华尔街疯狂抢购比特币

无论暴涨,还是暴跌,华尔街从未停止抢购比特币的步伐。

1月10日,美国证监会审批通过包括贝莱德在内的11只比特币ETF。在审批通过前,释放出通过信号的过去半年中,比特币从最低近27000美元附近上涨至最高近49000万美元附近,总计上涨近162%,领跑加密资产上涨榜单。

在审批通过后,比特币连续暴跌2次。一次是1月13日,比特币一度跌破42000美元,日内跌幅超过7%。另一次是1月23日凌晨,比特币跌破40000美元,日内跌超3%。

比特币的暴涨与暴跌本身似乎从未阻挡华尔街金融巨头们疯狂抢购比特币的步伐。

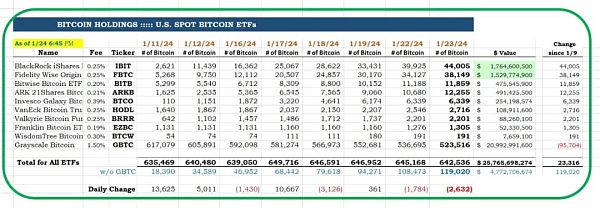

根据CC15Capital最新统计数据显示,从1月9日开始,在比特币ETF推出的8个交易日内,包括贝莱德在内的10只比特币现货ETF机构总计已买入119020个比特币,价值约47亿美元。还不包括灰度GBTC目前已经持有的523516个比特币,价值约200多亿。自1月10日,美国证监会审批通过包括贝莱德在内的比特币现货ETF之后,灰度GBTC一直处于赎回状态,

据自始至终跟踪比特币ETF的彭博社ETF高级分析师Eric Balchunas表示,截止1月24日,GBTC资金流出量「只有」4.25亿美元,这是自第一天推出ETF以来的最低水平,而且似乎还有下降趋势。尽管如此,这仍然是一个相当大的数字。

问题的关键是,是要找到关键的问题。包括贝莱德在内的华尔街金融巨鳄们仅仅用8天时间,就疯狂抢购到119020个比特币。要知道华尔街另一家软件上市公司MicroStrategy是耗时了300天才抢购到10万个比特币。包括贝莱德在内的华尔街金融巨鳄们用了MicroStrategy所用的1/38的时间就抢到了和MicroStrategy一样多,甚至超过MicroStrategy持有的比特币数量。

比特币的未来属于华尔街似乎已经成为一个毋庸置疑的事实。毕竟比特币ETF只要在纳斯达克、纽交所存在一天交易,包括贝莱德在内的金融巨鳄抢购比特币的步伐就会永不止步。

在119020个比特币中,贝莱德毋庸置疑首当其冲,储备44005个比特币,价值约17.65亿。碳链价值曾在1月17日撰写《贝莱德大爆发》一文时,当时贝莱德持币数量在1.15万个。时隔7天,持币数量增至44005个。

其次是富达投资,储备38149个比特币,价值约15.30亿美元。

Bitwise储备11859个比特币,价值约4.75亿美元。

方舟资本ARK储备12255个比特币,价值约4.9亿美元。

景顺invesco Galaxy储备6339个比特币,价值约2.54亿美元。

VanEck储备2716个比特币,价值约1亿美元。

Valkyrie储备2201个比特币,价值约8626万美元。

富兰克林储备1305个比特币,价值约5233万美元。

智慧树WisdomTree储备191个比特币,价值约766万美元

最后是Grayscale储备523516个比特币,价值约210亿美元。相比原有581274个比特币,已经相继抛售近6万个BTC。

为什么灰度GBTC会抛售?碳链价值价值此前已经撰文阐述过,灰度GBTC创立于2013年。在美国证券交易委员会批准其转换为ETF时,其已经积累近300亿美元的资产。这些资产来自大型机构与合格的个人投资者。当灰度GBTC相对其他10家比特币ETF机构收取高昂费率时(1.5%),这就导致部分个人投资者会考虑赎回现金,而选择其他费率较低的投资机构进行投资。带来的结果就是灰度只能抛售BTC。

其次,存在类似FTX这种直接赎回清盘的大型机构导致灰度抛售BTC。据《Coindesk》此前报道,FTX已经出售了约10亿美元的Grayscale比特币ETF,从而解释了大部分资金外流的原因。

Wall Street has never stopped snapping up bitcoin, no matter whether it is skyrocketing or plummeting. On May, the US Securities and Futures Commission approved only bitcoin including BlackRock, and released a passing signal before the approval. In the past six months, bitcoin rose from the lowest near US dollars to the highest near US dollars, with a total increase of nearly 10,000 dollars. The list of crypto-assets rose, leading the way. After the approval, bitcoin plummeted once, once fell below US dollars, and once fell below US dollars in the morning of May. The sharp rise and fall of bitcoin in a day never seems to stop the Wall Street financial giants from snapping up bitcoin. According to the latest statistics, only bitcoin spot institutions, including BlackRock, have bought a total of about 100 million dollars worth of bitcoin in the first trading day since the launch of bitcoin on January, not including the gray value. The gray value of the bitcoin that has been held at present has been more than 100 million yuan since the US Securities and Futures Commission approved the spot of bitcoin, including BlackRock. According to Bloomberg senior analysts who have been tracking bitcoin from beginning to end, the outflow of funds is only $100 million as of March, which is the lowest level since the first day of its launch, and it seems that there is still a downward trend. However, this is still a considerable digital problem. The key is to find the key problem. Wall Street financial giants including BlackRock snapped up a bitcoin in just a few days, knowing that another software listed company on Wall Street took a genius to snap up. It seems to be an indisputable fact that the future of bitcoin belongs to Wall Street in the time it took Wall Street financial giants including BlackRock to grab as much as or even more than the number of bitcoins they held. After all, as long as bitcoin is traded on Nasdaq NYSE for one day, the pace of financial giants including BlackRock snapping up bitcoin will never stop in a bitcoin. BlackRock is undoubtedly the first to reserve a bitcoin worth about 100 million carbon. Chain value once wrote an article about BlackRock's outbreak on, at that time, BlackRock's holding amount of coins increased to 10,000 the next day, followed by Fidelity's investment to reserve a bitcoin worth about $100 million, Ark Capital to reserve a bitcoin worth about $100 million, Jing Shun to reserve a bitcoin worth about $100 million, Franklin to reserve a bitcoin worth about $10,000, and wisdom tree to reserve a bitcoin price. The value is about 10,000 US dollars, and finally, a reserve bitcoin is worth about 100 million US dollars. Compared with the original bitcoin, nearly 10,000 bitcoins have been sold one after another. Why does the gray scale sell off the value of the carbon chain? It has been previously written that when the gray scale was founded in and approved by the US Securities and Exchange Commission, it has accumulated assets of nearly 100 million US dollars. These assets come from large institutions and qualified individual investors. When the gray scale charges a high rate compared with other bitcoin institutions, some individual investors will consider redeeming the cash. The result of choosing other investment institutions with lower rates is that the gray scale can only be sold. Secondly, there are large institutions like this kind of direct redemption and liquidation, which leads to the gray scale selling. It is reported that about 100 million dollars of bitcoin has been sold, which explains the reason for most of the capital outflow. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。