质押市场的新趋势 EigenLayer的崛起与Lido的挑战

作者:David Ma,AllianceDAO 翻译:善欧巴,比特币买卖交易网

二十年前的我曾经天真地认为自由市场是最好的市场形式。现在,我的观点变得柔和了,这可能是智慧,也可能是单纯的年龄增长。

我不会去赞美自由市场,因为这已经主导了过去50多年的社会经济主流。那么,现在我来说说它的弊端...

自由市场触及到每一个角落,促成全球范围的优化。世界各地都在进行调整,走向高度专业化。但如今我明白,这种优化会让地方经济停滞、过度投资,并在市场风向变化时变成萧条之地。繁荣的经济体完全被追求短期全球最优所压榨。

例子比比皆是:矿业小镇的兴衰,委内瑞拉2010年中期因过度投资石油产业而在油价下跌时遭遇到重创,甚至在美国,底特律的汽车产业和铁锈带的制造业因无法在全球经济中保持竞争力,导致当地经济陷入严重衰退。

在加密世界,Axie Infinity 游戏使菲律宾大量人口开始依靠全球投机性狂热赚取收入。幸运的是,这个例子最终结果还不错。这场狂热没有持续太久,没有对当地经济产生结构性变化。

但我认为什么是“恰当”的自由市场并不重要,我只是采访创始人。事实是,加密货币目前是历史上最自由的市场。

加密货币的资金流动简直是市场原教旨主义者的美梦。这是金融市场全球化的巅峰,资本自由流动,就像水一样流向提供最高收益的最小的裂缝。

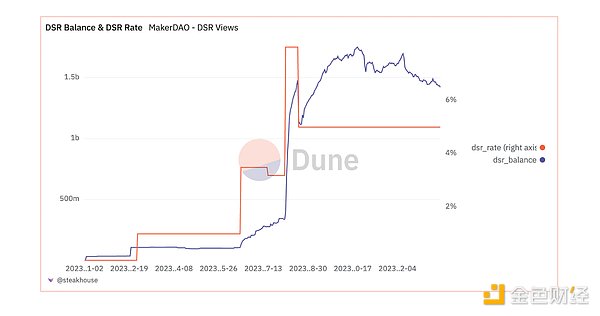

国库券 vs. Maker's sDAI 的 8% 收益率

在熊市低谷(没有那么低),链上收益率压缩到 5% 以下,低于短期国库券收益率。结果,整体稳定币市值缓慢萎缩。

Maker 一直将支持 DAI 的抵押品用于赚取链下收益 - 我们的行业将其称为 RWA(实物资产)。Maker 悄然将自己变成了 defi 中最大的 RWA 提供商。我仍然不知道这是如何从法律上实现的。

我最好的猜测是,sDAI 对 Maker 生成的收益没有实际要求。Maker 只是控制 DAI 的借贷和借贷利率,以稳定 DAI 与美元的锚定。另一方面,抵押品被用于购买国库券。碰巧的是,DAI 的 5% 储蓄利率非常接近国库券利率。

事实上,Maker 决定将 sDAI 的收益率作为一种促销活动提升到 8%,持续了大概两周。他们的 TVL 立即飙升了 5 倍,其中很大一部分来自素来不会错过免费资金机会的“币圈领导人”孙宇晨。

这次促销活动无疑是成功的,因为即使在利率恢复到正常水平 (5%) 后,资金仍持续流入。Maker 很快将自己定位为链上停放稳定币流动性最充足的地方。流动性是粘性的,而这一切只需要花 100 万美元做“广告”。

与此同时,像 Ondo Finance 和 Mountain Protocol 这样更新的 T-Bill RWA 项目虽然产品结构更清晰,但仍在为增加 TVL 的每一百万美元而努力。稍后将进一步讨论他们。

蚕食 Lido 的市场份额

2023 年的一段时间,人们一直在讨论 Lido 在流动质押以太坊方面的主导地位,以及他们是否应该出于去中心化的目的而进行自我限制。

早期挑战 Lido 的尝试大多千篇一律:积分计划、DeFi 集成、KOL 宣传活动以及实施分布式验证器技术 (DVT) 的承诺。市场对这些举措都没有反应。牛市遥遥无期,投资回报率不确定,积分奖励没有价值。参与者避 risk 并且对现状感到满意。

