Sui这波暴涨的原因是什么?Sui的生态是否即将迎来爆发?

作者:菠菜菠菜,Web3caff Reseach & 万物研究院研究员 来源:X,@wzxznl

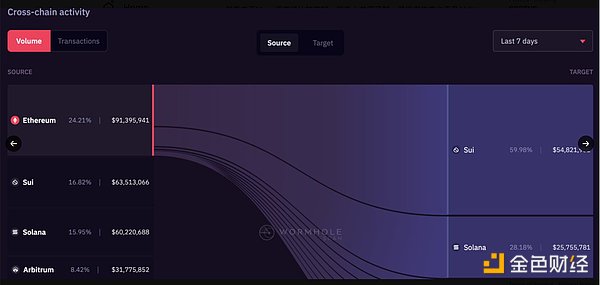

继上次观察Sui的TVL和跨链活动出现显著增长后,这次Sui的暴涨引起了广泛关注。在未做太多研究的情况下,我们简要复盘一下Sui的暴涨原因,同时了解一些当前备受关注的Sui生态项目。

Move生态菠菜之前从来没有研究过,也没有关注,所以一直不太了解,但自从写了几篇Move智能铭文的推文后,菠菜发现了Move语言的优势,特别是其在金融应用场景上有着非常强大的优势,这是因为其可以实现资产所有权和智能合约的解藕。

这点与以太坊体系不同,在EVM体系中如果智能合约出了安全问题,那么里面的资产也会跟着出问题,而使用Move语言的话便可以避免这样的情况发生,即便是智能合约出了安全问题你的资产也不会有事(这取决于合约的设计,如果是池子的话还是存在风险),总而言之就是Move语言会比Solidity更安全更灵活。

但是由于Move语言还比较年轻,很多人并不了解,开发者生态也不及以太坊以及Solana,之前一直不温不火,但是随着高性能链的叙事以及Solana的浴火重生,菠菜认为Sui可能也会迎来一次生态爆发,尤其是在金融、RWA、DePIN领域。

Sui最近的暴涨有两个主要原因:

1. Move生态大会的举办,一般来说公链开会大概率都会搞一波“拉盘”,毕竟需要给大家打打鸡血才更有动力嘛

2. Sui生态项目开启了高额补贴,这也是TVL和跨链活动迅速增长的主要因素。

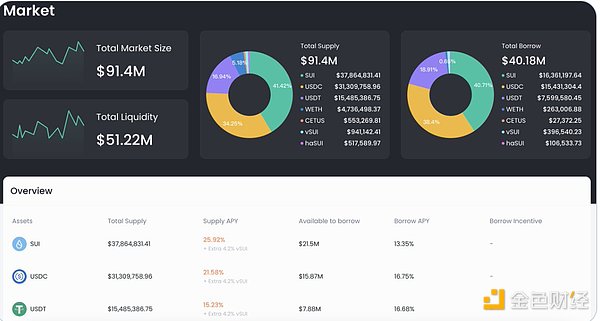

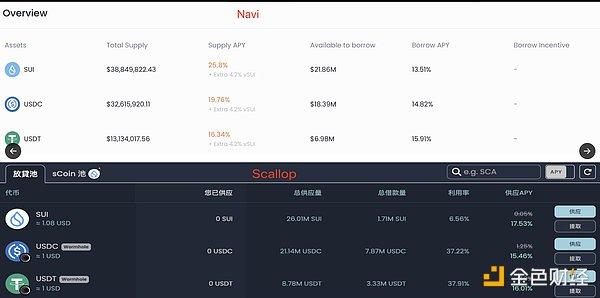

例如在Navi Protocol上存Sui和USDC的利率都超过了20%,高额补贴吸引了大量资金前来薅羊毛,也导致了大量的Sui被锁在协议里吃利息,造成了一定的飞轮效应将Sui的价格不断拉高。

