暴涨的比特币与爆仓的25亿元

来源:北京商报记者 廖蒙

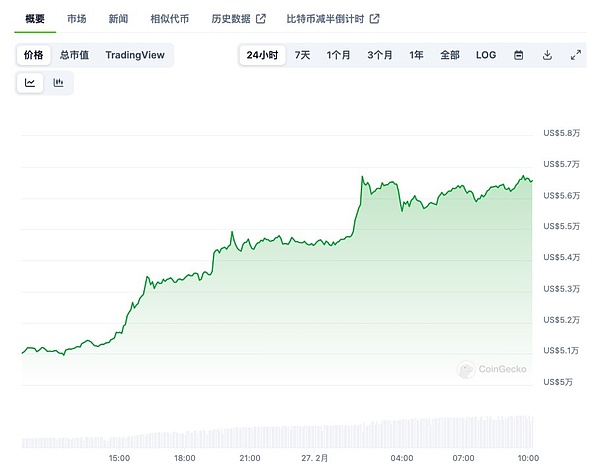

比特币再现暴涨。突破50000美元大关后,比特币在51000美元附近横盘多日,直至1月24日开始,比特币在50500美元附近开始启动上行态势。2月27日,比特币涨势持续扩大,盘中一度逼近57000美元,续创2021年12月以来新高。

比特币涨势引人注目,同样带来了超过25亿元的资金被爆仓的疯狂局面,风险不容忽视。在分析人士看来,不论是比特币上涨还是下跌,均有玩家可能会面临巨大的亏损,这是一场充满赌博性质的博傻游戏,也真实反映了加密货币市场的投机性和高风险性。

比特币涨破56000美元

全球币价网站CoinGecko数据显示,2月27日,比特币突破56000美元关口,过去24小时涨幅一度接近10%,最高触及56726.52美元,达到2021年12月以来的最高水平。截至2月27日18时,比特币报56577.28美元,24小时涨幅为10.9%。

图片来源:CoinGecko

在40000美元震荡多日后,能否突破50000美元大关,是近两个月针对比特币走势市场猜测的重要内容。但事实上,在1月23日短暂跌至40000美元关口下方后,比特币强势反弹,在半个月内达到了50000美元水平。将时间线再拉长来看,比特币价格连续六个月处于上行走势,相较2023年9月的价格低点24900美元,涨幅接近125%。尤其是2024年2月,比特币单月涨幅已经达到30%。

自2021年11月触及历史最高点、逼近70000美元后,比特币进入漫长寒冬。2022年11月,比特币交易价格最低触及15500美元,随后便开始陆续反弹。CoinGecko数据显示,随着比特币价格上涨带动,其他主流加密货币同样涨幅明显,当前比特币总市值已突破1.1万亿美元,加密货币总市值也已突破2.24万亿美元。

近半年来比特币交易价格再次走高,又是何原因推动?北京市社会科学院副研究员王鹏告诉北京商报记者,比特币本轮上涨存在多方面因素影响。首先,全球经济复苏的预期增强,投资者信心提升,推动了比特币等加密货币的价格上涨。其次,随着比特币ETF在美国正式获批,同时2月26日是比特币期货的结算日,吸引了更多资金流入而推动价格上涨。

“此外,比特币的减半事件也可能对价格产生了积极影响。减半事件是指比特币的挖矿奖励减半,这减少了新比特币的供应量,从而可能对价格产生支撑作用。”王鹏补充道。不过,王鹏同样提醒,比特币价格的波动受到多种因素的影响,包括市场情绪、政策变化、技术创新等,因此需要综合考虑以评估价格走势。

就在2024年1月11日,加密货币市场迎来了期待已久的好消息,那便是美国证监会正式批准了比特币ETF上市交易,首日成交量便达到46亿美元,也由此进一步推动了包括比特币在内的加密货币交易价格上涨。

爆仓仍在加剧

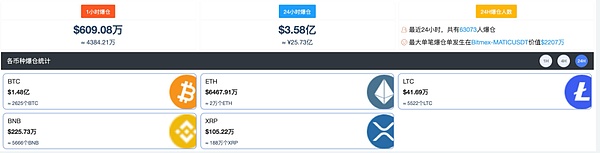

比特币涨势狂热,却依旧是有人欢喜有人愁。随着比特币连日来一路上行,尤其是2月27日涨幅扩大,参与币圈合约交易、尤其是“做空”的玩家遭遇惨痛损失。

根据第三方币价网站币家园数据,在截至2月27日10时40分的最近24小时里,共有64701名用户发生爆仓,共计2.05亿美元资金灰飞烟灭,约合人民币14.73亿元。随着比特币价格波动,相关爆仓数据仍在进一步加剧中。在截至2月27日18时的最近24小时里,爆仓用户数量小幅减少至63073人,爆仓金额却上涨至3.58亿美元,约合人民币25.73亿元。

