一文了解Jupiter :Solana史上最大空投

北京时间2024年1月31日晚23:10,Solana生态DeFi协议Jupiter平台币,$JUP,同时登陆币安和OKX两大交易所。

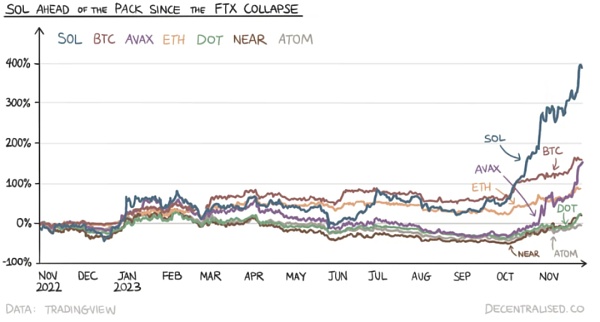

FTX事件后,Solana生态元气大伤,投资机构不再青睐,知名项目也纷纷出逃。几周时间内,$SOL从236美元暴跌至13美元。

然而,2023年,Solana完成了反超,涨幅超越诸多主流公链资产。其中的Defi佼佼者Jupiter,也完成月交易量的十倍增长,更是带来了号称“史上最大规模空投”的$JUP。

$JUP为何获得两大巨头交易所的青睐?Solana和Jupiter还能带来什么样的未来?白露会客厅本期文章为你解读。

认识Jupiter

Jupiter为Solana公链上的DeFi一站式服务平台,成立于2021年10月,核心为集成各类DeFi应用,并优化用户使用体验。产品最初定位交换引擎,经过迭代以支持更多相关功能,如:成本平均化策略(DCA,又称定投法)、限价订单、永续交易,以及最近推出的launchpad。

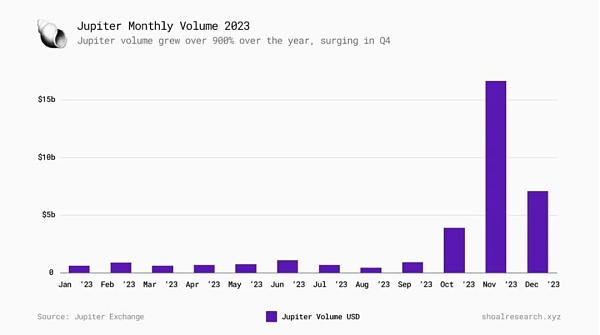

2023年,Jupiter月交易量增长约十倍。1月交易量6.5亿美元,12月增长至交易量71亿美元。平台宣布发行$JUP代币之后,11月交易量创下新高,超过160亿美元。

目前,Jupiter已处理超过665亿美元的交易量和超过120万笔交易,占Solana 所有DEX中超过70%的有机交易量,成为Solana上交易者的首选平台。

2024年1月26日,Solana日活跃地址数突破100万。对于活跃变化,Artemis CEO公开发表了数据分析结论:Jupiter是驱动大部分新活跃地址最多的应用。

