灰度抛压不断 曾经的「比特币貔貅」影响何时休?

灰度,从诞生之日起便是加密世界举足轻重的买入机构代表,也是最大的加密“明牌巨鲸”之一,多年来一直以信托基金的方式为投资者提供合规的加密货币投资渠道。

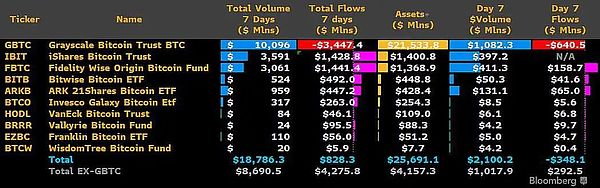

只是 1 月 11 日灰度 GBTC 信托在成功转为现货比特币 ETF 之后,反而开始造成持续的 BTC 抛压——截至发文时,GBTC 累计已流出 34.5 亿美元,而除 GBTC 外,其余 10 支 ETF 都处于净流入状态。

这也就意味灰度 GBTC 是造成目前比特币 ETF 整体资金流出的核心因素,成为短期内最大的抛盘。

灰度:(曾经)最大的加密「明牌巨鲸」

从 2019 年起,灰度就一直是加密世界举足轻重的明牌巨鲸——作为数字货币集团 DCG(Digital Currency Group)于 2013 年专门设立的子公司,在现货比特币 ETF 上市交易之前,灰度一直以信托基金的方式为投资者提供合规投资渠道,且超过90%的资金都来源于机构投资者和退休基金。

而在今年 1 月 11 日 GBTC 转 ETF 之时,灰度 GBTC 的管理规模(AUM)高达 250 亿美元,是最大的加密货币托管巨鲸。

目前在灰度目前的单一信托基金中,还包含 ETH、BCH、LTC、XLM、ETC、ZEC、ZEN、SOL、BAT 等,从中也可以看出身为“机构之友”的灰度,投资喜好颇为稳健,基本都是主流资产和老牌币种。

且这些信托本身都是“裸多信托”,就像是专门以加密货币为食的“貔貅”——在短期内只进不出。

那投资者出于套利目的选择入金BTC、ETH,不仅导致灰度对应的信托规模持续增长,对现货市场而言也是绝对的利好——从供给端强势吃进对应的币种,缓冲抛压。

因此虽然如今灰度的 GBTC 成为饱受诟病的熊市诱因,但此前它可一度被视为牛市(2020 年)的主要发动机:

在2020年之前,比特币 ETF 一直都是市场心心念念期盼的场外增量资金进场的主要渠道,大家都期待比特币 ETF 能带来天量规模的增量资金,打通传统主流投资者投资加密货币的道路,并尽可能推动比特币等被华尔街大规模地接受,使得加密资产配置获得更广泛的认可。

自从 2020 年以灰度为代表的机构明牌入场之后,也承接了大家对比特币 ETF 的期待,甚至一度扮演了牛市发动机的角色。

尤其是在比特币 ETF 申请迟迟不通过的背景下,灰度奠定了自身近乎唯一的合规入场渠道地位,堪称闷声发大财:

其实是充当了合格投资者与机构介入Crypto市场的一个中间管道,实现了投资者与ETH现货之间的弱连接状态,打通了增量场外资金直接入场的渠道。

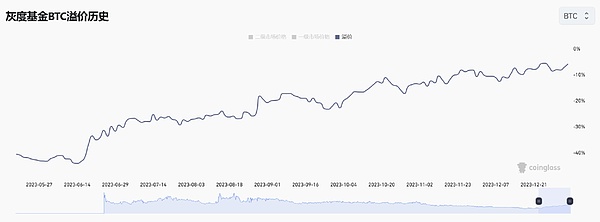

负溢价逐步抹平

其实早在 2023 年 6 月关于贝莱德传出现货比特币 ETF 的消息后,GBTC 的负溢价就开始逐步收窄。

以 2023 年 7 月 1 日的 Coinglass 数据为例,灰度 GBTC、ETHE 等信托产品负溢价几乎处于历史新低——GBTC 信托负溢价达 30%,ETHE 也高达 30%,ETC 信托的负溢价更是达到了离谱的 50% 以上。

而在过去大半年的 ETF 预期博弈中,GBTC 的负溢价一路收窄,从 30% 上升至如今的趋近于 0,绝大部分提前布局买入的资金已经到了获利退出的时机(例如木头姐)。

