美比特币ETF持仓跨越20万枚BTC大关 成为华尔街有史以来最受欢迎的ETF

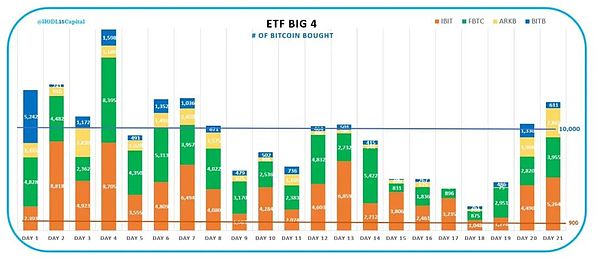

自SEC在2024年1月份一口气批准了十多支比特币现货ETF之后,机构们“不待扬鞭自奋蹄”,在吸收客户上使出浑身解数,激烈竞争。贝莱德(IBIT)、富达(FBTC)这俩大牌子自不待言,持仓量哗哗地涨。新贵Bitwise(BITB)和木头姐的方舟基金(ARKB)也是不甘人后,积极买进。这四支也由此成为美股市场上比特币现货ETF的“四大”(Big 4)。

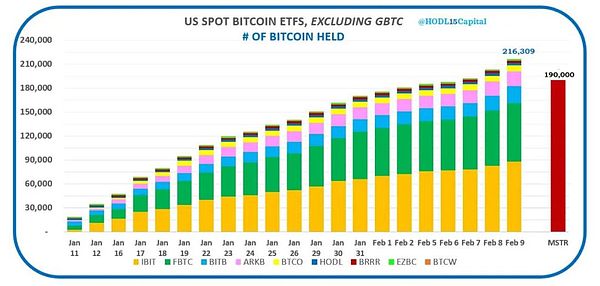

在比特币现货ETF批准之后,仅仅20天光景,其中9支ETF就累计净买进了21.6万余枚BTC。这个数字已经超过了著名囤币大户微策略在过去三年多拼命买买买所积累的仓位19万枚BTC的数量。

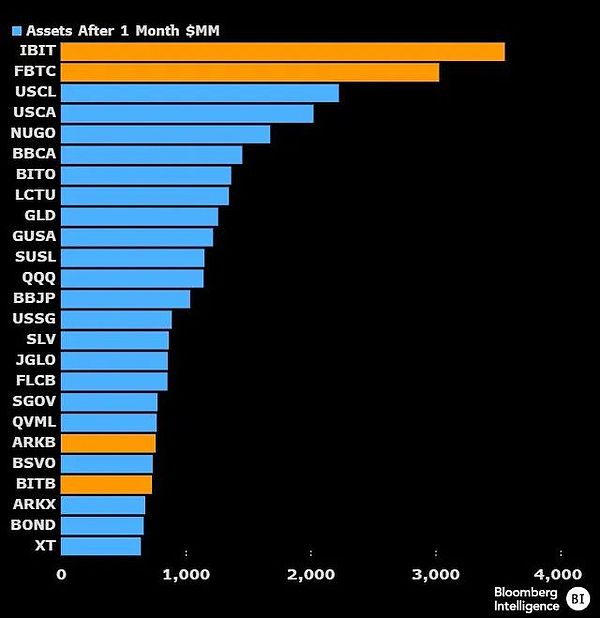

现货ETF,实打实地为比特币带来了购买力,而且是不容小觑的购买力。这股来自美股市场的强大购买力,也让比特币现货ETF正式跻身华尔街有史以来最受欢迎的ETF之榜首!

上图显示了,在ETF上市一个月时间内,涌入的资金量,贝莱德的IBIT排名第一,富达的FBTC排名第二,与身后的各种ETF产品拉开了一个身位。

当然,也远超当年黄金ETF(图中的GLD)的表现。

但是,为何ETF发行机构在买买买的同时,市场却较之于上市之初波澜不惊呢?1月11号,BTC最高48.9k。2月11号,BTC刚刚重回48k上方。

关键在于,机构的对手盘,无论是持仓不足1个BTC的小虾米,持仓1-10个BTC的“中产”,抑或是持仓10-100个BTC的大户,在过去30天,全部是净卖出。

只有持仓100枚以上BTC的机构们,在不断地加仓。

可见,市场在过去一个月的主旋律是“换手”。

买盘力量和卖盘力量达到了一个动态平衡。散户们放弃了自己的BTC,机构囤积了它们。

在4万刀放弃的筹码,也许到10万刀之后,就会花更大的代价买回来。

在这场围绕ETF和BTC控制权的暗战中,散户和机构相向而行,擦肩而过,互道晚安。

Since the approval of more than 10 bitcoin spot in one breath in January, the institutions have tried their best to attract customers, and the two brands BlackRock Fidelity have been fiercely competitive. It goes without saying that their positions have soared, and the Ark Fund of upstart and Mujie has also been unwilling to actively buy these four, thus becoming the four largest bitcoin spot in the US stock market. Only a few days after the approval of bitcoin spot, one of them has accumulated a net purchase of more than 10,000 pieces, which has exceeded the famous hoard of coins. In the past three years, the large-scale micro-strategy has been desperately trying to buy 10,000 positions in buy buy, which has actually brought purchasing power to Bitcoin, and it is a purchasing power that cannot be underestimated. This strong purchasing power from the US stock market has also made Bitcoin officially rank among the most popular on Wall Street in history. The above figure shows the amount of funds that poured in within one month of listing. BlackRock ranked first, Fidelity ranked second and various products behind it opened up a position, and of course it far surpassed that of that year. The performance in the gold chart, but why is the market calm when the issuer buys in buy buy compared with the initial listing? The highest month of the month has just returned to the top. The key lies in the opponent's disk of the institution, whether it is a small shrimp with less than one position, a middle-class one or a large one with one position. In the past few days, all of them have sold net, and institutions with only more than one position are constantly adding positions. It can be seen that the main theme of the market in the past month is that the buying power and selling power have reached a dynamic balance among retail investors. They gave up their own institutions and hoarded the chips they gave up at ten thousand dollars. Maybe they will spend more money to buy them back after ten thousand dollars. In this dark battle around control, retail investors and institutions passed each other and said good night. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。