Yield Farming与Staking:哪种被动收入策略更有利?

作者:MrNouman / 来源 翻译:白话区块链

多年来,有关如何从加密货币中获得 passsive 收入的辩论一直在进行。许多投资者转向挖矿和质押作为两种最有利可图的 passsive 收入策略;然而,这些术语周围存在着重大的混淆。

挖矿和质押都是赚钱的可行方法,而无需在市场上活跃,但它们之间存在重大差异,可能影响您的投资回报。在这篇博客文章中,我们将探讨每种策略的利弊,帮助您做出明智的决定,找到最适合您目标的选项。

1、Yield Farming

1)什么是Yield Farming?

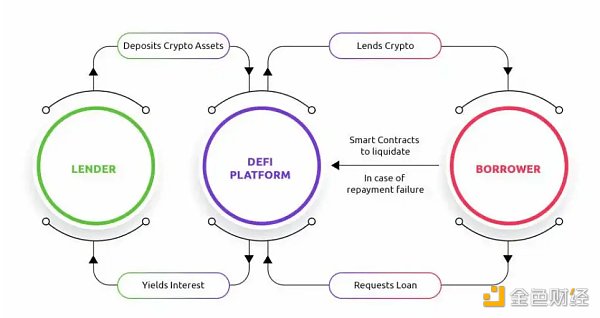

向DeFi(去中心化金融)协议提供流动性的过程,例如流动性池和加密货币借代服务,被称为Yield Farming(挖矿)。它被比喻为Yield Farming 农耕,因为这是一种“种植”您加密货币的新方法。

Liquidity Mining(也称为流动性挖矿)目前是从加密资产中获利的最流行方法。当区块生产者提供流动性时,他们会从像 Uniswap 这样的去中心化交易平台(DEX)中获得一定比例的平台费用。这些平台费用是由使用流动性的Token交换者支付的。这是一种双赢的局面:加密货币持有者可以获得更多曝光,而协议则受益于增加的流动性和交易量。

一些加密货币爱好者将Liquidity Mining和Yield Farming收益视为两种不同的投资策略——主要是因为用户会收到Liquidity Mining系统中的流动性提供者Token(LP Token)作为交易对的回报。

然而,这些术语经常被互换使用。加密货币Yield Farming也可以被称为 DEX 挖矿、DeFi挖矿、DeFi 流动性挖矿或加密货币流动性挖矿。

2)Yield Farming是如何工作的?

Yield Farming的一个关键概念是自动做市商(AMMs),它们是无需许可的自动交易平台,不像涉及买家和卖家的传统交易平台那样需要用户提交订单。AMMs使投资者能够更高效、更方便地进行交易,无需中介或第三方。此外,由于自动做市商,交易几乎是即时完成的,这进一步增加了挖矿对许多投资者的吸引力。

流动性提供者(LPs)和流动性池

自动做市商(AMM)系统维护订单簿,其中主要由流动性池和流动性提供者(LPs)组成。

实质上,流动性池是智能合约,它们收集资金,使加密货币用户更容易借代、购买和交易数字货币。流动性提供者(LPs)将资金投入流动性池,利用这笔资金推动DeFi生态系统。流动性池对他们进行激励。

3)Yield Farming 的优势

挖矿使许多普通投资者能够从数字资产中获得回报,而无需对区块链技术有深入的理解或制定复杂的交易策略。通过挖矿产生的回报使得投资者可以获得传统投资工具无法达到的回报。随着 DeFi 的不断发展和演变,很明显,加密挖矿将成为一种更主流的在线 passsive 收入生成方法。

4)比较好的Yield Farming平台

不同形式的公司提供不同金融服务,其中大部分都能够产生惊人的高利息。你可能会从大银行那里获得 0.01% 到 0.25% 的年利率,但这些低回报无法与某些 DeFi 平台承诺的 20% 到 200% 的利润相匹敌。利率越高,质押池的风险就越高— 这是一个关键的相关性。要警惕可能让你损失资金的欺诈和未经证实的平台。

最有利可图的 DeFi 平台(如 Aave、Curve、Uniswap 等)位于以太坊上,但币安智能链(BSC)也有一些实质性项目,例如 PancakeSwap 和 Venus Protocol,可以与以太坊网络抗衡。

以下是一些比较好的平台的列表:

-在 Uniswap 上提供流动性:年收益率约为 20% 到 50%

-在 Aave 上赚取利息:年收益率约为 0.01% 到 15%

-在 PancakeSwap 上进行挖矿:年收益率约为 8% 到 250%

-在 Curve Finance 上提供流动性:年收益率约为 2.5% 到 25%

-Yearn Finance:年收益率约为 0.3% 到 35%

挖矿池的高利率(年化收益率)使其竞争异常激烈。利率经常波动,迫使流动性挖矿者在不同平台之间交替。不足之处在于,每次挖矿者离开或进入流动性池时,他们都必须支付 gas 费用。

2、Staking

1)什么是Staking (质押)?