2024年1月26日,Solana上37%的日活跃地址为新地址,很有可能是机器人为利用Jupiter而开设的新钱包和新地址。

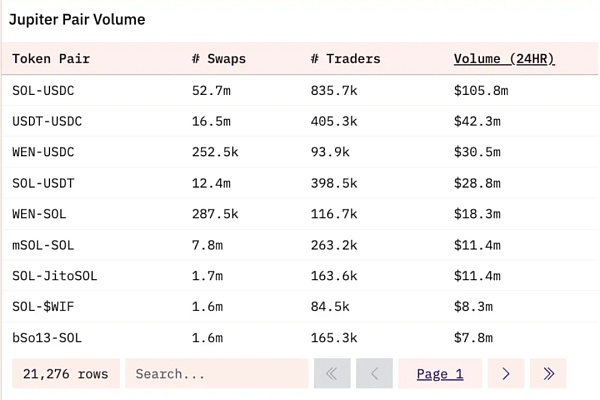

2024年1月28日,Jupiter上$SOL-$USDC交易对发生5270万美元交易量,此外,$WEN与$SOL和$USDC之间的交易量约为4800万美元。

1月31日,$JUP第一期空投正式开始发放,市场关注度空前火热,Solana历史上最受关注,潜在规模最大的空投,拉开了序幕。

$JUP

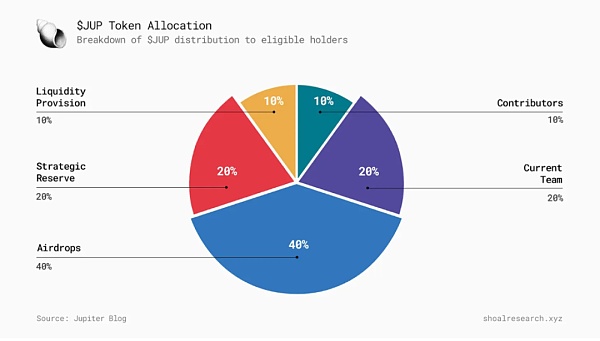

$JUP的最大供应量为100亿个,代币分发平均分配到2个冷钱包中:团队钱包和社区钱包。团队钱包将用于分配给当前团队、财政和提供流动性,而社区钱包则用于空投和各种早期贡献者。

从第一天起,15%-17.5%的代币就开始流通,10%-7.5%位于热钱包中,75% 位于冷钱包中。

Jupiter将对955,000名早期用户(截止日期为2023年11月2日之前)进行的追溯性空投,以及旨在吸引新用户和流动性。然后,DAO将对代币解锁数据进行投票,代币将被初始锁定,解锁日期由DAO 设置。JUP持有者将能够对 Jupiter协议的各个关键方面和代币的作用进行投票,包括初始流动性提供的时间、未来的排放安排、该项目将在Jupiter Start上展示等等。

$JUP能获得如此高的关注,归根之底,是Jupiter能够发挥Solana的优势,和其不断创新Defi未来的潜力。

基于SVM的构建更适合DEX的发展

虚拟机可以最好地描述为由数千台运行特定链(如以太坊)验证客户端的联网计算机维护的单一实体,是所有智能合约和账户实际存在的环境。直到今天,大多数DeFi和其他链上活动都通过以太坊虚拟机(EVM)进行。

然而,尽管不再在聚光灯下,SVM也具有强大的架构,肯定会继续吸引更多寻求构建面向消费者的、针对速度和性能进行优化的应用程序的开发人员。

用Rust、C、C++编写的智能合约代码会被SVM编译成BPF字节码。Sealevel 引擎是Solana上实现并行处理的关键组件;随着Solana交易中集成了状态访问列表,使得不冲突的交易可以同时运行,从而实现更快的整体性能。

另一方面Solana平均交互成本低廉。gas成本不到一分钱。从多个来源获取流动性的成本几乎与从一个来源获取一样,因此,在像Solana这样的链上,DEX聚合器比在EVM链上更加实际和有益。

作为Solana上的领先聚合器,Jupiter在长期内更有望实现显著的增长和采用,而EVM链上的聚合器面临着更高的成本和更大的竞争。

同样的理念也适用于简单的A换B之外的其他用例,例如为用户提供结构化的美元成本平均法(DCA)或时间加权平均价(TWAP)产品。

更具想象力的DEX开发方向

Jupiter结合了大量链上DEX的创新功能,为用户创造最流畅的交易体验同时,为Defi未来的发展方向也提供了很好的范例。

AMM和聚合器

自动化做市商在过去几年中是数字资产领域的一项新颖创新。随着AMM的出现,交易者可以部署由数学和代码而不是复杂的中间商制造市场的数字资产。即使在极低流动性的情况下,交易者也可以进出头寸。

当然,低流动性会带来新的缺点。一是交易者会遇到滑点,即预期交易价值与实现交易价值之间的差额;二是交易者还可能通过公共mempool中信息不对称的利用而在交易中损失价值,例如被部署MEV机器人的复杂参与者抢跑或夹击。这些还需要开发者进行更多的攻克。

而链上聚合器的出现是为了减轻低流动性交易的影响,让交易者能够下订单,从多个来源而不是一个来源传递流动性。流动性可以从多种来源获取,包括 AMM。Jupiter和其他DEX 聚合器跨多个交易场所获取流动性,从而为交易者提供更好的交易价格,提供更好的用户体验。

