提钱跑路 又一家香港加密交易所上演“空城计”

众所周知,在JPEX和HOUNAX诈骗案之后,香港在虚拟资产交易平台的监管上很是谨慎,不论是从信息披露还是广告宣传上均有覆盖,颇有“一朝被蛇咬,十年怕井绳”之感,竭尽全力保证投资者的利益。

但身处行业内的大家也都知道,堵不如疏,公众认知不提升,离案交易所满地跑,在钓鱼链接、熟人传销、盗号操作无处不在的加密圈,跑路这件事并不少见。

就在日前,又一家交易平台在香港成功敛财,上演了一出“空城计”,这次的操作更为离谱,动拳不动嘴——直接提钱跑路。2月23日,声称总部在香港的加密交易所BitForex在其热钱包中提取了近5700万美元后彻底消失在公众视野,而用户,再也无法登录访问自己的账户。

这次的监管机构,似乎又是晚了一步。

BitForex提桶跑路,上演人去楼空

2月23日,总部位于香港的加密交易所BitForex突然暂停提款,而在此前,该平台以进行钱包及网站维护为由使得用户提现延迟。就在同一时间,其被链上侦探ZachXBT 监测到在交易所停止处理交易之前,三个BitForex热钱包出现了约5650万美元的加密货币外流。

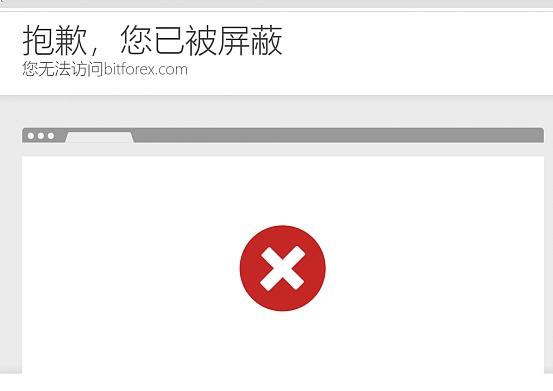

2月26日,该交易所的网站也正式关闭。用户无法登录自己的账户,也无法加载网页,开始在社交媒体上寻求帮助。然而,BitForex的X平台账户在2月21日以来就已不再更新,而在其官方Telegram频道上,多个用户发布消息称其账户无法输入,仪表板也不显示任何资产。该群组拥有23413 名成员,目前有超过1000 名用户在线等待交易所的回复。据小道消息称,Bitforex电报渠道的管理员之一Hazel_BitForex 已删除个人账户。

BitForex官网已无法打开,图片来源:BitForex官网

尽管平台官网已无法进入,但根据LinkedIn 上的披露,大众仍能找到诸多公开信息。BitForex 平台总部位于香港,声称拥有600万注册用户,并有51-200名员工,在德国、爱沙尼亚、新加坡、马来西亚、菲律宾和其他国家均设有团队。而根据香港公司注册处的信息,该公司于2018年注册成立,注册地点于香港北部新界的葵芳地区。实际上,其早年曾以币夫网这一中文名称在大陆活跃过一段时间,后因监管退回至海外地区。在该公司发布的新闻稿中,也列明了几个相关的营业地点。而从营业地点来看,最终事实只有四个字——人去楼空。

在此特援引DL news的驻港记者Callan Quinn经实地走访注册地与营业地后的报道进行说明,不同于加密企业密集注册在市中心,或扎堆在科学园以及数码港,该企业反而坐落在距市中心约40分钟的地铁荃湾线的终点站,住宅区葵芳屋村附近的大连排工业区内。

BitForex所在注册地点,图片来源:Callan Quinn

据注册地现场的工作人员表示,其公司主要提供虚拟地址供旨在设立香港办事处的中国大陆企业使用,目前已服务数千家企业,在公司网址上均有列明,BitForex也仅仅是其中之一。BitForex 还把公司秘书的地址列在拐角处的另一个处——工业综合体二楼的D/3公寓楼上的办公楼,不出意外,此处也并无人在。

最后一个相关地点则在相对繁华的旺角,尽管由于住户不在而难以进入,但办公楼门口散落的信件与包裹对应着不同的公司名,可以推测,该地址也不过是虚拟地址服务之一。谷歌地图应证了这一事实,地图显示不止BitForex一家企业使用了这一地址。

