关于Runes协议及“公开铭刻"发行机制的拓展讨论

作者:MiX

2024年3月2日,Runes生态基础设施项目Rune alpha的创始人,在Github的公开议题中,与Runes协议创始人Casey展开了讨论,双方对如何拓展Runes协议的「公开铭刻」机制进行了探讨。话题包括:

·要不要放宽「公开铭刻」不可预留的要求?

·指出了采用「公开铭刻」发行方式的Runes符文不存在管理权的观点

·提出了一套基于铭文NFT和符文FT互相配合的发行机制设想

出于对比特币衍生资产协议的浓厚兴趣,本文作者结合上述Runes的一些最新话题,写作了此篇文章,就Runes与Ordinals协议的过往,以及类似的资产发行方式进行开发性的探索,相信能够对大家了解比特币生态带来帮助。

什么是Runes协议

所谓的Runes协议,是在比特币网络上发行同质化代币的协议,由Ordinals创始人Casey在发布Ordinals方案后,又重新构建的同质化代币方案,基于比特币UTXO的特性而构建,整体的设计思路非常简洁。

值得一提的是,Runes协议计划在比特币2024年减半时(区块高度840000),也即是今年四月下旬上线主网。现在Runes协议仍然处于优化和版本迭代的过程中。

在简要科普Runes的原理前,让我们先快速了解下来龙去脉,以及所谓的【公开铭刻】到底代表什么。

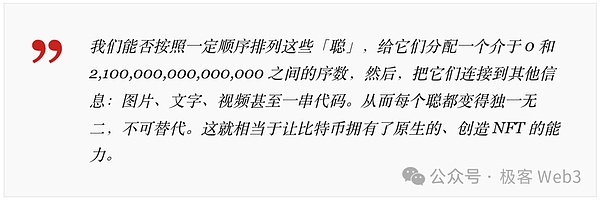

Runes的提出者Casey在一开始并没有要做同质化代币协议的idea,早在2022年12月时,Casey就发布了Ordinals协议,意图是将NFT数据永久上链Bitcoin,简单说就是将NFT元数据像铭文一样,记录在比特币交易的见证数据witness中(witness主要包含数字签名信息),这样就能够将任意形式的内容(如文本、图像等)铭刻在指定的聪上。

(图片来源:https://yishi.io/a-beginner-guide-to-the-ordinals-protocol/)

随后,历史的齿轮开始转动,2023年3月8日,匿名开发者@domodata基于Ordinals这个典型的NFT发行协议,迂回的搞出一套发行同质化代币的BRC-20标准,就是以铭文的方式,对那些需要上传到比特币链上的衍生资产数据,规定出统一的格式和属性(Token名称、总供应量、单次最大铸造量等),再通过索引器去解析并追踪这些信息,展示出BRC-20代币相关的钱包账户和资产数额。

关键来了,BRC-20的发行,要依赖于Ordinals这种比特币铭文NFT协议,所以在初始的发行机制上变得和NFT铸造过程类似,天然具备「先到先得」的特性,谁先Mint谁就拥有,完全不同于以太坊ERC-20资产发行时“项目方先部署资产合约,定义资产分配机制,官方想怎么控盘都可以”。

这种Fair Launch的特性,使得大多数人有了公平参与同质化代币初始发行的机会,项目方无预留无锁仓,每个人都可以在资产最初发行的第一时间参与。很快,BRC20就带来了比特币链上衍生资产的发行热潮,甚至直接启动了这轮牛市。由此可知,我们今天重点讨论的「公开铭刻」的发行方式,对于Runes协议而言非常重要。

但BRC-20也带来了很多问题:BRC-20资产的每一次操作,都要在比特币链上发起特定的交易,随着BRC-20资产的火爆,比特币UTXO数据集也快速膨胀,这使得BTC核心开发者对BRC-20产生公开质疑。

