深入了解Solana上即将到来的Jupiter大空投

作者:Aylo,alpha please作者;翻译:比特币买卖交易网xiaozou

继上次获取巨大成功的Jito(峰值价值超4.5亿美元)空投之后,JUP空投即将到来,JUP是Jupiter的代币,而Jupiter则是Solana上的一个关键DeFi聚合平台。

这次空投定于1月31日开启,是Solana历史上最受期待的一次空投。

是什么让Jupiter与众不同?JUP会兑现承诺吗?我们应该在什么价格售出?或者我们什么时候应该买入更多?

本文,我将带你深入了解有关Jupiter产品线、未来计划和JUP空投潜在机会的一切。

1、Jupiter:Solana上的一站式DeFi商店

自2021年10月推出以来,Jupiter一直努力追求在Solana上打造最佳去中心化交易体验。该平台通过将各种DeFi功能聚合到一个应用程序中提供最无缝顺畅的用户体验来实现这一愿景。

虽然Jupiter最初被视为一个swap交换引擎,但该协议已有重大发展,为不同类型的用户提供了各种不同产品,包括:美元成本平均法(DCA)、限价订单、永续合约交易,以及最近的发布平台。

在我看来,DCA工具可能是目前DeFi中最好的产品。

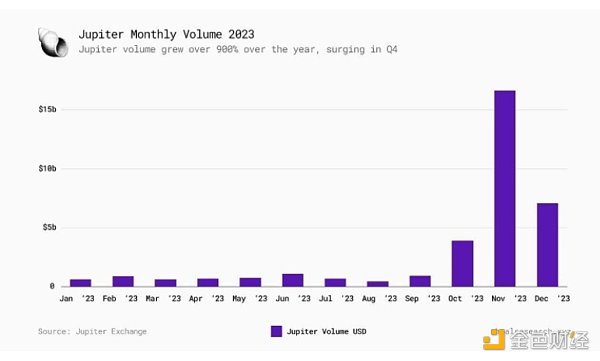

Jupiter在2023年的增长非常出色,月交易量飙升约10倍——从1月份的6.5亿美元增长到12月份的71亿美元。值得注意的是,在JUP代币宣布后,11月份的月交易量超过了160亿美元,创下历史新高。

而2023年Uniswap的月交易量最低为174亿美元,最高为700多亿美元。

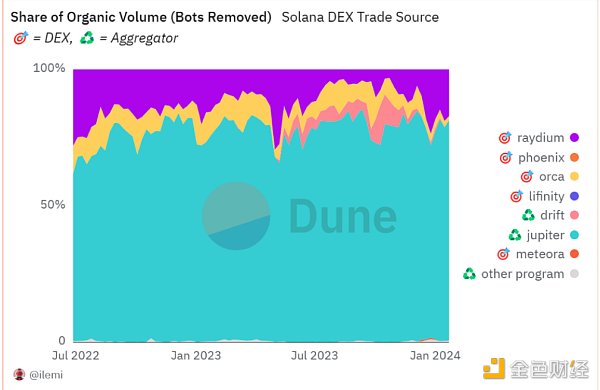

目前,Jupiter的交易量超665亿美元,处理交易超120万笔,已成为Solana生态系统的关键一层。它占Solana DEX有机交易量的70%以上,成为Solana散户交易员可信赖的参考平台。

尽管如此,Jupiter仍然在不断创新,改进现有功能,并根据其三大主要商业模式推出新产品:

提供最好的用户体验

最大限度地发挥Solana技术能力

改善Solana的整体流动性状况

鉴于其独特的定位,我相信Jupiter是在下面这两件事上下注:

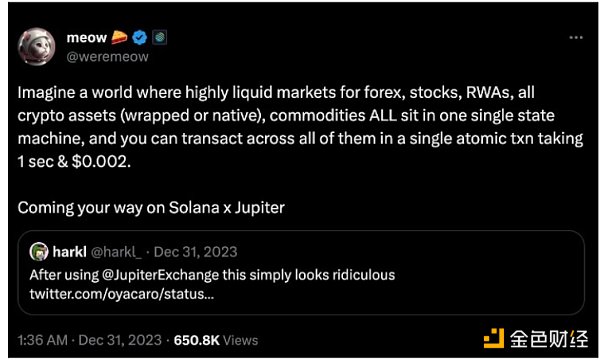

Solana的长期采用:2023年Solana网络活动增加,是Solana重生的一年。我相信Solana有能力继续保持增长,并在L1市场占据更大的份额。这将对Jupiter有利。