质押在加密货币行业越来越受欢迎,因为它允许用户在支持自己喜爱的网络或协议的同时,获得被动但高收入。它涉及在安全钱包中持有一定数量的硬币或Token,并参与验证某些区块链网络上的交易过程,例如以太坊、Polkadot、BNB、Cardano等。作为回报,质押者会获得更多的硬币或Token,这可以产生稳定的收入流。由于奖励通常取决于网络的波动性,如果操作得当,质押可以非常有利可图,因此对于希望多样化投资组合的加密货币爱好者来说,它是一个具有吸引力的选择。

工作证明(PoW)与权益证明(PoS)

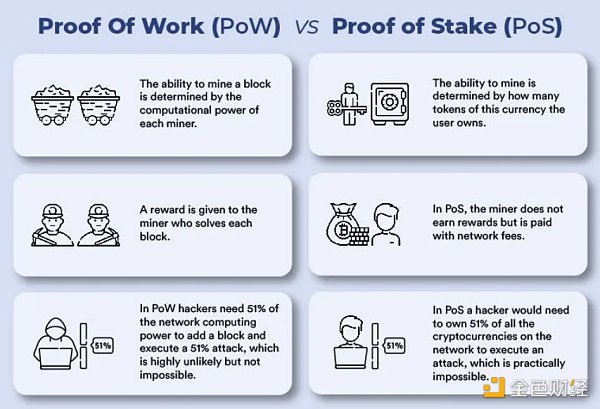

在加密货币领域,有两种核心共识机制备受关注,它们分别是工作证明(PoW)和权益证明(PoS)。虽然 PoW 目前是行业中最主导的协议,但 PoS 也越来越受欢迎。

这些协议各自都有优缺点。在 PoW 中,矿工投入计算能力以处理(验证)交易 —— 矿工通过获得Token的方式获得他们的努力工作的奖励。这使其成为一个安全的系统,但 PoW 也与巨大的能源消耗相关联。

在 PoS 中,持有者从他们的余额中投入Token并获得奖励。这抵消了mining,从而降低了能源成本。然而,由于该协议利用验证器选择算法进行交易验证,如果实施不当,可能导致控制权的集中化。

因此,这两种协议都没有本质上的优劣之分;了解每种协议的优缺点有助于确定哪种协议最适合特定情况。

2)加密货币质押是如何工作的?

来源:Bitpanda

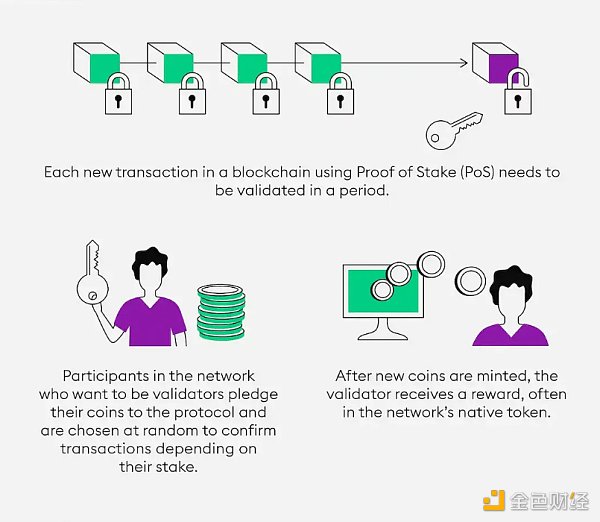

质押是在区块链世界中通过承诺资金作为抵押品来赚取收入的一种流行方式。它涉及锁定一定数量的加密货币,通过验证过程产生奖励,类似于挖矿但工作量和风险较少。作为对质押他们的Token的回报,用户可以获得为生态系统的安全性和稳定性做出贡献的奖励。

