FTX重启“梦碎” FTT沦为“空气币”

近日,深陷债务纠纷的FTX又有新消息传来。

众所周知,22年10月FTX的爆雷事件几乎点燃了整个传媒与投资圈,但到了今年,除了债主们仍孜孜不倦地关注其庭审事件外,随着FTX各种暗箱操作浮出水面,行业内其他人士多以颇为鄙夷且评判的态度提及这一机构。

而本次这一消息,恰好与债权人们息息相关。债主们终于在近日得偿所愿,在最新的庭审会议中,FTX方表示有望全额偿付债权人,预计资金将在2024年第二季度末之前支付。而坏消息是,不会按照当前价格赔付。另一方面,不同于此前的口径,FTX称已然重启无望,而这,也让FTT的持有者难以接受。

以此而言,这次的消息一如加密的常态——有人欢喜有人愁。

FTX,加密市场的难言之隐

在加密圈,FTX无疑是绝对的明星企业,在22年10月之前,其可以称之为加密圈的上流代表,而在10月之后,却变成了加密圈人人喊打的毒瘤。

关于FTX破产事件,在此也并不一一赘述,但简单提一下其债务总额。2022年11月11日,当时是全球第二大加密货币平台的FTX通过官方社交媒体账号发布公告宣布,FTX交易公司、FTX美国、Alameda研究公司和其他大约130个附属公司已经按照《美国破产法》第11章开始在特拉华州地区法院启动自愿破产程序。在当时,华尔街日报称FTX资金缺口约为80亿美元。但随着庭审不断深入,债权总额持续增长,最终索赔超过36000 项,债权总额约为 160 亿美元。

高额的欠款对加密圈影响深远,实际上,整个2023年,加密市场仍在消化FTX带来的消极影响,最为显著的价格表现是比特币一度在2023年跌至16000美元,而在FTX破产一周年后,做市商交易量几乎腰斩,各交易所的交易量也相应减少一半。除此之外,监管的不断收紧、党派博弈的持续深入等外部效应显现,可以认为,FTX对于当前加密版图的塑造起到了关键性作用。

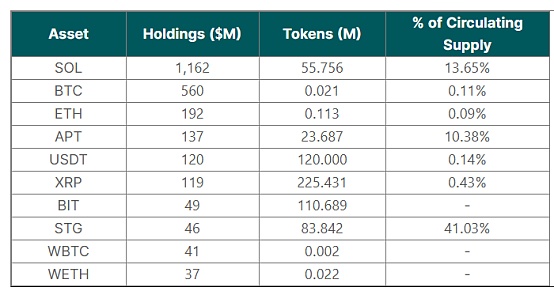

即使在如今ETF通过后,FTX的债权抛售仍对比特币与其他币种价格有着较大的影响,但随着抛售的进行,从数据来看,这一影响正逐渐减少。截至 2024 年1月22日,FTX 机构已清算其持有的全部GBTC 2200 万股,含约20000枚BTC。

23年8月底FTX公开持仓数据,来源:coingecko

也正是因为影响深远,FTX的重启才会如此备受关注,固然其自身问题重重,但导致其现金流难以存续的关键所在是此前宏观紧缩下的流动性环境,而作为前第二大交易所,其曾坐拥900万客户数据,重启并非是无稽之谈。

FTX的重启“狼来了”,FTT“meme”初显

关于重启的讨论最早开始于2023年1月,当时FTX新上任的首席执行官 John J. Ray III在公开采访中表示已建立了特别行动组,对重启交易所业务持开放态度,并称客户对于FTX的技术表示认同。当然,当时FTX破产仍不足3个月,该消息在市场并无任何水花。

后续,关于重启的消息不断。不仅FTX 无担保债权人官方委员会的律师事务所多次召开重启的主题研讨会,部分债权人也跳出称对重启表示积极,而在FTX的庭审文件记录中,也可以看到含“重启”相关的财务细节。但债权人的看好,多被市场视为解套操作,而当时,FTX更多细节的流出,再度加深了其诈骗且不尊重投资者的印象,市场仍对其的重启表示高度怀疑。

反转来自4月的庭审。4 月12日凌晨,来自 FTX 代理律师事务所 Sullivan Cromwell 的律师 Andy Dietderich 在特拉华州的法庭听证会上表示,FTX 已收回了73亿美元的资产,包含 20 亿美元现金,43 亿美元 A 类加密货币,3 亿美元的证券,6 亿美元应收投资等。其还首次在法庭中提到,FTX 正考虑在未来某个时候重新开启交易所业务,FTX 的债权人有望将其债权转换为重新开放的交易所的股份。