DeFi将成为主流:交易的未来在链上,甚至像Larry Fink这样的大型传统金融机构的首席执行官们也开始谈论起“每一种金融资产的代币化”。所以,认为Jupiter可以促进这种转变似乎在情理之中。

最近宣布的JUP代币进一步体现了Jupiter在这一方向上的战略措施。

2、JUP:DeFi 2.0象征

JUP代币标志着Jupiter的发展和精神的一个重要里程碑。就像Uniswap的治理代币UNI象征着以太坊上DeFi的第一波浪潮一样,JUP渴望在Solana上体现DeFi 2.0的精髓。

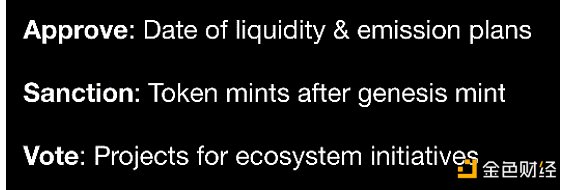

作为一种治理代币,JUP将允许持有者影响决定生态系统的关键方面,包括对代币本身的关键方面进行投票,例如初始流动性供应的时间、未来分发释放以及重要的生态系统举措。

代币主要目标是:

通过吸引新的资本流和用户,为Solana生态系统注入活力。

为推出新的生态系统代币创造动力:JUP将成为推出更多生态系统代币的催化剂。

建立一个强大的分布式JUP社区。

正如匿名的联合创始人Meow所述,JUP渴望建立“一个有史以来最有效、最具前瞻性、最去中心化、非内部投票的DAO”。

此外,JUP的效用将随着时间的推移而发展,这将取决于社区采取什么方向。该代币的潜在用途可能有:

降低永续期货合约交易费用。

优化对发布平台的访问和分配。

自动做市商(AMM)费用共享。

然而,Meow明确表示,在用户规模扩展至少10倍之前,他们不会开启收益共享模式。

3、代币经济学

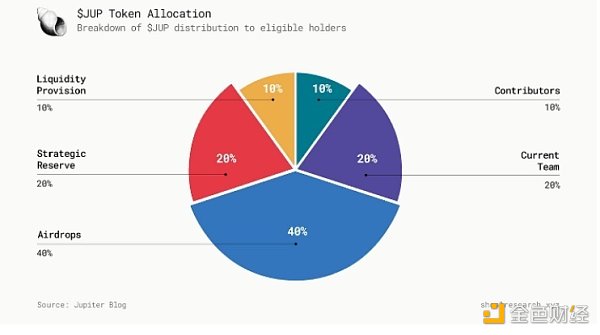

一个项目的代币经济学将反映该项目的精神,而Jupiter的愿景是使其尽可能简单。在最大供应量为100亿枚JUP的情况下,代币平均分配给两个冷钱包——团队钱包和社区钱包。团队钱包将用于当前团队、金库和流动性供应分配,而社区钱包则面向空投和各种早期贡献者。

4、空投细节

第一轮空投定于1月31日进行,将首先向社区分发总供应量的10%。空投详细情况如下:

所有钱包平均分配(2%):2亿枚代币将平均分配给2023年11月2日之前使用过Jupiter的所有用户,相当于每个用户大约200枚JUP。

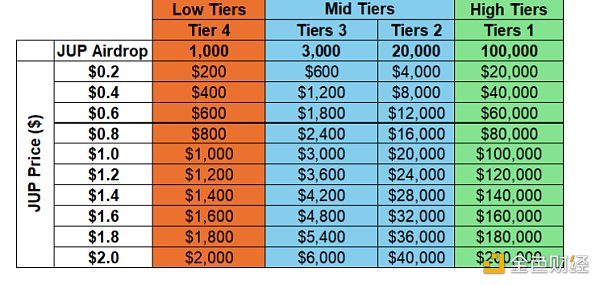

分级计分分配,分数基于未调整额度(7%):具体分配大致如下:

一级分配:前2000名用户,每人分配10万枚代币(预估交易量超100万)

二级分配:接下来的10,000名用户,每人分配2万枚代币(预估交易量超10万)

三级分配:接下来的50,000名用户,每人分配3千枚代币(预估交易量超1万)

