代币化风潮下的现实挑战 RWA行业透视

作者:Dave Hendricks,Vertalo CEO 翻译:善欧巴,比特币买卖交易网

虽然 "代币化" 是目前加密领域最热门的趋势,尤其是在 DeFi 领域,但这其实只是另一种形式的 "证券代币"。尽管将传统资产转移到链上理论上可行,但实际操作难度远超人们想象。

"代币化",特别是 "现实世界资产" (RWA) 代币化,最近被大肆宣传为加密领域的下一个颠覆性趋势。然而,大多数人并没有意识到,这一趋势实际上是另一种形式的证券代币,而该术语自 2018 年以来就鲜少提起(这并非没有理由)。

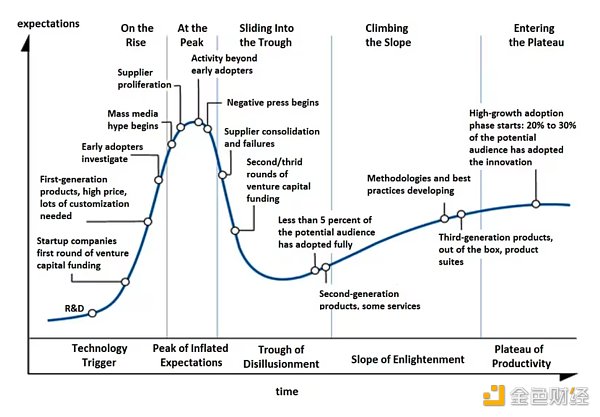

大肆鼓吹代币化的人们大多观点错误,但他们的出发点可能是好的。某种事物成为潮流并不该归咎于任何人。然而,如果说「证券代币」、「代币化」和 RWA 都属于同一技术演进路线,那么根据 Gartner 的「炒作周期」理论,另一场泡沫破裂可能即将到来。

许多当前的代币化鼓吹者其实是从昔日炒作热点「去中心化金融」(DeFi)逃离而来的。

一些传统金融领域的影响人物和 CEO 将代币化视为金融的自然演进——例如,贝莱德 CEO Larry Fink 就认为最近推出的比特币 ETF 是所有事物链上化的「第一步」。然而,将「所有金融资产」代币化要复杂得多,支持者和反对者都普遍存在误解。

实物资产代币化(RWA Tokenization)行业即将迎来它的第八个年头,其最早可以追溯到 2017 年底。我的公司 Vertalo 在 2018 年 3 月推出了一项完全合规的 Reg D/S 股权代币化项目,是业内最早的项目之一。尽管遇到了许多挑战(此处无法一一列举),我们还是从最初的角色“代币化股权发行者”转型为一家“淘金工具”企业软件公司,致力于“连接和支持数字资产生态系统”。

自从我们开始从事实物资产代币化以来,非同质化代币 (NFT) 和去中心化金融 (DeFi) 经历了扩张和随之而来的大规模萎缩。 NFT 和 DeFi 是更易于用户使用的代币化技术应用。 例如,在 OpenSea 等易于访问的市场上,你可以用可交易的代币购买电脑生成的艺术品。

如果让我把 NFT 的发展过程映射到 Gartner 的炒作周期上,我会把它放在过峰期,正快速滑向「幻灭低谷」。例如,OpenSea 的投资者 Coatue 将其 1.2 亿美元的投资减记到 1300 万美元,原因是该交易所的财富正在减少。

同样,曾经炙手可热的 DeFi 市场也出现了降温——许多项目现在似乎正在重塑品牌并重新关注现实世界的资产。其中包括 DeFi 巨头 MakerDAO 和 Aave。

宣扬 RWA 信誉的团队现在将大型传统金融机构作为客户或合作伙伴,这是有道理的,因为许多 DeFi 创始人在进入华尔街银行工作之前都在斯坦福大学或沃顿商学院崭露头角。

DeFi 运动厌倦了为债券销售人员和股票交易员提供支持的量化工作,但又着迷于去中心化带来的波动性和工作与生活的平衡,他们对全球金融世界(和货币)非常熟悉,但对其规则不太感兴趣、法规和严格性。

作为敏锐的趋势观察者,聪明的 DeFi 创始人和他们的工程师数学家看到了不祥之兆,并在 2022 年退出了治理代币空投游戏,并开始重新调整他们的营销和策略,以创造“新的、新的事物”,即标记化。结果?大规模迁移和采用 RWA 名称,以及迅速摆脱任何看似复制粘贴的东西,这是 2020-22 年不受欢迎的 DeFi 世界的标志性举措和风险。

