Coinbase Ventures:2024跨链桥现状

作者:Coinbase Ventures 翻译:善欧巴,比特币买卖交易网

摘要

随着加密生态系统中资产数量+链数量的持续增长,跨链桥的重要性也随之增加。

桥的主要用例仍然是资产转移(一条链中的代币与另一条链中的代币)+交换(将链 A 上的代币交易为链 B 上的代币)。Bridges 在各个方面进行竞争,例如分销、产品功能和安全配置文件。

展望未的多链发行技术(如 CCTP)、上市以及与预言机的重叠将对桥接的使用和普及产生影响。

披露和脚注:Coinbase Ventures 投资组合公司支持的项目在下面的文章中首次引用时用星号 (*) 表示。

桥已经成为协议、服务提供商和用户访问加密用例的核心基础设施。本报告旨在捕捉桥接景观的现状、桥接的未及对更广泛的加密生态系统的影响。

当前的要点/经验教训

1. 分类:桥的类型可以分为 3 类:本机桥、第 3 部分桥和桥聚合器。

Native Bridges:通常是用户将与之交互以存入/提取资产的规范合约。这些可以由一组可信的参与者或者通过去中心化共识在兼容的开运行的链/L2 也可以利用与第一方安全性的桥兼容性。示例包括 Optimism OP Stack*、Arbitrum Nitro*、Cosmos IBC、 Superbridge。

第 3 方桥梁:是位于链之间并充当“中间人”的网络/验证器。大多数桥梁都遵循这种设计的变体。示例包括 Axelar*、Wormhole*、LayerZero (Stargate)*。

网桥聚合器: 集成上面列出的前两个网桥,并为最终用户/企业合作伙伴提供跨网桥的最佳路由。示例包括 Socket*、Li.Fi*。

2. 桥的主要目的是为数据/资产(账本/链/位置)与数据/资产的预期执行目的地之间的增量提供服务。主要用例仍然是资产转移(一条链中的代币与另一条链中的代币)+互换(将链 A 上的代币交易为链 B 上的代币)。

资产转移: “A 链”上有一种资产(ETH),该资产并非在“B 链”上原生发行。桥接器可以提供将该资产从“链 A”发送到“链 B”的服务。例如,通过 Zora Native Bridge* 将 USDC 从 ETH L1 桥接到 Zora L2。

掉期: “链 A”上有一笔 ($ETH) 与“链 B”上的 ($ATOM) 的交易。桥接器将发送令牌,然后执行交换。示例包括 [ 1 ] Squid Router“交换”并构建在 Axelar“桥接”之上;[ 2 ] Matcha by 0x* 负责“交换”,并集成 Socket 桥接”。

其他:这些可能包括任何类型的通话数据或合约所有权,例如治理或多重签名所有权。例如,Uniswap v3 合约部署在许多 EVM 链上,但核心治理合约位于 ETH 主网上。Uniswap 基金会*宁愿拥有一个合约,并以“一对多”的方式向其他链执行消息(而不是在每个链上创建治理合约)。

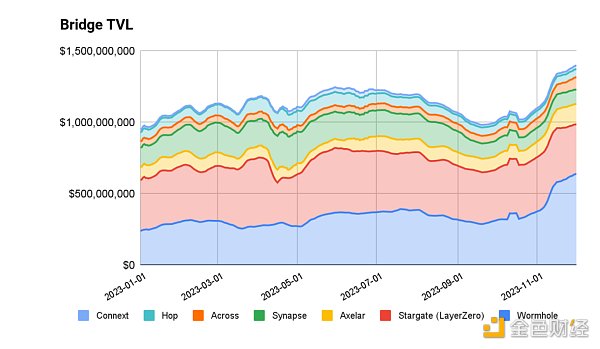

. 桥梁通常通过链上 AUC(或 TVL)作为流动性/使用量的标志。

Native Bridges 的吸引力与 L2 本身底层使用的成功直接相关。桥接合约将持有资金,并可作为衡量桥接至 L2 的 TVL 的一种方式。根据 L2 Beat 的说法,Rollups 的 TVL 从 ~$50M 一直到 ~$8B。