四级分配:接下来的150,000名用户,每人分配1千枚代币(预估交易量超1千)

discord、twitter和开发者社区成员(1%):1亿枚代币将分配给最有价值的贡献者和社区成员。

未来还将进行三轮空投。

5、JUP代币估值 — 与JTO比较

新空投的一个常见问题是确定代币的公允价值。

虽然JUP的这个问题没有办法直接回答,但一种可能的方法就是根据与Solana上最近的空投进行比较分析,也就是与JTO代币比较。

JTO是Jito Lab的治理代币,Jito Lab是一个建立在Solana上的流动性质押平台。空投将JTO供应的10%分发给了大约10,000名用户。空投金额曾一度超过4.5亿美元。

JTO价格分析

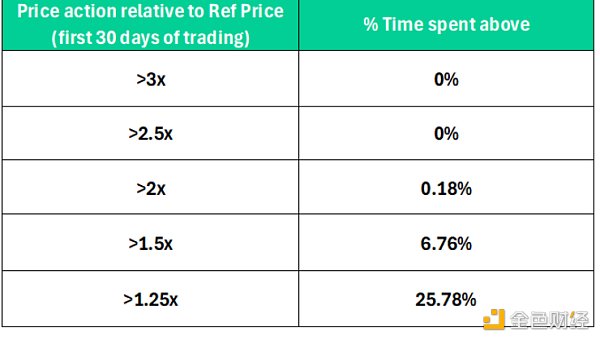

使用币安首次报价(在最初的市场波动之后)2.13美元的参考价格(Ref Price),这是JTO发布后的大概价格走势:

以下是表格体现的一些趋势:

最初,在首个交易日,代币价格大幅波动,从1.74美元上涨至3.77美元。此外,交易价格在83%的时间里都高于2.13美元的初始报价。

此外,值得注意的是,第一周的交易对JTO来说确实是向好的。该代币的交易价格在97%的时间里都超过其参考价格,达到4.45美元的历史高点(ATH)。

现在来看不同价格区域所占的时间百分比,我们可以看出JTO并没有在历史高点占据太长时间,只在18%的时间里超过参考价格2.13美元2倍以上。

此外,我们还看到,与首次报价相比,JTO价格下跌幅度不曾过半。此外,它只有大约8.6%的时间跌幅超25%。

虽然JUP的价格走势不一定和JTO的走势一致,但你可以做一些假设:

JUP在首个交易日预计将出现高度波动,可能会为短期交易员提供机会。

JUP的推出可能会引发极大的兴奋度,很可能在交易的第一周达到局部峰值,价格迅速上涨,超过最初报价的两倍,也可能意味着抛售时机到了。

相反,如果从最初报价下跌超过50%,则可能被视为买入机会。

6、“超买”指标 — JTO FDV / LDO FDV比率

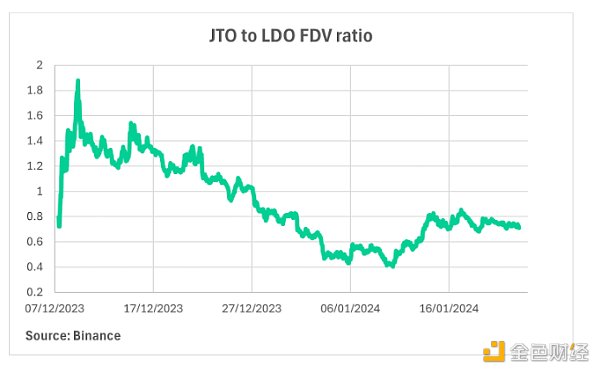

Jito类似于Lido协议。二者的关键区别在于,Jito运行在Solana上,而Lido则是在以太坊上。所以,在JTO发布时,一种合理的代币定价方法就是观察JTO FDV(完全稀释估值)与LDO(Lido治理代币)FDV之间的关系。这种比较让我们能够衡量相对于以太坊上的同类产品,市场是如何评估JTO的。

这是自JTO发布以来的JTO FDV / LDO FDV比率:

我们观察到,JTO发布后其FDV迅速高于LDO FDV,达到近1.9的比值,几乎是LDO FDV的两倍。然而,这种飙升可能受乐观情绪的推动,市场随后迅速将JTO重新拉回较低水平。在随后的几周里,JTO与LDO的FDV比率呈下降趋势,直降到0.4,然后强劲反弹至0.7-0.8左右。到目前为止,市场似乎终于在这个范围内确定了一个公允价值,与过去几个月的均值(0.9)非常接近。

