比特币二层金融复兴 但如何保障资金的安全性?

比特币二层网络蕴含着巨大潜力,然而,伴随而来是不容忽视的安全风险。值得注意的是,这些风险因参与者而异。对于动辄高达数亿美金 TVL 的 BTC Layer 2 项目方来说,风险挑战是如何安全存储和管理这些来自用户存入的 BTC 原生资产以防止黑客攻击,对于参与质押的普通投资者来说,风险挑战在于确保资产能够安全赎回。

前言

本文分析了比特币二层网络作为 BTC 生态金融基础设施的巨大潜力,具体表现在以下几个方面:首先,BTC Layer 2 协议的总锁定价值(TVL)已突破 25 亿美元,不到一个月便实现了 734% 的增长,这反映了市场对 BTC DeFi 的强烈需求和巨大潜力;其次,比特币作为加密领域中最具特色的资产,不仅市值和交易量是以太坊的 2.5 倍,而且全球比特币用户超过 2 亿,远超以太坊的 1400 万用户;最后,作为世界上最有价值、最广泛采用、最安全的去中心化加密货币,比特币是充当全球结算层的最佳选项,但相对于其规模,比特币仍算世界上金融化程度最低的资产之一。

这一切意味着,谁能在这轮牛市把握住 BTC Layer 2 的机遇,谁就能在比特币减半效应驱动的牛市中收获可观的回报。

然而,随之而来的是资金存储的高风险,特别是对于动辄高达数亿美金 TVL 的 BTC Layer 2 项目方,如何安全存储和管理这些用户存入的 BTC 原生资产以防止黑客攻击是个巨大挑战。Cobo 专为 BTC Layer 2 推出的基于 MPC(多方计算)协管方案,可从操作层面上有效抵御外部的恶意行为,并允许项目方自定义更多风控规则来细化安全管理措施。

需要指出的是,安全风险是多维度的,不同参与者面临的安全威胁也各不相同。

在此案例中,BTC Layer 2 项目将接收散户质押者的比特币,并存储在 BTC 一层网络中,这里需防范的是外部黑客和内部人员的恶意提款行为。Cobo 的 MPC Layer 2 协管方案本质上是依靠 MPC 技术的多重签名机制,确保所有被批准的行动都是出于项目方的意图,而任何项目方之外的恶意操作都将是无效的。

对于参与质押的散户投资者而言,面临的安全风险则来自另一层面。比特币质押用户需要明白的是,BTC Layer 2 的高收益潜力总是伴随着风险。这意味着匿名项目最好避免参与,有不良历史的项目创始人应谨慎处理,同时遵循 「Do Your Own Research」(自行研究)原则,理解相关的风险控制策略,如提款限额或时间锁定等措施。