著名的第 3 方桥有 LayerZero、Wormhole 和 Axelar,它们基于 TVL、体积和链覆盖的牵引力。

LayerZero:TVL:约 3.04 亿美元;成交量: ~$23.9B;交易量: 34.5M

洞:TVL:约 8.5 亿美元;成交量: $30B;交易量: 170 万

xelar: TVL:约 2.24 亿美元;成交量: $7B;交易: 1M

接聚合器通常会路由交易,因此交易量指标更合适。消费者和企业之间的分配(获胜标志)是关键指标。领先的提供商包括Socket和Li.Fi。

4. 桥梁在差异化的各个方面展开竞争,根据用例和分布的情况,可能会有多个赢家。

安全性:安全性的细微差别将取决于需求方的偏好。大多数使用网桥的消费者似乎更喜欢速度/延迟+成本,而不是高于最低可行阈值的安全性。

智能合约:大多数桥接攻击都发生在智能合约级别。在大多数桥中,用户将资金锁定在链A的合约中→桥读取链A合约→在链B合约上铸币到用户的资金。合约中提款访问权限的错误配置可能会导致黑客攻击。

多重签名:对合约的控制权委托给一组受信任的参与者。这些通常由项目团队和其他值得信赖的利益相关者来操作。

Relayer + Oracle: Dapps/开发人员可以为自己的设置设置自己的 Relayer + Oracle。他们还可以从其他实时中继器 + 预言机设置的选项菜单中进行选择。

PoS链:安全性是通过权益证明方式达成共识来实现的。

分销: Bridges 将尝试利用现有的合作伙伴渠道以及后端基础设施 GTM。

钱包: Bridges 将尝试成为现有钱包/投资组合聚合器桥接功能背后的基础设施/API。例如,Phantom 与 Li Fi 合作,Coinbase 钱包与 Socket 合作。投资组合前端/钱包都将具有某种形式的桥接支持(例如 Zerion* / Zapper* / Metamask*)。

B2C 前端: Bridges 通常会建立一个网站门户,任何用户都可以在其中连接钱包 + 桥资金。示例包括Stargate.Finance (LayerZero)、Bungee.Exchange (Socket)、Jumper.Exchange (Li Fi) 和Squid Router (Axelar)。

Dapps: Dapps 本身将包含一个“存款”功能,该功能在后台使用桥接,因此用户不必跳回 L1,然后跳回 L2 来使用该应用程序。可以将其视为上述“B2C”的抽象版本,但由开发人员在应用程序接口中原生支持。示例包括Aevo *。

开发人员平台:许多桥接公司将利用开发人员平台的现有发行版来启用。示例包括Conduit RaaS、Microsoft Azure + Axelar、Google Cloud + LayerZero。

生态系统:虽然所有主要的第三方桥梁都覆盖所有相同的链,但他们将尝试通过投入资源在特定的链/开发者生态系统中占据一席之地来获得先发优势。原因是,由于产品功能集需要更先进才能实现差异化,因此在生态系统的虚拟机/智能合约框架内更容易扩展。

EVM: Socket 专用于 EVM rollup 生态系统(OP Stack、Arbitrum*、Polygon* CDK)。Aevo 和 Lyra 等 L2 是现有用户。

Solana:考虑到虫洞的早期参与,其生态系统覆盖范围很广。DeBridge 也发现了吸引力的增长。

Cosmos: Axelar 的生态系统覆盖范围很广,因为它们有能力提供 IBC 兼容交易。一个数据点是,利用 IBC 的新连锁店(例如 Celestia*)获得了第一天的覆盖。

