数名高管出走、ETF被清算:Global X“水逆不断”

作者:Vicky Ge Huang;来源:华尔街日报;编译:比推BitpushNews Mary Liu

过去三个月,至少有六名高管离开了 Global X ETF,这给这家420亿美元的以主题ETF而闻名的基金管理公司造成了不小的混乱。

Global X 首席投资官Jon Maier

公司发言人表示,Global X 首席投资官Jon Maier、财务主管Ronnie Riven已决定辞去职务,二人都将留任一段过渡期。

根据公开资料,Jon Maier 于 2017 年从美林 (Merrill Lynch) 加盟 Global X 。Maier 是 ETF 行业的传奇人物,他帮助美林模型投资组合中的资产从不到 10 亿美元增加到超过 400 亿美元,这些策略获得了“ Maier 模型”的称号。

而Global X的高层更换从去年末就开始了。

去年 11 月,首席执行官Luis Berruga决定离开,首席运营官John Belanger在一周后也离开了 Global X。紧接着,人力资源主管Crystal Christy 和负责巴西业务的Bruno Stein于 12 月离职。

据知情人士透露,此次高管异动引发了 Global X 员工对其韩国母公司日益增长的影响力以及两种不同文化冲突的担忧。 Global X 于 2018 年被资产管理巨头Mirae Asset Global Investments收购。

Mirae 去年年底任命Mirae 创始人Park Hyeon-Joo的侄子、Mirae 美国业务联席首席执行官Thomas Park为 Global X 的临时首席执行官。在他上任后不久,Global X 解雇了约 10% 的员工。

知情人士称,这些裁员主要影响到了数字资产团队。

Global X 是美国第一批现货比特币 ETF 的早期竞争者,在其他 10 只基金成功上市后,Global X 上个月撤回了申请。

该基金经理还在 1 月份表示将清算 19 只 ETF,这些基金将于下周停止交易。关闭的基金包括专注于中国市场的 ETF 以及提供从大麻行业到健康和“绿色建筑”等各个领域的主题基金。

该发言人表示:“对于任何企业来说,短期内领导层变动都可能很困难,Global X 是 Mirae Asset 未来和增长不可或缺的一部分,我们仍然致力于成为全球 ETF 行业的创新领导者。”

根据数据提供商 VettaFi 的数据,Global X 是美国第 14 大 ETF 发行商,仅次于 Fidelity Investments。它在提供利基基金方面取得了成功,但选择不与贝莱德和道富银行等大型资产管理公司在低成本、广泛的股票市场基金上竞争。

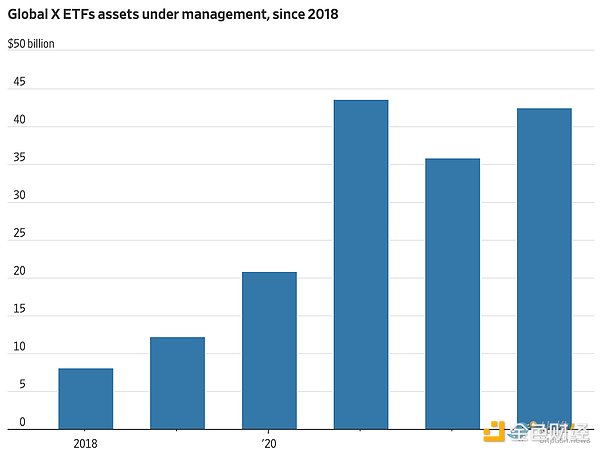

VettaFi 研究主管Todd Rosenbluth表示,在流行的以收入为中心的主题战略的支持下,Global X 资产规模从 2017 年的 50 亿美元飙升,该公司是这些战略的“先驱和行业领导者”,并于2023年实现了盈利。

Global X 最大的基金投资于纳斯达克 100 股票,同时还以备兑看涨期权策略出售期权,旨在为投资者创造额外收入。它还运营着专注于基础设施开发、机器人和人工智能的热门股票基金。

Mirae 总部位于首尔,成立于 1997 年,管理着约 6000 亿美元的资产。 2020 年初,它将 Global X 的少数股权出售给总部位于东京的大和证券集团,这项投资的结构为 1.2 亿美元的可转换债券,可能会在 2025 年转换为该ETF资产管理公司的少数股权。

The author's source is The Wall Street Journal. At least six executives have left in the past three months, which has caused a lot of confusion for this billion-dollar fund management company. A spokesman for the chief investment officer company said that the chief investment officer and the financial officer have decided to resign, and both of them will stay for a transitional period. According to public information, they joined Merrill Lynch in 2000, which is a legend in the industry. He helped the assets in the Merrill Lynch model portfolio increase from less than 100 million dollars to more than 100 million dollars. The top management change that won the title of model began at the end of last year. Last month, the CEO decided to leave the chief operating officer, and one week later, followed by the departure of the human resources director and the person in charge of Brazil's business in January. According to informed sources, this top management change triggered the employees' growing influence on their Korean parent company and the fear of two different cultural conflicts. At the end of last year, it was acquired by the asset management giant, and the nephew of the founder was appointed as the joint CEO of the US business. Shortly after he took office, the CEO fired about 20 employees. People familiar with the matter said that these layoffs mainly affected the digital asset team, which was the first batch of early competitors of spot bitcoin in the United States. After other funds were successfully listed, the fund manager withdrew his application last month. The fund manager also said in January that only these funds would be liquidated, and the closed funds would stop trading next week, including those focusing on the China market and providing thematic funds in various fields from cannabis industry to health and green buildings, the spokesman said. For any enterprise, it may be difficult to change the leadership in the short term, which is an indispensable part of the future and growth. We are still committed to becoming an innovative leader in the global industry. According to the data of data providers, it is the largest publisher in the United States, second only to it, which has succeeded in providing niche funds, but chose not to compete with large asset management companies such as BlackRock and State Street Bank on low-cost and extensive stock market funds. In the afternoon, the research director said that in the popular income-centered market, With the support of the strategy, the asset scale soared from $ billion in 2000. The company is the pioneer and industry leader of these strategies, and realized the most profitable fund to invest in Nasdaq stocks in 2000. At the same time, it also sold options with the call option strategy to create additional income for investors. It also operated active stock Fund, which is headquartered in Seoul and managed assets of about $ billion in 2000. At the beginning of the year, it sold its minority stake to Daiwa Securities Group, which is headquartered in Tokyo. This convertible bond with an investment structure of $ billion may be converted into a minority stake in this asset management company in 2000. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。