最后,Cobo 强调,尽管 Cobo 提供了技术解决方案,但并不代表对项目方的背书。用户资产的最终安全性取决于项目方如何制定自身的风控策略。

比特币的技术创新与 DeFi 潜力

比特币是加密生态系统中最独特的资产之一,其市值和交易量大约是以太坊的 2.5 倍。全球有超过 2 亿比特币持有者,与之对比,以太坊持有者为 1400 万。

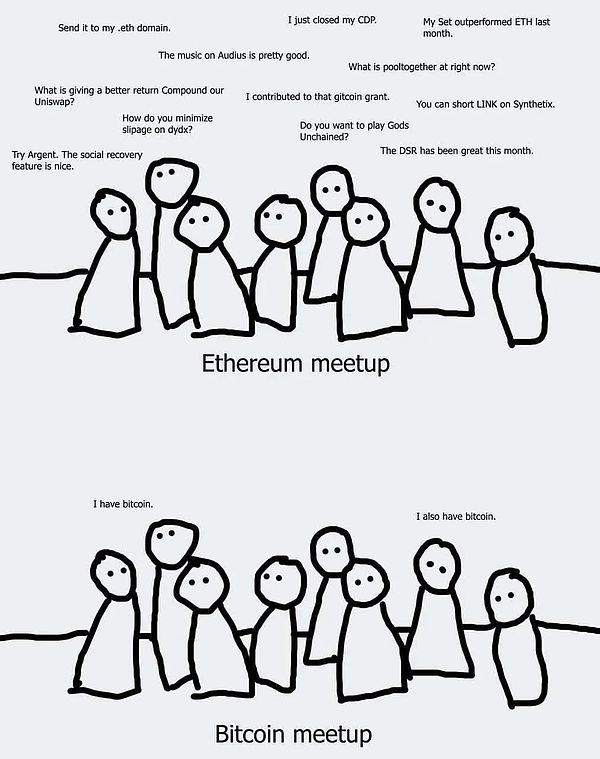

与比特币在市场上的巨大影响力相比,其在技术创新上的潜能却似乎未得到充分挖掘。这种局限性,对比特币在扩展性、编程能力和吸引开发者方面的潜力构成了障碍。网络上流传的一则关于比特币的 meme 梗非常尖刻地指出了这一点,「比特币作为一种投资标的,除了长期持有(‘hodl’),似乎别无它途。」这个 meme 传递出这样一个事实:比特币虽然是一种强大的价值存储手段,但在应用层面上,其功能和使用场景仍有很大的拓展空间。

随着势不可挡宏观趋势的来临和比特币底层技术的演进,这种情况正在发生改变。

技术上,自从 Taproot 升级以来,比特币上交易可存储的数据量和逻辑得到扩展。自此,比特币可执行更加复杂的交易,拓展了比特币上的用例。Ordinal 铭文的推出,支持在比特币最小单位「聪」上铭刻(inscribe)更加丰富的数据(如图像、文本、SVG、HTML 等),并添加到比特币交易中形成铭文,从此,携带了铭文的「聪」有了独特性和稀缺性,这意味着,比特币生态有了不可替代代币的元数据层。最后,BRC-20 的推出进一步改进了 Ordinals,该协议通过将代币名称、总量等信息用规范的 JSON 格式写入「聪」中以实现代币的部署、铸造和转移功能。

此外,随着比特币现货 ETF 的通过以及 4 月份比特币减半预期的来临,投资者开始寻求比特币作为数字黄金之外的用例,尤其是对比特币去中心化金融的兴趣。

最新的趋势显示,比特币之上的去中心化金融正悄然兴起,其潜力与当今以太坊上的 DeFi 相似或更大。数据显示,BTC Layer 2 协议总锁定价值(TVL)突破 25 亿美元,不到 1 个月的时间内增长了 734%,这反映了对 BTC DeFi 的强烈需求和巨大潜力。谁抓住了BTC Layer 2这个风口,谁就有望在比特币减半预期所催化的牛市中获得丰厚的回报。

作为世界上最有价值、最广泛采用、最安全的去中心化加密货币,比特币是充当全球结算层的最佳选项,但相对于其规模,比特币仍算世界上金融化程度最低的资产之一。

这表明比特币在去中心化金融领域有很大的发展空间。那么,比特币上的 DeFi 潜力有多大呢?

数据显示,目前市值约 4246 亿美元的以太坊承载着当今大部分的 DeFi 活动。历史数据显示,DeFi 应用占以太坊市值的比例在 8% 到 50% 之间,而目前这一比例约为 13%。

如果以以太坊为参考,假设比特币生态中的 DeFi 能达到与以太坊相同的比例,那么,我们可以推算出,比特币上 DeFi 应用的总市值将达到 1618 亿美元(占比特币市值的 13%),历史规模可能在 996 亿美元至 6222 亿美元之间(即比特币市值的 8% 至 50%)。值得注意的是,所有以上假设是比特币当前市值保持不变的情况下进行的估算。

毫无疑问,宏观经济的大趋势与比特币的技术创新,不仅点燃了投资者对比特币去中心化金融(DeFi)的热情,而且预示着比特币 DeFi 领域的一个关键性突破点的到来。DeFi 将从比特币所带来的巨大影响力、充沛流动性,以及其在市场上的主导地位中获益匪浅。随着比特币 Layer 2(L2)技术的全面展开,通过前沿创新解决方案对 DeFi 产生的深远影响,极有可能进一步加强比特币在 Web3 领域的领导地位。

比特币的桥接标准:基于 MPC 的安全保障

要释放比特币生态去中心化金融的潜力,最大的挑战是如何把比特币原生资产桥接到这些新的 Layer 2 上去。

在以太坊 Layer 2 方案 中,与 L2 的桥接由 L1 控制。桥接到 L2,又名转入,实际上意味着将资产锁定在 L1 上,并在 L2 上铸造该资产的副本。在以太坊的案例中,这是通过 L2 原生的桥接智能合约实现的。该智能合约存储了桥接至 L2 的所有资产,且该智能合约的安全性源自 L1 验证节点。这使得到 L2 的桥接变得安全且信任最小化。

