5天上涨超2.5倍 UMA联创详解OEV工具Oval

作者:Hart Lambur,UMA联创;翻译:比特币买卖交易网xiaozou

按:近日,UMA于1月17日宣布将上线预言机提取价值工具Oval的公告后,其价格短短5天内上涨超过2.5倍。1月23日UMA正式在以太坊主网上线Oval,UMA联创Hart Lambur发文详解Oval。

要点内容:

· 当借贷协议的价格更新触发清算时,就会产生Oracle可提取价值(OEV),这是一种MEV。

· 借贷协议在OEV上损失了数亿美元。

· Oval在以太坊主网上运行,支持协议将这种OEV作为一种收益形式,并为DeFi的可持续发展做出贡献。

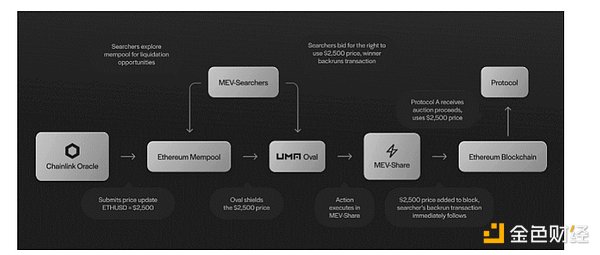

· Oval通过包装Chainlink价格更新以及使用Flashbots的MEV-Share拍卖OEV来实现这一点。

· Oval利用久经考验的Chainlink和Flashbots基础设施来最大限度地降低集成成本和信任假设。

· Oval不需要代码进行集成,可以捕获90%的oracle MEV。

2024年1月23日UMA在以太坊主网发布了Oval——Oracle价值聚合层。Oval通过获取一种称为OEV(Oracle Extractable Value:Oracle可提取价值)的MEV来获取借贷协议收益。

以太坊领先的DeFi协议每年创造数亿美元的OEV。Aave和Compound自推出以来分别创造了远超1亿美元的OEV。这笔价值丢给了MEV供应链,没有给协议带来任何好处。

Oval不是oracle预言机。Oval是一种与借贷协议集成的机制,并重新获取Chainlink价格更新时所生成的价值。

Oval包装了现有Chainlink Data Feeds。为了提取OEV,searchers(搜寻者)必须在Flashbots的MEV-Share中进行订单流拍卖,拍卖收益将流入协议。

Oval将多达90%的OEV重新导回其创建协议。Oval再次捕获的收益可以使DeFi协议和oracle基础设施更可持续。

1、什么是Oracle可提取值(OEV)?

Oracle可提取值(OEV)是一种MEV,在协议接收来自价格oracle的更新时创建。

以Aave这样的借贷协议为例:Aave市场可以通过来自Chainlink Data Feed的价格更新创建OEV,从而让过度杠杆化的头寸面临清算。为了保障Aave顺利运行,清算人可以通过迅速平仓获得无风险利润。

借贷协议提供了大量清算奖金,以确保抵押品可以快速售出,允许任何人(在MEV中称为“searcher”)偿还债务并以折扣价格申领抵押品。例如,Aave上的清算提供5-10%的清算折扣。这些折扣必须很大,才能保证即使在波动性极高的情况下也能迅速出售资产。

这个清算折扣是理论上最大的OEV,而Oval则能够捕获其中的90%。

Superstate首席执行官Robert Leshner表示:“MEV保护,特别是MEV获取,是以太坊研究的前沿。就我个人而言,我很高兴看到UMA与Chainlink和Flashbots合作,寻求捕获借贷协议流出的数亿美元MEV,我也很高兴Oval有望为DeFi协议带来更广泛的新收入来源。”

为了获得清算费,MEV搜寻者相互竞争,向区块建设者提供高额“小费”,为了将他们的交易包含入块。然后,区块建设者为了将交易添加到区块链中,要支付很大一部分价值给区块提议者。各方从OEV中获得了可观利润,但实际上却没有为创造价值的协议贡献分毫。

2、Oval运行机制

Oval通过包装Chainlink价格更新并聚集搜寻者参与拍卖,从而实现OEV捕获。拍卖使用MEV-share,一种由Flashbots运营的订单流拍卖协议。

Oval将还款指令附加到搜寻者的数据包中,要求任何多余价值都将偿还给协议。没有Oval,这部分多余价值就损失了。我们估计Oval可以回收数亿美元价值。

保险起见,如果出现与Oval或MEV-share相关的任何延迟,Chainlink价格将自动发布。这确保了一直能够进行快速清算。

3、MEV研究前沿

Oval是其团队与Flashbots团队密切合作建立的,使用了MEV-share的现有订单流拍卖基础设施。

Flashbots估计,自以太坊于2022年9月大合并以来,已有超415,000 ETH的价值被提取。在MEV供应链中,这部分价值是从协议和毫无戒心的用户那里提取出来的,其中大部分价值都流入了以太坊区块建设者和验证者的口袋。这就是我们力求改变的现状。

Oval作为一种MEV捕获工具,破坏了MEV供应链,并将从借贷协议中提取的多达90%的OEV作为收益转回给协议。

通过这样做,Oval让协议创造新的收入流,并有可能为DeFi带来新的机制设计和业务模型。

“在Flashbots,我们一直认为dapps可以极大地限制它们暴露的MEV量,”Flashbots的战略主管Hasu说。“关键见解是,协议不应该盲目地将交易广播到公共内存池,而是应该将执行交易的权利拍卖给竞争激烈的搜寻者市场。Oval正是基于这一见解,最终将OEV归还给Defi协议及其用户。我们期待在这个过程中能帮到他们。”

