微策略爆买3万枚数字货币

日前,因囤积比特币(BTC)而知名的美股上市公司微策略(Microstrategy)放出了2023四季度财报。看了这篇财报,才发现在2024年初现货ETF通过之前,自2023年10月份启动的暴拉行情的动力源头,就有微策略的一份不小的贡献。

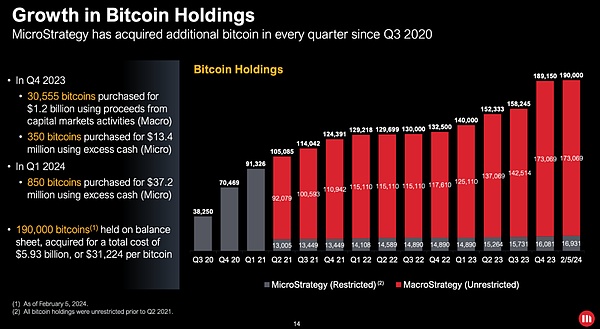

从微策略报告中给出的持仓增长图表可以看到,2023年三季度还在缓慢地按部就班加仓到持仓15.8万枚BTC的微策略,在四季度突然爆买3万多枚BTC,仓位猛地增长到了18.9万枚!

到了2024年一季度,微策略又小幅补仓850枚BTC,使得截至2月5号,持仓达到了19万枚BTC整数大关。

根据财报披露,19万枚BTC持仓,所用的建仓总资金量为59.3亿美刀,算下来折合平均持仓成本为每枚BTC 31224美刀。根据目前44.5k左右的价格来看,浮盈40%多。

2023年四季度爆买的30905枚BTC,总成本12.13亿美刀,平均加仓成本39262美刀。2024年一季度补仓850枚BTC,总成本3720万美刀,平均加仓成本43764美刀。目前二者都买得不亏。

要知道,整个四季度矿工一共才能生产多少枚BTC呢?按每个区块6.25个BTC的固定产量来计算,一小时6个区块,一天24小时,一个季度90天,那么季度产量就是6.25 x 6 x 24 x 90 = 8.1万枚BTC。

也就是说,仅微策略一家,就收走了季度产量的三成多!

难怪比特币从10月份开盘的27k,一个季度猛地拉升到12月收盘的42.5k,季度增幅57%!

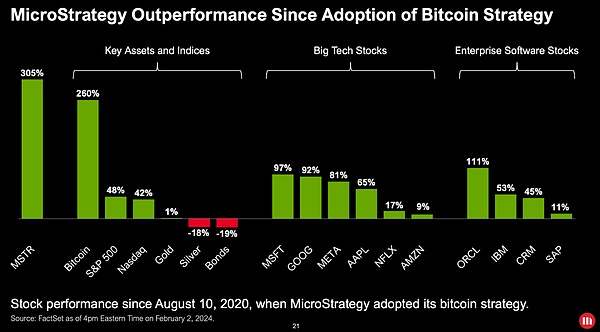

自从囤了比特币,微策略的股价也是溜得飞起。下面这张图,便是微策略老板引以为傲的一张美股增长对比图了。

图中显示,自2020年8月微策略开始囤饼伊始,截至2024年2月初,其美股增幅高达305%,远超美股的几大头部公司的股价表现。

就这,它还不忘捎上“同一赛道”的竞争对手们。但其实,已经很难说微策略还是一家“企业软件开发公司”了。

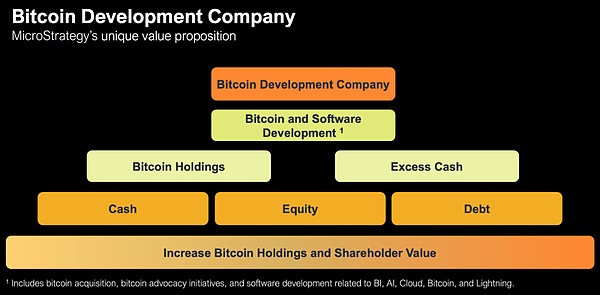

连微策略自己,也开始标榜自己已经成为“世界上第一家比特币发展公司”。

在报告中,它这样写道:「“微策略公司是全球首家比特币发展公司”

「微策略公司(纳斯达克股票代码:MSTR)认为自己是世界上第一家比特币发展公司。

「我们是一家公开上市运营的公司,致力于通过我们在金融市场、宣传和技术创新方面的活动,持续发展比特币网络。作为一家运营中的企业,我们能够利用现金流以及股权和债务融资的收益来积累比特币,作为我们的主要财务储备资产。

