比特币的真相 全面揭穿常见误解

上周的事件表明,尽管比特币被越来越多的机构所接受,但比特币仍然被严重误解:

Jamie Dimon 声称中本聪控制了比特币

Vanguard 声称比特币波动太大,不可投资

瑞银声称比特币在现实世界中没有应用价值

在这篇文章中,我将重温比特币最常见的误解。

我们还为时尚早。

观点:比特币没有任何支撑。

反驳:比特币由世界上最强大的计算网络支持。

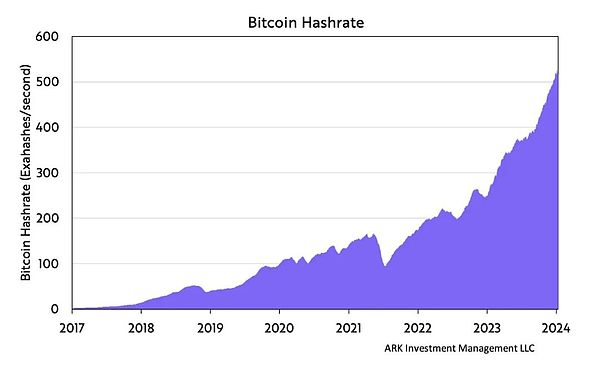

「支撑」比特币的计算能力达到了 500 exahashes/秒,超过了世界上最大计算网络的总和。这种计算能力不是集中在一个地方,也不是由一个实体控制的。它分布在全球网络中,确保了去中心化和抵御攻击或故障的能力。

矿工支持 > 政府支持

观点:比特币浪费了太多电力。

反驳:比特币消耗的能源并非浪费。它被有目的地分配用于维持一个对未来货币具有深远意义的网络。

比特币的能源消耗是一个重要的设计特征,它为去中心化、独立、全球化和自动化的货币系统提供了必要的安全性。比特币的挖矿对计算能力的要求很高,成本也很高,因此比特币建立的系统让任何攻击网络的企图都变得非常不可行。

此外,比特币的能源消耗很大一部分来自可再生能源。比特币挖矿的自由市场原则为矿工寻求廉价电力提供了强大的动力,无意中引导他们采用更可持续的能源解决方案。许多采矿场都战略性地位于丰富的可再生能源附近。这些矿工利用了原本可能被闲置的能源,特别是在可再生能源产量变化很大、并不总是与需求保持一致的地区。在这种情况下,比特币挖矿可以作为可再生能源电网的稳定器,提供持续的能源需求,帮助资助和支持可再生能源基础设施的扩展。

同样值得注意的是,比特币浪费的特性很大程度上取决于其能源消耗的直接性和明确性,这与包括传统金融系统在内的其他系统更为隐蔽和分散的能源成本形成了鲜明对比。

比特币挖矿所消耗的能源应该与一种去中心化的、全球性的、安全的、透明的、超越国界和政治制度的货币的内在价值相权衡。有鉴于此,比特币的能源消耗不是一种浪费,而是对全球金融网络的投资,任何人在任何地方都可以不受歧视地使用比特币。它象征着支持基于自由市场原则的开放式全球经济体系的集体承诺。

对不起,怀疑论者们,你们只能选择一个。

观点:比特币处理交易的速度很慢。

反驳:比特币提供了强大的交易结算保障。

比特币的交易速度反映了其优先考虑安全性和去中心化的设计选择。

在去中心化的全球货币体系中,“交易速度”远不如“交易不变性”更能衡量性能。虽然区块时间会影响交易的初始确认速度,但并不能保证交易的不变性。与“更高吞吐量”的金融结算网络相比,比特币的去中心化结算保证是无与伦比的。按照确保交易最终完成的时间来衡量,比特币是“最快”区块链。

此外,比特币的“小”区块大小为了平衡交易吞吐量和个人参与网络的能力,而不需要过多的数据资源。其 10 分钟的区块间隔也是经过深思熟虑的设计选择,以便有足够的时间进行网络同步和稳定的交易验证。