比特币设计的初心是仅作为支付媒介被使用,其底层采用了 UTXO 模型,这种简单的支付分类账本没有智能合约,这种设计在支付场景时非常适用,一旦涉及更加复杂的逻辑和循环时,这种设计的弊端就凸显出来了,它不够灵活,限制了比特币的可能性,无法像以太坊一样平衡桥的安全和效率问题。

为了拥抱比特币这一 DeFi 时刻,Cobo 推出了基于 BTC Layer 2 的 MPC 协管方案,并已首次在 拥有高达30亿美金的TVL( BTC Layer 2+Ordinals)的Merlin Chain 进行实践。这一方案支持将多种原生资产从比特币 Layer 1 连接到 Layer 2。Cobo 希望将专业的 BTC 桥接技术框架推广至更广泛的应用,现在向所有 BTC Layer 2 项目敞开大门,提供安全灵活的 BTC Layer 2 链构建框架。

Cobo MPC 协管方案通过以下两个关键措施提供资产的安全保护:

多重签名机制:Cobo MPC 协管方案采用多重签名机制,即需要多个独立的私钥分片参与才能签署有效交易。Cobo 作为协管方参与验证,确保每一笔交易都真实反映了项目方的意图,而非外部的恶意行为,这让任何来自外部的黑客攻击的行为都无法得逞。

风控策略:Cobo MPC 协管方案允许项目方对资产提取实施预定义的风控策略,如限额和提取次数限制。任何不符合项目方设定的风控策略的操作都可能会被拒绝或延迟,为项目方提供进一步的安全保障。

Cobo 为 BTC Layer 2 提供了技术解决方案,但并不对项目方背书,终端用户资产的安全性还得取决于项目方本身如何定义自身的风控策略。在某种极端案例中,项目方甚至可以进行恶意的资金提取行为,比如项目方自己设置了一个匿名地址为白名单,并提取限额之内的资产,这种情况并不会触发风控规则,作为协签方,Cobo 也无法判断该操作是否属于恶意行为。

对于质押用户来说,资产安全受到项目方所定义的风控策略的影响。即使在MPC协管的情况下,如果项目方设置了不当的风险控制措施,用户的资产仍然可能面临风险。

Cobo 提醒用户,在参与 BTC 质押时应注意风险,并遵循「Do Your Own Research」(DYOR)原则,以确保资产安全。DYOR 包括但不限于:

评估收益和风险平衡;

理解相关的风险控制策略,如提款限额或时间锁定;

考虑项目方和资产托管方的信誉、历史和透明度,避免匿名项目方;