大多数RWA 项目通常管理的资产和抵押品主要是稳定币,而不是实际的硬资产。

代币化并不是一场安静的骚乱。如果将当前的 RWA 市场映射到炒作周期,它今天可能会正好落在“供应商激增”的位置。现在每个人都想涉足 RWA 业务,并且希望尽快进入。

RWA 的代币化实际上是一个好主意。如今,大多数私人资产(RWA 的目标资产类别)的所有权是通过电子表格和集中数据库进行跟踪的。如果某种资产被限制出售——比如公开股票、无记名债券或加密货币——那么就没有理由投资于更容易出售的技术。私人市场中陈旧的数据管理基础设施是惯性的函数。

根据 RWA 支持者的说法,代币化解决了这个问题。

代币化真的能解决这个问题吗?

这个善意的小谎言有一定道理,但绝对的事实是,虽然代币化本身并不能解决私人资产的流动性或合法性问题,但它也带来了新的挑战。RWA 代币化倡导者可以方便地回避这个问题,而且他们很容易做到这一点,因为大多数被代币化的所谓现实世界资产都是简单的债务或抵押工具,它们不遵守与受监管证券相同的合规和报告标准。

事实上,大多数 RWA 项目都采用一种称为“再抵押”的旧流程,其中抵押品本身是监管较轻的加密货币,而产品是一种贷款形式。这就是为什么几乎所有 RWA 项目都将货币市场类型的收益率作为其吸引力。只是不要太仔细地关注抵押品的质量。

借贷是一项大生意,因此我不会指望代币化的未来和长期成功。但说你将现实世界的资产带到链上是不准确的。它只是以代币为代表的加密资产的抵押。代币化只是这个难题的一小部分,而且是重要的一部分。

当拉里·芬克(Larry Fink)和杰米·戴蒙(Jamie Dimon)谈论“每种金融资产”的代币化时,他们并不是在谈论加密抵押品 RWA,他们实际上是在谈论房地产和私募股权,以及最终的公共股权的代币化。这不能仅仅通过智能合约来实现。

第一手经验

经过七年多的时间建立了一个数字转移代理和代币化平台,该平台已经对代表近 100 家公司利益的近 40 亿单位进行了代币化,大众金融资产代币化的现实要复杂得多。

首先,代币化只是整个过程中的一个小步骤,相对简单并不重要。已经有数百家公司可以进行资产代币化,这使得代币化本身成为一种商品化业务,利润空间相当有限。从商业模式的角度来看,代币化领域的竞争最终会演变成一场“费用下调竞赛”,由于太多供应商提供相同的服务,它很快就会变成一种纯粹的商品。

其次,更为重要的是,在代币化和转移实物资产 (RWA) 时,存在着受托责任。这就是关键部分,也是区块链技术发挥作用的地方。

分布式账本通过提供不变性、可审计性和可信性,为金融资产代币化带来了真正的好处。这为可证明所有权奠定了基础,并能够立即无差错地记录所有交易。如果没有这一点,使用代币的金融将会发生革命。

账本创建的信任将使金融专业人士及其客户能够支持 Larry Fink 和 Jamie Dimon 的言论,但这样做的方式比 DeFi 和加密货币的棘手和技术世界更容易被采用。