观点:比特币太不稳定。

反驳:比特币的波动性凸显了其货币政策的可信度。

波动性是比特币货币政策的自然结果。与现代中央银行不同,比特币并不优先考虑汇率的稳定性。相反,基于货币数量规则,比特币限制货币供应量的增长,允许资本自由流动,放弃稳定的汇率。因此,比特币的价格是需求相对于供应的函数。

比特币的波动性不足为奇。

不过,随着时间的推移,比特币的波动性会逐渐减小。随着比特币应用的增加,比特币的边际需求在其总网络价值中所占的比例会越来越小,从而降低价格波动的幅度。例如,在其他条件相同的情况下,100 亿美元市值的 10 亿美元新需求对比特币价格的影响应该比 1000 亿美元网络价值的 10 亿美元新需求对比特币价格的影响更大。

重要的是,我们认为波动不应排除比特币作为价值储存手段的可能性,这主要是因为波动通常与比特币价格的大幅上扬相吻合。

观点:比特币被犯罪分子利用。

反驳:比特币是抗审查的。

批评比特币为犯罪活动提供便利,就是批评比特币的一个基本价值主张:抵制审查。作为一种中立技术,比特币允许任何人进行交易,无法识别“罪犯”。比特币不依赖中央机构通过名称或 IP 地址来识别参与者,而是通过加密数字密钥和地址来区分参与者,这就赋予了比特币强大的抗审查能力。只要参与者向矿工支付费用,任何人都可以随时随地进行交易。

如果比特币网络上的犯罪活动可以被审查,那么所有活动都可以被审查。相反,比特币使任何人都可以在全球范围内进行无限制的价值交换。这并不意味着比特币天生就是犯罪工具。与比特币相比,手机、汽车和互联网为犯罪活动提供便利的可禁止性并不逊色。

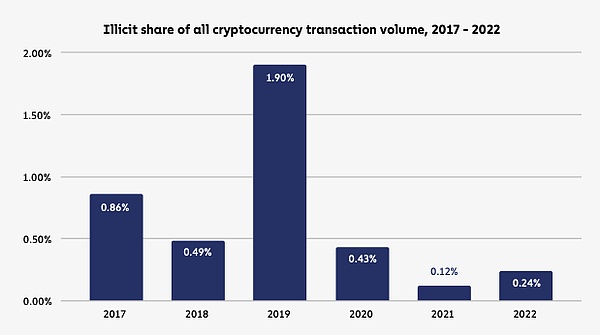

即便如此,只有一小部分比特币交易是出于非法目的。根据 Chainalysis 的数据,2022 年有 0.24% 的加密货币交易被认为是非法的,在过去 6 年中平均不到 0.7%。

观点:政府可以轻易关闭比特币。

反驳:政府无法阻止比特币。他们只能阻止自己使用比特币。

比特币是在全球计算机网络上运行的,因此任何一个政府或机构要想关闭它都是极具挑战性的。比特币网络的弹性来自于它的分布式架构,分布在不同辖区的数千个节点维护并验证区块链。只要世界上任何地方至少有两个节点在运行,比特币就能继续运行。

虽然政府可以在其境内监管或限制比特币的使用,但比特币的全球性和去中心化特性使得完全关闭比特币实际上是不可能的。

观点:中本聪控制着比特币。

反驳:比特币包含一个独特的制衡系统,确保任何个人或实体都无法控制它。

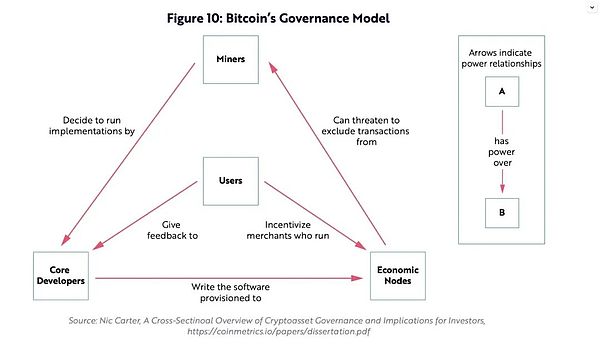

中本聪并不控制比特币。比特币的核心是一个由分散的计算机节点网络支持的软件。它的软件正式确定了它的规则。人类不是真理的最终仲裁者,不能单方面决定改变其规则。相反,验证交易的节点也会执行规则。

