谈普通人应如何在币圈牛市中“盯真”和“维权”?

随着比特币、以太坊等老牌虚拟币近期的猛涨,大部分老友们都认为期盼已久的“加密资产之春”“超级牛市”已经到来,开始迫不及待地将大量资金投入加密资产市场中寻找暴富机遇。同时飒姐注意到,由于比特币老大哥的爆发光环巨大,连带着整个币圈大大小小的币都跟着喝汤,价格或多或少的开始看涨。

对长期关注加密资产的伙伴们来说这本来是件好事,但奈何机遇之下总是潜伏着危机,部分不法分子又开始把目光投向了币圈投资者的钱袋上,并且作案手法愈发粗暴迅速。2024年2月23日,一家公开声称总部在香港的加密交易所BitForex以迅雷不及掩耳之势,从自己的线上加密资产钱包中提现5700万美元后,直接提桶跑路,创造了香港加密资产圈2024年“第一跑”的新纪录。

BitForex是怎么骗、怎么跑的?

币圈的伙伴们可能对BitForex这个名字比较陌生,但实际上BitForex就是之前的“币夫网”交易所换了个皮而已。对于长期关注和研究加密资产犯罪的飒姐团队而言,BitForex可算是“老相识”了,甚至团队在BitForex尚未跑路前,还经常以该交易所为典型案例,讲解加密资产犯罪案例中经典的“虚假流动性陷阱”“洗售交易”等具体犯罪手段。

从2019年前后,BitForex就通过频繁的多账号自买自卖、多平台交叉交易、资金体内体外循环的方式,将自家交易所的流动性虚假地拉高。但2023年9月,其甚至开始自称自己是“全球市值领先的加密货币交易所之一,日交易量约为26亿美元”。

但实际上BitForex整个交易所层面的交易数据都假得惊人,根据著名第三方加密资产犯罪平台Chainalysis的犯罪研究报告数据,早在2019年BitForex的真实交易数据大约只有其对外公开数据的八百分之一。但即使是在其8000%的惊人造假率被揭露之后,由于缺乏强有力的监管措施,BitForex依然能够继续通过频繁上线多种小币、刷流水做市的方式吸引到数量众多的散户投资者。

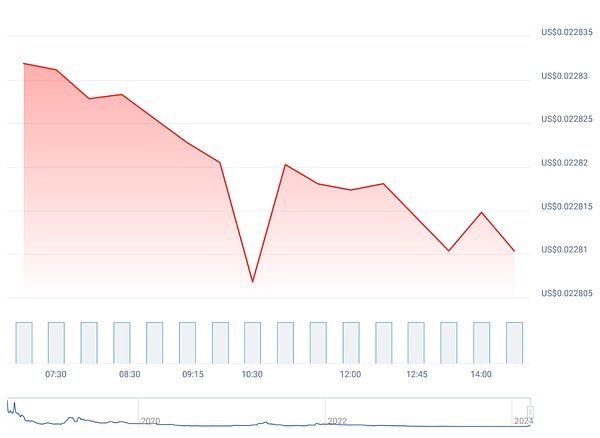

飒姐团队在拉取该交易所交易数据的时候还注意到,该平台在跑路前其实已有明显预兆:就在跑路前两天,BitForex的交易数据开始断崖式下跌,2月22日的交易数据在图表上甚至快跌出了一个“直角”,整个交易数据极度异常,就像一个长期打药续命的病人突然被拔管一样。

(图片来自第三方数据公司)

像这样的小规模交易所在流水暴跌之后,不出意外就是提桶跑路了,但让大家没想到的是,这家跑得如此之快。2024年2月23日,BitForex直接在自己的线上加密资产钱包中提现5700万美元后关闭了自己的网站,加密社群客服直接删号消失。根据ZachXBT的报告,准确来说,BitForex 的钱包共流出了 5650 万美元。其中包括5400 万美元的TRB、100 万美元的ETH和25 万美元的USDC。

普通散户,如何在纷繁的牛市中一眼盯真?

1、远离野鸡交易所

远离十八线野鸡交易所!这句话飒姐团队已经在无数个场合和无数篇普法文章中说了百八十遍,并且一直以来都不厌其烦地致力于将这一铁则扩散传播至一切与加密资产投资者教育相关的地方。

相信对于各位理性、聪明的伙伴们来说,远离野鸡交易所的原因和理由已经不用再赘述,但飒姐团队作为专业的刑事辩护团队,在总结办案经验的基础上还是要提示大家:再高级的骗术也会被识破,再低级的骗术也有人上当。聪明人踩坑野鸡交易所无外乎对自身的投资水平过于自信、被短暂的收益所欺骗,从而忽视了骗局的本质。换言之,远离野鸡交易所也就是远离迷信“短平快”投机的错误认知和不适宜的贪欲。

2、学会使用第三方数据工具辨假识真

对于投资者而言,合理、正确地使用第三方数据工具是非常重要的,合理的参考各项数据能够有效的帮助投资者识别平台的异常举动以及可能存在的吸收交易情况,例如在BitForex案中,如果投资者利用第三方工具核查2024年2月22日至24日期间的标准化交易数据(将平台网络的实际流量作为参数加入算法,用以识别平台是否存在操纵市场行为的统计数据)就能发现,BitForex的实际交易量水分极大,其真实发生的交易量大约只有千万美元级别,远不及其公开的20亿美元。