Diva(第一个集成 DVT)和 Swell 都在 2023 年第三季度左右推出了 Enzyme 池,以激励早期参与。这两个池都没有达到他们公开分享的目标结果。到今天,他们合并后的金额约为 2.5 万枚 ETH,远低于 Lido 的 930 万枚 ETH。

二级原生收益率赛道:Blast 和模仿者们

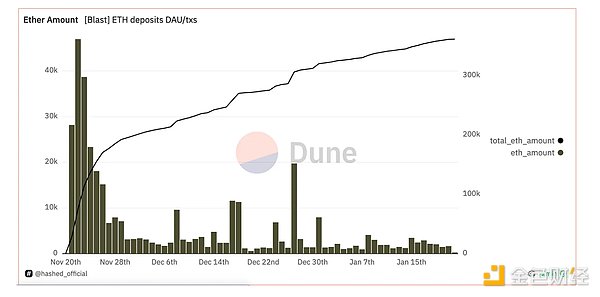

随着 Blur 第二季空投结束,PacmanBlur 没有停下脚步,并在 2023 年 11 月宣布了 Blast 二级原生质押收益。大量加密货币 KOL 立即转发并宣布他们对 Blast 的天使投资。

尽管除了一个接收和质押承诺 ETH 的多重签名钱包外,没有任何产品,但他们的营销活动在一周内吸引了 18.5 万枚 ETH,目前已攀升至 36 万枚。近 5% 的 Lido TVL 被锁定到 2024 年 5 月,期待着丰厚的空投。

直到最近,质押 ETH 主要是一个一级功能。像 Optimism 和 Arbitrum 这样的流行二级解决方案使用原生 ETH 作为 Gas 代币,他们不会以任何形式的质押方式让用户将合约锁定的 ETH 置于风险中。二级上唯一存在的质押 ETH 是桥接的 wstETH,它是 Lido 质押 ETH 的非重新计基版本。即使这样,其流动性也微不足道。

因此,市场得到它想要的东西只是时间问题:收益和资本效率,而不是扩展性。扩展性是潜在叙事,但收益才是推动市场的东西。

当然,这只是半开玩笑的说法。目前尚不清楚 Blast 在其他项目没有做到的情况下,为何能吸引如此高的 TVL。我想到的原因包括:抓住牛市初期的时机,让 CT 影响者加入他们的投资名单,Paradigm 的名气,拥有一家知名品牌和项目 (Blur),或者可能是推荐点游戏。

模仿者

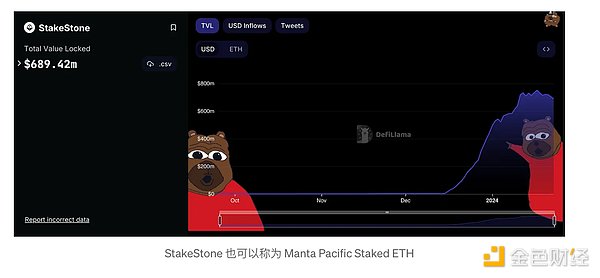

每一次成功事件之后,加密货币领域肯定会出现模仿者。关键是迅速行动,并在某些方面超越原作。Manta L2 和 Mantle L2(名称非常混淆)在 Blast 之后不到一个月的时间里迅速出现,并宣布了自己的二级原生收益计划。

Manta 通过他们在 2021 年牛市顶峰筹集的大量资金(正在寻找产品市场契合点)向存款人支付大约 7% 的收益,是质押收益的两倍。此外,他们质押的 ETH 交易代码 $mETH 非常适合成为 meme 素材,这也是一个有利因素。