3)如何质押 PoS 加密货币

要质押加密货币,用户必须下载和同步钱包,并转移Token。用户可以设置他们的钱包的质押设置,检查质押Token的统计数据,并密切关注奖励的区块链。确保所有网络安全设置都是最新的,并启用最高级别的保护,以确保不会将质押资金置于风险之中。此外,应尽可能频繁地备份数据,因为意外事件可能导致中断,从而危及资金。质押加密货币是一种奖励自己的好方法,因为是一种采积极保护钱包并支持网络的共识的途径。

以下是最常质押的加密货币:

-以太坊(ETH)

-Cardano(ADA)

-Tezos(XTZ)

-Polygon(MATIC)

-Theta(THETA)

这五种加密货币为那些愿意将资金锁定在网络内一段时间的用户提供了高潜力的奖励。虽然每种情况下的奖励各有不同,但与其他币种相比,质押这五种币种被认为更为可靠。

4)DeFi 对质押的影响

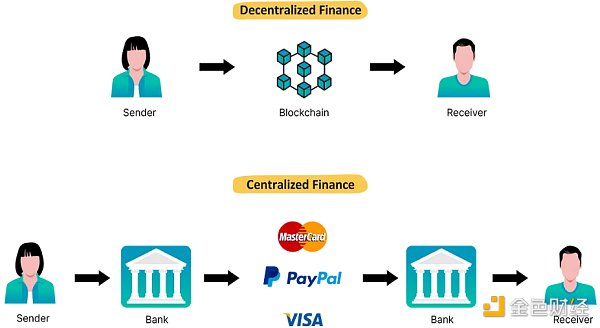

由于 DeFi 平台是去中心化的,因此比传统银行应用程序更不容易遭受安全漏洞,它们通常比后者更安全。DeFi 设置还为用户提供了访问高年化收益率、额外的治理特权或投票权等激励,其他金融系统无法提供。

参与 DeFi 的投资者在进行质押时应该采取一些额外的预防措施,其中包括:

-考虑 DeFi 平台的安全性;

-确定质押Token的流动性如何;

-调查奖励是否会导致通货膨胀;

-通过不同的质押平台和倡议进行多样化。

3、挖矿与质押的区别是什么?

在作为一种投资形式之间选择挖矿和质押可能会有些棘手。虽然两者都提供了额外收入的潜力,但重要的是要了解哪种适合您的情况和目标。

虽然“挖矿”和“质押”这两个术语有时被用作同义词,但它们之间有一些明显的区别。

盈利能力:挖矿和质押产生的利润相差很大,通常用“年化收益率”(APY)来表示。

例如,早期加入新项目或方法的挖矿者可以获得相当可观的利润。根据 CoinGecko 的数据,可能的回报范围是从 1% 到 1,000% 的 APY。与挖矿不同,质押的回报通常在 5% 到 14% 之间波动。

风险水平:挖矿提供了更高的收益,但也伴随着更大的风险。其中一个原因是,由于加密挖矿经常用于较新的DeFi项目中,因此存在更高的“拉盘”风险。在风险较低的已建立的PoS网络上,质押更为普遍。

然而,无论是挖矿还是质押,波动性都带来了一定程度的风险。如果Token价值意外下跌,无论是挖矿者还是质押者都可能会损失资金。还有被清算的可能性,如果您的投资不能被您的抵押品覆盖,这种情况可能会发生。

复杂性:质押通常被视为一种较简单的被动收入技术,因为它只需要投资者选择一个质押池并锁定他们的加密货币。它也不需要很大的初始投资。另一方面,挖矿可能会耗费时间,因为投资者必须决定借出哪些Token以及在哪个平台,还有可能反复地更改平台或Token。最终,您选择如何积极管理投资可能会决定您是选择质押还是挖矿。

只需一个加密资产即可开始质押。相反,挖矿允许您从交易对中赚钱。

流动性:当比较挖矿与质押时,对于寻求流动性的投资者来说,获胜的策略是显而易见的。这两种策略都要求加密货币投资者拥有一定数量的加密资产才能盈利。然而,与质押不同的是,在进行挖矿时,投资者无需锁定资金 —— 通过这种技术,他们可以完全控制加密货币,并可以随时提取。

通货膨胀:PoS Token往往会受到通货膨胀的影响,给质押者的任何收益都是由新创建的Token供应组成的。至少质押您的Token使您有资格获得与质押数量成比例且与通货膨胀同步的利益。如果您错过了质押,您当前资产的价值将因通货膨胀而下降。