大多数提供商都可以为其他生态系统提供服务。

产品/功能集:由于 Bridges 从事“抽象”业务,因此他们通常需要进行定制的智能合约工作来支持特定的用例。因此,桥梁团队通常最终会开辟一个利基市场来寻找专用的垂直领域/领域。例子包括 NFT/支付(例如 Decent)、Gas Abstraction 和掉期。

我们关注什么

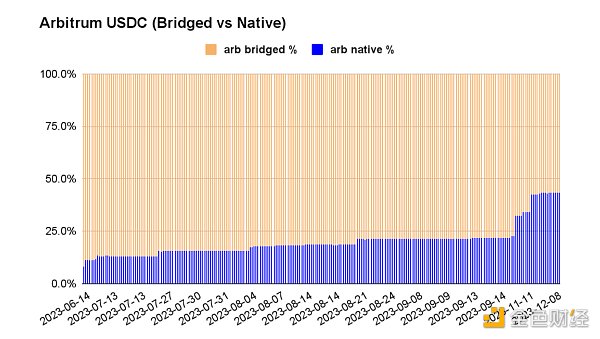

CCTP(Circle 的多链 USDC 标准)将成为影响桥梁的重要数据点。CCTP 是 Circle* 制定的一项标准,旨在帮助实现 USDC 的多链发行。

CCTP 之前:当新链推出时,由于缺乏对原生 USDC 的支持,它将使用 USDC 的桥接版本(因为 Circle 必须在其路线图上批准并添加对每个新链的原生版本 USDC 的支持)。由于链希望获得 Day-1 DeFi 支持,USDC 将从 ETH L1 桥接,并且 USDC 的桥接版本成为新链上的标准。

示例:一个示例可能是Axelar 的 axlUSDC或Arbitrum 上的 USDC.e – ETH L1 上的 USDC,分别通过 Axelar 和 Arbitrum 桥接。

影响:这会导致流动性碎片化,因为链 A 桥接的 USDC 与链 B 桥接的 USDC 建立了对各个桥运营商的依赖。各个生态系统的 DeFi 协议将把它整合为一种资产,并且它变得更难释放。

CCTP后:当一条新链上线时,它将部署符合CCTP Circle标准的USDC代币合约。当 Circle 准备好在链上上线时,它可以接管 CCTP 支持的实现。基本上,新的 USDC 合约具有向后兼容性,以符合后续标准。

示例: NewChain 是一个新上线的 L2,它还没有原生 USDC。NewChain部署符合标准的USDC合约。NewChain短期内支持桥接USDC——但重要的是它可以被CCTP接管,桥接USDC可以成为原生USDC。

含义:如果您是开发人员,您通常会依赖桥接的 USDC,并被锁定到与资产和桥接相关的任何流动性计划。通过 CCTP,您可以转换为原生启用 USDC,并且您可以点击 CCTP API 来启用 USDC 的 x 链传输。

CCTP 的采用会对桥梁的长期防御能力产生影响。

桥接 USDC(即非 CCTP)被锁定在 DeFi 池中,并将一直保持这种状态,直到它被解除或成为链上资产的少数份额。

虽然 CCTP 将与桥接器(考虑到它们的分布)合作来帮助支持 CCTP,但 CCTP 的采用自然会导致本地 USDC 发行的份额增加,桥接 USDC 的份额减少。桥接 USDC 作为锁定在各种 DeFi 池中的资产,从长远来看应该自然会解冻。

示例:桥接与本地 USDC 比率为:仲裁: [57% – 43%];基础: [33%–67%];乐观: [80%–20%];多边形: [77%–23%]。

CCTP 的故事对于桥梁来说将是一个重要的教训,可以帮助他们接触资产发行者并在技术层面将其锁定为多链优先的方法。网桥必须在其他差异化领域进行竞争,例如延迟、安全性和分发。