DCA

平均成本法DCA,又称定投,涉及将资本分配拆分成多个交易,而不是一个交易。DCA在熊市中积累资产时,平均自己的入场价格,以减轻波动性并在时间和市场条件变化的过程中获得更大的回报。同样,DCA在牛市中也可以帮助获利,与立即完全出售自己的头寸不同,DCA可以帮助分散销售,以捕捉平仓期间可能出现的任何额外上涨空间,而不是立即完全抛售头寸。

交易者还可以执行加权平均价格策略,即TWAP来购买或出售资产。与DCA类似,TWAP通常用于需要拆分成较小部分的大额订单,以防止一次性购买导致的价格影响。

由于Solana具有高吞吐量的架构,Jupiter是少数几个使用户能够在链上执行频繁的限时策略的平台之一。在以太坊上低时间范围交易的DCA(例如每天)可能会导致数百美元的交易费用,而在Solana上只需几美分。即使在L2上,如果交易者想在1小时内执行10笔交易,费用也会很快增加。

永续合约

Jupiter推出了LP-Traders永续合约交易所。尽管仍处于测试阶段,但交易者可以使用高达100倍的杠杆交易SOL、ETH和wBTC永续合约,而LP则可以提供资本以赚取费用。

在Jupiter上,交易者可以使用几乎任何受支持的Solana代币作为抵押品,在 SOL、ETH和wBTC上开设多头或空头头寸。多头头寸需要相应的标的物,而空头头寸则需要稳定币作为抵押品。交易者可以通过从流动性池中借入资产来承担杠杆作用 - 通过从JLP池中借入1倍的SOL,SOL-USD头寸的杠杆率可以达到2倍。

Jupiter Perps利用了JLP池,该池包括SOL、ETH、WBTC、USDC和USDT。提供流动性只需将任何支持的Solana代币存入JLP池,以换取等值的$JLP代币。JLP池获得了Jupiter永续合约生成的70%的费用,$JLP的价格与基础池的价值同步增长。

JLP池还有益于更大的 Solana 生态系统,因为Jupiter Swap已经本地集成到永续合约交易所中,这意味着不仅可以使用任何代币作为JLP抵押品,而且 Solana交易者可以从 JLP池增加的流动性中获益,获得更好的交易价格。

与前述功能不同,Jupiter的永续合约交易所对交易者和LP都收取更多的费用。交易者根据每小时借款费用或资金费率向池支付费用,费率基于每小时借款率、头寸大小和代币利用率,可以表示为:

资金费率=(借入的代币/池中的代币)*0.01%*头寸大小

LP也需要支付自己的一部分费用,用于开仓/平仓头寸以及在JLP池内进行不同资产的交换。

Jupiter是Solana近期和长期采用的可行押注。随着Solana上的网络活动不断增加,Jupiter可能通过其已建立的生态系统、各种产品套件以及可持续的收入模型捕获大量的流动性,理论上会使$JUP持有者从中受益长期。在如今主流金融巨头也对资产代币化越发关注的背景下,Jupiter功能创新上的领先,很有可能尽得新一代Defi市场的先机。