另一方面,Manta 在创纪录的时间内拼凑了一个 DeFi 生态系统,并复制了 Blast 的推荐点游戏,甚至包括 NFT 卡和盒子。

这导致了超过 45 万枚 ETH 的质押,还不包括其他桥接资产。

正如 Blast 与 Lido 和 Maker 合作作为其收益提供商一样,Mantle 和 Manta 也分别与各自的协议合作。Mantle 与 Ondo Finance(国库券)合作。Manta 与 Mountain Protocol(国库券)和 StakeStone(LSTs)合作。

这些合作伙伴关系证明了他们对小型协议的扶持力度。Mountain Protocol 的 TVL 与 Manta 合作后增长了 10 倍,而 Stakestone 则从零开始迅速发展。

Manta 的仓促发布

有人私下将 Manta 的做法称为“现成解决方案的大杂烩”,这是一个高杠杆赌注,试图赶上叙事潮流。他们是第一个空投,也是第一个在 Celestia 上拥有略微可用的产品的项目。

这是一次令人印象深刻的敏捷性展示,但不可避免地会有一些漏洞、错位,以及一些被承诺空投但被 Manta "遗漏" 的群体。

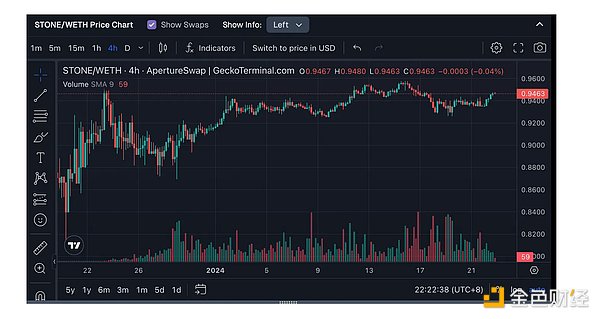

在 Manta Pacific 发布中途,他们决定将两个产生收益的资产锁定 69 天,作为换取 Manta 空投积分(活动名为 New Paradigm)让用户承诺使用二级。

由于只有 STONE (一个质押 ETH) 和 wUSDM 被锁定在二级上,而大多数资产可以自由提取,这意味着被锁定的资产将面临流动性折扣。

事实上,几乎立即,STONE 就比 ETH 低价交易,因为空投农民将 STONE 卖成 ETH,然后再桥接出去,然后再桥接回来。

这种耕种是徒劳的,因为从我在 Twitter 上收集到的抱怨来看,空投远没有农民期望的那么慷慨。大部分空投都给了能够让人们使用推荐代码的影响者。

EigenLayer 的崛起

与以收益为核心的二级解决方案形成对比,EigenLayer 的叙事一直是一个缓慢但持续上升的浪潮。自从 Eigenlayer 开放存款以来,其自我设定的存款限制每次提高都会立即填满。

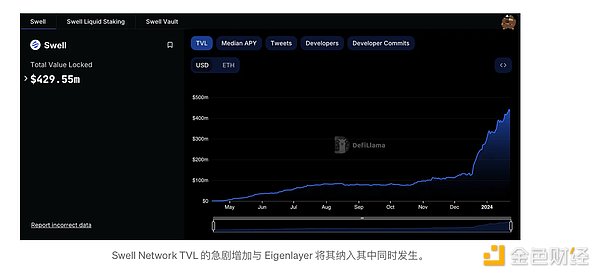

最初只限于三种 LST(stETH、cbETH 和 rETH),然后 Eigenlayer 开放了新的 LST。这就是 Swell Network 最终取得突破的地方。他们能够进入新的 LST 列表,耕种 EigenLayer 的需求如此之大,以至于将其 TVL 推到了新的 LST 上。

这实际上证明了 Swell 一直在努力耕耘。他们一直在与各个方面建立合作伙伴关系,不仅包括 Eigenlayer,还包括 Enzyme、Pendle、Penpie、Sommelier、Maverick、Aura 等。并非所有举措都会起到推动作用,但同时你也不知道什么会给你带来你需要的 10 倍增长。