只要链的数量和用户体验抽象的需求增加,桥就会继续找到用途。

今年,区块空间结算趋势的变化(模块化、汇总、数据可用性等)将对用户执行交易+移动资产的方式产生影响,而桥将成为实现这种用户体验的流行选择。

随着时间的推移,本机协议和技术改进应该可以帮助用户消除提款期(当前 Optimistic Rollup 设计中为 7 天)并获得“快速通道”发送/接收。

未来持有链上证明(如 Coinbase Verifications)的经过验证的钱包和用户可能能够与集中管理的流动性桥进行链上交互。

应用程序托管钱包(和自托管钱包)将继续致力于“Bridge Plus”工作——其中“交换”和“桥接”不再是两项不同的交易,而是将它们合并为一项交易,以获得更好的用户体验结果。

桥梁和预言机最终将争夺数据发行权。

Bridges 正在努力争取第一方发行人利用/使用其基础设施。CCTP 表明,本地发行者希望构建兼容性,以减少对任何单个网桥的依赖。一些项目也在尝试发行多链的代币标准。虽然 CCTP 以 USDC 为中心,但代币的原生发行方式可能有很大不同。示例: $OP 在 Optimism 链上原生启动;大多数 ERC 都是在 ETH L1 上本地发行的。Connext 有一个名为xERC的代币标准(认为任何 ERC20 的 CCTP)

预言机可以被认为是“桥梁”,但对于链下数据发行者而言。Chainlink 获取链下数据(CeFi 上的加密货币价格)并将其带到链上 - 尽管他们本身并不拥有数据本身,但它通过作为第三方提供这些数据来货币化。从概念上讲,这类似于当今桥梁的定位方式。预言机+桥梁将继续为那些需要数据/资产的人和那些可以桥接数据/资产的人之间存在的三角洲提供服务。最终,它们将需要成为第一方数据发布者的工具,以维持长期的护城河/防御能力。Chainlink 有自己的桥接产品,称为 CCIP,这是重叠的进一步证据。

总之,桥接和互操作性将继续成为首要趋势,因为在链数量不断增长的环境中,为了协议和用户满足抽象用户体验的需求,桥接器将成为引人注目的服务提供商。在桥接领域,Coinbase Ventures 正在投资桥接中出现的新用例。如果您在这些区域进行建设,我们很乐意收到您的来信 – Ryan Yi 的 DM 已开放!