从中我们可以得出这样的结论:对于JTO来说,超过1.6的比率就是明显的超买信号,而0.4则是强烈的超卖信号。

7、将此评估应用于JUP

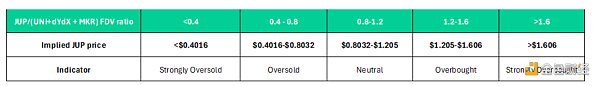

就像LDO对应JTO一样,我们也需要在以太坊上为JUP找到一个比较锚点。

鉴于Jupiter是Solana上最大的去中心化交易所(DEX),具有自动做市商(AMM)、DCA、永续合约交易和发布平台机会等功能,在以太坊上找到差不多的对应项目是很有挑战性的。所以,我认为Uniswap、dYdX和DAO Maker结合在一起几乎最接近JUP。因此,可以结合使用它们的完全稀释估值(FDV)进行比较。在撰写本文时,他们各自代币(UNI、dYdX和MKR)的总FDV约为100.4亿美元。

我们可以利用这个综合的FDV值,以及JTO/LDO FDV比率的各关键值,来评估不同情况下的JUP价格。

通过使用同样的相对估值分析,我们可以得到这些关键价格水平,进一步优化空投决策:

然而,值得注意的是,JTO相对于Solana日Beta值相对较高,为0.86。因此,JTO的价格走势与Solana密切相关,JUP很可能会遵循相同的模式。

撰写本文时,Solana的交易价格为80-82美元,低于120-130美元的水平,也就是超过30%的跌幅,说明市场状况可能不像JTO空投时那样乐观。

在比较JTO空投前一个月与最近的SOL价格时,可以明显看出市场状况发生了变化。因此,似乎有理由认为这可能会对JUP的价格产生负面影响。

8、潜在空投回报

这次空投规模能像JTO那样大吗?让我们来一起分析一下。

如果我们参照各级分配的不同回报,就可以得出JUP在给定价格下的潜在空投潜力:

相比之下,这是JTO在不同分级和不同关键价格下的回报情况:

即使在1.323美元的历史最低价下,JTO的各级空投规模也要高于JUP空投的潜在回报(即使在JUP价格为2美元的情况下)。

为了说明这一点,为了使JUP的最低分级在其历史最低价格下匹配JTO的最低分级回报,JUP的交易价格需要超过20美元。这意味着FDV为2000亿美元,而这完全是一个不现实的数字。

然而,必须强调的是,JTO空投只集中面向10,000名用户,而JUP正在向近100万用户分发代币。这也就是说,JTO会有很多观望中的买家想要入场,而JUP的发行范围很广,所以一开始可能不会有很多买家。

市场也未曾预料到JTO最终会有如此高的市值,似乎对JUP的期望值也非常高,所以这也是一个应该考虑的关键差异。当所有人都期待同一件事时,这件事几乎不会如期发生。

所以,尽管JUP空投可能不会像JTO空投那样为个人用户提供可观的回报,但其对更大用户群的广泛影响使其成为Solana上迄今为止最重要的空投之一。

我们很有可能看到JUP空投后链上活动显著增加。对于许多人来说,这将是一种激励,尤其是对于degens来说,在风险曲线上走得更远,用他们认为来自JUP的“免费资金”追逐更高回报是很常见的行为。

