期权如何推动比特币上涨?

作者:Ben Lilly、JJ the Janitor 翻译:善欧巴,比特币买卖交易网

市场低语已成轰鸣

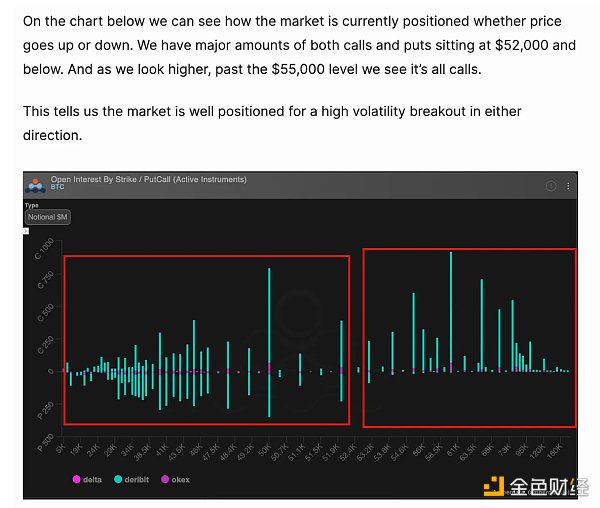

上周我们提到,市场正蓄势准备在 5 万至 5.3 万美元区间爆发。正如上周的净持仓图所示,大量未平仓的看跌期权合约集中于 5 万美元以下,而看涨期权合约则集中于 5.5 万美元以上,反映出巨大的潜在波动性。

以下摘录自上周的更新,供错过该更新的人士参考:

周一到来时,随着数十亿资金流入现货比特币 ETF,市场犹如火药桶遇到引线,瞬间点燃。

如果您收看过本周二的《交易战壕》节目,您便会听到我和 Ben Lilly 详细分解了事情的经过。

简而言之,当价格突破 5.2 万美元的关键关口后,期权交易商之间展开了激烈的竞争。这些做市商正是之前卖出超出价外看涨期权的同一家机构。价格上涨迫使他们对看涨期权空头头寸进行套期保值,就好比突然着火的人急需跳进水里灭火一样……这一切都因为价格暴涨。

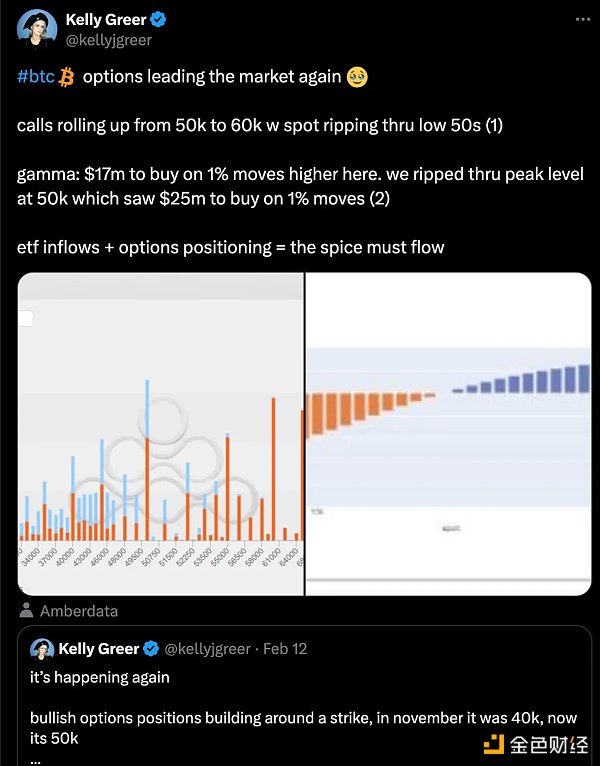

正如 Galaxy HQ 的 Kelly Greer 指出的那样,这意味着比特币每上涨 1%,交易商就不得不额外买入价值 1700 万美元的比特币以保持 delta 中性。