从负溢价的角度看,这对曾经在一级市场以现金或是 BTC、ETH 的方式参与 GBTC、ETHE 信托的私募的投资者伤害很大,因为灰度加密货币信托并不能直接赎回其标的资产——没有明确的退出机制,不存在赎回或减持。

那等这些投资者过 6 或 12 个月后(GBTC、ETHE 的解锁期),手中解锁的 BTCG、ETHE 份额在美股二级市场出售,按目前的负溢价只能是亏损。

从这个角度看,有人也因为负溢价而在二级市场大量买入 GBTC——BlockFi 曾向 Three Arrows Capital 提供了约 10 亿美元的贷款,抵押品就是三分之二的比特币和三分之一的 GBTC。

而 Three Arrows Capital 作为 GBTC 的大买家,很大概率上就是赌将来 GBTC 变为 ETF 或是开通兑换后,负溢价扳平,自己好获得期间的收益差。

所以早在此轮 ETF 申请热潮之前,灰度就早已在明面上积极推动 GBTC、ETHE 等信托产品变为 ETF,以此打通资金和兑换的渠道,将负溢价扳平,以此对投资者交代,可惜 Three Arrows Capital 没有等到这一天。

灰度的影响何时休?

彼时蜜糖,今日砒霜,在 1 月 11 日灰度的 GBTC 信托在成功转为现货 ETF 之后,开始造成持续的 BTC 抛压:

截至发文时,GBTC 单日再度流出超过 6.4 亿美元,创迄今为止最大的单日资金流出,转 ETF 后累计已流出 34.5 亿美元,而除 GBTC 外,其余 10 支 ETF 都处于净流入状态。

尤其是截至 1 月 23 日,所有现货比特币 ETF 的前 7 个交易日总成交量约 190 亿美元,而 GBTC 就占比过半,这也意味着目前 ETF 所带来的增量资金,整体仍处于对冲 GBTC 持续资金流出的阶段抛压。

当然,其中处于破产进程的 FTX 的抛售也占了很大一部分——FTX 清仓出售的 2200 万股 GBTC 价值接近 10 亿美元。

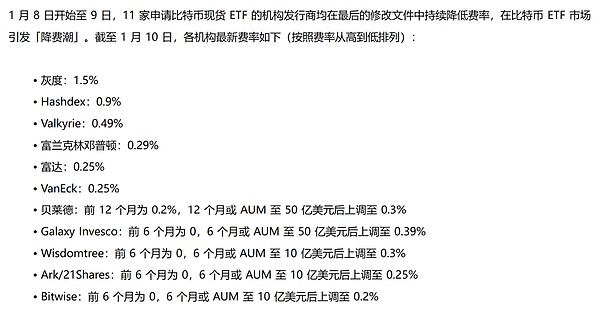

总的来看,虽然灰度和 GBTC 在上轮牛市是最大的发动机之一,多年来一直以信托基金的方式为投资者提供合规的加密货币投资渠道,但 ETF 通过后,GBTC 的资金流出与抛压都有迹可寻:

GBTC 1.5% 的管理费要远远高于其它家 0.2%-0.9% 的费用范畴。

从某种程度上讲,这在接下来一段时间会是一场明牌博弈:目前 GBTC 仍持有超 50 万枚 BTC(约 200 亿美元),待入场的机构与资金们肯定会等合适时机,以收集筹码蚕食份额。

这也意味着未来一段时间,GBTC 的抛压可能仍会压倒资金主观流入的意愿。

如今回头看,灰度这些曾经在 2020 年曾被当作拉动场外增量资金的“牛市发动机”,在如今的大环境之下,不仅不再奏效,甚至成了一颗颗随时可能引发行业海啸的潜在风险点。

顺风时的积极因素会被放大,只有退潮时的坚持才更难能可贵。对于仍处于高速发展的行业而言,破除对巨鲸布局的执念,祛魅机构,或许会是这个特别的周期中,我们所能收获的最大经验之一。

