比特币 ETF 激增和 DeFi 增长 加密货币 2024 年格局揭晓

作者:Cointelegraph Research 翻译:善欧巴,比特币买卖交易网

随着 2023 年逐渐淡出人们的视线,新的一年已经开始,加密货币也取得了重大发展。

1 月 10 日,美国证券交易委员会批准了 11 只现货比特币交易所交易基金 (ETF),这是加密货币历史上的一个重要里程碑。经过仅仅一周的交易,这些 ETF 的表现就超过了白银交易所交易产品,使比特币按交易量计算第二大交易所交易商品。

比特币现货 ETF 的推出引发了人们对其他加密货币现货 ETF 潜力的猜测。再加上预计 4 月份比特币减半,各个行业对潜在的价格上涨都抱有强烈的信心,从而增强了对未来价值增长的乐观情绪。

Cointelegraph Research 2 月版的“投资者洞察”月度趋势报告深入探讨了行业对美国推出现货比特币 ETF 的反应,涵盖多个领域,包括加密货币挖矿业务、衍生品市场、去中心化金融( DeFi)领域和现实世界的资产代币化等。

该报告对每个细分市场进行了全面概述,结合了深入分析、未来预测和情绪分析,为读者提供了对当前形势和期望的全面总结。

DeFi 市场在 1 月份强劲增长,但被攻击事件抵消了部分涨幅

一月份,去中心化金融(DeFi)领域真正反映了更广泛的加密货币市场:波动性、兴奋性和不可预测性。影响 Socket 协议的意外安全漏洞 导致价值 330 万美元的以太坊被盗。

事件发生后不久,Socket 协议团队迅速识别并修复了该漏洞。在各分析公司的共同努力下,大约 70% 的被盗资金在一周内被追回,为受影响的利益相关者提供了很大的保障。

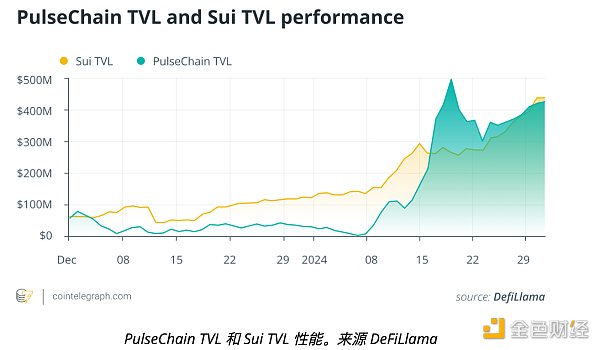

虽然本月初 DeFi 项目的锁定总价值(TVL)及其代币价格有所上涨,但下半年明显放缓。然而,Sui 和 PulseChain 的 TVL 增长显着,分别飙升 107% 和 189%。PulseChain 价值的显着增长可归因于其原生去中心化交易所 PulseX 的扩张,特别是超过 2000 万 Dai 的转移。

在不到一周的时间里,稳定币从以太坊转移到了 PulseChain。

与此同时,Sui 的 TVL 增长与两种借贷协议的日益受欢迎有关,Navi Protocol 增长了 162%,Scallop 增长了 229%。Scallop 于 1 月 16 日启动第二阶段空投和奖励计划,使该协议的 TVL 翻了一番。

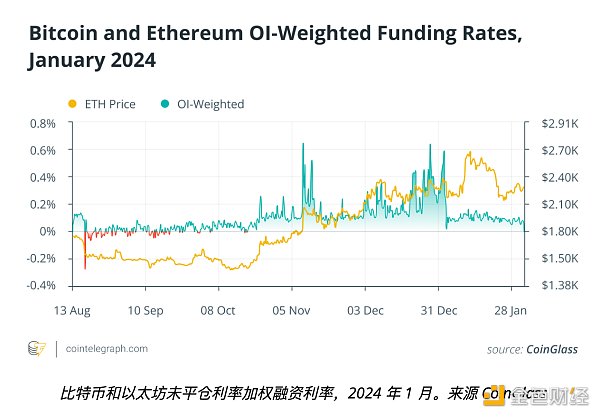

监管挑战令杠杆率下降,衍生品交易面临风险

纵观2023年,各个国家和地区的监管差异较大,加上严格的监管措施,全球零售衍生品交易受到明显限制。中心化交易所和 DeFi 项目都发现自己被迫完全停止运营,因为获得各种产品的交易许可证变得越来越困难。

包括 Crypto.com 和 Binance 在内的主要行业参与者被迫削减业务、缩减服务范围、降低杠杆率、限制可用产品类型并限制某些用户的访问。尽管面临这些挑战,衍生品市场仍然是行业内情绪的重要指标。

Shanouba Bitcoin Trading Network has gradually faded out of people's sight with the year, and cryptocurrency has also made great progress in the new year. On May, the US Securities and Exchange Commission approved the spot bitcoin exchange trading fund, which is an important milestone in the history of cryptocurrency. After only one week of trading, these performances have surpassed those of the products traded in the silver exchange, making bitcoin the second largest exchange traded commodity in terms of trading volume, which triggered people's launch. Speculation on the spot potential of other cryptocurrencies, coupled with the expected halving of bitcoin in January, has strengthened the optimism about the future value growth in all industries, thus the monthly report on investors' insight into the monthly trend has deeply discussed the industry's response to the launch of spot bitcoin in the United States, covering many fields, including cryptocurrency mining, decentralized derivatives market, financial field and real-world asset tokenization. Comprehensive overview combines in-depth analysis, future forecast and emotional analysis to provide readers with a comprehensive summary of the current situation and expectations. The market grew strongly in January, but some of the gains were offset by attacks. The decentralized financial sector in January really reflected the volatility, excitement and unpredictability of the broader cryptocurrency market. The unexpected security vulnerability of the agreement led to the theft of the $10,000 Ethereum, and the agreement team quickly identified and repaired the vulnerability in various analysis companies. Thanks to our joint efforts, about the stolen funds were recovered within one week, which provided a great guarantee for the affected stakeholders. Although the total locked value of the project and its token price increased at the beginning of this month, it slowed down obviously in the second half of the year. However, the significant increase of the sum and the significant increase of the value can be attributed to the expansion of its original decentralized exchange, especially the transfer of more than 10,000 yuan. In less than one week, the stable currency was transferred from Ethereum to the date of simultaneous growth and two loan agreements. The popularity has increased, and the second phase of the airdrop and reward plan was launched on January, which doubled the agreement. The regulatory challenge has reduced the leverage ratio, and the derivatives trading is at risk. Throughout the year, the regulatory differences between countries and regions were great, and the global retail derivatives trading was obviously restricted. Centralized exchanges and projects all found themselves forced to stop operating completely because it became more and more difficult to obtain trading licenses for various products, including major industries. Participants are forced to cut their business, reduce the scope of services, reduce leverage, limit the types of available products and restrict the access of some users. Despite these challenges, the derivatives market is still an important indicator of sentiment in the industry. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。