Uniswap 将改变游戏规则?协议费用分配的潜在影响

作者:Atis E,独立研究员 来源:medium 翻译:善欧巴,比特币买卖交易网

在接下来的几个月中,Uniswap DAO 似乎准备就向 UNI 质押者分配协议费用进行投票。本文分享了个人对这次投票的未来影响的看法和猜测。

UNI 质押提案摘要

Uniswap 治理论坛目前正在讨论一项旨在将 UNI 转变为费用共享代币的提案。主要想法是:

升级 Uniswap 协议治理,实现无需许可、程序化的协议费用收取

按比例向已质押和委托投票的 UNI 代币持有者分配任何协议费用

允许治理继续控制核心参数:哪些矿池收取费用,以及费用的大小

这个最初的提案是另一个未来提案的基础,该提案实际上会在一些 Uniswap v3 池上引入协议费用:

假设链上投票成功,社区将可以选择收取费用。

作为 Uniswap代表,我普遍赞成从 Uniswap v3 池中向 UNI 质押者分配费用的提议。我认为这将是一个有趣的实验。该提案背后的充分准备清楚地表明了基金会的能力和能力。

目前仍存在不确定性,例如将实施费用的具体池以及确切的协议税率。费用开关必须针对每个池进行定制,这意味着仅针对选定的 Uniswap v3 池组激活费用。从经济上讲,对容量小或寿命短的矿池收取费用是没有意义的,特别是在考虑每个费用转换决策所需的 DAO 治理工作时。所选的矿池很可能与 Uniswap Labs已经收取0.15% 前端费用的矿池基本一致。根据之前的投票,预计协议费率将设定在总互换费用的 10% 到 20% 之间。

目前,还没有公开的计划在 v2、v4 或 UniswapX 上实施收费。这些版本可以在未来的讨论中解决,V3 费用转换实验将作为重要的参考点。

V3的未来

Uniswap v3 是目前该平台最具主导地位的迭代,从某些方面来看,也是现有最大的 DEX。然而,我认为 Uniswap v3 已经在衰落,原因如下。这意味着在 v3 上尝试费用切换是相对低风险的行为。

V4 即将到来并将在很大程度上取代 v3

Uniswap 的发展策略与英特尔之前的 tick-tock 模型有一些相似之处,即架构进步(“tocks”)之后是优化(“ticks”)。在这种情况下,Uniswap v1 和 v2 代表一个滴答周期,v3 和即将推出的 v4 构成另一个周期。

Uniswap v1 相对于当时的技术水平来说是一个重大进步。V2 在架构上类似,但具有 ERC20/ERC20 互换和价格预言机等新功能,并对整体设计进行了其他增强。尽管面临 v3 的竞争,v2 仍然强劲,凸显了其持久的吸引力。

V3引入了另一个架构飞跃,流动性集中。然而,它确实有一些重大缺点,不仅使用起来更加复杂,增加了有限合伙人的市场风险,而且更容易受到套利者 MEV 泄漏的影响,特别是在波动性资产的较低费用级别池中。

我预测 Uniswap v3 的设计从长远来看不会持续下去,而久经考验且值得信赖的 v2 模型可能会比它更持久。一旦推出,v4 预计将很快超越 v3,这得益于以下几项改进:

Gas 优化:v4 引入了各种优化,包括降低 ERC20 传输成本的单例设计和显着降低 Gas 费用的瞬态存储机制。

有利于有限合伙人的创新:旨在通过拍卖和动态费用重新夺回套利 (LVR) 损失价值的功能,为有限合伙人提供更有利的环境。

支持 v2 功能:V4 将重新整合全方位的流动性头寸,容纳转账费用代币,并允许流动性池内的 LP 捐赠,以及其他增强功能。

从本质上讲,v4 旨在解决 v3 的缺点,同时融合其前身的优点。

DEX 格局竞争加剧

1. AMM 竞争对手不断崛起

Uniswap v3 最初利用其创新的集中流动性模型和限制性许可来主导该行业。然而,这些特殊的优势已经不复存在。V3核心代码现在已经在GPL下近一年了。高质量的竞争性 AMM 不断涌现。Uniswap v3 确实仍然拥有最林迪性、最经受考验和最坚实的代码库,而一些竞争对手已经陷入了黑客攻击。然而,这些好处也不可避免地会随着时间的推移而减弱。

2. 不断发展的交易机制

链上交易正在朝着基于意图的系统发展。因此,我们预计通过 AMM 进行的交易比例将会下降。虽然现在宣布 AMM 模型过时还为时过早,但 UniswapX 和 Cowswap 等平台的崛起可能会继续并增加其市场份额。

