现货以太坊 ETF 能获批吗?希望与挑战并存

作者:Prashant Jha 来源:cointelegraph 翻译:善欧巴,比特币买卖交易网

比特币 ETF 的批准让许多人对以太坊现货 ETF 很快推出的可能性感到乐观,但专家警告称,这可能是一个漫长的过程。

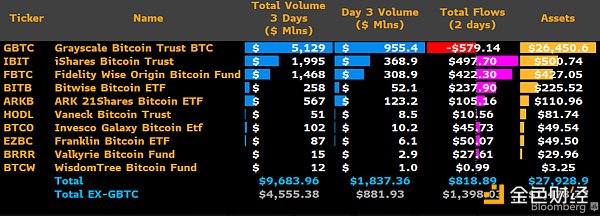

美国证券交易委员会 (SEC) 于 1 月 10 日批准了 10 只现货比特币交易所交易基金 (ETF),允许美国投资者投资由比特币支持的证券。 现货比特币 ETF 于 1 月 11 日开始在公共交易所交易,至今已吸引了数十亿美元的资金流入。

多年来,现货比特币 ETF 的获批标志着比特币历史上的一个重要时刻。 然而,随着现货比特币 ETF 获得批准,所有目光都转向了现货以太坊 ETF 申请,该申请的最终截止日期为 5 月份。

与 2023 年现货比特币 ETF 申请类似,包括贝莱德、ARK Invest、Fidelity、Invesco Galaxy 等主要金融机构正在申请现货以太坊 ETF。 Ark 在 2023 年 9 月率先提交了现货以太坊 ETF 申请,随后是贝莱德和其他机构。

SEC 多次推迟了对现货以太坊 ETF 的决定,这与之前是否批准现货比特币 ETF 的众多推迟类似。

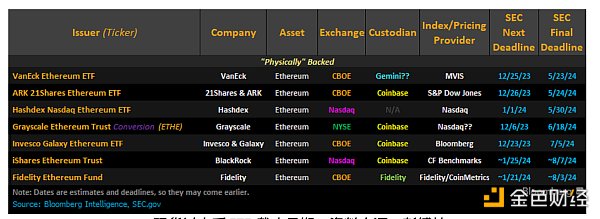

虽然七个以太坊 ETF 申请人有不同的截止日期,但 SEC 也可能像现货比特币 ETF 一样,同时对所有申请做出决定。

现货以太坊 ETF 截止日期。资料来源:彭博社

随着最终期限逼近,ETF专家和加密货币社区对于美国证券交易委员会(SEC)是否会在2024年批准现货以太坊ETF意见分歧。

一方面,彭博社ETF分析师James Seyffart认为,美国证券监管机构在批准以太坊期货ETF时已将Ether视为商品。因此,SEC最终批准Ether ETF只是时间问题。彭博社高级分析师Eric Balchunas表示,现货Ether ETF在5月之前获得批准的可能性高达70%。

另一方面,Morgan Creek Capital的CEO Mark Yusko则认为,现货Ether ETF在2024年获得美国批准的可能性不到50%。Yusko认为,SEC仍对加密货币抱有普遍敌意,正如该机构主席Gary Gensler在产品获批当天发布的信息中所暗示的那样。他补充说,SEC仍可能将Ether视为证券,不像比特币被视为商品。Gensler经常辩称,除比特币之外的所有加密货币都是证券。然而,彭博社分析师James Seyffart认为,“SEC实际上已经默認将以太坊视为商品。”

Bitstamp 美国首席法律官 Rika Khurdayan 告诉 Cointelegraph,她相信美国证券交易委员会 (SEC) 将批准现货以太坊 ETF,但该批准过程可能比比特币更长:

“然而,由于 SEC 需要考虑以太坊与比特币相比的独特特征,包括其底层技术、功能以及其复杂的创建历史和环境,因此审批过程可能会很漫长。我认为,SEC 可能也想观察比特币 ETF 市场后再批准另一个加密货币 ETF。”

