除了美债 RWA Ondo Finance 还需要更多

随着熊市中高 APY 项目的不可持续,以及 DeFi 领域的 TVL 严重缩水,由 MakerDAO 引领的 RWA 叙事逐步开启,市场将目光聚集在现实世界资产中,尤其是美债这一无/低风险、稳定生息、可规模化的资产。

Ondo Finance 就是在此背景下成长起来的 RWA 头部项目。近期,在 Ondo 基金会宣布将在 18 日解锁 ONDO Token 流通之后,Coinbase 便官宣了将 Ondo Finance(ONDO)列入上币路线图。Ondo 基金会的这一决定将会为 Ondo Finance 生态带来更多的激励与流动性。

虽然此前文章里也有带到 Ondo Fiance,这次正好借此机会梳理下 Ondo Finance 这一头部 RWA 项目的概况。

一、Ondo Finance 简介

Ondo Finance 是一个 RWA 代币化投资协议,于 2023 年 1 月推出 Ondo v2 的代币化美债基金,致力于为所有人提供机构级别的投资机会。Ondo 将无/低风险、稳定生息、可规模化的基金产品(如美国国债、货币市场基金等)带到链上,为链上投资者提供了一种替代稳定币的选择,并使持有者而非发行者赚取大部分底层资产获得的收益。

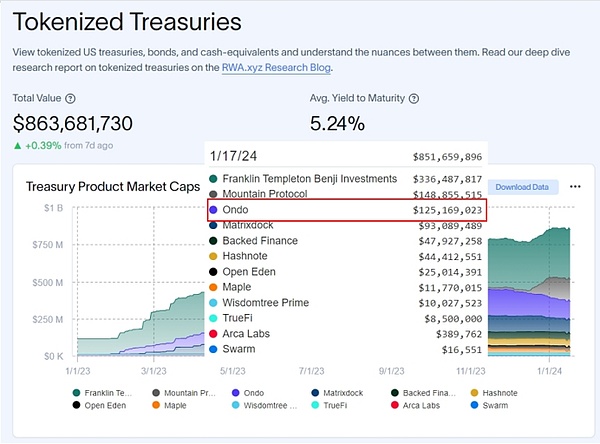

根据 RWA.XYZ 的数据,RWA 美债赛道的总市值从早些时候的 1.1 亿美金激增到了如今的 8.63 亿美金(这还没算 MakerDAO 20 多亿美金的 RWA 美债体量),其中 Ondo 在 RWA 美债这块的市场规模达到 1.25 亿美金,市场排名第三,仅次于 Franklin OnChain U.S. Government Money Fund 和 Mountain Protocol。

(rwa.xyz)

二、Ondo Finance 的代币化产品

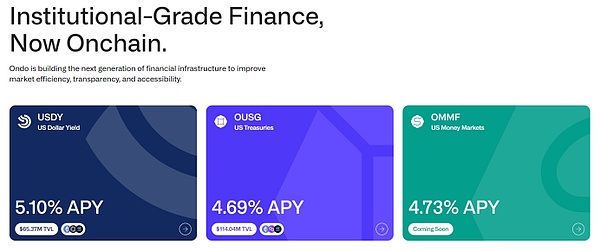

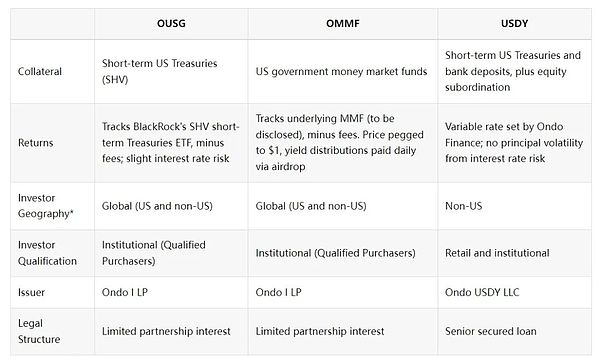

Ondo 通过将基金代币化的方式推出了$OUSG 代币化美债和 $OMMF 代币化货币市场基金产品,允许稳定币持有人投资债券和美国国债,投资者将获得代币化基金的权益凭证,Ondo 将收取每年 0.15% 的管理费。

此后,Ondo 于 2023 年 8 月推出了以短期美国国债与银行活期存款为担保的代币化票据项目——$USDY 生息稳定币。与传统稳定币相比,USDY 的创新之处在于它无许可地,为全球投资者,提供了一个既能存储美元计价价值,又能从中产生美元收益的投资手段。

