比特币挖矿业:2024年预测

2023 年对于比特币矿工来说绝对是一个救世恩赐。

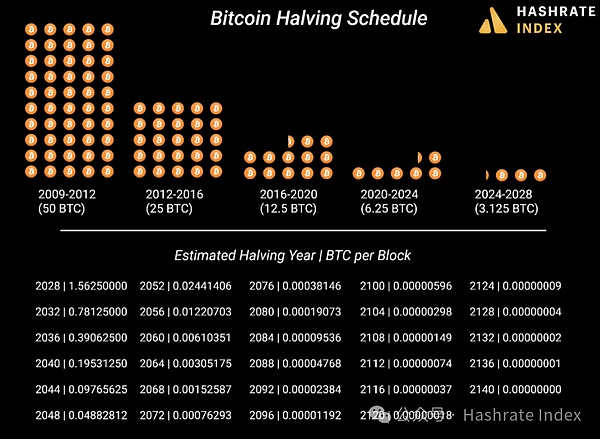

它为一个被2022年低迷市场所削弱的行业提供了必要的第二次机遇,但随着2024的到来,矿工们开始面临另一个巨大挑战,即第四次减半。比特币的第四次减半将把比特币的区块补贴从6.25 BTC减至3.125 BTC,意味着矿工收益将减少50%。

图一:历年来比特币减半事件

与过去的减半一样,2024年的比特币减半无疑将在当前的比特币挖矿市场上留下不可磨灭的印记。

虽然第三次减半(2020-2024)并非是直接导火索,但伴随着中国在2021年实行的比特币挖矿禁令和随之而来的大规模算力迁移,三者为一个与第二次减半时期(2016-2020)截然不同的挖矿市场的形成创造了条件。

我们相信,第四次减半将带来更大的变化,并可能伴随着比特币算力向新地理区域的再分配。对于2024年和未来几年,我们(粗略)预测以下情况:

比特币算力分布更具全球化

北美洲的算力主导地位将会减弱。在第二次减半时期,中国主导了比特币网络的算力份额,峰值时占总算力的70-90%。在中国实行比特币挖矿禁令后,这种力量平衡转向了北美洲,从 2021 年夏季到现在,美国和加拿大共同占据了全球约 50% 的算力份额(左右波动)。

预计北美洲在全球算力份额中的占比已经达到峰值,并将在2024年4月的减半后逐渐减少,因为矿工的利润将被压缩,他们将不断寻找更便宜的电力,南美洲、非洲和其他未开发地区将迎来显著增长的机会。

零售托管服务行业将遭受重大打击

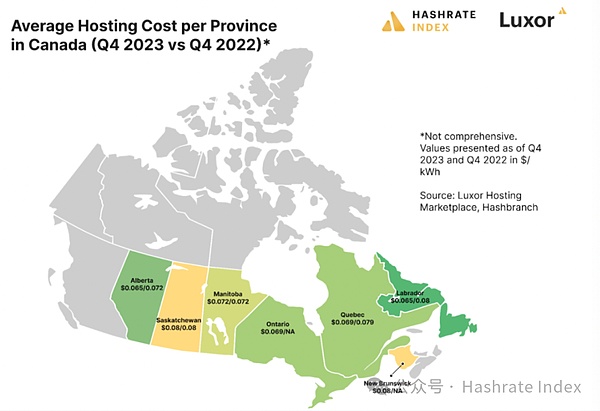

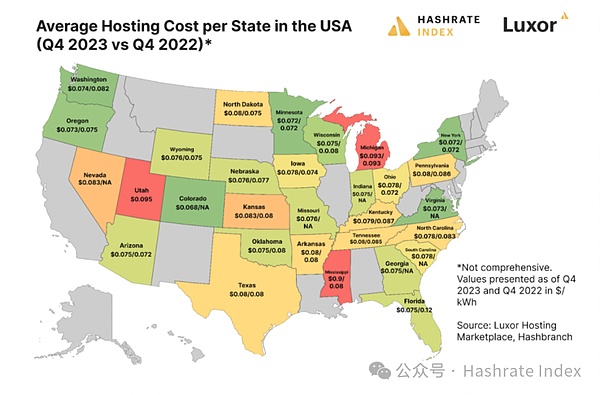

在北美洲(和其他地方),由于较低的挖矿利润压缩了托管方和客户双方,零售托管服务业将走向低迷。

2023年美国的平均全包式托管费用为0.078美元/千瓦时,加拿大为0.072美元/千瓦时;到2023年第四季度,平均全包式费率分别为0.078美元/千瓦时和0.071美元/千瓦时。

