探索 DeFi 中的现实世界资产

作者:IntoTheBlock 翻译:善欧巴,比特币买卖交易网

虽然现实世界的资产代币化可以追溯到90 年代,但直到 2023 年该行业才经历了大幅增长。在本文中,我们通过链上指标探讨了 DeFi 中 RWA 的现状。

现实世界资产(RWA)旨在利用实体经济的收益和资产并将其引入 DeFi,利用其固有的互操作性。2023 年标志着重大进展,项目通过创建稳定币成功将美国国债收益率纳入 DeFi。

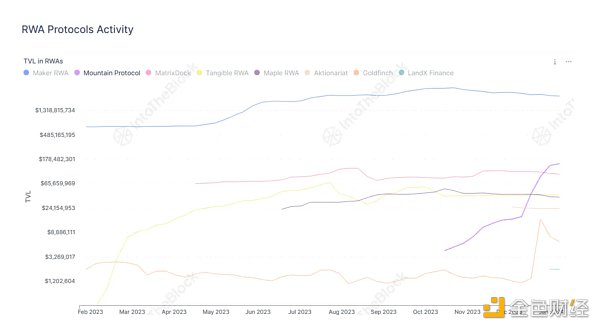

此类创新使得 RWA 协议锁定的总价值超过 $2.6B,几乎与顶级 RWA 协议的 $2.87B 总市值持平。目前,RWA 生态系统非常成功,拥有超过 127,000 个 RWA 协议代币持有者。

MakerDAO 的战略多元化

MakerDAO 通过将美国国债纳入其投资组合,战略性地实现了收入多元化。此举不仅增强了其收入流的稳定性,产生了超过1亿美元的年化收入,而且还改善了其抵押资产的风险状况。这一战略体现了 MakerDAO 致力于整合传统金融元素以加强 DAI 稳定币的可持续性。

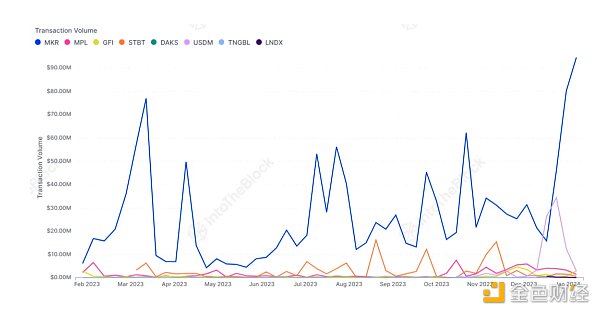

正是这一策略推动了 MKR 的积极价格走势,在顶级 RWA 协议中引领年度回报。毫不奇怪,MKR 在平均交易量方面名列前茅,1 月第二周的日均交易量达到 9450 万美元。

虽然该类别中的其他资产目前无法与 MKR 的交易量竞争,但仍有大量交易量,其中 USDM 在 12 月份达到了 3400 万美元的高位。

Mountain Protocol 在 TVL 增长方面表现突出

Mountain Protocol 凭借其独特的收益稳定币 USDM(一种由短期美国国债支持的 ERC20 代币)已成为 DeFi 领域的知名实体。

Mountain Protocol 的增长显着,其 TVL 达到 1.5 亿美元,仅上个月就增长了 400%。这使其成为仅次于 MakerDAO 的第二大 RWA DeFi 协议。

分析 RWA 协议持有者

深入研究特定的RWA协议代币,我们可以观察到更多显著的代币。对各种RWA代币的持有人盈利能力进行分析,揭示了多样化的情况。MKR以稳健的75%的地址盈利而脱颖而出。

相比之下,TNGBL 和 GFI 等代币的盈利率较低,持有者的盈利率分别为 12.2% 和 33%。

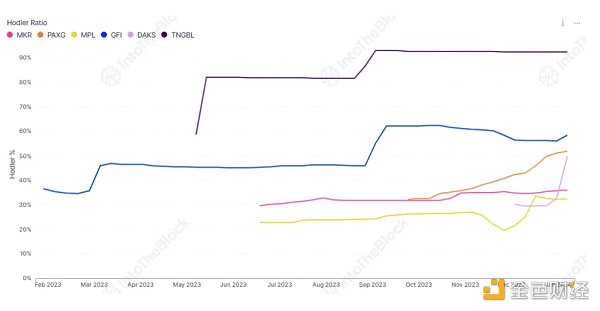

TNGBL 拥有最多“钻石手”

“Hodlers”比率指标代表持有特定代币至少一年的地址比例,是长期投资信心和潜在市场稳定性的关键指标。大量持有者表明对代币未来价值的坚定信念,同时也意味着市场更加稳定,因为这些人不太可能对短期市场变化做出反应。在RWA生态中,TNGBL以超过90%的Hodler比例脱颖而出。

RWA 在 DeFi 中的未来

RWA 与 DeFi 的整合为加密货币领域带来了难以置信的价值。从各种 RWA 协议分析的数据展示了一个令人兴奋且不断发展的生态系统。MakerDAO 等先驱将美国国债等传统金融工具无缝集成到 DeFi 协议中,而 Mountain Protocol 等协议的快速增长凸显了该领域的价值和潜力。

Although the real-world asset tokenization can be traced back to the 1980 s, the industry did not experience a substantial growth until 2000. In this paper, we discussed the current situation in China through on-chain indicators. Real-world assets are aimed at utilizing the benefits and assets of the real economy and introducing them to take advantage of their inherent interoperability. The year marks a major progress. The project successfully incorporated the yield of US Treasury bonds into such innovations by creating stable coins, making the total value of the agreement lock-in exceed almost the same. At present, the total market value of top-level agreements is flat. At present, the ecosystem is very successful. The strategic diversification of more than 10 agreement token holders has strategically realized income diversification by including US Treasury bonds in its portfolio, which not only enhanced the stability of its income stream, but also improved the risk status of its mortgaged assets. This strategy embodies the commitment to integrating traditional financial elements to strengthen the sustainability of stable coins, which is the positive price promoted by this strategy. It is not surprising that the trend leads the annual return in the top agreements, and it ranks among the best in the average transaction volume. The average daily transaction volume in the second week of last month reached $10,000. Although other assets in this category can't compete with the transaction volume at present, there are still a lot of transactions, among which it reached a high of $10,000 in January, showing outstanding performance in growth. With its unique income stability currency, a token backed by short-term US Treasury bonds has become a well-known entity in the field, and its growth has reached $100 million, which only increased last month. In order to make it the second largest agreement analysis after the agreement analysis, the agreement holders study the specific agreement tokens in depth, and we can observe more significant tokens. The analysis of the profitability of the holders of various tokens reveals the diversified situation and stands out with a stable address profit. In contrast, the profitability of the holders is lower than that of the other tokens, and the profitability of the holders is respectively and the ratio of the holders with the most diamonds represents the address ratio of holding a specific token for at least one year, which is long-term investment confidence and potential market. The key indicator of field stability is that a large number of holders show their firm belief in the future value of tokens, which also means that the market is more stable, because these people are unlikely to respond to short-term market changes, and the integration of the future and the future in China has brought incredible value to the cryptocurrency field. The data analyzed from various agreements show an exciting and developing ecosystem, and other pioneers have seamlessly integrated traditional financial instruments such as US Treasury bonds into the agreement, and the rapid growth of such agreements highlights the value and potential of this field. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。