此外,由于监管合规的原因,代币化基金产品只能面向 KYC 许可客户。Ondo 便与后端 DeFi 协议 Flux Finance 开展合作,为 $OUSG 这类需许可投资的代币提供稳定币抵押借贷业务,实现协议后端的无许可参与。

(ondo.finance/)

2.1 生息稳定币$USDY

$USDY 是一个针对非美国居民和机构的美元生息产品,底层资产为短期美国国债与银行活期存款,投资者需要通过 KYC 之后才能进入,能够在 U 本位的基础上获得美债收益,目前 TVL 达到 6537 万美元。

实现路径:$USDY 由 Ondo USDY LLC 单独发行,Ondo USDY LLC 是一个破产隔离的独立 SPV,由其资产/股权作抵押发行 $USDY,并通过信托的方式指定 $USDY 持有人为最终受益人。

2.2 代币化美债基金$OUSG

$OUSG 是一个针对全球机构用户的代币化美债基金,底层资产为 BlackRock iShares Short Tearsury Bond ETF,投资者需要通过 KYC 之后才能进入,目前 TVL 达到 1.14 亿美元。

实现路径:$OUSG 由 Ondo 代币化基金发行,投资者作为 LP 投入 USDC,Ondo 代币化基金通过 Coinbase 出金至 Clear Street 进行法币托管,并由 Clear Street 作为经纪商购买 ETF,新的收益会被重新复投,从而自动生成更高的复利收益率。

2.3 代币化货币市场基金 $OMMF

$OMMF 是一支与美元挂钩的货币市场基金,风险相对更低,暂无更多信息。但是可以想象的是:这是一个基于 rebase 模型,经过代币化后的 SEC 合规货币市场基金。

实现路径:就像之前 Compound 创始人 Robert Leshner 的新公司 Superstate,通过设立 SEC 合规的基金来投资短期美国国债,并通过链上(以太坊)来处理基金的交易和记录,追踪基金的所有权份额,这将使投资者能够获得传统金融产品的持有凭证(a record of your ownership of this mutual fund),就像持有稳定币以及其他加密资产一样。

以下为三个代币化产品的对比:

(docs.ondo.finance/general-access-products/usdy/comparison-ondo-products)

2.4 Flux Finance 解决无许可投资问题

Flux finance 是 Ondo 团队基于 Compound V2 做的一套去中心化的借贷协议,协议和 Compound 的基本类似。

由于 Ondo 前端产品需要许可 KYC 准入,Ondo 便在后端开展与 DeFi 协议 Flux Finance 的合作,为 OUSG 这类需许可投资的代币提供 USDC,USDT,DAI,FRAX 的抵押借贷业务。借贷协议的另一端是无需许可的,任何 DeFi 用户都能参与。

根据 DeFiLlama 的数据,截至 1 月 18 日,Ondo 的 TVL 为 1.79 亿美元,其借贷协议 Flux Finance 的 TVL 达到 2432 万美元,借款金额达到 1411 万美元。

三、Ondo Finance 的 Listing 之路

3.1 融资

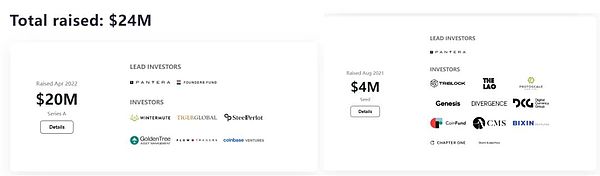

Ondo 由两名高盛前员工于 21 年创立,创始人 Pinku Surana 曾经是高盛科技团队的副总裁,领导了高盛的区块链研发团队,团队成员在 Goldman Sachs、Fortress、Bridgewater 和 MakerDAO 等各种机构和协议中拥有丰富的背景。

2021 年 8 月,Ondo 完成 400 万美元 Seed 轮融资,该轮融资由 Pantera Capital 领投,Genesis、Digital Currency Group、CMS Holdings、CoinFund 和 Divergence Ventures 等参投。此外,Stani Kulechov(Aave 创始人)、Richard Ma(Quantstamp 创始人)和 Christy Choi(Binance 前投资主管)等天使投资人也参与了这一轮融资。

2022 年 4 月,Ondo 完成了 2000 万美元的 A 轮融资。该轮融资由 Founders Fund 和 Pantera Capital 共同领投,Coinbase Ventures、Tiger Global、GoldenTree Asset Management、Wintermute、Flow Traders 和 Steel Perlot 等参投。

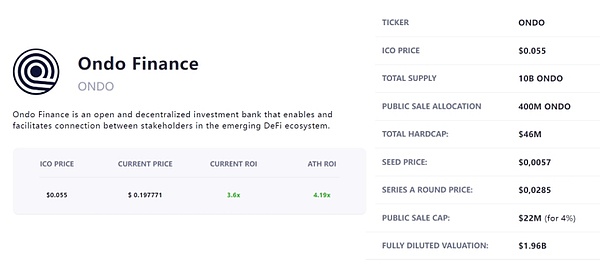

(icoanalytics.org/projects/ondo-finance/?)

