比特币现货ETF引起轰动 但其资产管理规模能超越黄金ETF吗?

作者:Marcel Pechman,cointelegraph 翻译:善欧巴,比特币买卖交易网

比特币现货ETF因媒体报道的28亿美元管理资产而成为头条新闻,但这个数字的重要性到底如何?

现货比特币的飙升交易所交易基金(ETF)已成为金融市场的焦点,引发人们对其超越黄金等传统资产的潜力的猜测。ETF 可在常规证券交易所方便地买卖,简化了日常投资者使用标准经纪账户交易比特币的流程。

另一个好处是这些工具受到监管监督,打破了共同基金和专业财务经理此前无法直接持有和管理数字资产的障碍。

现货ETF比特币对基础现货市场的影响

ETF 有一种独特的方式来维持其价格与其所代表的资产的价值一致,其中涉及一个称为创建和赎回的过程。这一过程在管理市场上可用的 ETF 份额数量并确保 ETF 价格与其所代表的资产价值密切相关方面发挥着至关重要的作用。

与其他可买卖物品的价格类似,ETF 的价格受到人们想要购买它的数量(需求)和人们想要出售它的数量(供应)的影响。有时,对 ETF 的需求可能非常高或非常低,导致其价格偏离其所持有资产的实际价值。

为了防止 ETF 价格与其资产价值之间出现重大差异,金融界有一些特殊的参与者,称为授权参与者。这些参与者可以根据市场需求创建或赎回ETF份额。创建新股会增加供应量,而赎回股票会减少供应量。通过这样做,他们可以帮助控制 ETF 价格并避免与其所代表的资产的真实价值发生重大偏差。

现货比特币 ETF 交易量超出预期

比特币 ETF现货交易于 1 月 11 日开始,这些产品在前 5 天就积累了创纪录的 140 亿美元交易量,这是其他商品 ETF 无法比拟的壮举。

正如彭博社高级 ETF 分析师 Eric Balchunas 所强调的那样,唯一在交易量方面超越比特币的资产类别是追踪标准普尔 500 指数或纳斯达克 100 指数的资产类别。客观来看,美国股市市值为 52 万亿美元,是比特币 8100 亿美元的 60 多倍。

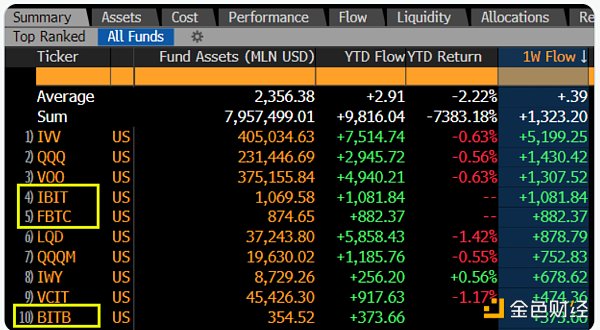

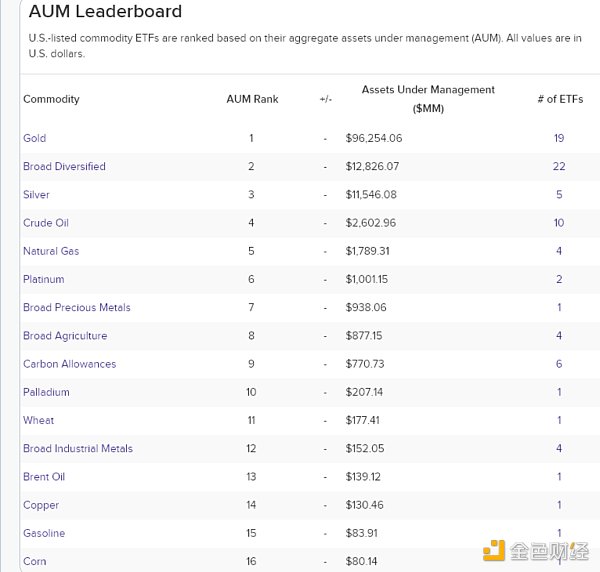

更重要的是,比特币现货 ETF 发行人的管理资产总额 (AUM)达到 28 亿美元,超过了白银、原油和广泛多元化商品的总和,使得黄金成为唯一剩下的竞争对手。

CryptoSlate 首席分析师 James Van Straten 在 X(前 Twitter)上发表的一篇文章将贵金属黄金描述为大宗商品领域的绝对领导者,其 ETF 工具下持有价值 960 亿美元的黄金。