Gray scale has been an important representative of buying institutions in the encryption world since its birth, and it is also one of the largest encrypted whales in winning numbers. For many years, it has been providing investors with a compliant investment channel for encrypted currency in the form of trust funds. It is only after the successful conversion of gray scale trust into spot bitcoin that it began to cause continuous selling pressure. Up to the time of publication, the accumulated outflow has reached 100 million US dollars, except for the other branches, which means that gray scale is the core cause of the overall outflow of bitcoin. Known as the largest selling gray scale in the short term, the winning numbers whale has been the largest encryption gray scale since 2000. As a subsidiary specially established by digital currency Group in 2000, the gray scale has been providing investors with compliant investment channels in the form of trust funds before the spot bitcoin is listed and traded, and more than the funds come from institutional investors and pension funds. At the turn of this year, the management scale of gray scale is as high as US$ 100 million, which is the largest cryptocurrency custody. The whale is currently included in the current single trust fund of gray scale, etc. From this, it can be seen that the gray scale investment preference as a friend of institutions is quite stable, basically mainstream assets and old currencies, and these trusts themselves are bare multi-trusts, just like those that only feed on cryptocurrencies. In the short term, investors can't enter the fund for arbitrage purposes, which not only leads to the continuous growth of the trust scale corresponding to gray scale, but also is absolutely good for the spot market to eat the corresponding currency from the supply side. This kind of buffer selling pressure, therefore, although the gray scale has become a bear market incentive that has been criticized, it was once regarded as the main engine of the bull market year. Before 2000, Bitcoin was always the main channel for the market to enter the market with incremental funds that were eagerly awaited. Everyone expected that Bitcoin could bring a large amount of incremental funds to open the way for traditional mainstream investors to invest in cryptocurrencies and try to promote the large-scale acceptance of Bitcoin by Wall Street, so that the allocation of cryptoassets was more widely recognized. Since winning numbers, an institution represented by Grayscale, entered the market in, it has also accepted everyone's expectations for Bitcoin, and even once played the role of a bull market engine. Especially in the context of the delay in the application of Bitcoin, Grayscale has established its almost unique status as a compliant entry channel, which can be called making a fortune in silence. In fact, it has acted as an intermediate channel for qualified investors and institutions to intervene in the market, realizing the weak connection between investors and spot, and opening up the negative overflow of direct entry channels for incremental off-site funds. In fact, the negative premium began to narrow as early as the news of BlackRock's spot bitcoin came out in June. Take the data of June as an example, the negative premium of trust products such as gray scale is almost at a historical low, and the negative premium of trust is even higher than that of trust. In the expected game of the past six months, the negative premium has narrowed all the way, from rising to the present, and most of the funds bought in advance have reached the time of profit withdrawal, for example, Sister Mu from From the perspective of negative premium, this is very harmful to the private investors who once participated in the trust in cash or in other ways in the primary market, because the gray-scale cryptocurrency trust can not directly redeem its underlying assets, there is no clear exit mechanism, there is no redemption or reduction, and the shares unlocked by these investors after the unlocking period of one or two months are sold in the secondary market of the US stock market. According to the current negative premium, it can only be a loss. From this perspective, some people have bought a lot in the secondary market because of the negative premium. About $100 million in loan collateral is two-thirds of bitcoin and one-third of the total value. The big buyer is likely to bet that it will become a negative premium in the future or open the exchange to equalize the income difference during the period. Therefore, before this round of application boom, the gray scale has been actively promoted on the bright side, and trust products have been changed to open up funds and exchange channels to equalize the negative premium, so as to explain to investors. Unfortunately, it has not waited until this day when the impact of gray scale will stop. After the successful conversion of the trust with the gray scale on January to the spot, it began to cause continuous selling pressure. As of the date of publication, the single-day outflow exceeded US$ 100 million, the largest single-day outflow to date. After the conversion, the accumulated outflow was US$ 100 million, except for the other branches, which were in a net inflow state. Especially, the total transaction volume of all spot bitcoins in the previous trading day was about US$ 100 million, accounting for more than half. This also means that the incremental funds brought by the current period are still in the stage of hedging the continuous outflow of funds. Of course, among them Selling in the process of bankruptcy also accounts for a large part. The value of 10,000 shares sold through clearance is close to US$ 100 million. Generally speaking, although Gray Scale and the last bull market are one of the biggest engines, they have been providing investors with compliant cryptocurrency investment channels in the form of trust funds for many years, but the management fees of capital outflow and selling pressure after passing are far higher than those of other companies. To some extent, this will be a winning numbers game, and they still hold more than 10,000 shares. About $100 million of institutions and funds waiting to enter the market will certainly wait for the right time to collect chips and eat up their share, which means that the selling pressure may still overwhelm the willingness of the subjective inflow of funds in the future. Now, looking back at the gray scale, these bull market engines, which were once used as driving off-site incremental funds in, are not only ineffective in today's environment, but even become potential risk points that may trigger the tsunami in the industry at any time. The positive factors will be amplified when the tide is low, only when they persist. It is commendable that for the industry that is still developing at a high speed, it may be one of the greatest experiences we can gain in this special cycle to get rid of the obsession with the layout of giant whales. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。