地址都是虚假伪造,而宣称的数百名工作人员早已不翼而飞,无疑不在昭示这是一起有预谋的骗局。暂停提款发生在平台首席执行官Jason Luo离职一个月后,这也让用户认为这就是拿钱跑路的开端,因为据文件显示,Jason是公司唯一的股东和董事,现居住在深圳。

实际上,先不论诈骗手段如何,该平台也已不是首次出问题,多地金融监管机构都对其进行过警告声明。早在20年10月,马来西亚金融管理机构证券委员会(SC)就将BitForex列入未授权警告名单。而在2023年4月,日本金融厅 (FSA) 也曾指控 BitForex 违反该国的资金结算法,英国金融服务管理局也披露称,BitForex交易所一直在未经注册的情况下在该国开展业务。

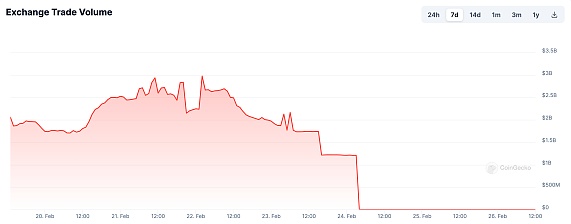

但这似乎并不影响平台运营,在退出上述地区后,23年9月,BitForex就称自身为全球市值领先的加密货币交易所之一,日交易量约为26亿美元。根据CoinGecko数据,2月22日至24日期间,该交易所的交易量从25亿美元下降至10亿美元。目前已无数据机构记录追踪该平台,但有趣的是,早在19年,BitForex就被Chainalysis 曝光过交易数据造假,指出平台真实流动性仅为其报告交易量的 1/800,造假比例让人瞠目结舌。

BitForex交易量下降迅速,来源:CoinGecko

海外群体覆盖,线索千丝万缕,证监会终发声明

监管一如既往般姗姗来迟。

3月4日,在暂停提款超过一周后,香港证券及期货事务监察委员会(证监会)发布公告告诫公众,提防一个宣称以BitForex名称运作的虚拟资产交易平台,其涉嫌虚拟资产欺诈行为。BitForex没有获证监会发牌,亦没有向证监会申请牌照,以在香港经营虚拟资产交易平台,证监会已将其列入可疑虚拟资产交易平台警示名单。

同时,香港证监会再次告诫投资者提防在不受规管的虚拟资产交易平台上买卖虚拟资产的风险。如平台终止运作、倒闭、遭黑客入侵或出现任何资产被挪用的情况,投资者或有可能损失在该平台上持有的全部投资。

香港证监会列出的可疑平台,来源:香港证监会

但在之前,证监会列出了14家可疑虚拟资产交易平台警示名单,该名单并无BitForex。就在2月29日,证监会宣布虚拟资产交易平台申牌截止,共有21家平台提交了申请材料,根据条例规定,在该日期前未申请牌照的交易所须在2024年5月31日前结束在香港的业务,无牌经营属刑事罪行。或许这也是压垮BitForex交易所最后一根稻草的原因。

相比此前诈骗更多针对港人,纵观X平台的发言,本次交易平台消失似乎牵扯了更多海外群体,众多海外人士发起受骗人电报群进行声讨与追踪。而进一步追踪,OMI这个代币被频频提及。

X平台上多个海外OMI持有者询问BitForex,来源:X平台

据官网披露,OMI是基于区块链NFT以及数字收藏品的交易平台ECOMI的生态币,该代币仅在4个交易平台上上线,分别为OKX、BitForex、Gate和AscendEx,其中,又尤其以BitForex为主要集聚地,数据显示,该交易所持有OMI总供应量的7%。因此,本次交易所的跑路,对OMI的部分持有者而言影响显著,X平台上针对此的追诉也最为激烈。但从币价来看,该币种似乎并未遭受影响,现报0.001083美元,7天内上涨29.20%,不过要是对比最高的0.008美元,显然跌了不止一星半点。

在事件发生后,ECOMI在X平台的官方账号立马给出了回应,称已经开始尝试与当地政府联系,并积极联系交易所,但没有任何更新可提供。对此,也有部分持有人认为该机构或与交易所有所关联,原因是其把大部分市值与生态放置于BitForex上,同时也有人称当局正在介入展开调查,原因是OMI相关项目在事件后关闭了电报群并进行了人员调整与变动。但从当前的信息来看,似乎并无直接信息点名该机构与交易所跑路的相关关系,证监会也未提到相关项目。

