2100万枚BTC挖完倒逼中本聪现身并引发新一轮“印钞潮”?

对于比特币、以及更广泛的加密货币行业而言,2024年注定不平凡。

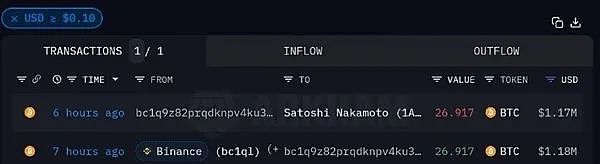

1月6日,一个“bc1q9z”开头的神秘地址将26.91枚BTC发送至被标记为Satoshi Nakamoto(中本聪)的地址。Coinbase主管Conor在社交平台表示,要么是中本聪醒来了,从币安购买了27个比特币并存入钱包,要么就是有人刚刚销毁了价值100万美元的比特币。

1月11日,美国证券交易委员会公布了对审批比特币现货ETF上市申请的投票结果,投票以3比2通过,主席Gary Gensler、委员Hester Pierce和委员Mark Uyeda投支持票,正式批准同意现货比特币ETF上市。

1月13日,Gary Gensler在接受CNBC采访时罕见提到“中本聪”,表示区块链账本系统领域存在创新,但现货比特币ETF的推出具有一定的讽刺意味,因为它违背了中本聪的去中心化使命,他解释说:“毫无疑问,这个领域存在创新,而我在麻省理工学院围绕分类账系统教授的这些创新,只是称为区块链技术的记账系统,这其中有一个讽刺之处,中本聪说这将是一个去中心化的系统和金融,而这(ETF)导致了中心化”。

这一系列操作加上即将到来的比特币区块奖励减半,让加密社区不禁质疑2100万枚BTC挖完后,是不是真的会“倒逼”中本聪现身呢?Koala考拉财经将在本文中做深度分析。

2100万枚BTC挖完倒逼中本聪现身并引发新一轮“印钞潮”?

被誉为“比特币之父”的中本聪在2008年发布《比特币白皮书》,其中约定比特币总量将只有2100万枚,比特币在2009年横空出世,但自那以后,中本聪的踪迹成为世纪之谜,当今没有任何人能准确证明中本聪是谁。

事实上,最早提出2100万枚比特币触及最大供应量后中本聪将现身的人也非常知名,就是摩根大通首席执行官Jamie Dimon,他认为一旦发行最大供应量,比特币就可能被淘汰并指出:“我认为很有可能,当我们达到2100万枚比特币时,中本聪就会出现,歇斯底里地大笑,然后安静下来,然后所有比特币都将被删除。”

另一方面,由于采矿难度不断增加,最后一个比特币要到2140年左右才会被完全开采,这意味着即便“中本聪”在世,到2140年也很难现身证实,毕竟没人能活到130多岁。据BTC.com数据显示,比特币挖矿难度已于区块高度824,544处迎来了最新一次挖矿难度调整,当前挖矿难度上调至73.2 T,涨幅约1.65%续创历史新高,而难度曲线和难度对数等指标也一直在攀升中,这意味着最后一枚比特币开采时间甚至会在2140年之后,甚至更远。

还有一个质疑是,如果不能保证一旦流通供应量达到2100万比特币,比特币的发行就会结束吗?没有人知道比特币是否会停在2100万枚,Jamie Dimon也坦言“从来没有遇到过一个人告诉我他们知道事实”,因此他提出了这个与众不同的理论,即:一旦比特币触及发行最大供应量(即2300万枚),就会继续增发,就像美元“印钞潮”一样。

当然,市场也有其他角度看待比特币,并且认为2024年将是比特币最关键的一年,让我们继续分析——

2024将是“比特币之年”?

随着美国证券交易委员会批准现货比特币ETF,以及比特币下一次减半活动定于今年4月举行,2024已经成为数字资产(尤其是比特币)变革的一年。

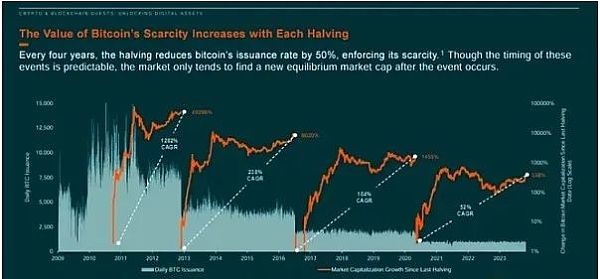

从历史上看,“减半”会导致比特币价格在随后的几个月和几年内大幅上涨(如下图所示)。虽然这一事件的实际发生时间是可以预测的,但市场需要时间才能找到新的价格均衡点。

不仅如此,现阶段比特币RSI低于50,MACD低于其信号线呈负值,当前价格低于20和50周期移动平均线,分别为42701和42932美元。分析认为如果比特币上行突破43100美元“枢轴点位”,则会有较大幅度的弹性空间。