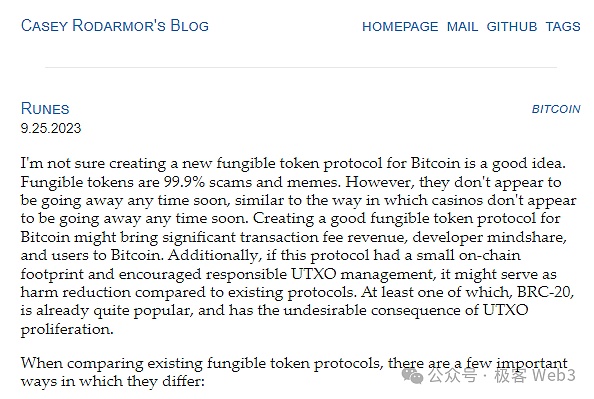

Ordinals创始人Casey不仅反对BRC-20,更是对基于Ordinals之上发行的FT资产不予认可,但是BRC-20的火爆,让他觉得虽然99%的代币都是骗局和噱头,但这些东西仍会像赌场一样无法消失。

同时,BRC-20在比特币链上留下了“过多的痕迹”,为比特币节点带来了数据承载上的负担,但如果有人提出一套,能够在上链数据方面“减负”的资产协议,或许能减缓BRC-20带来的问题。

所以Casey决定为比特币构建一种“更好的同质化代币协议”,随后在2023年9月25日,他发布了Runes协议的初步构想。

从技术角度看,Runes协议基于比特币UTXO和附加信息而构建,每一笔交易的触发,都要把链下生成的数字签名信息on chain,我们可以在签名信息中携带特定格式的消息。Runes协议通过OP_RETURN操作码来标记出“特定消息”,这些特定消息就是与Runes资产变更相关的信息。

相比于BRC-20协议,Runes 优势很多,其中最重要在于:

1.交易步骤简化,且不会生成多余的无用UTXO,能更好的为比特币节点“减轻负担”。此外,BRC-20的一笔转账交易仅支持一个接收者和一种代币,而Runes支持同时向多个接收者转账,且可转账多种Runes代币。

2.资产数据的存储与索引更简洁:BRC-20的数据以JSON格式存储在特定交易的witness数据中,且BRC-20基于账户模型,资产余额与指定的账户相关联。而Runes协议的数据存储在特定交易的OP_RETURN字段中,资产的记录方式采用UTXO模型,可以直接与比特币链上的UTXO“同构绑定”。

在确认一个人的Runes资产状况时,只需验证这个人拥有的、与Runes资产相绑定的特殊UTXO,虽然还是要追溯部分信息完成计算,但无需像BRC-20那样扫描比特币链上的完整UTXO集合,这种轻量化的方式对数据索引更友好。

3.与UTXO功能拓展层兼容:Runes基于UTXO的设计,使其能够与CKB、Cardano、Fuel等基于UTXO的功能拓展层更好地兼容。通过类似于RGB++的“UTXO同构绑定”,上述功能拓展层可以为Runes提供智能合约场景。

简要谈完了技术,我们回到本文最开始谈论的发行机制的事情。Casey为Runes符文设计了两套发行方式,即「固定总量」和「公开铭刻」:

1.固定总量就是发行方直接铭刻所有Runes符文,然后再进行分发,相对更中心化。

2.公开铭刻就是对Runes符文的发行方式设定参数,比如指明一个区块高度或时间戳,在符合规则的时间段内,用户Mint了多少资产,最后该符文的总量就是多少。

两种发行方式对应的场景与机制完全不同,下文中我们只聊「公开铭刻」。

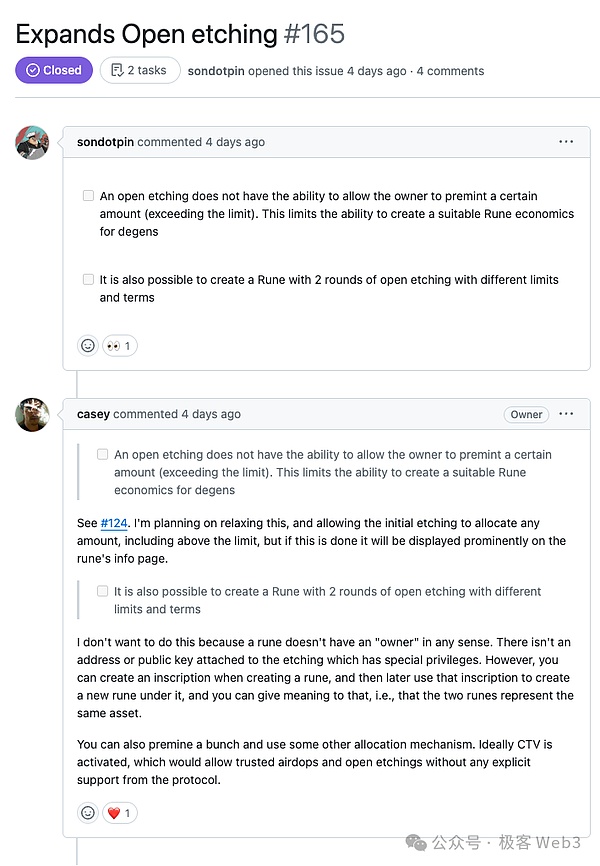

事实上,Sondotpin从Runes的Issues#124议题中,就开始讨论此话题,并得到了Casey的认可。

而Issues#165具体内容如下:

Sondotpin:目前的公开发行,项目方/发行方不能提前预留Runes符文,这限制了项目方设计优秀通证经济模型的机会。

Casey:请查看之前的Issues#124。我正在考虑放宽这个要求,允许发行方在发行时以合理的方式安排符文,甚至超出参数的设定范围。如果这样设计,相关信息会在Runes符文的详情页做非常突出的展示。

Sondotpin:是不是可以设计一个多次发行的机制,比如能有两轮「公开铭刻」Runes符文,然后每一轮发行设定不同的参数?

Casey:我并不倾向于这样的做法,因为Runes符文本质上并没有「管理者」。发行的权限不应该掌握在有特别权限的单一实体手上。但是你可以在发行符文的时候添加一个铭文,然后在这个铭文的基础上再发行新的符文,这样就可以实现两次发行的符文都是同一个资产。当然,你也可以采用预挖的方式,然后用其他的分配方式进行发行。

如果未来 CTV 的功能能够顺利启动,就不需要协议支持了,CTV 直接可以预先设定条件模板,达到条件后就可以做符合条件设置的空投和公开发行。

围绕Casey和SonPin的讨论,个人看法:

1.在发起项目的早期,预留部分Token确有必要

在早期,项目方想要实现业务的自举,需要有一定的Token储备去激励核心团队、凝聚社区。如果可以按照本次讨论去实现协议,是对「公开铭刻」的公平和全民参与价值的补充,可以让更多有价值基础项目方通过「公开铭刻」的方式参与到Runes生态中。

2.是否预留、如何预留,是将自证的手段交给发行方

事实上,Casey曾多次在Youtube视频里直言,同质化通证99.9%都是骗局,大家也别冠冕堂皇的说自己要改变世界,坦率地承认这是一个充满赌博和投机的行业,以诚相待,对所有人都好。IT’S JUST FOR FUN!