每个节点都遵循同一套规则,只有在遵循这些规则的情况下才允许进入网络。如果某个节点试图破坏规则,所有其他节点都会拒绝接受其信息。除非各利益相关方选择接受,否则建议的软件更改毫无意义。节点遍布全球,各自为政,它们不会接受任何有损于完整性的行为。然而,节点只是维护比特币完整性的一部分。比特币包含一个独特的制衡系统,旨在鼓励协议创新和维护,同时确保任何改变都符合利益相关者的利益。

制衡系统的关键是比特币这一资产的价值,它为利益相关者提供了解决争端和维护系统完整性的经济激励。任何利益相关者都不享有优先权利或待遇,但每个利益相关者都能从比特币的价格升值中获益,这是网络的主要信号机制。任何威胁系统完整性的改变都会威胁到比特币的价值。因此,利益相关者几乎没有恶意行为的动机。

这种制衡系统也是比特币能够维持其可预测的货币政策并将比特币供应量限制在 2100 万枚的原因。任意改变比特币的规则是非常不可能的。

观点:比特币没有内在价值。

反驳:比特币是全球货币的竞争者。

虽然比特币的价值驱动因素与传统资产不同,但断言它没有内在价值是不正确的。比特币作为货币资产的特性是其价值的基础,并表明它在金融世界中的作用是可持续的,而不仅仅是投机。比特币的内在价值不在于传统的基于现金流的资产,而在于其符合货币体系历史和现代需求的独特属性。

比特币常被称为“数字黄金”,它不仅具有黄金的许多特性,而且还对这些特性进行了改进。比特币既稀缺又耐用,同时还具有可分割、可验证、可携带和可转移的特点,这些货币特性赋予了比特币超强的实用性,可能会推动需求,并使比特币成为全球数字货币的合适人选。

观点:没有人使用比特币。

反驳:你看到数字了吗?