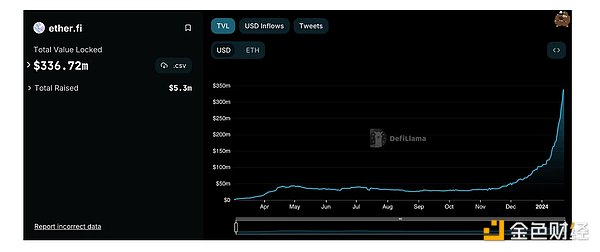

当达到 EigenLayer 对 LST 的限制时,注意力转向了没有限制的原生 restaking 选项。像 Ether.fi 这样的原生 restaking 协议为任何想获得 EigenLayer 点数的人打开了大门。这是一个绝妙的策略。

今天,EigenLayer 的 TVL 超过 75 万枚 ETH,其中只有 11.2 万枚来自 Lido。

Lido 仍然是王者吗?

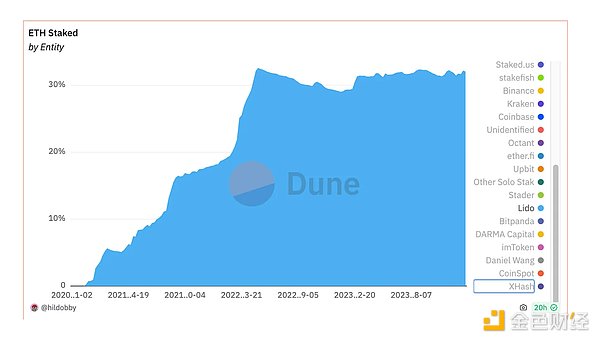

尽管所有这些新发展都在蚕食 Lido 的份额,但 Lido 在质押 ETH 中的份额仍然稳定在 31% 左右。然而,裂缝正在形成,因为其中越来越多的质押 ETH 现在由 Blast 和 Mantle 等实体控制,它们可以切换提供商或内部进行质押。

在过去的几个月里,我认为 Lido 在 LST 市场的主导地位并非不可动摇。非 Lido 提供商每天都在获得信任和流动性,努力抢占市场份额。L2 和 restaking 改变了格局。

还有一些新的协议开始聚集仍然缺乏流动性的长尾质押市场。Solana 上的 Sanctum 和 Polygon 和 The Graph 上的 Tenderize 正在建立一个市场,为所有个人质押者提供流动性,而他们今天别无选择,只能等待解质押期结束。这是有道理的,因为一旦资产进入解质押队列,大多数质押风险就会消失。我预计他们很快会转向以太坊,抢占更大的市场份额。