图二:加拿大各省份平均托管成本(2022年Q4 VS 2023年Q4)

图三:美国各州平均托管成本(2022年Q4 VS 2023年Q4)

考虑到减半后的挖矿经济,托管成本处于平均或更高水平的矿工很可能无法保持盈利,这意味着只有那些享有有利费率的矿工才能在2024年存活下来。

2024年将催生更多的合并及收购活动

在算力价格压缩的环境下,2024年和2025年将会出现更多的合并、收购和资产出售。

2022年其实已经奏响了前奏。随着当时算力价格暴跌并在Q4达到历史最低点,比特币最大的托管服务提供商之一Compute North宣布破产和清算,Argo和其他矿企则是进行资产出售。

图四:各大上市矿企资产出售及购买活动一览

2023年财务困境下并没有看到太多的资产购买和收购活动,但它见证了比特币挖矿历史上最大的合并——Hut 8和US Bitcoin。预计2024年的资产收购活动将达到或超过2022年的水平。

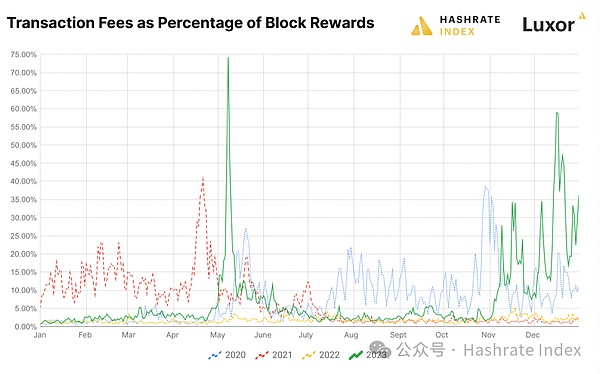

铭文及其他区块空间利用活动将继续提高交易费用收入

2024年的铭文活动和区块空间的替代用途将使得交易费用水平达到与2023年的平均水平相当或更高。

2023年最大的黑马是在比特币基于非同质化代币(NFT)的新技术标准——序数和铭文——的背后进入市场的。这种在比特币上创建数字艺术品和工件的新方法使交易费用成为挖矿收入的重要来源。

事实上,2023年比特币交易费用总量在比特币历史上仅为倒数第二;矿工在2023年赚取了797,867,915美元的交易费用,仅次于2021年的创纪录的 1,019,725,113 美元。2023年交易费用占区块奖励的比例为7.6%,而2022年时仅为1.5%。

图五:交易费用占比区块奖励变化图

铭文活动在2022年12月至2023年底期间产生了1.88亿美元的交易费用,矿工在2023年第四季度赚取了1.295亿美元(占总费用的69%)。此外,矿工在2023年第四季度收益为2023年总交易费用奖励的63%(5.018亿美元)。

如果比特币今年继续上涨,那么预计铭文活动交易量在2024年将会不断增加。

比特币矿业股票或将失去其价格溢价

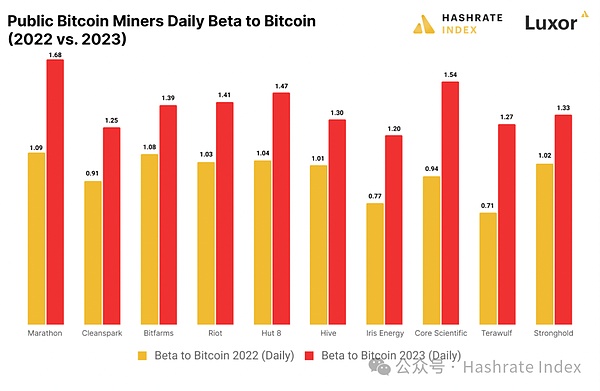

从历史上看,投资者将比特币矿业股票作为高 beta 玩法来进行比特币交易,既将它们用作比特币替代品,也将它们用作在比特币上涨时能够产生超额收益的资产。

根据下面的beta图表分析,比特币矿业股票显示了其在牛市或熊市中的相关性趋势。在熊市中,股票价格的波动与币价日波动相关性更大。在牛市中,由于股票与比特币有很强的beta相关性,所以其相对于比特币有强劲的上行回报。交易者可以通过观察比特币矿工与比特币现货价格的日波动更紧密的相关性来更好的把握回报收益。当这种趋势上升时(> 1.15 beta),比特币矿工正在转向更强的回报期。

图六:各上市矿企比特币Beta系数对比

鉴于各种比特币ETF最近获得批准,预计比特币矿业股票将失去一些作为比特币替代品的投资溢价,因为投资者现在可以通过多种比特币ETF直接获得收益敞口。投资者仍可能将它们视为曝光比特币价格的高beta工具,但ETF可能会对其价格溢价有所削减。