这就好比用一根杠杆手指抬起推土机。

再加上持续的现货买盘流入 ETF 以及空头头寸被平仓,这些因素共同创造了完美风暴,最终导致比特币自 2021 年以来首次突破 6 万美元大关。

这与今年 10 月突破 3 万美元关口的情况非常相似,再次证明了期权市场的顺周期性。

然而,期权市场仍是许多加密货币交易者忽视的领域,因为他们往往只关注永续合约和现货市场。 交易商看跌期权失误 经常是导致比特币单日最大波动幅度的 主要驱动因素。

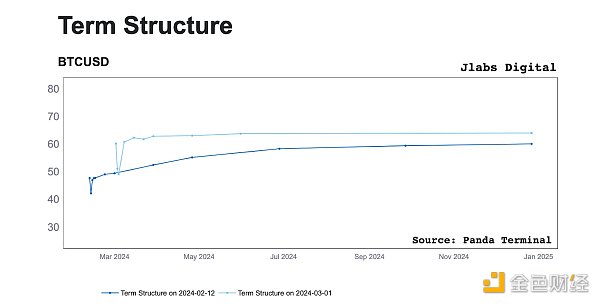

让我们比较一下当前和 2 月初的期限结构图(一种反映期权定价与隐含波动率关系的图表)。

我们可以看到 明显的变化 是,交易商可能从 低价卖出波动率 中吸取了教训。与 2 月初相比,当前的期权定价反映出市场预期未来波动性将更大,否则交易商会更多地卖出期权以降低价格。

对于想要更深入了解此主题的人,我们制作了一系列教程,教您如何在 2024 年有效交易比特币期权,因为这种期限结构的变动通常发生在比特币周期的当前阶段。

展望未来

虽然期权市场提供了捕捉波动的机会,但也要时刻保持谨慎。考虑到最近期权价格飙升难以持续到 3 月底,建议 谨慎持有 看涨期权仓位,并 避免 害怕错过 (FOMO) 而盲目追涨。

错过这次机会不必担心,因为错过一次之后总会有更好的机会。就像上周那样,低风险、高回报的波动率交易策略在期权市场中经常出现。不要害怕错过而盲目接盘,否则您可能会为高额溢价购买很快贬值的合约。

当类似的机会再次出现时,我们会及时通知您。但在此之前,请务必谨慎交易,记住,波动性就像能带来收益一样,也能迅速带走收益。

Last week, we mentioned that the market is poised to explode in the range of $10,000 to $10,000. As shown in last week's net position chart, a large number of open put options contracts are concentrated below $10,000, while call options contracts are concentrated above $10,000, reflecting the huge potential volatility. The following excerpt is from last week's update for those who missed the update. When Monday came, with billions of funds flowing into the spot bitcoin market, it was like a powder keg. If you have watched the trading trench program on Tuesday, you will hear me and the story in detail. In short, after the price broke through the key threshold of 10,000 US dollars, there was a fierce competition among option traders. These market makers were the same institutions that sold out-of-price call options before. The price increase forced them to hedge the short positions of call options, just as people who suddenly caught fire urgently needed to jump into the water to put out the fire, all because of the skyrocketing price. As pointed out, this means that every time bitcoin goes up, traders have to buy an extra $10,000 worth of bitcoin to keep neutral options. How to push bitcoin up is like lifting a bulldozer with a lever finger, combined with the continuous inflow of spot buying and the liquidation of short positions, creating a perfect storm, which finally led to bitcoin breaking through the $10,000 mark for the first time since 2000, which is very similar to the situation of breaking through the $10,000 mark this month, which once again proves the option market. Pro-cyclicality of the field, however, the option market is still a neglected area for many cryptocurrency traders, because they tend to focus only on perpetual contracts and spot market traders' put options mistakes, which are often the main driving factors leading to the maximum volatility of bitcoin in a single day. Let's compare the term structure chart of the current and early month, a chart reflecting the relationship between option pricing and implied volatility. How options promote bitcoin to rise? We can see that the obvious change is that traders may sell volatility at low prices. Lessons learned Compared with the beginning of the month, the current option pricing reflects that the market expects greater volatility in the future, otherwise traders will sell more options to lower prices. For those who want to know more about this topic, we have made a series of tutorials to teach you how to effectively trade bitcoin options in 2008, because this change in term structure usually occurs at the current stage of the bitcoin cycle. Looking ahead, although the option market provides opportunities to capture fluctuations, we should always be cautious and consider the most recent period. It is difficult for the soaring price of rights to last until the end of the month. It is recommended to hold the call option position carefully and avoid blindly chasing up for fear of missing this opportunity. Don't worry about missing this opportunity, because there will always be a better opportunity after missing it once, just like last week. The volatility trading strategy with low risk and high return often appears in the option market. Don't be afraid of missing it and blindly take over, otherwise you may buy a contract that depreciates quickly for a high premium. When similar opportunities reappear, we will inform you in time, but before that, please be careful to trade. Remember that volatility can take away benefits as quickly as it can bring benefits. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。