3.新兴的以DEX为中心的链和rollups

关于专用 Uniswap 应用链还是 rollup 是 DEX 的未来的争论双方都有令人信服的论据。

案例:正如Dan Elitzer 所强调的那样,在当前的模型中,交换者支付的以太坊网络费用高于他们向 Uniswap 的有限合伙人支付的交换费用。这是令人震惊的低效率。此外,由于滑点导致的不完美执行造成的交易者损失也大于掉期费用——至少在 2021/2022 年是这样。DEX 交易用户体验每年都在显着改善但如果以太坊的重点仍然是结算层,这些问题未来不太可能得到完全解决。人们可以不断优化 DEX 的设计并使之复杂化,但是,在具有 12 秒出块时间的链上完全复制 CEX 交易体验是不可能的——至少在不牺牲去中心化或审查阻力的情况下是不可能的。

反对的理由:没有人愿意将他们的资产跨链连接起来以略微改善他们的交易体验。此外,我们确实不需要进一步的流动性碎片化。

然而,以太坊主网上共享排序的潜力可能会改变游戏规则。这项创新将实现 Rollup 之间的同步可组合性,从而允许 Uniswap Rollup 上的 DEX 合约无缝地访问所有参与 Rollup 的流动性。这样的发展将消除对流动性分散和用户不便的大部分担忧。

总而言之,这些因素使得 Uniswap v3 继续占据主网主导地位的可能性很小。仔细尝试费用转换并不会造成太大损失。

有限合伙人的问题:没有代表就纳税?

费用转换的风险

如果收费转换导致许多流动性提供者 (LP) 退出 Uniswap,则可能会适得其反。失去有限合伙人将意味着资金池的流动性减少,从而降低资金池对交易者的吸引力。交换活动的减少将降低剩余有限合伙人的收入,导致更多有限合伙人离开。这可能会引发连锁反应,流动性不断下降,导致最坏的情况——死亡螺旋。

幸运的是,到目前为止,DeFi交易者似乎对价格变化并没有过于敏感。即使一些有限合伙人在收费后决定离开,总体交易量也可能不会大幅下降。这意味着留下来的有限合伙人最终将获得更高的年利率(在考虑协议费用之前)。在某种程度上,这些较高的交易收益将抵消协议费用的成本,从而实现稳定的平衡。

支持这一观点的是,Gauntlet 的研究(目前正在更新)表明,只要费用不定得太高,死亡螺旋就不太可能发生。他们的数据驱动方法让人放心,如果谨慎地收取费用,不会导致有限合伙人大规模外流。

协议税率的公允价值

10%至20%的税率在现实经济中并不罕见。然而,这并不能直接转化为 Uniswap 的情况,原因如下:

通常,税收的目标是利润,而不是总收入。对于 Uniswap 上的有限合伙人来说,互换费用代表他们的总收入,而不是净收入。使用无常损失模型或损失与再平衡 (LVR) 模型(分别适用于未受保护和对冲的 LP)来衡量 LP 收益的研究得出的结论是,Uniswap v3 LP 的净利润率几乎为零。因此,在这种情况下,旨在准确征收收益的税收制度将产生最少的收入,这凸显了传统税收逻辑与有限合伙人收益动态之间的不匹配。

税收用于资助传统经济中的公共服务,例如基础设施和医疗保健。将税收收入重新分配给 UNI 代币持有者并不能以符合典型纳税人期望的方式本质上确保贡献者(即有限合伙人)的利益。

尽管存在这些挑战,仍有令人信服的理由考虑协议费用:

协议费更像是增值税 (VAT),而不是所得税或资本利得税。增值税的一个主要特点是它由客户支付,而不是由提供商支付。有限合伙人可以在某种程度上迫使交换者支付更多费用,并通过将其资产迁移到费用等级较高的池中来抵消协议费用。然而,如果没有协调一致的行动,这种转变不太可能广泛发生,从而导致 Uniswap v3 中的 LP 流动性持续被低估。

费用分配模型通过要求代币委托进行收入分享来激励 UNI 代币持有者积极参与治理。研究表明,积极的授权可以提高 DAO 的去中心化程度。这也是使 Uniswap 生态系统(特别是基金会和 DAO)实现自我可持续发展而不是依赖财政部的一大进步。

LP 和 DAO

结合上述情况,很明显,费用转换的目的是:

交换 Uniswap LP 的部分费用收入

增强 Uniswap 生态系统的功能。

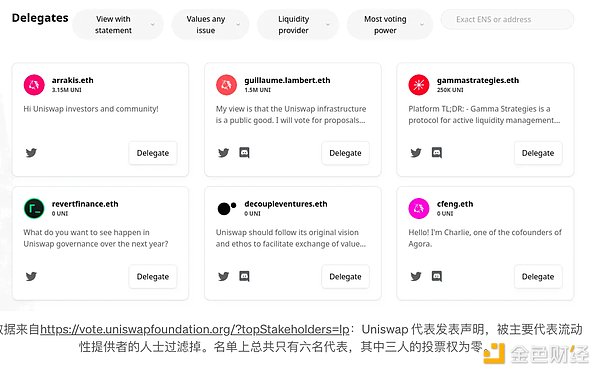

然而,被要求进行这项交易的并不是有限合伙人——或者至少不是主要是有限合伙人。目前的情况是一种无代表征税的情况。至少,没有足够的代表性。明确优先支持 LP 的代表只有几百万张 UNI 选票。

此外,大型 DAO 代表之间还存在一些著名的贸易公司。他们与 Uniswap LP(尤其是零售 LP)之间存在明显的潜在利益冲突。

我的立场是,有限合伙人是任何去中心化交易所的命脉,他们的投票权应该反映出这一点。希望即将到来的 UNI 质押和重新授权将为 Uniswap LP 提供获得更多选票的机会。

增加 LP 投票权的一项技术步骤是允许在其流动性头寸中授权 UNI 代币。这需要一些技术上的改变,但肯定是可行的。

补偿 LP?

关于如何将有限合伙人的支持与费用转换计划联系起来,目前存在一些想法,例如:

流动性挖矿计划

为“忠诚”LP 空投

天然气回扣

即使假设有限合伙人有足够的投票权来通过这些想法(这是不确定的),我发现这些想法都没有完全有说服力:

有针对性的流动性激励作为税收再分配的一种手段可能会有效。然而,它们可能会扰乱自由市场并损害 Uniswap 作为中立平台的信誉。准确的目标定位具有挑战性,并且需要大量的监测、研究和管理费用,而目标不明确的激励措施主要会吸引唯利是图的有限合伙人,从而可能损害生态系统。

如果涉及公共 DAO 投票,空投的标准很容易被大型代币持有者操纵。未来的空投更有可能导致治理危机,破坏 Uniswap 的中立性,并鼓励空投挖矿作为 LP 投机策略。此外,没有 KYC 要求的空投将对大持有者或 sybils 带来不成比例的好处,而要求 KYC 将是一个更糟糕的选择,与 Uniswap 无需许可的精神相矛盾。

天然气回扣将不公平地有利于活跃的有限合伙人,而不是那些承担较低风险的有限合伙人或零售有限合伙人。它们的长期影响将是促使有限合伙人采取事实上更糟糕的策略。

Uniswap 基金会专注于发展生态系统的战略似乎比任何这些选项都更可行(有针对性的流动性挖矿可能除外)。理想的情况是,有限合伙人获得的份额相对较小,但蛋糕却大得多。