此前提及过,市场传FTX资金缺口为80亿美元,而4月就已收回73亿美元,这无疑为市场注入了一针强心针。受此消息影响,FTT迅速上升,当日最高突破 3 USDT,涨幅超过90%。

由于此前FTX的高光时刻,部分投资者坚信其可以从头再来。在此背景下,FTX的重组对于平台币FTT无疑是巨大利好,而其曾经风光的历史价格更让投资者充满想象。自此,重启成为了FTT持有者的关键词,只要重启消息面世,FTT就呈现出高涨趋势,FTT的meme性质初显,而FTX,也不负众望,陆续传出利好。

5月,John J. Ray III 确认 FTX 2.0 计划,重启提上时间线;6月份,一份法庭文件名单中显示包括纳斯达克、Ripple、贝莱德等在内的多家公司对FTX 2.0重启有意向。随后在10月25日,彭博社报道,FTX 正在与三个未公开的竞标者谈判重启其交易平台。

知情人士表明,坐拥900万客户的FTX在拍卖过程中曾收到超过75家机构的关注,但经历了多轮洽谈与考量后,最终有3位潜在买家脱颖而出。这三位分别是Block.one旗下聘请纽约证券交易所前总裁Tom Farley运营的加密货币交易所Bullish、金融科技初创公司Figure Technologies和曾参与Celsius破产收购、投资过Aptos和Sui的加密风险投资公司Proof Group。收购要约将一并递送至特拉华州的破产法院审核,最终在23年12月中旬确立。

而11 月 9 日,美国证券交易委员会(SEC)主席 Gary Gensler 更是公开表示,在法律框架范围内重新启动FTX 是有可能的。在一连串的利好刺激下,当日FTT一小时内迅速拉升40%。在收购方披露后,场外用户也蠢蠢欲动,当时社区消息称 FTX 或将会按照 11 月 11 日申请破产当天的价格五折(50%)赔付,并需支付 5% 左右的手续费。

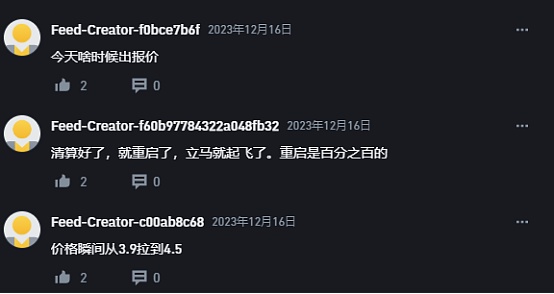

在各种消息面的支撑下,FTT价格持续保持在2美元上方,即使是12月传出巴哈马主体清算的消息也被投资者视为重启前兆,12月11日,FTT最高涨至5.54美元。

部分社区对重启充满信心,来源:Binance广场

重启梦碎,债权人却迎来好消息

但FTT美好的梦想,最终却无奈止步。

在1月28日的最新公布庭审文件中,文件显示FTX的赔偿是在2024年的第二季度,但尚不能完全偿还债权人所有损失,目前仍然有部分加密货币还尚未清算,并在等待或正在清算中。

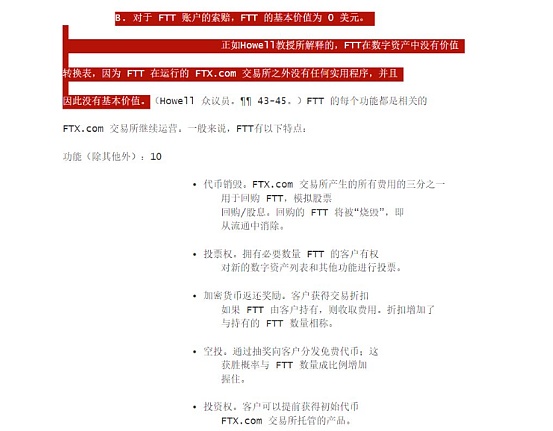

值得注意的是,文件中对FTT的追偿进行了明确描述,表示FTT的基本价值为零。法院认为,FTT仅是一种实用代币,在当前不存在的运营交易所之外没有任何价值,任何当前的FTT市场价格都是投机性的。换而言之,FTT就是空气币,以后也不会存在以FTT为平台币的FTX交易所。即使FTX作为2.0平台重启,FTT也并不会有任何关系。实际上,从美国监管要求而言,合规交易所本就不应存在发币情况,这也是为何Coinbase选择上市这一资本途径。