「我们还开发并提供业界领先的人工智能驱动的企业分析软件,以促进我们“智能无处不在”的愿景,并利用我们的软件开发能力来开发比特币应用。

「我们相信,我们的运营结构、比特币战略和对技术创新的关注相结合,为创造价值提供了一个独特的机会。」

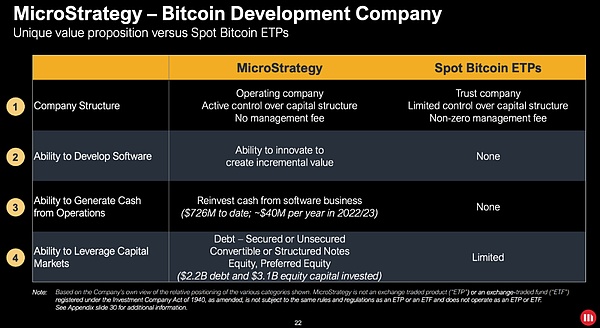

有人说,微策略就是一个自带场外现金流和灵活运用杠杆的囤饼代理人。微策略自己也是这么宣传的。

不过,仔细看财报就会发现,这个场外现金流还是略显尴尬的。2022年和2023年连续两年,Non-GAAP运营收入都是负数!其中2022年亏损12亿美刀,2023年亏损4500万美刀。2024年他们预计有希望扭亏为盈。

所以,至少从目前来看,它的场外负现金流反而损害了囤积的BTC资产的账面价值。这使得在目前的会计准则下,微策略持仓的账面价值并不是市场价值81亿美刀,而是成本59亿美刀,减去折损23亿美刀,结果只有37亿美刀。

这大大限制了微策略加杠杆的能力。但依旧不妨碍微策略爆买的主要策略,其实就是上杠杆,俗称借钱!

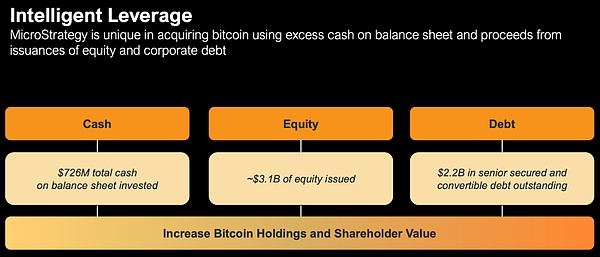

在微策略的财报里,它说自己用的是“巧妙的杠杆”。

微策略现在资产负债表上有7.26亿美刀现金,以及约31亿美刀资产(注意上文谈到的会计准则问题)。负债则有22亿美刀。也就是说,净资产大概只有7.26 + 31 - 22 = 16.26亿美刀。

常看教链内参的星球会员都知道,微策略公司和老板Michael Salyor,其实都在趁着微策略股票跑赢之际,抓紧减持套现,该囤饼囤饼,该储备弹药储备弹药。(参考阅读教链内参11.30《微策略售股囤饼》,教链内参1.3《该如何计划减持》)

他们虽然嘴上说微策略股票千般好万般好,比现货ETF还要好,云云。但是他们更知道,有花堪折直须折,莫待无花空折枝。靠负债支撑起来的仓位,毕竟不如现货BTC来的安稳、踏实。无债一身轻嘛。

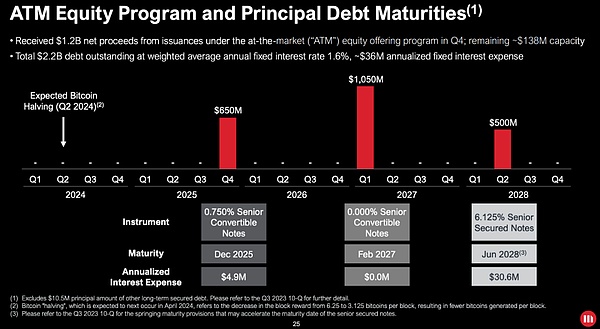

微策略的债务,主要有三笔。客观地讲,已经比绝大多数个人韭菜能拿到的杠杆要美丽太多了。最大的一笔10.5亿美刀,免利息!到期日,2027年2月。

另外两笔,一笔6.5亿美刀,利息千分之7.5(超级低),到期日早一些,是2025年12月;另一笔5亿美刀,利息百分之6.125(比较高),但到期日很晚,要到2028年6月。

从这个债务到期日的时间设置上就能一眼看到微策略的小算盘:它一定是盘算着,2025年底很可能是下一轮牛市的顶点,到时候高位抛售,还掉这笔债务,剩下的都是自己的,美滋滋。

至于最大的一笔债务,则跳过2026年的预期熊市,待到熊市结束开始反弹之际,2027年一季度,再开始还债。我不知道微策略究竟是准备在2025年底牛市高点一气呵成把这两笔债务的偿债成本都给卖出来,还是等到2026年底、2027年初熊市低点再卖饼还债。但是依照常理推测,它很有可能会想最大化自己的利润,所以大概率会选择最充分地利用好2025年底的牛市。

微策略目前囤积的近20万枚BTC,如果在2025年牛市高点倾泻而出的话,会不会有可能成为下一轮牛市结束转熊的重要诱因呢?

(免责声明:本文内容均不构成任何投资建议。加密货币为极高风险品种,有随时归零的风险,请谨慎参与,自我负责。)

喜欢本文就请点亮在看、点赞、转发支持哦

???