一些要点

TVL 的变化很大程度上反映了大型收益机会的位置,而收益机会又与整体市场情绪有关联。然而,正是这些机会时刻,用户才最愿意尝试新项目,这打开了格局改变的窗口。

幕后工作大多是看不见的。市场反馈缓慢发生,然后突然出现,而且非常嘈杂。试着专注,同时也拥抱叙事。建立合作伙伴关系,这最终是一个合作游戏。

Twenty years ago, I naively thought that the free market was the best market form, and now my opinion has softened. This may be wisdom or simple age growth. I will not praise the free market because it has dominated the social and economic mainstream for many years, so now I will talk about its disadvantages. The free market has touched every corner and promoted global optimization. But now I am adjusting all over the world and moving towards high specialization. Understand that this optimization will make the local economy stagnate, over-invest and become a depressed place when the market wind changes. Prosperous economies are completely pursued by short-term global optimization. Examples abound of the rise and fall of mining towns. Venezuela suffered heavy losses when oil prices fell in the middle of the year because of over-investment in the oil industry. Even the automobile industry and rust belt manufacturing industry in Detroit, USA, failed to remain competitive in the global economy, leading to a serious recession in the local economy. A large number of people began to rely on global speculative fanaticism to earn income. Fortunately, the final result of this example is not bad. This fanaticism did not last long and did not cause structural changes to the local economy. But I think what is an appropriate free market is not important. I just interviewed the founder. The fact is that cryptocurrency is currently the freest market in history. The capital flow of cryptocurrency is simply the dream of market fundamentalists. This is the peak of financial market globalization. The free flow of capital flows like water. The yield of the smallest crack treasury bonds that provide the highest returns is not so low in the bear market trough. The yield on the chain is compressed below the yield on short-term treasury bonds. As a result, the market value of the currency has been slowly shrinking, and the collateral it supports has been used to earn offline income. Our industry has quietly turned itself into the largest provider in China. I still don't know how this is legally realized. My best guess is that there is no actual requirement for the generated income, but only controlled lending. And on the other hand, collateral is used to buy treasury bills. Coincidentally, the savings rate is very close to that of treasury bill rate. In fact, they decided to raise the rate of return as a promotional activity to last for about two weeks. A large part of it came from Sun Yuchen, the leader of the currency circle who never missed the opportunity of free funds. This promotional activity is undoubtedly successful, because even after the interest rate returns to normal level, funds will continue to flow in soon. Positioning itself as the place with the most abundant liquidity where stable coins are parked on the chain, the liquidity is sticky, and all this only costs 10,000 dollars for advertising. At the same time, the updated projects like Hehe are still striving for the increase of 1 million dollars, although the product structure is clearer. Later, we will further discuss their eroded market share. For some time in 2008, people have been discussing the dominant position in the mobile pledge of Ethereum and whether they should restrict themselves early for the purpose of decentralization. Most of the attempts to challenge are the same. The market has no response to these measures, such as the integrated promotion activities and the commitment to implement the distributed verifier technology. The bull market is far away, the return on investment is uncertain, and the points reward has no value. Participants avoid and are satisfied with the status quo. The first integrated sum was launched around the third quarter of 2008 to encourage early participation in these two pools. As a result, the amount after their merger is about 10,000 pieces, far less than 10,000 pieces. The track and imitators didn't stop with the end of the airdrop in the second season, and announced the benefits of the second-class protoplasm pledge in June. A large number of encrypted currencies were immediately forwarded and announced their investment in angels. Although there were no products except a multi-signature wallet that received and pledged commitments, their marketing activities attracted 10,000 pieces in a week, and they have climbed to nearly 10,000 pieces. Until recently, the pledge was mainly a first-class function like this. The popular secondary solution uses the native as a token, and they will not let users lock the contract at risk in any form of pledge. The only pledge that exists on the secondary level is bridging. Even so, its liquidity is negligible, so it is only a matter of time before the market gets what it wants, income and capital efficiency rather than expansibility. It is a potential narrative, but of course, this is only a half-joking statement. At present, it is not yet. It is clear why other projects are so attractive when they are not done. The reasons I think include seizing the early opportunity of the bull market to let influencers join their investment list, owning a well-known brand and project, or possibly recommending a game imitator. After every successful event, imitators will definitely appear in the cryptocurrency field. The key is to act quickly and surpass the original in some aspects. The name is very confused, and they quickly appear and announce their own in less than a month. The secondary primary income plan is looking for a product market fit point through a large amount of funds they raised at the peak of the bull market in, and pays depositors about twice the pledged income. In addition, the transaction code they pledged is very suitable to be the material, which is also a favorable factor. On the other hand, an ecosystem has been pieced together and copied in record time, and the recommended point game even includes cards and boxes, which has led to more than 10,000 pledges, excluding other bridging assets, just like cooperation with Hehe. Their income providers cooperate with their respective agreements, treasury bills and treasury bills respectively. These partnerships have proved that their support for small-scale agreements has doubled after cooperation, but they have developed rapidly from scratch. Some people privately call the practice a hodgepodge of ready-made solutions. This is a highly leveraged bet trying to catch up with the narrative trend. They are the first airdrop and the first project with slightly usable products in the world. This is an impression. Like the profound agility demonstration, there will inevitably be some loopholes and misplacements, and some groups that have been promised to airdrop but have been missed in the middle of the release, they decided to lock two profitable assets in exchange for airdrop points. The activity is called making users promise to use the second level, because there is only one pledge and most assets can be freely extracted, which means that the locked assets will face liquidity discount almost immediately, in fact, it will be traded at a low price, because airdrop farmers will sell them, then bridge them out and then bridge them back. This kind of farming is futile, because from the complaints I collected on the Internet, airdrop. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。