时长:二者都需要用户必须在不同的区块链网络上质押他们的资金一段时间。有些还有必需的最低金额要求。

交易费用:挖矿者可以每周频繁地切换池子。他们不断调整自己的策略,以增加收入并充分最大化收益。这就是为什么对于自由切换流动性池的挖矿者来说,gas费无疑是一个主要问题,但在比较挖矿与质押时,这个费用可能被忽视。即使挖矿者在另一个网络上找到更大的回报,他们也必须考虑到任何切换成本。

安全性:因为质押者参与了底层区块链使用的严格共识过程,所以质押通常更安全。

另一方面,挖矿(尤其是基于较新的 DeFi 协议)可能更容易受到黑客攻击。特别是如果智能合约代码中存在漏洞。

临时损失:由于加密货币价格波动,挖矿者在双边流动性池中可能会遭受临时损失。数字资产价值的上涨对投资者没有好处。举个例子,如果一位投资者将资金存入挖矿池,而加密货币的价格飙升,那么这位投资者最好将这些加密货币保留下来,而不是将它们添加到池中。如果投资者的Token价值下降,他们也可能遭受临时损失。

质押不会导致临时损失。

挖矿与质押的相似之处是它们都是加密货币爱好者赚取被动收入的两种最流行方式。

4、总结哪种更好?

质押是适合那些不在意短期价格波动,但关心长期投资回报的投资者的绝佳选择。如果在质押期限到期之前可能需要迅速取回资金,则应避免将资金锁定用于质押。

对于偏好短期方法的投资者来说,挖矿是一个不错的选择。它不需要固定资金。您可以在平台之间切换,以寻找更高的年化收益率。在采用短期方法时,挖矿可以产生更多收入。与质押相比,这是一项高风险的尝试。交易量较低的Token通常在挖矿中受益最多,因为这是交易它们的唯一实用方式。

总的来说挖矿和质押都有特定优势。质押通常风险较低,且不需要锁定资金,适合需要快速操作的情况。而长期看,挖矿提供更大的灵活性,能在不同平台和Token间切换以获取更高的收益率。挖矿有助于多样化投资组合,并且可以将收益再投资以获得更多利息。尽管挖矿可能带来更高的收入,但要考虑切换平台和Token的成本。总的来说,质押更安全稳定,适合长期投资。

质押和挖矿是这两个概念仍然有些新鲜,它们有时甚至被用作同义词。两者都涉及持有加密货币资产以生成利息。对于这两种情况,最后解答一些常见问题:

1)挖矿是否比质押更好? 在大多数情况下,挖矿提供的回报比质押更高。然而,这些回报是动态的。另一方面,由于质押策略提供的固定年化收益率,用户可以在质押期结束时确保自己的收益。最终,一切都取决于您自己的风险偏好和投资风格。

2)挖矿比质押更加风险吗? 挖矿(特别是杠杆挖矿)可能存在风险,因为它受到与某些Token相关的价格波动的影响;然而,许多挖矿者通过这种策略获得了积极的回报。

3)质押是一种挖矿吗? 有点像。流动性挖矿是挖矿的派生形式,而挖矿是质押的派生形式。

4)挖矿是否有利可图? 是的,收益通常在 5% 到 30% 之间波动,具体取决于所涉及的特定 DeFi 协议和资产类别。尽管每种投资策略都存在风险,但质押为寻求更高收益而不愿承担过多风险的交易者提供了一个有趣的选择。