无独有偶,一家22年就已倒闭的香港交易所 Atom Asset (AAX)也于最近有所动作。据Beosin团队追踪,沉寂426天后,AAX交易所钱包开始活动,分批次转移了7400万美元大额资金至其它地址,尝试躲避AML工具的识别和监控。AAX曾经是香港最大的加密交易所之一,尽管前首席执行官 Thor Chan 和董事会成员梁浩明已于22年因诈骗被香港警方逮捕,但其创始人仍然身份不明,且携带价值2.3 亿港元(合2941万美元)的用户资金和持有交易所钱包访问权限的私钥,现处于在逃状态。由于事件发生的巧合性,也有人推测两大交易所创始人或许有所关联,但也多是猜测,并无实质证据。

监管的问题?还是最坏的结局?

种种事件的发生,再度让加密和证监会涌上风口浪尖。

但从事实来看,仅从金融监管来看,香港已然是全球领先级别,而对于加密监管,由于严苛的牌照化许可和可投资币种的局限性,《亚洲周刊》更是发文表示认为香港监管过度保守阻碍创新灵活性。

其次,证监会作为证券监督性机构,本就难以在诈骗事实发生前介入调查,其也并无该类权限,仅有在收到投诉后以声明形式发布警告或配合警方行动。香港作为全球遐迩闻名的金融之都,其优良且宽松的营商环境对所有企业开放,众多离岸机构来此注册,若一一查询,难度也如同大海捞针。而从另一角度来看,香港民众对于加密领域的认知显然不够充足,前科信息众多的交易所,竟也有号称的600万客户,不论数据真假,仍是让人难以置信,但或许也正是由于信息差,本次诈骗案才会涵盖众多的海外群体。

当然,也并非说证监会毫无责任,一个可疑的交易所蹦跶了快6年,期间也有多家机构曾对其进行过报道和其他地区金融监管方的声明,而监管本身却毫无反应,这也无疑折射出香港的过度宽容与监管忽视。

从影响来看,本次平台事件远不如JPEX影响深远,后续处理跟进如何尚难追踪,但新创始人能否搜寻到、赃款能否追回,以目前来看,仍是疑点重重,而最差的结果,或许又只是多了一桩无头悬案,以及再次被血淋淋的现实上了一节课的投资者们。

参考文献:

Callan Quinn:My search for a Hong Kong crypto exchange that disappeared with $57m led to an empty office in a strip mall;

Gaurav Roy:BitForex Disappears Without a Trace—Website Vanishes, Investors Left in Limbo