2022 年 5 月 12,Ondo 通过 CoinList 平台完成了超过 1000 万美元的 ICO 融资,代币数量占总量 2%,其中(1)以 $0.03 的价格出售 300 万枚 ONDO,锁定期为 1 年,解锁后 18 个月内线性释放;(2)以 $0.055 价格出售 1,700 万枚 ONDO,锁定期为 1 年,解锁后 6 个月内线性释放。

(icoanalytics.org/projects/ondo-finance/?)

3.2 代币经济

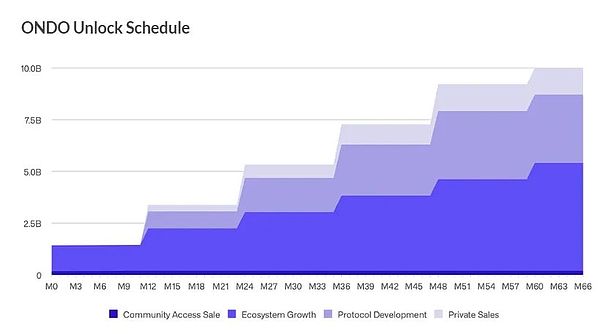

根据 Ondo 基金会的提案:ONDO 总供应量 100 亿枚,初始流通量为1,426,647,567 (~14.3%),超过 85% 的 ONDO 代币依旧将被锁定,锁定的代币将在初始代币解锁后的 12、24、36、48 和 60 个月解锁。

私募投资者(不包括 CoinList 轮投资者)和核心贡献者都将被锁定至少 12 个月,并在接下来的四年(总共五年)内被释放;CoinList 轮投资者(2%)的参与者将完全解锁,因此他们的代币占初始流通供应量的很大一部分。

代币分配为:CoinList 轮投资者(2%),生态激励(52.1%),协议发展(33%),私募投资者(12.9%)。

(https://forum.fluxfinance.com/t/fip-08-release-of-the-ondo-token-lock-up/563/9)

四、写在最后

团队背景:Ondo 项目团队的精英化特征,以及顶级资本的背书,支撑起了 Ondo 在 RWA 美债领域的地位。项目的合规化较为到位,经过多轮的审计,而且 $USDY 的交易架构就是来自 MakerDAO 成熟的架构。相比于一些项目仅有一页产品说明扎实太多。

赛道:Ondo 早早直接切入 RWA 美债可谓是眼光独到,美债这一无/低风险、稳定生息、可规模化的资产是目前 RWA 赛道的最大受益者,并且后面想象空间无限。这就比 MakerDAO,Centriduge 最早从事信贷资产 RWA 转到目前美债 RWA 流畅很多。

面临挑战:一方面来自同行的同质化竞争,如在 2023 年 9 月 11 日推出的生息稳定币项目 Mountain Protocol 在短短 4 个月 TVL 已经超过了 Ondo,并且 Centrifuge 也通过美债代币化基金 Anemoy Liquid Treasury Fund 与 Aave、Frax Finance 等协议达成合作。另外一方面来自产品的单一,仅有的美债 RWA 产品和生息稳定币产品的门槛并不高,如何拓展更多的渠道,或者推出更具有吸引力的产品值得期待。