图片来源:币家园

在过去的30日里,全网加密货币市场爆仓金额达到36.81亿美元,其中“空头”爆仓比例占比达到90%。

“现在阳台上站的,都是炒币的‘空军’。”2月27日,北京商报记者注意到,有币圈用户在社交平台这样打趣道。该名用户向北京商报记者解释称,按照币圈玩法,包括比特币在内的虚拟货币可以通过合约交易“多空两吃”,通过分析比较上涨或是下跌进行双向交易,并且可以通过加杠杆扩大交易。一旦币价波动水平超过对应限制区间,便会被系统强制平仓。“在这类猛涨的行情下,预测币价将下跌的用户往往会遭受巨额损失。”前述用户表示。

而在比特币狂热的上涨态势下,也有用户望而却步。读者张旭(化名)在采访中指出,过去两年比特币热度有所下降,炒币不足一年的时间里,自己在交出了近60万元的“学费”后及时止损,不再参与其中。“现在币价涨了,身边参与的朋友也再次变得活跃起来。但从个人实践经历来看,炒币这类交易风险实在难以把控,普通用户参与其中很容易血本无归,因此我还是会理智地保持距离。”张旭坦然说道。

在王鹏看来,不论是比特币上涨还是下跌,均有玩家可能会面临巨大的亏损,这是一场充满赌博性质的博傻游戏,也真实反映了加密货币市场的投机性和高风险性。王鹏称:“这也提醒我们加密货币市场的监管和规范仍然是一个重要的议题,需要相关部门加强监管措施,保护投资者的合法权益。”

中国人民大学国际货币研究所研究员、独立国际策略研究员陈佳更是指出,比特币等加密货币不属于传统低频资产大类,不能套用传统资产同比指标变化来分析,其日内波动幅度和频度都是传统金融机构和个人难以理解、传统投资交易技术无法把控的。叠加币圈交易从来都是高度杠杆化,缺乏风险对冲机制设计与投资者保护机制,便更容易产生爆仓。

风险不容忽视

2月27日,比特币价格上涨的热度持续发酵,比特币也久违地登上了微博热搜榜。在围绕比特币价格走势的讨论中,有人在鼓吹“牛市到来、前景无限”;也有人难忘早前一次次暴跌中被血洗的惨痛;还有人指出加密货币在境内已经被全面禁止,趁早放弃暴富的幻想……而相关页面也醒目提示:请远离非法虚拟货币交易,谨防上当受骗。

图片来源:微博

另一方面,在经历了此前的暴跌、稳定币崩盘以及交易所跑路后,加密货币的信任度受到更大打击。据外媒2月22日报道,尼日利亚总统发言人证实,尼日利亚要求本国电信公司和其他互联网服务商阻止人们访问加密货币交易平台,以此阻止本国货币持续走弱。

2月24日,北京市公安局网络安全保卫总队也就虚拟货币发布风险提示,一方面表示我国目前不承认虚拟货币的法定地位,任何从事代币发行融资行为均属非法,一方面指出仍有不法分子通过发行所谓的“虚拟货币”来吸收资金,涉嫌通过炒作概念进行非法集资、传销、诈骗等活动,强调虚拟货币炒的是“镜花水月”,亏的是“真金白银”,要树立正确的货币观念和理财观念。

对于炒币这一行为,陈佳表示,由于币圈交易波动剧烈并且缺乏必要的监管保护机制,因此无论是场内交易还是场外交易市场,不论是做多还是做空,除了那些少数专业从事高频交易的机构和庄家之外,绝大部分投资者都难逃出局的命运。

对此,王鹏建议,普通用户不要因为比特币价格上涨就盲目跟风投资,要结合自己的投资目标和风险承受能力做出决策,务必充分了解其价格波动的风险性,并评估自己的风险承受能力。同时,要密切关注相关部门对加密货币市场的监管政策动态,确保自己的投资行为符合法律法规的要求。