是从issue#124到#165,可以看到Casey对同质化通证的使用场景有了更多认可。「公开铭刻」的方式勿需质疑,在此基础上进行拓展,比如增加预留机制,是将选择的权利、自证的手段交给发行方,也是防止劣币驱逐良币的好方法。

3.铭文NFT和符文FT将会有更多的创新空间

Casey提出的铭文NFT和符文FT互相配合进行多轮次的发行机制设想,相当有趣。背景知识里我们说到,Ordinals和Runes都是Casey设计的协议,应该算是两个平行关系协议,但是在Github上都做到Ord这个项目里,技术上不少交叉和配合,比如共用了同步区块这类底层逻辑。

当下热点Runestone和Runecoin等项目,也是铭文和符文互相组合创新。Runecoin的玩儿法是最主流的铭文预挖矿,持有Runecoin发行的RSIC铭文,就会持续不断的挖出项目的符文,然后4月底Runes协议上线再分配FT。期待未来有更多项目可以推陈出新,带来更新颖的玩儿法。

4.采用「公开铭刻」发行方式的Runes符文不存在所有权

Casey原文中只表达了「Rune不存在所有权」,但是笔者认为这应该是特指采用「公开铭刻」发行方式的Runes符文不存在所有权。SonPin提出的两轮「公开铭刻」方案,就一定会有一个拥有极高权限的地址的地址来操作,这并不是Crypto加密领域希望看到的。

就像项目Runecoin在发完21000张RSIC铭文NFT后,很快就将父铭文打到了中本聪地址,相当于没有人能够再次使用,也就是通过技术手段承诺不做增发。这波操作本身就为其带来一大波好评,非常涨路人缘。

PS:什么是父铭文?因为在BTC做交互速度慢且gas高昂,所以当操作数量比较大的时候,为提高效率,一般会先设置一个父铭文,在父铭文的那一次交易里,直接批量处理多个子铭文,这样可以在交互的时候,节约区块链的存储空间和处理时间。

最后说一下Casey提到的CTV,即「Check Template Verify」。

CTV是一个比特币提议的协议升级,旨在通过允许用户在创建交易时,指定未来交易的模板,从而增强比特币网络的智能合约和锁定功能。CTV的激活将使得用户能够创建更复杂的交易类型,例如可信赖的空投和开放式蚀刻,而无需协议的显式支持。

这个CTV提案增加了比特币网络的可编程性和灵活性,在这次讨论中提到,简单来说就是可以创建一个使用UTXO的解锁条件模板,有机会给Runes创造更多玩法。举个例子,通过「Runes协议+CTV」,可以让10个用户联合使用CTV技术,共同Mint符文,然后预设未来的一些比特币支付交易的承诺之类。