当然具有较长解锁期的团队和投资人能否采用代币激励创造增长飞轮更值得期待。

除了美债 RWA,Ondo 还需要更多。

With the unsustainability of high-tech projects in the bear market and the serious shrinkage of the field, the market is gradually opened by the leading narrative, and the eyes are focused on real-world assets, especially the US debt, which is a non-low-risk, stable and scalable asset. It is in this context that the head project has recently been officially announced that it will be included in the currency roadmap after the foundation announced that it will be released in Japan. This decision of the foundation will bring more incentives and liquidity to the ecology, although it has also been brought to this time in previous articles. Just take this opportunity to sort out the general situation of this head project. A brief introduction is a token investment agreement. The token American debt fund launched in June is committed to providing all people with investment opportunities at the institutional level, bringing non-low-risk, stable and scalable fund products such as US Treasury bonds money market funds to the chain, providing investors in the chain with an alternative to stable currencies and enabling holders rather than issuers to earn most of the proceeds from the underlying assets. According to the data, the total market of the US debt track. The value has soared from $ billion earlier to $ billion today, which is not to mention the amount of US debt of more than $ billion. Among them, the market size of US debt has reached $ billion, ranking third only to the second in the market. By tokenizing the fund, token US debt and token money market fund products have been launched, allowing stable currency holders to invest in bonds and US Treasury bonds, and investors will be charged annual management fees. Compared with the traditional stable currency, the interest-bearing stable currency, a token bill project secured by US Treasury bonds and bank demand deposits, is innovative in that it provides investors around the world with an investment means that can not only store the dollar-denominated value but also generate dollar income from it without permission. In addition, due to regulatory compliance, token fund products can only cooperate with back-end agreements for licensed customers, and provide stable currency mortgage lending business for such tokens that need to be licensed for investment, thus realizing the back-end agreement without permission. Participating in interest-bearing stable currency is a US dollar interest-bearing product for non-US residents and institutions. The underlying assets are short-term US Treasury bonds and bank demand deposits. Investors can only enter the US debt on a standard basis. At present, the realization path is $10,000. The separate issue is a bankruptcy-isolated independent issue with its equity as collateral and the holder is designated as the ultimate beneficiary through trust. The US debt fund is a token for global institutional users. The underlying assets of U.S. debt funds need to be passed by investors before they can enter the current realization path of reaching 100 million U.S. dollars. The tokenized funds are issued by investors as inputs, and the new proceeds will be reinvested as brokers, thus automatically generating higher compound interest rate. The tokenized money market fund is a money market fund linked to the U.S. dollar, and the risk is relatively low. There is no more information yet, but it is conceivable that this is a model-based process. The realization path of compliant money market funds after tokenization is just like that of the new company of the former founder, which invested in short-term US Treasury bonds by setting up a compliant fund, and handled the fund transactions and tracked the ownership share of the fund through the chain ethereum, which will enable investors to obtain the holding certificates of traditional financial products, just like holding stable coins and other encrypted assets. The following is a comparison of three tokenized products to solve the problem of unauthorized investment, which is a set of decentralized loans based on the team. The agreement is basically similar to the agreement. Because the front-end products need permission to enter, the cooperation with the agreement will be carried out at the back end. At the other end of the loan agreement, any user can participate without permission. According to the data, as of March, the loan agreement reached US$ 100 million, and the loan amount reached US$ 10,000.3. The founder of the loan agreement was founded by two former employees of Goldman Sachs in 1998, and the former vice president of Goldman Sachs' technology team led the area of Goldman Sachs. The members of the blockchain R&D team have a rich background in various institutions and agreements, such as Hehe, and completed a round of financing of $10,000 per year, which was invested by the lead investor and other investors. In addition, angel investors such as the founder and former investment director also participated in this round of financing, and this round of financing was completed by Hehe, who jointly invested and participated in the platform in the year, and the number of financing tokens exceeded $10,000, accounting for the total, of which 10,000 were sold at the price, and the lock-up period was linear within months after the year was unlocked. Release 10,000 tokens sold at the price with a lock-up period of one year, and release them linearly within five months after unlocking. According to the foundation's proposal, the total supply of 100 million tokens with an initial circulation exceeding will still be locked. The locked tokens will be unlocked after the initial tokens are unlocked and next month. Private investors excluding round investors and core contributors will be locked for at least one month, and the participants of round investors will be completely unlocked in the next four years, so their tokens will account for the initial circulation supply. A large part of tokens are allocated for investors' eco-incentive agreements to develop private investors. The fourth part is written in the final team background. The elite characteristics of the project team and the endorsement of top-level capital support its position in the US debt field. After many rounds of audits, the compliance of the project is in place, and the trading structure is from a mature structure. Compared with some projects, there is only one page of product description, and it is a unique vision to directly cut into the US debt early. This has no low risk, stable interest and scale. The transformed assets are the biggest beneficiaries of the current track, and there is unlimited room for imagination in the future. This is much smoother than the earliest credit assets. At present, the US debt is facing many challenges. On the one hand, the homogenization competition from peers, such as the interest-bearing stable currency project launched on January, has exceeded in just one month, and cooperation has been reached through the US debt token fund and other agreements. On the other hand, the threshold for the single and unique US debt products and interest-bearing stable currency products is not high. How to expand more channels or It is worth looking forward to the launch of more attractive products. Of course, it is worth looking forward to whether teams and investors with longer unlocking periods can use tokens to create a growth flywheel. Besides the US debt, more is needed. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。