For bitcoin miners, 2008 is definitely a salvation gift, which provides a necessary second opportunity for an industry weakened by the downturn in the market in 2008. But with the arrival, miners are beginning to face another huge challenge, that is, halving bitcoin for the fourth time will reduce the block subsidy of bitcoin from to, which means that miners' income will be reduced. The halving of bitcoin in the past year will undoubtedly leave an indelible mark in the current bitcoin mining market. Although the third halving is not the direct fuse, the ban on bitcoin mining implemented by China in and the subsequent large-scale migration of computing power have created conditions for the formation of a mining market that is completely different from the second halving. We believe that the fourth halving will bring greater changes and may be accompanied by the redistribution of bitcoin computing power to new geographical areas. For 2008 and the next few years, we roughly predict that the distribution of bitcoin computing power will be more global in North America. The dominant position of computing power will be weakened. During the second halving period, China dominated the computing power share of Bitcoin network, and it was the last power at the peak. After the ban on bitcoin mining was implemented in China, the balance of power shifted to North America. From the summer of 2008 to now, the United States and Canada jointly occupied about the global computing power share, and it is estimated that the share of North America in the global computing power share has reached its peak and will gradually decrease after halving in June, because the profits of miners will be compressed, and they will continue to look for more. Cheap electricity, South America, Africa and other undeveloped areas will usher in significant growth opportunities, and the retail custody service industry will suffer a heavy blow. In North America and other places, due to the low mining profits, the retail custody service industry will go into a downturn. The average all-inclusive custody fee in the United States is US$ kWh, and that in Canada is US$ kWh. The average all-inclusive rates in the fourth quarter of 2008 are US$ kWh and US$ kWh respectively. Figure 2 shows the average custody in Canada. Annual Cost Figure 3 Average Custody Cost of States in the United States Every year, considering the mining economy that has been halved, miners with average or higher custody costs are likely to be unable to maintain profits, which means that only those miners with favorable rates can survive in 2008, which will lead to more mergers and acquisitions in 2008 and 2008 under the environment of reduced computing power prices. In fact, the prelude has been played in 2008, when computing power prices plummeted and reached the lowest level in history. One of bitcoin's largest custody service providers declared bankruptcy and liquidation, and other mining enterprises sold assets. Figure 4: Overview of assets sale and purchase activities of major listed mining enterprises. In the financial difficulties of 2008, we did not see many assets purchase and acquisition activities, but it witnessed the largest merger in bitcoin mining history and the expected level of assets acquisition activities in 2008. Inscriptions and other block space utilization activities will continue to increase transaction costs and income. The alternative use of bitcoin will make the transaction cost level equal to or higher than the average level in 2008. The biggest dark horse in 2008 entered the market behind the new technical standard ordinal number and inscription of bitcoin based on non-homogeneous tokens. This new method of creating digital works of art and artifacts on bitcoin makes the transaction cost an important source of mining income. In fact, the total transaction cost of bitcoin last year was only the second last in the history of bitcoin, and the miners earned the transaction cost of US dollars in 2008, second only to the record of 2008. The ratio of the recorded annual transaction cost in US dollars to the block reward is only Figure 5. The inscription activity generated a transaction cost of US$ billion from June to the end of the year. Miners earned US$ billion in the fourth quarter of 2008, accounting for the total cost. In addition, the income of miners in the fourth quarter of 2008 was US$ billion in the total transaction cost reward. If Bitcoin continues to rise this year, it is expected that the transaction volume of inscription activity will continue to increase in 2008 or the price premium of Bitcoin mining stocks will be lost. Historically, investors have used bitcoin mining stocks as a high game to trade bitcoin, not only as substitutes for bitcoin, but also as assets that can generate excess returns when bitcoin rises. According to the chart below, bitcoin mining stocks show their correlation trend in bull market or bear market. In bear market, the fluctuation of stock price is more correlated with the daily fluctuation of currency price. In bull market, because of the strong correlation between stocks and bitcoin, they are stronger than bitcoin. The upward return traders can better grasp the return income by observing the closer correlation between bitcoin miners and the daily fluctuation of bitcoin spot price. When this trend rises, bitcoin miners are turning to a stronger return period. Figure 6 Comparison of bitcoin coefficients of listed mining enterprises. In view of the recent approval of various bitcoins, it is expected that bitcoin mining stocks will lose some investment premium as a substitute for bitcoin, because investors can now gain income exposure directly through various bitcoins. Investors may still regard them as high tools to expose bitcoin prices, but may reduce their price premium. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。