FTX庭审文件记录,来源@Phyrex_Ni

更残酷的消息随之而来,1月31日,在最新的法庭听证会上,FTX律师Andrew Dietderich表示,FTX不打算重新启动该平台,该平台花费数亿美元收购的企业被证明并无实际价值,感兴趣的买家并不多。其还表示尽管FTX坐拥大量的客户资源,但团队仍无法找到愿意投入巨额资金重启交易所的投资者。

在确定重启无望的消息打击下,FTT遭到重挫,一度跌至1.65美元,现报1.73美元,7天内跌幅达到37.44%。

FTT价格迅速下跌,来源:Binance

但不同于FTT持有者悲伤的情绪,债权人的索赔却迎来了好消息。

随着加密市场在近月的持续上涨,FTX方表示预计已有足够的资金来全额支付所有已批准的客户和债权人索赔,根据FTX此前公布的Top10持仓资产价值来算,截至2月1日,这部分追回资产已超78.3亿美元。

当然,尽管资产足够赔付,但显然债权人赔偿也不会按照市场最高价值,而是根据提交索赔的申请日期价值而定,该日期集中于22年11月前后。举例说明,FTX宣布破产的当时,绝大多数币种已经经历了巨大贬值,BTC报价大约为16000美元,但如今,BTC已高达43000美元,债权人显然不能以最高价格为赔偿,而仅能以其提交追偿的价格为基准,此外,赔付均以美元为本位进行,美国破产法官John Dorsey 裁定,每项索赔的规模将基于 FTX 申请破产当日所欠客户或债权人的金额。

币本位变美元本位,对此赔付方式,自然也有债权人表示不满。但至少也正是由于当前市场的转好,FTX才足以获得资金增值赔付熊市的欠账,即使赔付不算最高额,对于债权人而言,无疑也是不幸中的万幸。但据律师表示,全额赔付并非是一种保证,而仅仅是一种目标,能否赔付仍需依据具体情况而定。

再回顾已锒铛入狱的SBF,或许仅再支撑3个月,结局就不可同日而语,但时间难以暂停,世事也难以重来,市场终将对不尊重用户与不遵循客观规律的投资者落下铁锤。就在近日,FTX宣布破产当天4亿美元加密货币的流向也被查出,盗窃者为一个大规模的SIM卡犯罪团伙,而并非此前众人猜想中的SBF,再叠加FTX的清偿消息,不知面临115年刑期的SBF会作何感想。

至于FTT?炒作也该告一段落,因为不论是否被重启,该币种都已宣告毫无价值,更遑论已然确定不会重启。但最后,FTT或许也不会归零,而作为一种meme象征留下,毕竟在加密市场,人人皆可meme,动物币都能横行,而具有传奇色彩的FTT,岂不更符合标准?