累计交易额:41.6 万亿美元

累计交易量: 9.54 亿笔

累计矿工收入:588 亿美元

余额不为零的地址:5170 万

市场成本基础:4.4亿美元

Last week's events showed that although Bitcoin was accepted by more and more organizations, it was still seriously misunderstood, claiming that Satoshi Nakamoto controlled Bitcoin, claiming that Bitcoin was too volatile to invest, and UBS claimed that Bitcoin had no application value in the real world. In this article, I will revisit the most common misunderstanding of Bitcoin. We also think it is too early to refute that Bitcoin is supported by the most powerful computing network in the world, and its computing power has exceeded the world for seconds. The sum of the world's largest computing networks. This computing power is not concentrated in one place or controlled by one entity. Its distribution in the global network ensures decentralization and the ability to resist attacks or failures. Miners support the government's view that Bitcoin wastes too much electricity to refute that the energy consumed by Bitcoin is not wasted. It is purposefully allocated to maintain a network with far-reaching significance for the future currency. The energy consumption of Bitcoin is an important design feature. It is unique for decentralization. The globalization and automation of the currency system provide the necessary security. The mining of bitcoin requires high computing power and high cost, so the system established by bitcoin makes any attempt to attack the network very infeasible. In addition, a large part of bitcoin's energy consumption comes from renewable energy. The free market principle of bitcoin mining provides strong motivation for miners to seek cheap electricity, which inadvertently leads them to adopt more sustainable energy solutions. Many mining sites are strategic. Located near the abundant renewable energy, these miners have used the energy that might have been idle, especially in areas where the output of renewable energy varies greatly and is not always consistent with the demand. In this case, bitcoin mining can be used as a stabilizer of renewable energy power grid to provide continuous energy demand, help fund and support the expansion of renewable energy infrastructure. It is also worth noting that the characteristics of bitcoin waste largely depend on the directness and clarity of its energy consumption. Compared with other systems, including the traditional financial system, the hidden and scattered energy costs are in sharp contrast. The energy consumed by bitcoin mining should be weighed against the intrinsic value of a decentralized, global, safe and transparent currency that transcends national boundaries and political systems. In view of this, the energy consumption of bitcoin is not a waste, but an investment in the global financial network. Anyone can use bitcoin anywhere without discrimination. It symbolizes support based on the principle of free market. I'm sorry, skeptics, but you can only choose one point of view. Bitcoin handles transactions very slowly, refuting that Bitcoin provides a strong guarantee for transaction settlement. Bitcoin's transaction speed reflects its priority of security and decentralized design choice. In a decentralized global monetary system, transaction speed is far less than transaction invariance, which can measure performance. Although block time will affect the initial confirmation speed of transactions, it cannot guarantee the transaction invariance. Compared with the financial settlement network with higher throughput, the decentralized settlement guarantee of Bitcoin is unparalleled. According to the time to ensure the final completion of the transaction, Bitcoin is the fastest blockchain. In addition, in order to balance the transaction throughput and the ability of individuals to participate in the network, Bitcoin does not need too many data resources, and its block interval of minutes is also carefully designed to have enough time for network synchronization and stable transaction verification. Definitely refuting the volatility of Bitcoin highlights the credibility of its monetary policy. Volatility is the natural result of Bitcoin's monetary policy. Unlike modern central banks, Bitcoin does not give priority to the stability of exchange rate. On the contrary, based on the rules of money quantity, Bitcoin restricts the growth of money supply, allows capital to flow freely and abandons the stable exchange rate. Therefore, it is not surprising that the price of Bitcoin is a function of demand relative to supply, but the volatility of Bitcoin will gradually decrease over time. With the increasing application of bitcoin, the marginal demand of bitcoin will become smaller and smaller in its total network value, thus reducing the amplitude of price fluctuation. For example, under the same other conditions, the new demand of $ billion with a market value of $ billion should have a greater impact on bitcoin price than the new demand of $ billion with a network value of $ billion. The sharp rise in the price of coins is consistent with the view that Bitcoin is used by criminals to refute the criticism that Bitcoin is anti-censorship. It is a basic value proposition to criticize Bitcoin to resist censorship. As a neutral technology, Bitcoin allows anyone to conduct transactions and cannot identify criminals. Bitcoin does not rely on central institutions to identify participants by name or address, but to distinguish participants by encrypting digital keys and addresses, which gives Bitcoin a strong anti-censorship ability. As long as the participants pay the miners, anyone can trade anytime and anywhere. If the criminal activities on the bitcoin network can be censored, then all activities can be censored. On the contrary, bitcoin enables anyone to exchange unlimited value on a global scale. This does not mean that bitcoin is a criminal tool by nature. Compared with bitcoin, mobile phones, cars and the Internet are not inferior to the prohibition of criminal activities. Even so, only a small part of bitcoin transactions are due to. Illegal purposes According to the data, some cryptocurrency transactions are considered illegal in the past year. In the past year, the government can easily close Bitcoin and refute that the government cannot stop Bitcoin. They can only stop themselves from using Bitcoin, which runs on the global computer network. Therefore, it is very challenging for any government or institution to close it. The flexibility of Bitcoin network comes from its distributed architecture, which is distributed in thousands of nodes in different jurisdictions to maintain and verify the blockchain. If there are at least two nodes running Bitcoin anywhere in the world, it can continue to run. Although the government can supervise or restrict the use of Bitcoin within its territory, the global and decentralized nature of Bitcoin makes it virtually impossible to completely shut down Bitcoin. Satoshi Nakamoto controls Bitcoin and refutes the view that Bitcoin contains a unique system of checks and balances to ensure that no individual or entity can control it. Satoshi Nakamoto does not control Bitcoin. The core of Bitcoin is a software supported by a decentralized network of computer nodes. Its software has formally determined its rules. Humans are not the final arbiter of truth, and it cannot be decided unilaterally. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。