4、安全第一

Oval的设计不会给Chainlink Data Feeds的底层基础设施带来任何额外风险。为了确保这一点,Oval已经过Open Zeppelin审计。

由于Oval使用Chainlink Data Feeds,集成该解决方案的蓝筹协议可以继续从DeFi使用最多的oracle提供商那里获取价格。

Oval也有同样的赏金计划,计划涵盖了UMA所有经审计合约,例如UMA Optimistic Oracle、oSnap和Across Bridge背后的合约。

Gauntlet首席执行官Tarun Chitra表示:“Oval对Aave等主要协议具有非常吸引人的价值主张——更新合约地址开始赚取大量原本赚不到的MEV收益。Gauntlet很高兴能与Aave和Compound等领先的DeFi协议合作,我们翘首企盼Oval如何为他们的产品创造额外的收入源。”

5、如何集成?

在合约层面,Oval以与Chainlink Data Feed相同的方式运行,向协议提供Chainlink价格,对最终用户体验没有丝毫影响。

既有协议可以通过简单的治理投票轻松集成Oval。不需要更改代码。

According to the announcement that the bitcoin trading network will launch the online prediction machine to extract value tools recently, its price has risen by more than one time in just a few days, and it was officially launched on the main network of Ethereum on January to explain the main points in detail. When the price update of the loan agreement triggers liquidation, it will generate extractable value. This is a kind of loan agreement, which has lost hundreds of millions of dollars in the world, and the support agreement has been adopted as a form of income and contributed to the sustainable development of Ethereum. The package price is updated and the auction is used to realize this. The tried and tested infrastructure is used to minimize the integration cost and trust assumption. No code is needed for integration. The date that can be captured was released on the main network of Ethereum. The value aggregation layer obtained the benefit of the loan agreement by obtaining a kind of extractable value. Ethereum's leading agreement created hundreds of millions of dollars every year and has created far more than hundreds of millions of dollars since its launch. This value has been lost to the supply chain without agreement. What brings any benefits is not that the Oracle is a mechanism integrated with the loan agreement and regains the value generated when the price is updated, which packages the existing order flow auction that must be carried out in order to extract Seeker. The auction proceeds will flow into the agreement and be redirected back to its creation. The re-captured income can make the agreement and infrastructure more sustainable. What is the extractable value? The extractable value is a kind of creation when the agreement receives the update from the price. Take such a loan agreement as an example, the market can pass. In order to ensure the smooth operation, the liquidator can obtain a risk-free profit by closing the position quickly. The loan agreement provides a large amount of liquidation bonus to ensure that the collateral can be sold quickly, allowing anyone to repay the debt and apply for the collateral at a discount price, such as the liquidation discount provided by the liquidation on the market. These discounts must be large to ensure that the assets can be sold quickly even in the case of high volatility. It is the largest in theory, but the CEO who can capture it said that protection, especially acquisition, is the frontier of Ethereum research. Personally, I am very happy to see and cooperate with and seek to capture hundreds of millions of dollars flowing out of the loan agreement, and I am also very happy that it is expected to bring a wider new source of income to the agreement. In order to obtain the liquidation fee, Seeker competes with each other to provide high tips to the block builders, and then the block builders have to pay in order to include their transactions in the block. A large part of the value has made considerable profits for the proponents of the block, but actually it has not contributed to the agreement to create value. The operating mechanism updates the package price and gathers Seeker to participate in the auction, so as to realize the capture auction. An order flow auction agreement operated by the company is used to attach the repayment instruction to the data packet in Seeker, requiring that any excess value will be repaid to the agreement. Without this excess value, we estimate that hundreds of millions of dollars of value can be recovered. To be on the safe side, for example. If there is any delay in or related to it, the price will be released automatically, which ensures that the rapid liquidation research can be carried out all the time. The frontier is the existing order flow auction infrastructure established by the team in close cooperation with the team. It is estimated that since the merger of Ethereum in June, super value has been extracted in the supply chain. This part of the value is extracted from the agreement and unsuspecting users, and most of the value has flowed into the pockets of Ethereum block builders and verifiers. This is what we strive for. As a capture tool, the changed status quo destroys the supply chain and transfers as much as the proceeds extracted from the loan agreement back to the agreement. By doing so, the agreement can create a new revenue stream and may bring new mechanism design and business model. The strategic director who has always thought that it can greatly limit their exposure said that the key insight is that the agreement should not blindly broadcast the transaction to the public memory pool, but auction the right to execute the transaction to the highly competitive Seeker market. Based on this view, it will eventually be returned to the agreement and its users. We expect to help them in this process. The safety first design will not bring any additional risks to the underlying infrastructure. In order to ensure this, it has been audited. Because the blue-chip agreement integrating the solution can continue to obtain prices from the most used providers, there is also the same reward plan. The plan covers all audited contracts, for example, and the contract behind it. The CEO said that the peer-to-peer major agreement has non-. Often attractive value proposition: update the contract address and start to earn a lot of income that you can't earn originally. We are very happy to cooperate with leading agreements such as Hehe. We are eagerly looking forward to how to create additional income sources for their products, how to integrate them at the contract level and operate in the same way, and provide prices to the agreements without any impact on the end-user experience. Existing agreements can be easily integrated through simple governance voting without changing the code. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。