因此,在开始炒作周期之前,先看看之前发生了什么,以及接下来会发生什么。不要最终走错了周期,否则你将落入 NFT 版本二。

Although token is the hottest trend in the field of encryption at present, especially in the field, it is actually just another form of securities token. Although it is feasible in theory to transfer traditional assets to the chain, it is far more difficult to operate in practice than people think, especially in the real world. Tokenization of assets has recently been hyped as the next subversive trend in the field of encryption, but most people don't realize that this trend is actually another form of securities token. The term has rarely been mentioned since, which is not without reason. Most people who advocate tokenization are wrong, but their starting point may be good. It is not anyone's fault that something has become a trend. However, if securities tokenization and all belong to the same technological evolution route, another bubble burst may be coming. Many current advocates of tokenization are actually some traditional finance that fled from decentralized finance, a hot speculation spot in the past. For example, BlackRock thinks that the recently launched Bitcoin is the first step in the chain of all things, but it is much more complicated to tokenize all financial assets. Supporters and opponents generally have misunderstandings that the physical assets tokenization industry is about to usher in its eighth year, which can be traced back to the end of the year. My company launched a fully compliant equity tokenization project in June, which is one of the earliest projects in the industry, despite many encounters. Challenges can't be listed here. We have changed from the initial role of token equity issuer to a gold mining tool enterprise software company, which is committed to connecting and supporting the digital asset ecosystem. Since we started to engage in the token of physical assets, heterogeneous tokens and decentralized finance have experienced expansion and subsequent large-scale shrinkage, and it is more user-friendly token technology application. For example, in accessible markets, you can buy computer-generated ones with tradable tokens. If I map the development process of artworks to the hype cycle, I will put it in the peak period and quickly slide to the disillusionment trough. For example, investors have written down their investment of $100 million to $10,000 because the wealth of the exchange is decreasing, and the once-hot market has also cooled down. Many projects now seem to be reshaping their brands and re-paying attention to real-world assets, including giants and reputation-promoting teams, and now take large traditional financial institutions as customers or partners. This makes sense, because many founders made their mark at Stanford University or Wharton Business School before they joined the Wall Street Bank. They were tired of the quantitative work to support bond salesmen and stock traders, but they were fascinated by the volatility and work-life balance brought about by decentralization. They were very familiar with the global financial world and currency, but were not interested in its rules, regulations and strictness. As keen trend observers, smart founders and their engineers and mathematicians. Seeing the writing on the wall, they quit the game of managing token airdrops in and began to readjust their marketing and strategies to create new things, that is, the marked results, large-scale migration and adoption of names, and getting rid of anything that seems to be copied and pasted quickly. This is the symbolic measure and risk of the unpopular world in 2008. Most projects usually manage assets and collateral mainly stable coins rather than actual hard assets, which is not a quiet riot if the current market is mapped. By the hype cycle, it may just fall in the position of the surge of suppliers today. Now it is actually a good idea that everyone wants to get involved in business and want to enter as soon as possible. Nowadays, the ownership of the target asset category of most private assets is tracked through spreadsheets and centralized databases. If an asset is restricted from selling, such as public shares, bearer bonds or cryptocurrency, there is no reason to invest in the obsolete data management base in the private market, which is easier to sell. Infrastructure is a function of inertia. According to supporters, tokenization solves this problem. Can tokenization really solve this problem? This little white lie has some truth, but the absolute fact is that although tokenization itself cannot solve the liquidity or legality of private assets, it also brings new challenges. Tokenization advocates can easily avoid this problem, and they can easily do this because most of the so-called real-world assets that are tokenized are simple debts or liabilities. Mortgage instruments do not comply with the same compliance and reporting standards as regulated securities. In fact, most projects adopt an old process called re-mortgage, in which the collateral itself is a lightly regulated cryptocurrency and the product is a form of loan, which is why almost all projects take the yield of money market type as their attraction, just don't pay too much attention to the quality of collateral. Lending is a big business, so I won't expect the future and long-term success of tokenization, but I will say that you will cash in. It is not accurate to bring real-world assets to the chain. It is only a small part and an important part of this difficult problem. When Larry Fink and Jamie Dimon talk about the tokenization of each financial asset, they are not talking about encrypted collateral. They are actually talking about the tokenization of real estate, private equity and ultimately public equity. This cannot be achieved only through smart contracts. First-hand experience has been established for more than seven years. A digital transfer agent and tokenization platform has tokenized nearly 100 million units representing the interests of nearly 100 companies. The reality of tokenization of public financial assets is much more complicated. First of all, tokenization is only a small step in the whole process, which is relatively simple and unimportant. Hundreds of companies can tokenize assets, which makes tokenization itself a commercialized business. The profit margin is quite limited. From the perspective of business model, the competition in the tokenization field will eventually turn into a fee. Because too many suppliers provide the same service, it will soon become a pure commodity. Secondly, more importantly, there is a fiduciary responsibility when tokenizing and transferring physical assets. This is the key part and the place where blockchain technology plays a role. The distributed ledger brings real benefits to the tokenization of financial assets by providing immutability, auditability and credibility, which lays the foundation for provable ownership and can record all transactions immediately and without errors. Without this, the finance that uses tokens will have a revolution, and the trust created by the ledger will enable financial professionals and their customers to support it. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。