The debate on how to earn income from cryptocurrency has been going on for many years. Many investors turn to mining and pledge as the two most profitable income strategies. However, there is a great confusion around these terms. Mining and pledge are both feasible ways to make money without being active in the market, but there are significant differences between them, which may affect your return on investment. In this blog post, we will discuss the advantages and disadvantages of each strategy to help you make a wise decision. Find the best option for your goal. What is the process of providing liquidity to decentralized financial agreements, such as liquidity pool and cryptocurrency lending service? It is called mining. It is compared to farming because it is a new method to grow your cryptocurrency and which passive income strategy is more beneficial. It is also called liquidity mining. At present, it is the most popular method to profit from cryptoassets. When block producers provide liquidity, they will get a certain proportion of platforms from decentralized trading platforms like this. The fees of these platforms are paid by the exchange users who use liquidity, which is a win-win situation. Cryptographic currency holders can get more exposure, while agreements benefit from increased liquidity and transaction volume. Some cryptocurrency lovers regard and income as two different investment strategies, mainly because users will receive returns from the liquidity providers in the system as transaction pairs. However, these terms are often used interchangeably, and cryptocurrency can also be called mining, mining, liquidity mining or cryptogoods. A key concept of how currency liquidity mining works and which passive income strategy is more beneficial is automatic market makers, which are automatic trading platforms without permission, unlike traditional trading platforms involving buyers and sellers, which require users to submit orders, so that investors can conduct transactions more efficiently and conveniently without intermediaries or third parties. In addition, because automatic market makers' transactions are almost completed immediately, this further increases the attraction of mining to many investors, liquidity providers and liquidity pools. The automatic market maker system maintains an order book, which is mainly composed of a liquidity pool and a liquidity provider. In essence, the liquidity pool is a smart contract. They collect funds to make it easier for cryptocurrency users to buy and trade on their behalf. digital currency liquidity providers put funds into the liquidity pool, and use this fund to promote the advantages of the ecosystem liquidity pool to encourage them to mine, so that many ordinary investors can get returns from digital assets without having a deep understanding of blockchain technology or making a complex. With the continuous development and evolution, it is obvious that encryption mining will become a more mainstream online income generation method, and different forms of companies provide different financial services, most of which can generate amazing high interest rates. You may get the annual interest rate from big banks, but these low returns cannot compete with the profits promised by some platforms. The higher the risk of a high pledge pool, which is a key correlation. Beware of fraud and unconfirmed platforms. The most profitable platform is located on the Ethereum, but there are also some substantive projects in the intelligent chain of currency security, such as competing with the Ethereum network. The following is a list of some better platforms. The annual rate of return on providing liquidity on the Internet is about to earn interest on the Internet. The annual rate of return on mining on the Internet is about to provide liquidity on the Internet. The annual rate of return is about to reach the mining pool, and the high interest rate annualized rate of return makes its competition fierce. The frequent fluctuation of interest rates forces liquid miners to alternate between different platforms. The disadvantage is that they have to pay a fee every time miners leave or enter the liquidity pool. What is pledge pledge is becoming more and more popular in cryptocurrency industry because it allows users to obtain passive but high income while supporting their favorite networks or protocols. It involves holding a certain amount of hard money in a safe wallet. Coins may participate in verifying the transaction process on some blockchain networks, such as Ethereum, etc. In return, the pledgee will get more coins or this will generate a stable income stream. Because the reward usually depends on the fluctuation of the network, pledge can be very profitable if it is operated properly, so it is an attractive choice for cryptocurrency enthusiasts who want to diversify their portfolios. There are two core consensus mechanisms in the field of cryptocurrency, which have attracted much attention. In particular, although work certificate and rights certificate are the most dominant agreements in the industry at present, they are becoming more and more popular. Which passive income strategy is more favorable? These agreements have their own advantages and disadvantages. In China, miners put in computing power to deal with verification transactions. Miners get rewards for their hard work through acquisition, which makes it a safe system, but it is also related to huge energy consumption. In China, holders put in and get rewards from their balances, which offsets and reduces energy costs. However, because the protocol uses the verifier selection algorithm to verify transactions, if improperly implemented, it may lead to the centralization of control rights, so there is no essential difference between the two protocols. Understanding the advantages and disadvantages of each protocol is helpful to determine which protocol is most suitable for a specific situation, how cryptocurrency pledge works and which passive income strategy is more favorable. Source pledge is a popular way to earn income by promising funds as collateral in the blockchain world, which involves locking in a certain amount. The cryptocurrency generates rewards through the verification process, which is similar to mining, but the workload and risk are less. In return, users can get rewards for contributing to the security and stability of the ecosystem. How to pledge cryptocurrency? Users must download and synchronize their wallets and transfer them. Users can set the pledge settings of their wallets, check the pledge statistics and pay close attention to the blockchain of rewards to ensure that all network security settings are up-to-date and enable the highest. Level of protection to ensure that the pledged funds will not be put at risk. In addition, data should be backed up as frequently as possible, because unexpected events may lead to interruption and endanger the pledge of funds. Cryptographic currency is a good way to reward yourself because it is a way to actively protect wallets and support the consensus of the network. The following are the most commonly pledged cryptocurrencies. These five cryptocurrencies provide high-potential rewards for users who are willing to lock funds in the network for a period of time. Although the rewards in each case are different, they are considered more reliable than other currencies. Due to the impact on pledge, 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。