Penta Lab 研报:Ajna Protocol ——DeFi借贷赛道的下一个Aave

作者:PentaLab

项目名称: Ajna Protocol

代币: AJNA

目前市值: 15百万美金

6个月预估市值: 11.6亿美金

上升空间: 7600%

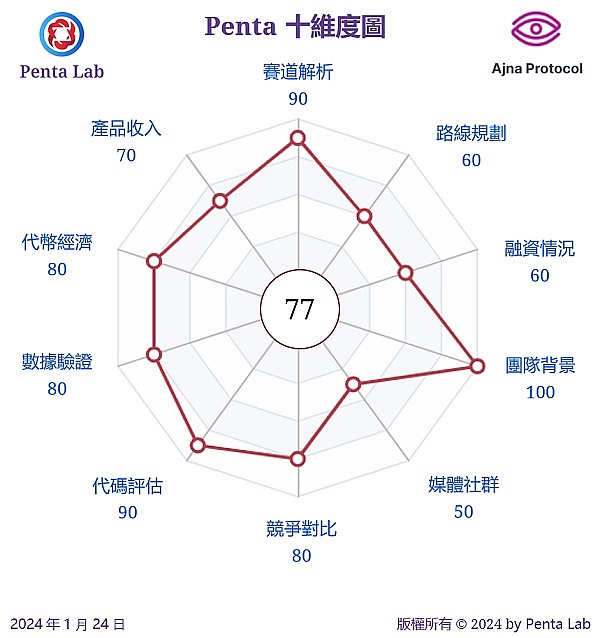

Penta十维度评分: 75分

数据截至: 2024年1月24日

完整报告下载:pentalab.io

Penta十维度评分:

研报概述:

借贷协议DeFi赛道重获份额。FTX暴雷后,交易员对中心化交易所的信任危机加速了去中心化金融 (DeFi) 快速发展,DeFi生态已经集合了货币发行、货币交易、借贷、资产交易、投融资等各个链上金融服务功能。其中DeFi借贷是DeFi的基石,解决了用户抵押杠杆,被动收入,以及代币激励的需求。在2020年中快速增长并在2021年年底达到峰峰值900亿美元,后来随著整体市场下滑以及几起平台安全等事件影响有所下滑,不过一直在DeFi赛道佔据30%并从2022年中开始重获提升。根据DefiLlama最新数据,截至2024年1月24日,DeFi借贷协议TVL总量为211亿美元,占比DeFi赛道581亿美元TVL的达到36%,仅次于TVL占比58%的流动性质押赛道。其中DeFi借贷赛道前三的Aave, JustLend以及Compound,TVL分别达到67亿美元,60亿美元以及21亿美元,前三市场份额为68%,相对集中度比较高。 Aave 开启了以供需控制利率的 peer-to-pool 模式 , 允许用户在不需要中间人的情况下借入、借出和赚取加密资产的利息,Aave和Compound均为浮动利率的代表借贷协议代表。

消除预言机脆弱性,点对池借贷市场提高长尾资产资本效率。传统预言机协议依赖外部数据获取资产价格,易受到短时操纵,亦是Compound 巨额(约9,000万)清算事件的风险源头。为解决预言机的脆弱性,在DeFi借贷领域,一些协议已经创新性地提出了无预言机方案,自给自足提高协议安全性,避免价格操纵风险,节约数据调用成本。方案主要分为两类,点对点模型和点对池模型。点对点借贷使借款人和放贷人直接在区块链上建立借贷协议,缺点是违约或欺诈风险高、借贷双方匹配时间长和流动性低。点对池借款通过借贷平台的流程化处理,更易于使用,资金流动性更高,贷款期限更具有灵活性。Ajna通过点对池借贷模型创建各类货币对借贷池,为长尾资产甚至NFT提高资本利用效率。