然而,比特币ETF的资产管理规模目前仅占比特币当前市值的3.5%。相比之下,即使排除用于珠宝、硬币、电子产品和其他应用的黄金资产管理规模的 63%,其 ETF 行业也仅占黄金剩余 5 万亿美元市值的 2%。

黄金并不是ETF行业唯一的直接竞争对手

虽然比特币 ETF 的增长速度超过了大宗商品 ETF 的增长速度,但债券市场却讲述了不同的故事,全球资产管理规模达到了令人印象深刻的 2 万亿美元。同样,标准普尔 500 ETF 行业的资产管理规模超过 1 万亿美元,凸显了传统股票的持久吸引力。

虽然比特币 ETF 的市值尚未超过黄金,但最近的增长表明了一个令人信服的故事。与石油、白银和黄金等大宗商品的比较突显了比特币作为合法资产类别的影响力日益增强。

随着比特币的成熟,其市值超过 1 万亿美元的潜力变得越来越有可能,这证实了其作为金融领域变革力量的地位。

The author's translation of Shanouba Bitcoin Trading Network has made headlines because of the media report that it manages assets for hundreds of millions of dollars, but how important is this figure? The soaring spot bitcoin has become the focus of the financial market, which has aroused people's speculation about its potential beyond traditional assets such as gold. It can be easily bought and sold on regular stock exchanges, which simplifies the process of daily investors trading bitcoin with standard brokerage accounts. Another advantage is that these tools are regulated. Supervision broke the barrier that mutual funds and professional financial managers could not directly hold and manage digital assets before. The impact of spot bitcoin on the basic spot market has a unique way to maintain its price consistent with the value of the assets it represents, which involves a process called creation and redemption, which plays a vital role in managing the number of shares available in the market and ensuring that the price is closely related to the value of the assets it represents, and the prices of other tradable goods. Similar prices are affected by the quantity demand that people want to buy it and the quantity supply that people want to sell it. Sometimes, the demand for it may be very high or very low, resulting in its price deviating from the actual value of the assets it holds. In order to prevent a significant difference between the price and the value of its assets, some special participants in the financial sector are called authorized participants. These participants can create or redeem shares according to market demand, which will increase the supply and redeem shares will reduce the supply. In this way, they can help control the price and avoid a major deviation from the real value of the assets they represent. The spot bitcoin transaction volume exceeds expectations. The spot bitcoin transaction started on June, and these products accumulated a record transaction volume of billions of dollars the day before yesterday. This is a feat unmatched by other commodities. As emphasized by senior analysts of Bloomberg, the only asset category that surpasses bitcoin in transaction volume is the asset category that tracks the Standard & Poor's Index or Nasdaq Index. Objectively speaking, The market value of the US stock market is trillion dollars, which is many times that of Bitcoin billion dollars. More importantly, the total assets under management of Bitcoin spot issuers reach billion dollars, which exceeds the sum of silver, crude oil and widely diversified commodities, making gold the only remaining competitor. An article published by the chief analyst in the previous issue described precious metal gold as the absolute leader in the field of bulk commodities, and the asset management scale of Bitcoin currently only accounts for billion dollars of gold. In contrast, even excluding the scale of gold asset management for jewelry, coins, electronic products and other applications, the industry only accounts for the remaining trillion dollars of gold. Gold is not the only direct competitor in the industry. Although the growth rate of Bitcoin exceeds the growth rate of bulk commodities, the bond market tells a different story. The global asset management scale has reached an impressive trillion dollars. Similarly, the asset management scale of Standard & Poor's industry has exceeded one trillion dollars, which highlights the biography. Although the market value of Bitcoin has not yet surpassed that of gold, the recent growth shows a convincing story. The comparison with commodities such as oil, silver and gold highlights the growing influence of Bitcoin as a legal asset class. With the maturity of Bitcoin, its market value has become more and more likely to exceed one trillion dollars, which confirms its position as a force for change in the financial field. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。