Source beijing business today reporter Liao Meng Bitcoin reappeared after the skyrocketing breakthrough of the US dollar mark, Bitcoin was sideways around the US dollar for many days until the start of the upward trend of Bitcoin near the US dollar on March. The upward trend of Bitcoin continued to expand on March, and it once approached the US dollar and continued to hit a new high since March. Bitcoin's upward trend is eye-catching, which also brought about a crazy situation in which more than 100 million yuan of funds were exploded. The risk can not be ignored. In the opinion of analysts, whether bitcoin rises or falls, players may face huge risks. Loss This is a silly game full of gambling nature, and it also truly reflects the speculation and high risk of the cryptocurrency market. Bitcoin broke through the US dollar mark in the global currency price website. The data shows that the increase of Bitcoin in the past hour was close to the highest in the past two months, hitting the US dollar to the highest level since June. By the end of June, Bitcoin reported an hourly increase in the US dollar as a picture source. Whether it can break through the US dollar mark after the US dollar fluctuated for many days is an important part of market speculation on the trend of Bitcoin in the past two months. However, In fact, after a short fall below the US dollar mark on March, Bitcoin rebounded strongly and reached the US dollar level within half a month. If the timeline is lengthened, the price of Bitcoin is on the upward trend for six consecutive months, and the price of Bitcoin is close to the low point in March, especially since the monthly increase of Bitcoin reached the historical high point in March and approached the US dollar, Bitcoin entered a long cold winter, and the lowest transaction price hit the US dollar, and then it began to rebound one after another. The data shows that with the price of Bitcoin, The rise has also driven other mainstream cryptocurrencies to increase significantly. At present, the total market value of Bitcoin has exceeded one trillion dollars, and the total market value of cryptocurrencies has also exceeded one trillion dollars. What is the reason for the bitcoin transaction price to rise again in the past six months? Wang Peng, an associate researcher at the Beijing Academy of Social Sciences, told beijing business today that there are many factors affecting the current round of bitcoin rise. First, the expected increase in global economic recovery has boosted the price of cryptocurrencies such as Bitcoin. Secondly, with the increase of investor confidence, In addition, the halving of bitcoin may also have a positive impact on the price, which means that the mining reward of bitcoin is halved, which reduces the supply of new bitcoin and may support the price, Wang Peng added, but Wang Peng also reminded that the fluctuation of bitcoin price is affected by many factors, including market sentiment, policy changes, technological innovation and so on, so it needs to be integrated. Considering to evaluate the price trend, the cryptocurrency market ushered in the long-awaited good news on March, that is, the US Securities Regulatory Commission officially approved the first day of bitcoin listing and trading, and the transaction volume reached US$ 100 million, which further promoted the price increase of cryptocurrency transactions including Bitcoin. The explosion is still intensifying the enthusiasm of Bitcoin's rise, but some people are still happy and worried. With the increase of Bitcoin in the past few days, especially on March, it has expanded to participate in currency circle contract trading, especially short-selling players. Suffering from painful losses, according to the data of the third-party currency price website, Currency Home, in the last hour as of March, a total of 100 million US dollars of funds have gone up in smoke, about 100 million yuan. With the fluctuation of bitcoin price, the related data of warehouse explosion is still getting worse. In the last hour as of March, the number of users who have exploded their positions has decreased slightly to one person, but the amount of warehouse explosion has risen to 100 million US dollars, about 100 million yuan. To billion dollars, the proportion of short positions has reached. Now, all the people standing on the balcony are speculating in coins. The beijing business today reporter noticed that the user in the coin circle joked on the social platform. The user explained to the beijing business today reporter that according to the coin circle game, virtual currencies including Bitcoin can be traded in two directions through contract trading, analysis and comparison, rising or falling, and can be expanded by adding leverage. Once the fluctuation level of the currency price exceeds the corresponding limit range, it will be tied. Users who predict that the currency price will fall under such a soaring market will often suffer huge losses. The aforementioned users said that under the frenzied rising trend of bitcoin, some users were discouraged. In an interview, Zhang Xu, a pseudonym, pointed out that the popularity of bitcoin has declined in the past two years. In less than one year, after paying the tuition fee of nearly 10,000 yuan, he stopped participating in it in time. Now that the currency price has risen, his friends who participated in it have become active again, but from personal experience, he speculated. It's really difficult to control the transaction risks such as coins, and it's easy for ordinary users to lose their money, so I'll keep my distance wisely. Zhang Xu said frankly that in Wang Peng's view, no matter whether bitcoin goes up or down, players may face huge losses. This is a stupid game full of gambling nature, which also truly reflects the speculation and high risk of cryptocurrency market. Wang Peng said that it also reminds us that the supervision and regulation of cryptocurrency market is still an important issue and needs relevant departments. Strengthen regulatory measures to protect the legitimate rights and interests of investors. Chen Jia, a researcher at the Institute of International Monetary Studies of Renmin University of China and an independent international strategy researcher, even pointed out that cryptocurrencies such as Bitcoin do not belong to the category of traditional low-frequency assets, and it is impossible to apply the year-on-year index changes of traditional assets to analyze their intraday fluctuation amplitude and frequency, which are difficult for traditional financial institutions and individuals to understand and cannot be controlled by traditional investment trading technology. Coin trading has always been highly leveraged, lacking risk hedging mechanism design and investor protection. The protection mechanism is more likely to lead to the risk of warehouse explosion, which can not be ignored. The popularity of bitcoin price increase on March continues to ferment, and bitcoin has also been on the hot search list of Weibo for a long time. In the discussion around the price trend of bitcoin, some people are advocating the infinite prospect of bull market, and some people will never forget the pain of being washed away in the previous plunge. Others point out that cryptocurrency has been completely banned in China from giving up the illusion of getting rich early, and related pages also highlight that please stay away from illegal virtual currency transactions and beware of being deceived. On the other hand, the source of Weibo suffered a greater blow to the trust of cryptocurrency after the previous plunge, stable currency crash and the escape of the exchange. According to foreign media reports on May, a spokesman for the Nigerian President confirmed that Nigeria asked domestic telecommunications companies and other Internet service providers to prevent people from accessing cryptocurrency trading platforms in order to prevent their currency from continuing to weaken. On May, the Network Security Corps of the Beijing Public Security Bureau also issued a risk warning on virtual currency. On the one hand, it indicated that China did not recognize the legal status of virtual currency at present, and on the other hand, it was illegal to engage in token issuance and financing. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。