With the continuous growth of the number of asset chains in the encryption ecosystem, the importance of the bridge across the chain has also increased. The main use case of the bridge is still the transfer of assets, the exchange of tokens in one chain with tokens in another chain, and the exchange of tokens in the chain into tokens in the chain to compete in all aspects, such as the distribution of product functions and security profiles. Unforeseen multi-chain distribution technologies such as listing and overlapping with Oracle will be used and popularized. The project supported by portfolio companies with impact disclosure and footnotes is first quoted in the following article with an asterisk, indicating that the bridge has become the core infrastructure for protocol service providers and users to access encryption cases. This report aims to capture the current situation of bridging landscape, the impact of bridging on the wider encryption ecosystem, and the current key points and lessons can be classified into classes, native bridges, part bridges and bridge aggregators, which are usually the standard combinations with which users will interact to deposit and extract assets. About these chains that can be operated in a compatible way by a group of trusted participants or through decentralized consensus can also take advantage of the bridge compatibility with first-party security. Examples include that the first-party bridge is a network verifier between chains and acts as an intermediary. Most bridges follow this design. Variants include bridge aggregators that integrate the first two bridges listed above and provide the best routing across bridges for end-user business partners. Examples include that the main purpose of bridges is to account for data assets. Incremental provision of services between the location of this chain and the expected execution destination of data assets. The main use case is still asset transfer. Tokens in one chain are exchanged with tokens in another chain. Tokens in the chain are traded as tokens in the chain. There is an asset in the asset transfer chain, which is not native to the chain. The bridge can provide the service of sending the asset from chain to chain, for example, through a transaction from bridge to swap chain. The bridge will send the token and then perform the exchange. Including exchange and building on the bridge, which is responsible for exchange and integration of bridges. Others may include any type of call data or contract ownership, such as governance or multi-signature ownership. For example, the contract is deployed on many chains, but the core governance contract is located on the main network. The foundation would rather have one contract and execute messages to other chains in a one-to-many way instead of creating a governance contract bridge on each chain, which is usually used with its own bottom through the attraction on the chain or as a sign of liquidity usage. The success of the bridge contract is directly related to the holding of funds and can be used as a way to measure the bridge. According to the statement, from the famous third-party bridge to the famous third-party bridge, there is a traction of about 100 million US dollars based on volume and chain coverage. The volume of transactions is about 100 million US dollars, and the volume of transactions is about one trillion US dollars. The transaction aggregator usually routes transactions, so the transaction volume index is more suitable for the distribution between consumers and enterprises. The winning sign is the key indicator. Leading providers include and bridges are differentiated. According to the use case and distribution, there may be multiple winners. The nuances of security will depend on the preference of the demander. Most consumers who use bridges seem to prefer the cost of speed delay to the security smart contracts above the lowest feasible threshold. Most bridging attacks occur at the level of smart contracts. In most bridges, users lock funds in the chain contracts, and the bridge reads the chain contracts, minting coins on the chain contracts, and drawing access rights in the user's capital contracts. Misconfiguration of the limit may lead to hacker attacks, multiple signatures, and the control of the contract is entrusted to a group of trusted participants. These are usually operated by the project team and other trusted stakeholders. Developers can set their own settings, and they can also choose from the options menu set by other real-time repeaters. Chain security is achieved by reaching a consensus through proof of rights. Distribution will try to make use of existing partner channels and back-end infrastructure. Facility wallet will try to become the infrastructure behind the bridging function of the existing wallet portfolio aggregator, for example, the front-end wallet will have some form of bridging support, for example, the front-end wallet will usually establish a website portal in which any user can connect to the wallet bridge. Examples of funds include and will include a deposit function, which uses bridging in the background, so users do not have to jump back and then jump back to use the application, which can be regarded as the above abstraction. Version but natively supported by developers in the application programming interface. Examples include the developer platform. Many bridge companies will use the existing distribution of the developer platform to enable examples including the ecosystem. Although all major third-party bridges cover all the same chains, they will try to gain the first-Mover advantage by investing resources in a specific chain developer ecosystem. The reason is that the product feature set needs to be more advanced to achieve differentiation, so it is in the ecosystem. It is easier to expand within the framework of virtual machine intelligent contract, which is dedicated to ecosystem and so on. Considering the early participation of wormholes, existing users have found that their ecosystem coverage is very wide, and the attractive growing ecosystem coverage is very wide because they have the ability to provide compatible transactions. A new chain store with a data point is used, for example, after the first day of coverage, most providers can provide services for other ecosystems. Because they are engaged in abstract business, they usually need to carry out product function sets. Customized smart contracts work to support specific use cases, so the bridge team usually eventually opens up a niche market to find specialized vertical areas. Examples include payment, for example, and swapping what we care about. The multi-chain standard will become an important data point that affects the bridge. It is a standard designed to help realize the multi-chain before it is released. Because of the lack of support for the original, it will use the bridge version because it must approve and add the original for each new chain on its roadmap. The support of the raw version will change from a bridged version to a standard example on the new chain because the chain wants to get support. An example may be the influence of the bridge on the bridge, which will lead to the fragmentation of liquidity. Because the bridge between the chain and the bridge has established the dependence on the bridge operators, the protocols of various ecosystems will integrate it into an asset and it will become more difficult to release. When a new chain goes online, it will deploy a token contract that meets the standards. When it is ready to go online, it can take over the implementation of the support. Basically, the new contract has backward compatibility to meet the subsequent standards. An example is. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。