以太坊现货 ETF 似乎可行,但问题依然存在

以太坊多年来一直保持着加密货币市值排名的第二位,美国市场已经允许以太坊期货交易。

然而,专家指出,以太坊区块链及其功能与比特币有很大不同,这可能使监管机构的审批过程更加复杂。

与比特币不同,以太坊没有固定的总量,并且支持挖矿机制,持币者可以将以太坊质押赚取收益。

Web3 开发公司 Wormhole Foundation 的法律总顾问 Cathy Yoon 告诉 Cointelegraph,她认为美国证券交易委员会 (SEC) 最终会批准 ETH ETF,但质押问题依然悬而未决:

“传统参与者是否愿意采用质押方式,尤其是在使用质押即服务提供商的情况下,其中许多都受到了 SEC 的加强审查,或者对于那些自托管的人来说,他们是否会自己进行质押,这是一个悬而未决的问题。”

现货比特币 ETF 的推出表明,传统金融市场对加密货币证券抱有浓厚兴趣,因为这些产品迅速获得了数十亿美元的日交易量,11 只现货比特币 ETF 在 1 月 16 日当天创造了比 2023 年全年推出的 500 只 ETF 总和还要多三倍的日交易量。但以太坊 ETF 是否会复制同样的趋势还有待观察。

尽管目前面临美国证券交易委员会 (SEC) 的挑战,以下几项因素让人们相信现货以太坊 ETF 有望在 2024 年获得批准:

比特币和以太坊期货的平行上市和监管:过去一年,这两项期货产品都吸引了大量大型交易员参与,在 SEC 眼中让它们成为可以类比的资产。

期待市场持续强劲以及机构投资者的需求增长,为监管批准施加了额外的压力。

贝莱德 (BlackRock) 的 ETF 记录与加里·詹斯勒 (Garry Gensler) 对比

贝莱德在现货比特币 ETF 获得批准过程中扮演了关键角色。2023 年之前,美国证券交易委员会 (SEC) 拒绝了多个现货比特币 ETF 提议。然而,贝莱德以其 575 次成功获批和仅 1 次被拒的记录进入比特币 ETF 市场后,加密社区对潜在批准产生信心。

随着现货以太坊 ETF 的最终决定截止日期临近(5 月),许多人想知道贝莱德能否保持其记录。

Bitfinex 衍生品主管 Jag Kooner 告诉 Cointelegraph,像贝莱德这样的大型金融公司进入比特币 ETF 市场被视为加密 ETF 获得普遍接受的积极信号,但他同时也警告了监管机构可能施加的早期阻力:

“机构兴趣往往会让监管机构对市场产生肯定看法;然而,Grayscale 将其以太坊信托转换为 ETF 的申请以及贝莱德的申请都受到了 SEC 的阻力。主要因素可能是以太坊是证券还是商品的分类。”

以太坊获得现货 ETF 的潜在障碍之一可能是 Gensler 对加密货币市场的看法。Gensler 曾多次重申,他认为除比特币以外的所有加密货币都是证券。

Bakkt 的法律总顾问 Marc D’Annunzio 告诉 Cointelegraph,Gensler 对加密货币的监管态度可能成为其他加密货币 ETF 获得批准的障碍。

他说:“Gensler 慎重地指出,最近批准的现货比特币 ETF 仅限于‘一种非证券商品’(即比特币)。此外,Gensler 还多次表示,他认为大多数加密货币代币都是证券,在委员会对以太坊的观点明确之前,现货 ETF 似乎无法获得批准。”

D’Annunzio 补充说,如果以太坊现货 ETF 获得批准,“将需要监管机构的明确指导,并可以从现货比特币 ETF 的实际运行结果中受益。”