On the evening of June, Beijing time, the platform currency of the ecological agreement landed in the currency security and the two major exchanges at the same time. After the incident, the ecological vitality was greatly damaged. Investment institutions no longer favored well-known projects and fled in succession. Within a few weeks, they plunged from the US dollar to the US dollar. However, in 2000, they completed the overtaking increase, surpassing many mainstream public chain assets, and the outstanding ones also completed a tenfold increase in monthly transaction volume, which brought the so-called largest airdrop in history. Why did they win the favor of the two giant exchanges and what kind of future the Bailu living room book could bring? The one-stop service platform on the public chain was established at the core of October, in order to integrate various applications and optimize the user experience. The exchange engine was initially positioned to support more related functions, such as the cost averaging strategy, which is also known as the fixed investment method, the price limit order perpetual transaction, and the recently launched monthly transaction volume increased by about ten times, and the monthly transaction volume increased to $ billion. After the platform announced the issuance of tokens, the monthly transaction volume reached a new high, exceeding $ billion. At present, it has been processed. The trading volume of over 100 million US dollars and more than 10,000 transactions account for more than all the organic trading volume, which has become the first choice platform for online traders. The number of active addresses has exceeded 10,000, and the data analysis conclusion has been published publicly for the active changes. The daily active address on the day of the month is the new address, which is likely to be a new wallet and new address opened by robots for use. In addition, the trading volume with and is about 10,000 US dollars. The first airdrop was officially launched, and the market attention was unprecedented. The most concerned airdrop with the largest potential scale in history kicked off. The maximum supply was 100 million tokens, which were distributed evenly in 100 cold wallets. Team wallets and community wallets will be used to distribute the current team finances and provide liquidity, while community wallets will be used for airdrops and various early contributors. The tokens will be circulated from the first day. They will be located in hot wallets and will be located in cold wallets, and the deadline for early users will be years. The retrospective airdrop conducted before, and the voting on the token unlocking data aimed at attracting new users and liquidity will be carried out. The token will be initially locked and the unlocking date will be set. The holder will be able to vote on all key aspects of the agreement and the role of the token, including the time provided by the initial liquidity, and the future emission arrangement. The project will be displayed on the Internet and so on. In the final analysis, it is more suitable for the development based on its advantages and its potential for continuous innovation in the future. The virtual exhibition machine can be best described as a single entity maintained by thousands of networked computers running a specific chain, such as the Ethereum authentication client. It is the environment where all smart contracts and accounts actually exist. Until today, most and other chain activities are carried out through the Ethereum virtual machine. However, although it is no longer in the spotlight, it has a powerful architecture, which will certainly continue to attract more developers seeking to build consumer-oriented applications optimized for speed and performance. About code will be compiled into bytecode engine, which is the key component to realize parallel processing in the world. With the integration of state access list in transactions, non-conflicting transactions can run at the same time, thus achieving faster overall performance. On the other hand, the average interaction cost is low and the cost is less than a penny. The cost of obtaining liquidity from multiple sources is almost the same as that of obtaining liquidity from one source. Therefore, the aggregator on the chain like this is more practical and beneficial than the leading aggregator on the chain, which is expected to achieve obvious results in the long run. With the growth and adoption of the book, the aggregator in the chain is facing higher cost and greater competition. The same concept can also be applied to other use cases other than simple exchange, such as providing users with a structured dollar cost averaging method or time-weighted average price products. The more imaginative development direction combines a large number of innovative functions in the chain to create the smoothest trading experience for users, and at the same time provides a good example and aggregator automation market makers as digital assets in the past few years. With the emergence of a novel innovation in the field, traders can deploy digital assets that are manufactured by mathematics and codes instead of complex middlemen. Even in the case of extremely low liquidity, traders can enter and exit positions. Of course, low liquidity will bring new shortcomings. First, traders will encounter slippage, that is, the difference between expected transaction value and realized transaction value. Second, traders may also lose value in transactions through the use of asymmetric information in the public, such as the complex parameters of deployed robots. It needs more efforts from developers to escape or attack, and the appearance of chain aggregators is to reduce the impact of low-liquidity transactions, so that traders can place orders and transfer liquidity from multiple sources instead of one source. Liquidity can be obtained from multiple sources, including other aggregators and across multiple trading places, thus providing traders with better transaction prices and better user experience. The average cost method, also known as fixed investment, involves splitting capital allocation into multiple transactions. It is not that a transaction averages its own admission price when accumulating assets in a bear market to reduce volatility and get greater returns in the process of changing time and market conditions. It can also help to make profits in a bull market, which is different from selling its position immediately and completely. It can help to spread sales to capture any extra upside that may occur during the liquidation period instead of selling the position immediately and completely. Traders can also implement a weighted average price strategy, that is, to buy or sell assets and similar ones that are usually used for demand. It is necessary to split the large order into smaller parts to prevent the price impact caused by one-time purchase. Because the architecture with high throughput is one of the few platforms that enable users to implement frequent time-limited strategies on the chain, trading in a low-time range on the Ethereum, for example, may lead to transaction costs of hundreds of dollars every day, while trading costs will increase rapidly even if traders want to execute a transaction within hours on the Internet, although the perpetual contract exchange is still in place. In the testing stage, however, traders can use leverage trading and perpetual contracts up to times, while they can provide capital to earn fees. In the past, traders can use almost any supported tokens as collateral to open long or short positions on the sum. Long positions need corresponding subject matter, while short positions need stable currency as collateral. Traders can take leverage by borrowing assets from the liquidity pool. The leverage ratio of positions that borrow times from the pool can be doubled. The pool includes and provides liquidity, and only any supported tokens need to be deposited in the pool in exchange for the equivalent token pool to obtain perpetual engagement. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。