比特币上一次减半发生在2020年5月11日,当时区块奖励从12.5 BTC降至6.25 BTC。 自该事件以来,比特币以52%的复合年增长率增长,其中最快的增长发生在事件发生后的前9 -12个月,这些因素的结合为比特币提供了令人信服的投资理由,并提供了一个潜在的切入点。 使用库存流量模型可以发现2024年4月每个比特币的隐含价值约为62,000美元,相对于当前价格大约上涨34%,(Koala考拉财经注:库存流量模型可以量化供应有限的资产的价值)。

无论如何,对于比特币、以及整个加密货币市场而言,今年值得重点关注,让我们拭目以待。

For bitcoin and the wider cryptocurrency industry, the year is doomed to be extraordinary. A mysterious address marked as Satoshi Nakamoto was sent to the address supervisor on the social platform, saying that either Satoshi Nakamoto woke up and bought a bitcoin from Bi 'an and deposited it in his wallet, or someone just destroyed the bitcoin worth $10,000. On May, the US Securities and Exchange Commission announced the voting results for approving the application for spot listing of bitcoin, in favor of the chairman and members. In an interview, it was rarely mentioned that Satoshi Nakamoto said that there was innovation in the field of blockchain ledger system, but the launch of spot bitcoin was ironic because it violated Satoshi Nakamoto's decentralization mission. He explained that there was no doubt that there was innovation in this field, and the innovations I taught around the ledger system at MIT were just called the bookkeeping system of blockchain technology. There was an irony in this. Satoshi Nakamoto said that it would be a go. Centralized system and finance, which led to a series of centralized operations, and the upcoming bitcoin block reward was halved, which made the encryption community wonder whether it would really force Satoshi Nakamoto to show up after 10,000 pieces were dug up. Koala Finance will make an in-depth analysis in this paper, forcing Satoshi Nakamoto to show up and triggering a new wave of banknote printing. Satoshi Nakamoto, known as the father of Bitcoin, published a white paper on Bitcoin in 2008, which stipulated that the total amount of Bitcoin would only be 10,000 pieces, but since then, The trace of Satoshi Nakamoto has become the mystery of the century. No one can accurately prove who Satoshi Nakamoto is today. In fact, the person who first proposed that Satoshi Nakamoto will appear after 10,000 bitcoins hit the maximum supply is also very well known, that is, the CEO of JPMorgan Chase. He thinks that once the largest supply of bitcoins is issued, it may be eliminated and points out that I think it is very likely that Satoshi Nakamoto will laugh hysterically and then be quiet when we reach 10,000 bitcoins. On the other hand, all bitcoins will be deleted. Due to the increasing difficulty of mining, the last bitcoin will not be fully mined until around 2008, which means that even if Satoshi Nakamoto is alive until 2008, it will be difficult to show up to prove that after all, no one can live to many years old. According to the data, the difficulty of bitcoin mining has ushered in the latest difficulty adjustment at the height of the block. At present, the difficulty of mining has been raised to a record high, and the indicators such as the difficulty curve and the difficulty logarithm have been climbing, which means that the mining time of the last bitcoin will even be very high after 2008. Further, there is another question: If there is no guarantee that once the circulation supply reaches 10,000 bitcoins, will the issuance of Bitcoin end? No one knows whether Bitcoin will stop at 10,000 bitcoins, and frankly, I have never met anyone who told me that they know the facts. Therefore, he put forward this unique theory that once Bitcoin reaches the maximum supply, that is, 10,000 bitcoins will continue to be issued, just like the dollar printing tide. Of course, the market also has other perspectives on Bitcoin and thinks that 2008 will be the best year for Bitcoin. The key year for us to continue our analysis will be the year of Bitcoin. With the approval of spot bitcoin by the US Securities and Exchange Commission and the next halving of bitcoin scheduled for this month, it has become a year of digital assets, especially bitcoin reform. Historically, halving bitcoin prices will lead to a sharp rise in the following months and years, as shown in the following figure. Although the actual occurrence time of this event is predictable, it will take time for the market to find a new price equilibrium point. At present, bitcoin is negative when it is lower than its signal line. The current price is lower than its signal line, and the periodic moving average is equal to and US dollar respectively. The analysis shows that if bitcoin breaks through the pivot point of the US dollar, there will be a large amount of flexibility. The last time bitcoin was halved, the block reward was reduced from to the compound annual growth rate since the incident, and the fastest growth occurred in the first month after the incident. The combination of these factors provides a convincing investment theory for bitcoin. By providing a potential breakthrough point, using the inventory flow model, we can find that the implied value of each bitcoin in June is about US dollars, which is about rising relative to the current price. Koala Financial Note Inventory flow model can quantify the value of assets with limited supply. In any case, for bitcoin and the entire cryptocurrency market, this year deserves special attention. Let us wait and see. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。