原MakerDAO核心团队引领Ajna借贷新叙事。Gregory Di Prisco和Joseph Quintilian是Ajna的联合创始人,此前分别是MakerDAO的商务拓展负责人和交易主管。此外,还有MakerDAO的区块链架构师Bartek Kiepuszewsk担任团队顾问。自2019年11月推出以来,MakerDAO已经发展成为DeFi借贷领域的领头羊和最大的去中心化稳定币协议。Ajna团队在市场扩张、技术开发、风险管理和产品设计的经验有助于其在迅速发展的DeFi借贷市场中构建强大的竞争优势。

估值:虽然目前Ajna的TVL刚过千万美元的门槛,但是平台在短短十三个交易日就成功将翻了十倍,增长潜力无限。我们同时研究发现Aave上线六个月TVL从58百万美元一路飙升到13.5亿美元,考虑Ajna在消除预言机脆弱性的点对池借贷市场以及富有经验的管理团队,我们认为Ajna有机会在六个月内拿下Aave以及Compound10%的份额,对应8.8亿美元TVL预测规模,及AJNA预估市值11.6亿。

风险提示:市场竞争加剧、用户教育难度和市场拓展不及预期

Author's project name Tokens have a current market value of one million US dollars per month, and the estimated market value is one hundred million US dollars. Ten-dimensional scoring sub-data is downloaded as of the date of the month. Ten-dimensional scoring research report outlines the loan agreement. After the storm, traders' trust crisis in the centralized exchange has accelerated. The rapid development of decentralized finance has integrated various financial service functions such as currency issuance, currency trading, lending assets trading, investment and financing, among which lending is the cornerstone to solve the mortgage leverage of users. The demand for dynamic income and token incentives increased rapidly in the middle of the year and reached a peak value of $ billion at the end of the year. Later, it declined with the overall market decline and the impact of several platform security incidents. However, it has been occupied by the track and has been upgraded since the middle of the year. According to the latest data, the total loan agreement reached $ billion, accounting for $ billion of the track, second only to the liquidity pledge track, in which the top three loan tracks and the top three cities reached $ billion and $ billion respectively. The market share is relatively high, which opens up the mode of controlling interest rate by supply and demand, allowing users to borrow and earn interest on encrypted assets without intermediaries, and the representative lending agreement with floating interest rates represents eliminating the vulnerability of the Oracle and improving the capital efficiency of the long-tailed assets in the pool lending market. The traditional Oracle agreement relies on external data to obtain asset prices, which is vulnerable to short-term manipulation and the risk source of huge liquidation events. In order to solve the vulnerability of the Oracle, in the lending field, Some agreements have innovatively put forward a non-Oracle scheme, which is self-sufficient to improve the security of the agreement, avoid the risk of price manipulation and save the cost of data call. The schemes are mainly divided into two types: point-to-point model and point-to-pool model. Point-to-point lending enables borrowers and lenders to establish lending agreements directly on the blockchain. The disadvantages are that the risk of default or fraud is high, and the matching time between borrowers and lenders is long and the liquidity is low. It is easier to use pool loans through the process of lending platform, and the loan term is higher. There is flexibility to create all kinds of currency-to-pool lending pools through the point-to-pool lending model, which is a long-tailed asset and even improves the efficiency of capital utilization. The original core team led the new narrative of lending, and the co-founders were the business development leaders and transaction directors respectively. In addition, some blockchain architects served as team consultants, and since its launch in June, it has developed into a leader in the lending field and the largest decentralized stable currency agreement team. The experience in market expansion, technology development, risk management and product design is as follows It will help it build a strong competitive advantage in the rapidly developing lending market. Although the current valuation has just passed the threshold of 10 million US dollars, the platform will be successfully doubled in just 13 trading days. The growth potential is unlimited. At the same time, we found that it has soared from one million US dollars to one hundred million US dollars in six months. Considering the point of eliminating the vulnerability of the prediction machine, the pool lending market and experienced management team, we think it is possible to win the share within six months, corresponding to the predicted scale and estimated market value of 100 million US dollars, suggesting that market competition will intensify, users' education difficulty and market expansion will be less than expected. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。