The approval of Bitcoin in Shanouba Bitcoin Trading Network has made many people optimistic about the possibility that the spot of Ethereum will be launched soon, but experts warn that it may be a long process. On May, the US Securities and Exchange Commission approved the spot bitcoin exchange trading fund to allow American investors to invest in bitcoin-backed securities. Since May, spot bitcoin has been traded on public exchanges, which has attracted billions of dollars to flow into spot bitcoin for many years. The approval marks an important moment in the history of bitcoin. However, with the approval of the spot bitcoin, all eyes turned to the spot ethereum. The final deadline for applying for the spot bitcoin was June, which was similar to that of. Major financial institutions including BlackRock were applying for the spot ethereum, which was the first to submit the spot ethereum application in June. Later, BlackRock and other institutions postponed the decision on the spot ethereum many times, which was similar to many delays in whether to approve the spot bitcoin before. Although seven applicants for Ethereum have different deadlines, they may make decisions on all applications at the same time, just like spot bitcoin. Source: Bloomberg As the deadline approaches, experts and cryptocurrency community have different opinions on whether the US Securities and Exchange Commission will approve spot Ethereum in. On the one hand, Bloomberg analysts believe that the US securities regulator will regard it as a commodity when approving Ethereum futures, so it is only a matter of time before the final approval. On the other hand, it is believed that the spot is unlikely to be approved by the United States in, and there is still general hostility to cryptocurrencies, as implied by the information released by the chairman of the agency on the day of product approval. He added that it may still be regarded as securities, unlike Bitcoin, which is regarded as commodities. It is often argued that all cryptocurrencies except Bitcoin are securities. However, Bloomberg analysts believe that it has actually been regarded as too square by default. The chief legal officer of the United States told her that she believed that the US Securities and Exchange Commission would approve the spot Ethereum, but the approval process might be longer than that of Bitcoin. However, due to the need to consider the unique characteristics of Ethereum compared with Bitcoin, including its underlying technical functions and its complicated creation history and environment, the approval process may be very long. I think it may be feasible to observe the bitcoin market before approving another cryptocurrency Ethereum, but the problem still exists. Ethereum has been for many years. However, experts pointed out that the Ethereum blockchain and its functions are very different from Bitcoin, which may make the approval process of the regulatory authorities more complicated. Unlike Bitcoin, Ethereum does not have a fixed total amount and supports the mining mechanism. The general counsel of the development company told her that she believed that the US Securities and Exchange Commission would eventually approve it, but the pledge issue remained unresolved. Whether traditional participants are willing to pledge, especially in the case of using pledge as a service provider, many of them have been subjected to enhanced scrutiny, or whether they will pledge themselves for those who are self-hosting, which is an open question. The launch of spot bitcoin shows that traditional financial markets have a strong interest in cryptocurrency securities, because these products have quickly gained billions of dollars in daily trading volume, and only spot bitcoin was launched on the day of May than in the whole year of. It remains to be seen whether Ethereum will replicate the same trend, although it is currently facing the challenge of the US Securities and Exchange Commission. The following factors make people believe that spot Ethereum is expected to be approved in 2008. The parallel listing and supervision of Bitcoin and Ethereum futures have attracted a large number of large traders in the past year, making them comparable assets in their eyes. We expect the market to continue to be strong and the demand of institutional investors to grow. Adding extra pressure to the regulatory approval; BlackRock's record is compared with Gary Gensler's; BlackRock played a key role in the approval process of spot bitcoin; years ago, the US Securities and Exchange Commission rejected several proposals of spot bitcoin; however, after BlackRock entered the bitcoin market with the record of second successful approval and second rejection, the encryption community became confident in the potential approval; with the final decision deadline of Spot Ethereum approaching, many people wondered whether BlackRock could keep its record. The director of biological products told BlackRock that the entry of large financial companies into the bitcoin market is regarded as a positive signal that encryption is generally accepted, but he also warned that the early resistance that regulators may impose will often make regulators have a positive view of the market. However, the application for converting its Ethereum trust into and BlackRock's application have been resisted. The main factor may be whether Ethereum is classified into securities or commodities. One of the potential obstacles for Ethereum to obtain cash may be His views on the cryptocurrency market have been reiterated many times. He believes that all cryptocurrencies except bitcoin are securities. The general counsel told me that the regulatory attitude towards cryptocurrencies may become an obstacle to the approval of other cryptocurrencies. He said that he carefully pointed out that the recently approved spot bitcoin is limited to a non-securities commodity, namely bitcoin. In addition, he repeatedly said that he believed that most cryptocurrency tokens are securities. It seems that the spot cannot be approved until the Committee's views on Ethereum are clear, adding that if Ethereum is approved, it will need clear guidance from the regulatory authorities and can benefit from the actual operation results of spot bitcoin. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。