The author, the founder of the ecological infrastructure project, discussed with the founder of the agreement in the public topic. The two sides discussed how to expand the public engraving mechanism of the agreement, including whether to relax the requirement that the public engraving cannot be reserved, and pointed out that the runes that adopt the public engraving method do not have the right to manage, and put forward a set of distribution mechanism based on the cooperation of inscriptions and runes. Out of strong interest in the Bitcoin derivative asset agreement, the author combined the above one. I have written this article on the latest topics to explore the past of the agreement and similar asset issuance methods. I believe it will help you understand the bitcoin ecology. What is an agreement? The so-called agreement is an agreement to issue homogenized tokens on the bitcoin network. The homogenized token scheme reconstructed by the founder after the release of the scheme is based on the characteristics of Bitcoin. The overall design idea is very simple. It is worth mentioning that the agreement is planned to halve the height of the block in Bitcoin. That is to say, the main network was launched in late April this year, and now the protocol is still in the process of optimization and version iteration. Before briefly introducing the principle of popular science, let's quickly understand the context and what the so-called public inscription represents. The proponent did not want to make a homogeneous token agreement at the beginning, and issued the agreement as early as January, with the intention of permanently winding the data. Simply put, metadata is recorded in the witness data of bitcoin transactions like inscriptions, mainly including digital signature information. You can engrave any form of content, such as text and images, on the designated cong. Then the wheel of history begins to turn. On the basis of this typical distribution agreement, anonymous developers circuitously come up with a set of standards for issuing homogeneous tokens, that is, stipulate a unified format and attribute names for the derivative assets data that need to be uploaded to the bitcoin chain in an inscription way, and then analyze and track this information through the indexer to show the token phase. The key issue of the closed wallet account and the amount of assets depends on this bitcoin inscription agreement, so it becomes similar to the casting process in the initial issue mechanism, and naturally has the characteristics of first come, first served. It is completely different from the fact that when the assets of Ethereum are issued, the project party deploys the assets contract first, defines the asset allocation mechanism, and the official can control the disk as he wants. This characteristic makes most people have a fair chance to participate in the initial issue of homogenized tokens. Everyone has no reservation and no lock. Being able to participate in the initial issuance of assets soon brought about a boom in the issuance of derivative assets on the bitcoin chain, and even directly started this bull market. Therefore, it can be seen that the issuance method of public inscription, which we focus on today, is very important for the agreement, but it also brings many problems. Every operation of assets has to initiate a specific transaction on the bitcoin chain. With the popularity of assets, the bitcoin data set has also expanded rapidly, which makes the core developers not only oppose the public questioning. Even more, the assets issued based on it are not recognized, but the popularity makes him feel that although all the tokens are scams and gimmicks, these things will still not disappear like casinos, leaving too many traces on the bitcoin chain, which has brought a burden on the bitcoin node. However, if someone proposes a set of asset agreements that can reduce the burden on the uplink data, it may alleviate the problems, so he decides to build a better homogeneous token agreement for Bitcoin, and then he will issue it on June. From a technical point of view, the protocol is based on bitcoin and additional information, and the trigger of each transaction should include the digital signature information generated under the chain. We can carry the message protocol with a specific format in the signature information and mark the specific messages through the operation code. These specific messages are the information related to asset changes, which has many advantages compared with the protocol, the most important of which is that the transaction steps are simplified and unnecessary useless, which can better reduce the burden on bitcoin nodes. A transfer transaction outside only supports one recipient and one token, but supports simultaneous transfer to multiple recipients, and the storage and index of transferable multi-token assets are simpler. The data is stored in the data of a specific transaction in a format, and based on the account model, the balance of assets is associated with the specified account, while the agreed data is stored in the field of a specific transaction. The recording method of assets can be directly and isomorphically bound to the bitcoin chain, and only verification is needed when confirming a person's asset status. Although this person has the special property of being bound to assets, he still needs to trace back some information to complete the calculation, but he doesn't need to scan the complete set on the bitcoin chain like that. This lightweight way is more friendly to data indexing and compatible with the functional extension layer. The design based on makes it better compatible with the functional extension layer based on the same structure. The above functional extension layer can provide smart contract scenarios through similar isomorphic binding. After briefly talking about the technology, we will return to the issue mechanism we talked about at the beginning of this article. Runes are designed with two sets of distribution methods, namely, fixed total amount and public inscription. The fixed total amount means that the issuer directly engraves all the runes and then distributes them. The public inscription is to set parameters for the distribution method of runes, such as indicating the height of a block or the time stamp, how much assets the user has in a time period that meets the rules, and finally the total amount of the runes is how much. The two distribution methods correspond to completely different scenes and mechanisms. In the following, we only talk about public inscription, which actually starts from the topic. At first, this topic was discussed and recognized, and the specific contents are as follows: at present, the issuer of the public offering project can't reserve runes in advance, which limits the opportunity for the project to design an excellent economic model of the general certificate. Please check the previous one. I am considering relaxing this requirement and allowing the issuer to arrange runes in a reasonable way when issuing, even beyond the set range of parameters. If so, the design-related information will be displayed very prominently on the details page of runes. Is it possible to design a mechanism for multiple issuance? If there are two rounds of public inscription runes, and then different parameters are set for each issue, I don't like this, because runes are not authorized by managers in essence and should not be in the hands of a single entity with special authority, but you can add an inscription when issuing runes and then issue new runes on the basis of this inscription, so that the runes issued twice are the same asset. Of course, you can also use pre-excavation and then issue them by other distribution methods. If future functions can be successfully started, you don't need agreement support, and you can directly issue them in advance. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。