认识到交易条件和限制,以及它们对资产流动性的影响。

Bitcoin second-tier network contains great potential, but it is accompanied by security risks that can't be ignored. It is worth noting that these risks vary from participant to participant. For the project parties who often reach hundreds of millions of dollars, the risk challenge is how to safely store and manage these native assets deposited by users to prevent hacker attacks. For ordinary investors who participate in pledge, the risk challenge is to ensure the safe redemption of assets. Preface This paper analyzes Bitcoin second-tier network as an eco-financial infrastructure. The great potential is embodied in the following aspects: firstly, the total locked value of the agreement has exceeded 100 million US dollars, and the growth has been realized in less than one month, which reflects the strong demand and great potential of the market; secondly, as the most distinctive asset in the encryption field, Bitcoin not only has twice the market value and transaction volume as that of Ethereum, but also has more than 100 million users worldwide, far exceeding 10,000 users of Ethereum. Finally, as the most valuable and widely used decentralized encryption currency in the world, Bitcoin acts as a global node. The best option of computing layer, but compared with its scale, Bitcoin is still one of the least financialized assets in the world. All this means that whoever can seize the opportunity in this bull market will reap considerable returns in the bull market driven by the halving effect of Bitcoin. However, it is accompanied by high risks of capital storage, especially for projects that are often as high as hundreds of millions of dollars. How to safely store and manage the original assets deposited by these users to prevent hacker attacks is a huge challenge. The side computing co-management scheme can effectively resist external malicious behaviors from the operational level and allow the project side to customize more risk control rules to refine the safety management measures. It should be pointed out that the security risks are multidimensional, and the security threats faced by different participants are also different. In this case, the project will receive the bitcoin of the retail pledger and store it in a layer of network. What needs to be guarded here is the multi-signature machine that relies on technology in essence. The system ensures that all approved actions are out of the intention of the project party, and any malicious operation outside the project party will be invalid. For retail investors who participate in the pledge, the security risks come from another level. Bitcoin pledge users need to understand that high-yield potential is always accompanied by risks, which means that anonymous projects are best avoided. The project founders with bad history should be cautious and follow the principle of self-study to understand relevant risk control strategies such as withdrawal limits or Finally, measures such as time locking emphasize that although technical solutions are provided, it does not mean that the final security of users' assets depends on how the project formulates its own risk control strategy. Bitcoin's technological innovation and potential are one of the most unique assets in the encryption ecosystem, and its market value and transaction volume are about twice that of Ethereum. In contrast, there are more than 100 million bitcoin holders in the world. Compared with Bitcoin's great influence in the market, it is a technological innovation. The potential of the new world seems to have not been fully tapped. This limitation constitutes an obstacle to the potential of Bitcoin in expanding programming ability and attracting developers. A stalk about Bitcoin circulated on the Internet pointed out this point very sharply. As an investment target, Bitcoin seems to have no other way but to hold it for a long time. This conveys the fact that although Bitcoin is a powerful value storage means, its functions and usage scenarios still have great room for expansion at the application level. With the advent of the irresistible macro trend and the evolution of the underlying technology of Bitcoin, this situation is changing. Technically, since the upgrade, the amount of data and logic that can be stored in Bitcoin transactions have been expanded. Since then, Bitcoin can execute more complex transactions, which has expanded the launch of use case inscriptions on Bitcoin. It supports the engraving of richer data such as images and texts on the smallest unit of Bitcoin and adding them to Bitcoin transactions to form inscriptions. Since then, the cleverness with inscriptions has become unique and scarce. It means that the bitcoin ecology has an irreplaceable metadata layer for tokens, and the final launch has further improved the protocol. By writing information such as the total number of tokens in a standardized format into Congzhong, the deployment, casting and transfer functions of tokens are realized. In addition, with the adoption of bitcoin spot and the expected halving of bitcoin in January, investors have begun to seek bitcoin as a use case other than digital gold, especially the interest in bitcoin decentralized finance. The latest trend shows that bitcoin is decentralized. Chemical finance is quietly emerging, and its potential is similar to or greater than that in today's ethereum. The total locking value of data display protocols has exceeded 100 million US dollars, which has increased in less than a month. This reflects the strong demand and great potential. Whoever seizes this vent is expected to get rich returns in the bull market catalyzed by the expectation of halving bitcoin. As the most valuable and widely used decentralized encryption currency in the world, Bitcoin is the best option to serve as a global settlement layer, but compared with its size. Coin is still one of the assets with the lowest degree of financialization in the world, which shows that Bitcoin has a great development space in the field of decentralized finance. So what is the potential of Bitcoin? The data shows that the Ethereum, which has a market value of about 100 million dollars at present, carries most of today's activities. The historical data shows that the proportion of applications in the market value of Ethereum is between and, and the current ratio is about. If we take Ethereum as a reference and assume that the bitcoin ecology can reach the same proportion as Ethereum, then we can calculate the ratio. The total market value of special currency applications will reach $ billion, accounting for the historical scale of bitcoin market value, which may be between $ billion and $ billion. It is worth noting that all the above assumptions are that the current market value of bitcoin remains unchanged. Undoubtedly, the macro-economic trend and technological innovation of bitcoin not only ignite investors' enthusiasm for bitcoin decentralized finance, but also indicate that a key breakthrough point in bitcoin field will come from Bitcoin. With the full development of bitcoin technology and its leading position in the market, it is very likely to further strengthen the leading position of bitcoin in the field through the far-reaching impact of cutting-edge innovative solutions. The security guarantee based on the bridging standard of bitcoin is to release the potential of bitcoin ecological decentralized finance. The biggest challenge is how to bridge the original assets of bitcoin to these new ones. The bridge between the control bridge and the Ethereum scheme is changed from a control bridge to a case that actually means locking the assets and casting a copy of the assets in the Ethereum. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。