Sui的一波爆发也引起了市场上的广泛关注,目前除了已经发币的Cetus之外,还未发币的DeFi借贷项目 Navi Protocol和 Scallop Lend 成为了大家重点关注的项目。 对于这两个项目,市场上已经有许多人对两个项目的机制设计做了分析,并按照TVL把Scallop称为龙一,Navi称为龙二,但是其实换一种角度去分析,Navi在一些方面会更具备优势。

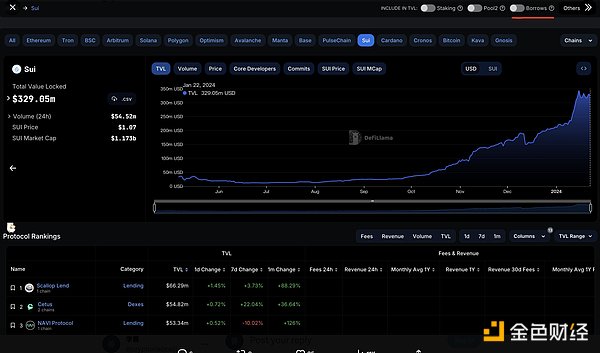

一. TVL

我们可以在Defillma上看到目前Scollop的TVL是高于Navi的,许多人也是依据这一点进行判断哪个项目是龙一,但是依此作为评判过于单一。

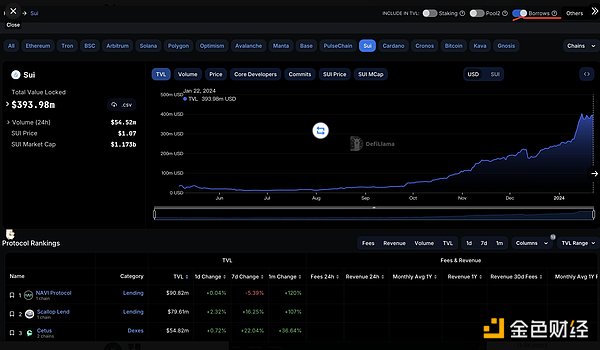

评估一个DeFi借贷项目还有一个指标便是借贷(Borrow)活动量,我们如果把借款的钱也算进去,Navi的TVL便成为了Sui生态上的龙一项目了,因为Defillma默认的视图是不算上借贷后重新存进去的资金量的。

这种逻辑就像你去对比两个银行,A银行的存款准备金多,而B银行的存款准备金比A少,但是B银行的贷款业务更多,B银行体系里通过信贷产生的“信用货币”是高于A银行的,虽然在DeFi领域目前不存在“信用派生货币” 但简单来说就是,从借贷活动和规模方面,Navi是高于Scallop的,而一个Defi借贷项目的利润主要就是来自于借贷活动,因此在真实的借贷业务方面Navi更胜一筹。

二.收益率

另外一个方面就是收益预期和未来的需求,目前我们进入这两个项目的官网可以发现,Navi在存款补贴的收益和每个代币的TVL上都是高于Scallop的,算上Extra的vSUI,Navi在SUI和USDC/USDT的收益率要高于Scallop 5%~13%左右。

并且Scallop目前不支持循环贷,而Navi的存贷利差可以使得用户目前可以通过循环贷获取更高的收益,例如存SUI吃25.8%+4.2%的收益然后借13.51%利息的SUI继续存进去,并且本币借本币几乎没有爆仓的风险,因此目前来说Navi的收益率是高于Scallop的。

关于SUI未来的走势,目前菠菜了解到的情况是这种高额补贴还会维持一两个季度的时间,并且由于这两个项目都有空投预期,会带来大量的TVL数据,数据好看了,炒作就容易了,懂的吧。 如果大家想刷点交互拿空投,又不想冒SUI波动的风险的话,可以选择把稳定币跨过去刷一刷交互。

Navi Protocol网站:https://app.naviprotocol.io/?code=404577578083422208

简单总结一下,SUI这波的爆发主要来自于其生态的高额补贴造成的锁仓正向飞轮以及生态大会的举办,从Move生态来看SUI的TVL已经高于APTOS很多了,但是市值却低于APTOS,并且未来数据越来越好看的情况下炒作空间较大,目前上面的两个DeFi龙头项目但从TVL来看Scallop是龙一,但是如果算上借贷金额的TVL和借贷活动量来看Navi更具优势,也收益更高。从技术上来说Move语言在金融场景有着更高的优势,加上高性能的优势,Move生态的RWA和DePIN领域或许也值得关注一下。