A few days ago, Microstrategy, a listed company in the U.S. which is famous for hoarding bitcoin, released its fourth-quarter financial report. It was only after reading this financial report that it was found that the power source of the sudden pull-up market started in January of this year had a great contribution from Microstrategy. From the chart of position growth given in the Microstrategy report, we can see that Microstrategy was still slowly adding positions step by step in the third quarter of 2003 to holding more than 10,000 positions in the fourth quarter, and it suddenly increased to 10,000 positions in the first quarter of 2003. According to the financial report, the total amount of funds used to open positions for 10,000 positions is US$ 100 million, which is equivalent to the average cost of each position. According to the current price, the total cost of the pieces bought in the fourth quarter of the year is US$ 100 million, the average cost of adding positions is US$ 100,000, and the total cost of adding positions in the first quarter of the year is US$ 100,000. Calculate one hour, one block, one hour, one quarter and one day, then the quarterly output is 10,000 pieces, that is to say, the micro-strategy alone has taken away more than 30% of the quarterly output. No wonder the quarterly increase of Bitcoin from the opening quarter of the month to the closing quarter of the month has soared since the stock price of Bitcoin Micro-strategy has been hoarded. The following picture is a comparison chart of the growth of US stocks that the micro-strategy boss is proud of. It shows that from the beginning of micro-strategy to the end of the month. At the beginning, the growth rate of American stocks was as high as that of several head companies, which far exceeded that of American stocks. That's why it didn't forget to catch up with competitors on the same track. But in fact, it's hard to say that Microstrategy is still an enterprise software development company, and even Microstrategy itself has begun to flaunt that it has become the world's first bitcoin development company. In the report, it wrote that Microstrategy is the world's first bitcoin development company. The Nasdaq Stock Code thinks that it is the world's first bitcoin development company. We are a publicly listed company, and we are committed to the continuous development of bitcoin network through our activities in financial market promotion and technological innovation. As an operating enterprise, we can use cash flow and the proceeds from equity and debt financing to accumulate bitcoin as our main financial reserve assets. We also develop and provide industry-leading enterprise analysis software driven by artificial intelligence to promote our vision of ubiquitous intelligence and make use of our software development capabilities. To develop bitcoin applications, we believe that the combination of our operating structure, bitcoin strategy and attention to technological innovation provides a unique opportunity to create value. Some people say that micro-strategy is a cake-hoarding agent with its own off-site cash flow and flexible use of leverage. Micro-strategy is also advertised in this way, but if you look closely at the financial report, you will find that this off-site cash flow is still slightly embarrassing. The operating income for two consecutive years is negative, with an annual loss of 100 million US dollars and an annual loss of 10 thousand US dollars. There is hope to turn losses into profits, so at least from the current point of view, its off-exchange negative cash flow has actually damaged the book value of the hoarded assets, which makes the book value of micro-strategy positions under the current accounting standards not the market value of US$ 100 million but the cost of US$ 100 million minus the loss of US$ 100 million, resulting in only US$ 100 million, which greatly limits the ability of micro-strategy to leverage, but still does not hinder the main strategy of micro-strategy explosion buying. In the financial report of micro-strategy, it says that it is clever. Wonderful leverage micro-strategy. Now there are billion dollars in cash and about billion dollars in assets on the balance sheet. Pay attention to the accounting standards mentioned above. The liabilities are billion dollars. That is to say, the net assets are only about billion dollars. All the members of the planet who often look at the micro-strategy stocks know that micro-strategy companies and bosses are actually trying to reduce their holdings and cash out the stocks. Read the teaching chain for reference. How to plan to reduce their holdings? In theory, micro-strategy stocks are as good as spot stocks, but they know that there are flowers that can be folded straight, and they need to be folded. After all, the positions supported by debts are not as stable as those from spot stocks. There are three micro-strategy debts that are objectively much more beautiful than the leverage that most individuals can get. The largest one is a billion dollars, and the other two are a billion dollars, and the interest is extremely low. The maturity date is another year. The interest rate of a billion dollars is relatively high, but the maturity date is very late. From the time setting of this debt maturity date, we can see the micro-strategic abacus at a glance. It must be calculating that the end of the year is likely to be the peak of the next bull market, and then the debt will be sold off at a high level. As for the biggest debt, we will skip the expected bear market in 2008 and start paying off debts in the first quarter of 2008 when the bear market ends and begins to rebound. I don't know whether the micro-strategy is going to be a bull market at the end of the year. Sell the debt service cost of these two debts at the same time at the high point, or wait until the bear market low point at the beginning of the year to sell cakes to pay off debts, but according to common sense, it is likely to want to maximize its own profits, so it is highly probable that it will choose to make the best use of the micro-strategy of the bull market at the end of the year. If it pours out at the high point of the bull market in 2008, will it be an important incentive for the next bull market to end and turn into a bear? Disclaimer: Nothing in this article constitutes any investment suggestion. Cryptographic currency is a very high-risk variety with the risk of returning to zero at any time. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。