capital efficiency or simplify it a little bit, that is, how to help users leverage better. The answer given to this proposition is to decompose the rate of return and volatility to realize the stability of capital utilization efficiency. One of the innovative designs of the core mechanism of the currency project is that all the networks have primary income, and the protocol layer can carry out various kinds on it. For example, when the user pledges the value, he can get the value, and the rate of return can be inherited from volatility. The specific process can be described by the following formula. In the above formula, one can be cast and the other can be liquidated when the price falls. After considering the risk preference of different users, the agreement will introduce diversified values. Through the decomposition agreement of volatility and rate of return, the needs of two types of users can be met at the same time. Risk aversion and pursuit of income users are all absorbed and risk-free. Assuming that the price of leverage income has risen from to six times that of the original leverage user, the value will increase to nearly double that of the token side. This part has not yet been introduced for follow-up discussion and summary. Because of the particularity of abundant liquidity, the above agreement can better focus on its own product mechanism and economic model design to achieve higher leverage and higher capital utilization efficiency, so we can see more excellent designs on it. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。