Author Spinach Spinach Institute of Everything Researcher Source After the last observation and the significant increase in cross-chain activities, this skyrocketing has aroused widespread concern. Without much research, we briefly re-examine the reasons for the skyrocketing, and at the same time understand some ecological projects that are currently receiving much attention. Ecological spinach has never been studied before and has not paid attention to it, so it has never been well understood. However, since writing several tweets with intelligent inscriptions, spinach has discovered the advantages of language, especially in financial application scenarios. It has a very strong advantage, because it can realize the decoupling of asset ownership and smart contracts, which is different from the Ethereum system. In the system, if there is a security problem with smart contracts, then the assets inside will also go wrong, and if you use language, you can avoid this situation. Even if there is a security problem with smart contracts, your assets will be fine, which depends on the design of the contracts. If it is a pool, there are still risks. In short, the language will be safer and more flexible than it is. Because the language is still young, many people don't understand the developer's ecology, which is not as good as that of Ethereum, and it has been tepid before. However, with the narrative of high-performance chain and the rebirth of the fire, spinach thinks that there may also be an ecological explosion, especially in the financial field. There are two main reasons for the recent surge in the ecological conference. Generally speaking, the public chain meeting will be held with a high probability. After all, it is necessary to give everyone a bloody meal to be more motivated. The ecological project has started a high subsidy, which is also a cross-chain activity. The main factors of rapid growth, such as the deposit and interest rates, exceeded the high subsidies, which attracted a lot of money to come to bonus hunter, and also caused a lot of money to be locked in the agreement to eat interest, which caused a certain flywheel effect and caused a wave of explosions that kept the price up, which also attracted widespread attention in the market. At present, the loan projects that have not been issued except the currency have become the key projects for everyone. Many people in the market have designed the mechanisms for these two projects. According to the analysis, it is called "Dragon One" or "Dragon Two", but in fact, it will be more advantageous in some aspects to analyze it from another angle. First, we can see that the current project is higher than that, and many people also judge which project is "Dragon One" based on this point. However, it is too simple to evaluate a lending project as a judgment, and another indicator is the amount of lending activities. If we count the borrowed money, it will become an ecological "Dragon One" project, because the default view is not to re-deposit after lending. The logic of the amount of money going in is like comparing two banks. The bank has more deposit reserves and the bank has less deposit reserves, but the bank has more loan business. The credit currency generated by credit in the banking system is higher than that of banks. Although there is no credit derivative currency in the field at present, it is simply higher in terms of lending activities and scale, and the profit of a lending project mainly comes from lending activities, so it is better than the second income in real lending business. The other aspect of the rate is income expectation and future demand. At present, when we enter these two projects in official website, we can find that the income from deposit subsidy and the income from each token are higher than the existing sum, and the deposit-loan spread that does not support revolving loan at present allows users to obtain higher income through revolving loan at present, such as the income from deposit and food, and then continue to deposit it by borrowing interest, and there is almost no risk of short positions in local currency. Therefore, at present, there is no income. The profit rate is higher than that of the future trend. At present, what spinach knows is that this high subsidy will last for one or two quarters, and because these two projects have airdrops, it is expected to bring a lot of data. It is easy to understand the hype if you want to take the airdrops interactively and don't want to take the risk of fluctuation. You can choose to brush the stable currency across the interactive website to briefly summarize that this wave of outbreaks mainly comes from the positive locking caused by the high subsidies of its ecology. The holding of Flywheel and Ecological Conference is much higher from the ecological point of view, but the market value is lower and the future data is getting better and better. There is more room for speculation. At present, the above two leading projects have never been regarded as Longyi, but if the loan amount and loan activity are counted, it has more advantages and higher benefits. Technically, language has higher advantages in financial scenarios, and the advantages of high performance may also be worthy of attention. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。