As we all know, after the fraud case, Hong Kong is very cautious in the supervision of the virtual asset trading platform, both in terms of information disclosure and advertising. It feels like being bitten by a snake for ten years, and we do our best to ensure the interests of investors. However, everyone in the industry also knows that it is better to block the public than to improve the public awareness. It is not uncommon to run around in the encryption circle where phishing links, acquaintances, pyramid schemes and hacking operations are everywhere. Just a few days ago, another trading platform was in Hong Kong. Successfully collecting money staged an empty plan. This operation was even more outrageous. It was claimed that the encrypted exchange headquartered in Hong Kong completely disappeared from public view after withdrawing nearly 10,000 dollars from its hot wallet, and users could no longer log in and visit their accounts. This time, it seems that the regulator was too late to lift the bucket and run away. The performer suddenly stopped withdrawing money from the encrypted exchange headquartered in Hong Kong on the grounds of wallet and website maintenance. At the same time, it was detected by online detectives that about ten thousand dollars of encrypted money flowed out of three hot wallets before the exchange stopped processing transactions. On April, the website of the exchange was officially closed, and users could not log in to their own accounts or load web pages and began to seek help on social media. However, the platform account has not been updated since June, and many users posted messages on its official channel saying that their accounts could not be entered into the dashboard or displayed any assets. According to gossip, one of the administrators of the telegraph channel has deleted his personal account. official website has been unable to open the picture source. Although the platform official website has been inaccessible, according to the disclosure on the website, the public can still find many public information platforms. The headquarters is in Hong Kong, claiming to have 10,000 registered users, and employees have teams in Germany, Estonia, Singapore, Malaysia, the Philippines and other countries. According to the Hong Kong Companies Registry, Information The company was incorporated in 1998 and its registered place is in Kwai Fong, New Territories, northern Hong Kong. In fact, it was active in the mainland under the Chinese name Bifu.com for some time in its early years, and then it was returned to overseas areas after supervision. In the press release issued by the company, several related business locations were also listed, but from the business location, the final fact is that only four people went to the building. Here, the report quoted by reporters in Hong Kong after visiting the registered place and business place on the spot is different from the intensive registration of encryption enterprises. In the city center or clustered in the Science Park and Cyberport, the company is located in the registered location of Dalian Pai Industrial Zone near Kwai Fong Uk Village, the terminal of the subway Tsuen Wan line about minutes away from the city center. According to the staff at the registration site, the company mainly provides virtual addresses for Chinese mainland enterprises aiming to set up Hong Kong offices. At present, thousands of enterprises have been listed on the company website, and only one of them has listed the address of the company secretary. The other corner is the office building above the apartment building on the second floor of the industrial complex. There is no accident here. At the last related location, it is in the relatively prosperous Mong Kok. Although it is difficult to enter because of the absence of residents, the letters and parcels scattered at the entrance of the office building correspond to different company names. It can be speculated that the address is just one of the virtual address services. Google Maps should prove this fact. The map shows that more than one company has used this address, and the addresses are all false and forged, claiming hundreds of jobs. The personnel have long since disappeared, which undoubtedly shows that this is a premeditated scam. The suspension of withdrawal occurred one month after the CEO of the platform left office, which also makes users think that this is the beginning of taking money and running away, because according to the documents, the only shareholder and director of the company now live in Shenzhen. In fact, regardless of the fraudulent means, the platform is not the first time to go wrong. Financial regulators have issued warning statements on it, and the Securities Committee of Malaysia's financial management institution will be listed as early as January. Authorized the warning list, and in June, Japan's Financial Services Agency also accused it of violating the country's fund settlement law. The British Financial Services Authority also disclosed that the exchange has been conducting business in the country without registration, but this does not seem to affect the operation of the platform. After withdrawing from the above-mentioned areas, it called itself one of the world's leading cryptocurrency exchanges in terms of market value, with a daily trading volume of about US$ 100 million. According to the data, the trading volume of the exchange dropped from US$ 100 million to US$ 100 million from June to June. At present, there is no data institution. The record tracks the platform, but it is interesting that it was exposed as early as in 2008 that the real liquidity of the platform is only the proportion of fraud in its reported trading volume, which is staggering. The trading volume has dropped rapidly, and the overseas groups have covered countless clues. The CSRC finally issued a statement that supervision is as late as ever. After suspending withdrawals for more than a week, the Securities and Futures Commission of Hong Kong issued an announcement to warn the public against a virtual asset trading platform that claims to operate under the name. The suspected fraud of virtual assets has not been licensed by the CSRC, nor has it applied to the CSRC for a license to operate a virtual asset trading platform in Hong Kong. The CSRC has included it in the warning list of suspected virtual asset trading platforms. At the same time, the CSRC once again warned investors to beware of the risks of buying and selling virtual assets on unregulated virtual asset trading platforms, such as the termination of operation, the collapse of the platform, hacking or any misappropriation of assets, and investors may lose all their holdings on the platform. Investing in the suspicious platform listed by the Hong Kong Securities Regulatory Commission comes from the Hong Kong Securities Regulatory Commission, but before that, the CSRC listed a warning list of suspicious virtual asset trading platforms, which did not submit application materials for the virtual asset trading platform to be closed on June. According to the regulations, an exchange that did not apply for a license before that date must terminate its business in Hong Kong before June. It is a criminal offence to operate without a license, which may be the last straw to crush the exchange. Deceive more speeches aimed at Hong Kong people looking at the platform. The disappearance of this trading platform seems to involve more overseas groups and many overseas people to initiate the telegram group of deceived people to denounce and track down further. This token has been frequently mentioned by many overseas holders on the platform, asking about the source platform. According to official website, this token is only online on a trading platform based on blockchain and digital collectibles, and it is especially thought that the data of the main gathering places show that the exchange holds the total supply, so the running of this exchange has a significant impact on some holders. The prosecution on this platform. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。