结论

鼓励 UNI 代币持有者委托其代币预计将改善 DAO 的去中心化和生态系统的可持续性。

目前,在 V3 上实施费用转换将提供关键数据,为 Uniswap 和生态系统内其他协议的未来版本的决策提供信息。

有限合伙人是预期费用转换中明显的短期损失者,并且不确定生态系统的长期预期收益是否足以弥补他们的损失。

LP 应努力在 DAO 决策中实现更好的协调和更强的发言权。这包括争取对更保守的费用转换方法的支持:例如,仅对一小部分矿池征收不超过 10% 的费用。

The author's independent researcher source translation Shanouba Bitcoin Trading Network seems to be preparing to vote on the allocation of agreement fees to the pledgee in the next few months. This paper shares my personal views and guesses about the future impact of this vote. The abstract of pledge proposal is currently being discussed in the governance forum. A proposal aimed at transforming it into a cost-sharing token is proposed. The main idea is to upgrade the agreement governance and realize the agreement fee collection without permission, and charge the token holders who have pledged and entrusted to vote in proportion. Allocating any agreement fee allows governance to continue to control the core parameters, which mines charge fees and the size of fees. This initial proposal is the basis of another future proposal, which will actually introduce agreement fees to some pools. Assuming that the voting on the chain is successful, the community will be able to choose to charge fees as a representative. I generally agree with the proposal of allocating fees from the pools to the pledgees. I think this will be an interesting experiment. The full preparation behind this proposal clearly shows the ability and ability of the foundation. At present, there are still uncertainties, for example, the specific pool where the fees will be implemented and the exact agreement rate fee switch must be customized for each pool, which means that it is meaningless to charge fees for mines with small capacity or short life only for the activation fee of the selected pool group economically, especially when considering the governance work required for each fee conversion decision, the selected mine pool is likely to be basically the same as the mine pool that has already charged the front-end fee. According to the previous voting, it is expected that the agreement rate will be set at the total mutual. At present, there is no public plan to implement fees on or before the exchange of fees. These versions can be solved in the future discussion. The experiment of fee conversion will be an important reference point. The future is the most dominant iteration of the platform at present, and in some ways it is also the largest at present. However, I think it is already declining for the following reasons, which means that trying to switch fees on the internet is a relatively low-risk behavior, and the development strategy that will be largely replaced is the same as Intel's previous model. Some similarities are that the architecture progress is followed by optimization. In this case, it represents a ticking cycle and the composition of the upcoming cycle. Compared with the technical level at that time, another cycle is a major progress. It is similar in architecture, but it has new functions such as interchange and price prediction machine, and other enhancements have been made to the overall design. Although the competition is still strong, it highlights its lasting appeal and introduces another architecture leap and liquidity concentration. However, it does have some major shortcomings, not only in use, but also in use. Complexity increases the market risk of limited partners, and it is more susceptible to arbitrage leakage, especially in the lower cost level pool of volatile assets. The design I predict will not last in the long run, and the tried and trusted model may last longer than it. Once it is launched, it is expected to surpass it soon, thanks to the following improvements and optimizations, including the singleton design that reduces transmission costs and the transient storage mechanism that significantly reduces costs, which is beneficial to limited partnerships. People's innovation aims at regaining the arbitrage loss value through auction and dynamic fees, providing more favorable environmental support for limited partners. The function will re-integrate all-round liquidity positions to accommodate transfer fees tokens and allow donations and other enhancement functions in the liquidity pool. Essentially, it aims to solve the shortcomings while integrating the advantages of its predecessor, intensifying competition and increasing competitors. At first, it used its innovative centralized liquidity model and restrictive licensing to dominate the industry. These special advantages no longer exist, and the core code has been emerging in the next year. It is true that high-quality competition continues to emerge, and it still has the most lindy, tested and solid code base, while some competitors have been caught in hacking attacks. However, these benefits will inevitably weaken with the passage of time, and the developing trading mechanism is developing towards an intention-based system. Therefore, we expect that the proportion of transactions through the chain will decline, although it is now announced. It's still too early for the cloth model to be outdated, but the rise of Isoplatform may continue and increase its market share. The emerging thought-centered chain and the debate about whether the dedicated application chain is the future have convincing arguments. As emphasized, in the current model, the exchange fees paid by the exchanges are higher than the exchange fees paid by the limited partners, which is shocking and inefficient. In addition, the losses caused by the imperfect execution caused by the slip point are also greater than those caused by the traders. Swap fees are at least like this in 2006, and the user experience of trading is improving significantly every year. However, if the focus of Ethereum is still on the settlement layer, these problems are unlikely to be completely solved in the future. People can constantly optimize the design and make it complicated, but it is impossible to completely copy the trading experience on the chain with a second block time, at least without sacrificing decentralization or censorship resistance. No one wants to connect their assets across the chain to slightly improve him. In addition, we really don't need further liquidity fragmentation. However, the potential of sharing sorting on the main network of Ethereum may change the rules of the game. This innovation will realize the synchronization and composability between the two, thus allowing the contracts on the network to seamlessly access all the participating liquidity. Such development will eliminate most of the concerns about liquidity dispersion and user inconvenience. All in all, these factors make it unlikely to continue to occupy the dominant position of the main network. It will not cause too much if you carefully try to convert the fees. The problem of big loss of limited partners does not represent the risk of tax fee conversion. If the fee conversion leads to the withdrawal of many liquidity providers, it may be counterproductive. Losing limited partners will mean that the liquidity of the fund pool will be reduced, thus reducing the attractiveness of the fund pool to traders. The reduction of exchange activities will reduce the income of the remaining limited partners and lead to the departure of more limited partners, which may trigger a chain reaction, and the liquidity will continue to decline, leading to the worst-case death spiral. Fortunately, the goal is achieved. Up to now, traders don't seem to be too sensitive to price changes. Even if some limited partners decide to leave the overall trading volume after charging, it may not drop sharply, which means that the remaining limited partners will eventually get a higher annual interest rate. Before considering the agreement fees, these higher trading gains will offset the cost of the agreement fees to some extent, thus achieving a stable balance. Some research supporting this view is currently being updated, indicating that as long as the fees are not too high, the death spiral is unlikely to occur. Their data-driven method is reassuring. If the fees are charged carefully, it will not lead to limited partners. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。