最后一点需要注意的是, SOL也可能受益于JUP获利用户带来的不断增加的买压,但很明显,市场在短期内远没有那么乐观,因此很难衡量SOL在较短时期内的表现如何。

After the last successful airdrop with a peak value of over 100 million US dollars, Bitcoin Trading Network airdropped the upcoming tokens, which is a key aggregation platform in the world. This airdrop is scheduled to open on May, which is the most anticipated airdrop in history. What makes it different? Will we honor our promise? At what price should we sell it or when should we buy more? In this article, I will take you to know more about the future plan of the product line and the potential opportunities of airdrop. Our one-stop shop has been striving to create the best decentralized trading experience in the world since its launch in June. This platform provides the most seamless and smooth user experience by aggregating various functions into one application. Although it was initially regarded as an exchange engine, the agreement has been greatly developed, providing different products for different types of users, including the dollar cost average method, price limit orders, perpetual contract transactions and the latest publishing platform. In my opinion, the tool may be the current one. The growth of the best products in 2008 was excellent, and the monthly transaction volume soared by about 100% from $100 million to $100 million in January. It is worth noting that after the announcement of tokens, the monthly transaction volume in January exceeded $100 million, a record high, while the monthly transaction volume in 2008 was the lowest and the highest was more than $100 million. At present, the transaction volume exceeded $100,000, which has become a key layer of the ecosystem, and it has become a reliable reference platform for retail traders. Constantly innovate and improve existing functions and launch new products according to its three major business models, provide the best user experience, give full play to technical capabilities and improve the overall liquidity. In view of its unique positioning, I believe that it is a long-term adoption bet on the following two things. The increase in network activities is a year of rebirth. I believe that I have the ability to continue to grow and occupy a larger share in the market, which will be beneficial to the future of mainstream transactions, even large traditional financial machines like this in the chain. The chief executives of the organization also began to talk about the tokenization of each financial asset, so it seems reasonable to think that it can promote this transformation. The recently announced token further embodies the strategic measures in this direction, symbolizing an important milestone in the development and spirit marked by the token, just as the governance token symbolizes the first wave in the Ethereum, eager for the essence embodied in the world. As a governance token, it will allow the holder to influence and decide the key aspects of the ecosystem, including the generation. Voting on key aspects of the currency itself, such as the time of initial liquidity supply, future distribution and release, and important ecosystem measures, the main goal of tokens is to inject vitality into the ecosystem by attracting new capital flows and users, and create momentum for launching new ecosystem tokens, which will become a catalyst for launching more ecosystem tokens, and build a strong distributed community. As the anonymous co-founder said, he is eager to build the most effective, forward-looking and decentralized non-internal in history. The other utility of voting will develop over time, which will depend on the direction taken by the community. The potential use of the token may be to reduce the transaction cost of perpetual futures contracts, optimize the access and distribution of the publishing platform, and share the expenses of automatic market makers. However, it is clearly stated that they will not open the revenue sharing mode until the scale of users is at least doubled. The token economics of a project will reflect the spirit of the project, and the vision is to make it as simple as possible with a maximum supply of 100 million. In the case of 100 coins, tokens will be evenly distributed to two cold wallets, team wallet and community wallet. Team wallet will be used for the current team vault and liquidity supply distribution, while community wallet will be airdropped for airdrops and various early contributors. The details of the first round of airdrops will be distributed to the community first. As follows, all wallets will be evenly distributed with 100 million tokens, which will be evenly distributed to all users who have used it before the year, month and day, which is equivalent to about 100 points for each user. The specific allocation of unadjusted quota is roughly as follows: the top users each allocate 10,000 tokens, and the estimated transaction volume exceeds 10,000; the next users each allocate 10,000 tokens, and the estimated transaction volume exceeds 10,000; the next users each allocate 1,000 tokens, and the next users each allocate 1,000 tokens, and the estimated transaction volume exceeds 1,000; and the next 100 million tokens will be distributed to the most valuable contributors and community members. Valuation and comparison of round airdrop tokens A common problem in new airdrops is to determine the fair value of tokens. Although there is no direct answer to this question, one possible way is to compare and analyze it with the recent airdrops in the world, that is, to compare it with tokens. Governing tokens is a mobile pledge platform based on the Internet. Airdrops distributed supplies to about 100 users. The airdrops once exceeded 100 million US dollars. Price analysis used the currency security to quote US dollars for the first time after the initial market fluctuation. Reference price This is the approximate price trend after the release. The following are some trends reflected in the table. At first, the token price fluctuated greatly from US dollars to US dollars on the first trading day. In addition, the transaction price in the first week was higher than the initial quotation of US dollars. In addition, it is worth noting that the transaction price of the token in the first week was indeed good for me. In all the time, it exceeded its reference price and reached an all-time high of US dollars. Now, we can see the percentage of time occupied by different price regions. It didn't occupy the historical high for a long time, but it only exceeded the reference price by more than US$ times in a short time. In addition, we also saw that the price dropped by less than half compared with the first quotation. In addition, it only fell by more than half in a short time. Although the price trend may not be consistent with the trend of, you can make some assumptions, which may provide opportunities for short-term traders to launch, which may lead to great excitement and may reach a local peak price in the first week of trading. A rapid rise of more than twice the initial quotation may also mean that the selling time is on the contrary. If it falls from the initial quotation, it may be regarded as a buying opportunity. The ratio of overbought indicators is similar to the agreement. The key difference between the two is that it runs on the market and it is on the Ethereum. Therefore, a reasonable token pricing method is to observe the relationship between the fully diluted valuation and the governance token at the time of release. This comparison allows us to measure how the market of similar products in the Ethereum is evaluated. This is the ratio since the release. We have observed that it is almost twice as high as near after the release. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。