Recently, there is new news about the debt dispute. It is well known that the mine explosion in September almost ignited the whole media and investment circle. But this year, except for the creditors who are still tirelessly paying attention to its trial events, with various black-box operations surfaced, other people in the industry mentioned this institution with a rather contemptuous and judgmental attitude, and this news happened to be closely related to the creditors. The creditors finally got their wish in recent days. At the latest trial meeting, China said that it was expected to pay off their creditors in full. Some people expect that the funds will be paid before the end of the second quarter of, but the bad news is that it will not be paid at the current price. On the other hand, it is different from the previous statement that it is hopeless to restart, which makes it difficult for the holders to accept. In this sense, this news is just like the normal state of encryption. Some people are happy and some people are worried that the secret of the encryption market is undoubtedly an absolute star enterprise in the encryption circle. Before June, it could be called the upper-class representative of the encryption circle, but after a month, it became a cancer that everyone in the encryption circle shouted about bankruptcy. I won't go into details here, but I will briefly mention its total debt. At that time, it was the second largest cryptocurrency platform in the world. It was announced through the official social media account that the trading company, American Research Corporation and some other subsidiaries had started voluntary bankruptcy proceedings in the Delaware District Court in accordance with Chapter of the US Bankruptcy Law. At that time, the Wall Street Journal said that the funding gap was about $100 million, but with the deepening of the trial, the total amount of claims continued to grow, and finally more than one total claim was made. The high debt of about $100 million has a far-reaching impact on the encryption circle. In fact, the encryption market is still digesting the negative impact throughout the year. The most significant price performance is that Bitcoin once fell to $ in, and after the first anniversary of bankruptcy, the trading volume of market makers almost halved, and the trading volume of exchanges also decreased by half. In addition, the external effects such as the continuous tightening of supervision and the continuous deepening of party games can be considered to have played a key role in shaping the current encryption map, even if it is passed today. After the debt selling, it still has a great impact on the prices of Bitcoin and other currencies, but with the selling going on, the impact is gradually decreasing from the data point of view. As of March, the institution has liquidated all 10,000 shares held by it, including about 10,000 public positions at the end of the year. It is precisely because of the far-reaching restart that the data source has attracted so much attention. Although it has many problems of its own, the key to making its cash flow difficult to survive is the liquidity environment under the previous macro-tightening, and it used to be the former second largest exchange. It's not a nonsense to restart the data of millions of customers. The wolf is coming. The discussion about the restart first began in January, when the newly appointed CEO said in a public interview that he had set up a special task force to restart the exchange business and that customers agreed with the technology. Of course, the news was still less than a month after bankruptcy, and there was no splash in the market. The news about the restart continued. Not only did the law firm of the official Committee of unsecured creditors hold the restart several times. Some creditors in the theme seminar also jumped out and said that they were positive about the restart, but financial details related to the restart can also be seen in the records of court documents. However, many of the creditors' views were regarded as unwinding operations by the market, and at that time, the outflow of more details once again deepened their fraud and disrespected the impression of investors. The market still expressed high suspicion about its restart. The lawyer from the attorney's office said at the court hearing in Delaware that it had recovered $100 million. Assets include $ billion in cash, $ billion in cryptocurrency, $ billion in securities, and $ billion in investment receivable, etc. It is also mentioned in court for the first time that creditors who are considering reopening the exchange business at some time in the future are expected to convert their creditor's rights into shares in the reopened exchange. It was mentioned earlier that the capital gap in the market was $ billion, and $ billion was recovered every month, which undoubtedly injected a shot in the arm into the market. Affected by this news, it rose rapidly, and the highest breakthrough on that day exceeded the previous highlight. At this moment, some investors firmly believe that it can start all over again. The reorganization under this background is undoubtedly a great benefit to the platform currency, and its historical price has made investors full of imagination. Since then, restarting has become the key word of the holder. As long as the news of restarting comes out, it has shown a rising trend, and it has not failed to live up to expectations. It has been reported that the plan to restart is on the timeline. In January, a list of court documents showed that many companies, including Nasdaq BlackRock, were interested in restarting. Later, on March, Bloomberg reported that it was negotiating with three undisclosed bidders to restart its trading platform. People familiar with the matter indicated that the one with 10,000 customers had received the attention of more than one institution in the auction process, but after several rounds of negotiations and consideration, a potential buyer finally stood out. The three were the cryptocurrency exchange financial technology start-up company operated by the former president of new york Stock Exchange and the crypto venture capital company that had participated in the bankruptcy acquisition and investment. The tender offer will be delivered together. The review of the bankruptcy court in Delaware was finally established in mid-May, and the chairman of the US Securities and Exchange Commission publicly stated on May that it was possible to restart within the legal framework. After a series of favorable incentives, the off-site users were also eager to move after the disclosure of the acquirer. At that time, the community news said that they would file for a 50% discount on the price on the day of bankruptcy according to May, and they had to pay about handling fees. With the support of various news, the price continued to remain in the US dollar. Even if the news of the main body liquidation in Bahamas came out in June, it was regarded by investors as a precursor to the restart, and some communities were full of confidence in the restart. The source square restarted the dream, but the creditors ushered in good news, but the beautiful dream finally ended up helpless. The compensation shown in the court documents was in the second quarter of 2008, but all the losses of creditors could not be fully repaid. At present, some cryptocurrencies have not yet been liquidated and are waiting or being liquidated, which is worth noting. It is a clear description of the recovery in the document, indicating that the basic value is zero. The court thinks that it is only a practical token and has no value outside the operating exchange that does not exist at present. In other words, the current market price is speculative. In other words, the exchange that thinks that the platform currency will not exist in the future will have nothing to do even if it is restarted as a platform. In fact, according to the regulatory requirements of the United States, the compliant exchange should not have issued money, which is why it chose to go public as a capital channel. The court documents recorded more cruel news, which followed at the latest court hearing. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。