另外,如Dune Analytics、Chainalysis也是飒姐团队常用的链上数据监测和分析工具,多家平台定期发布的虚拟资产报告不仅数据来源广泛,也具有一定的真实客观性,可作为投资参考。

3、重点关注交易所人事变动

对于缺乏有效监管的加密资产交易平台而言,投资者尤其需要注意平台在近期是否发生重大人事变动、股东变动等情况,根据飒姐团队的办案经验,加密资产平台大规模或显著异常的人事变动往往意味着平台可能已经“易主”或改变了正常的经营策略为跑路做准备,或是想要实现变相清盘。

从BitForex案件来看,ZachXBT的初步调查结果显示,2024年1月,BitForex明面上的首席执行官Jason Luo突然辞职,辞职理由为“新的领导团队将加入 BitForex,将交易所推向更高的高度”。目前,除Jason Luo的履历造假问题外,飒姐团队目前尚未发现其离职与BitForex卷款跑路之间存在因果关系,但依然提示大家需要对此类信息予以密切关注。

大陆居民被骗,如何在香港维权?

对于BitForex案而言,2024年3月4日,香港证券及期货事务监察委员会(简称“香港证监会”)就加密货币交易所BitForex涉嫌欺诈交易一事已经对外发布了公告:BitForex 虽然总部位于香港,但并不拥有该国数字资产运营商监管框架所要求的许可证。由此来看,香港的司法机关对该诈骗案具有管辖权,那么,大陆居民如果因BitForex诈骗行为而遭受巨大损失,就需要考虑通过香港司法体系维护自己的正当权利。

飒姐团队以前就为伙伴们讲解过我国香港地区刑事案件的追赃挽损制度设计与大陆地区存在极大的差异。简言之,大陆地区的《刑法》《刑事诉讼法》等法律、司法解释和行政法规要求司法机关在处理经济类刑事案件的过程中,负有依职权为被害人追回赃款、挽回损失的职责,大陆地区刑事犯罪案件的当事人可对司法机关的追赃挽损工作进行监督,但不得直接参与相关工作。而香港的司法机关处理经济类刑事犯罪案件的职权范围仅限于处理刑事案件本身,即查明刑事犯罪的事实,并依据法律规定对其定罪处罚,而不负有追查、追回被害人资金的职责,即使扣押的犯罪嫌疑人财物可能属于赃款、赃物,未经法定程序也不能直接归还给被害人。因此,被害人追赃挽损的重要途径就是向香港地区有管辖权的法院另行对犯罪嫌疑人提起民事诉讼。

以BitForex为例,大陆居民目前可直接通过电话、网上报案或肉身到港等方式,向香港警方或香港政府联合财富情报组(JFIU)等机构对BitForex实施诈骗犯罪一案进行举报、控告,并提供相关账户资料,明确要求警方冻结犯罪嫌疑人的相关银行账户、加密资产账户。另外,如果受损失金额较大而相关账户又尚未被警方冻结,资金存在被转移的风险的,可以委托律师向香港法院申请紧急冻结令以冻结涉案账户。

当然,如果要维护自身合法权益,BitForex案的受害人们还是需要进款委托律师追讨被诈骗的资金。从该类诉讼的诉因(类似于大陆地区的案由)来看,可选诉因主要有:(1)诈骗(Fraud);(2)不当得利(Unjust Enrichement);(3)法律构定信托或推定信托(Constructive or Resulting Trust)等。毫无疑问,BitForex案构成诈骗的可能性是极大的,原告已经能够提供相应证据来对BitForex实施了诈骗行为进行有效举证。

另外,如果大陆地区被害人要对BitForex提起民事诉讼,部分证据可能无法自行取得,例如犯罪嫌疑人的银行账户、账户开户人信息、银行转账流水、加密资产钱包详情等信息和文件。在实践中,该部分证据一般由香港警方或涉案银行、加密资产平台提供,若前述机构不提供相关证据,可通过律师向法院申请披露令的方式获得相关信息、文件。

With the recent surge of old virtual coins such as Bitcoin Ethereum, most of my old friends think that the long-awaited spring of encrypted assets and the super bull market have arrived, and they can't wait to put a lot of money into the encrypted assets market to find the opportunity to get rich. At the same time, Sister Sa noticed that due to the huge aura of Bitcoin's big brother, the whole currency circle, large and small coins, began to drink soup, and the price became more or less bullish, which was a good thing for the partners who had been concerned about encrypted assets for a long time, but there was nothing to do. Under the circumstances, there is always a latent crisis, and some lawless elements have begun to turn their attention to the money bags of investors in the currency circle, and their modus operandi has become more and more violent and rapid. On April, a crypto transaction that publicly claimed to be headquartered in Hong Kong was so fast that it was too fast to withdraw $10,000 from its online crypto asset wallet and then directly set a new record of how to cheat and run the first time in the crypto asset circle in Hong Kong. The partners in the currency circle may be unfamiliar with this name, but it was actually before. The exchange of Bifu.com has changed its skin, which can be regarded as an old acquaintance for Sister Sa's team who has been paying attention to and studying the crime of encrypted assets for a long time. Even before the team ran away, it often used the exchange as a typical case to explain the classic false liquidity trap in the crime of encrypted assets. wash sale trading and other specific criminal means have falsely increased the liquidity of their own exchanges through frequent in-vivo and out-of-circulation of multi-account self-buying and self-selling multi-platform cross-trading funds since the year before and after. Even began to claim to be one of the world's leading cryptocurrency exchanges with market value, with a daily trading volume of about US$ 100 million, but in fact, the transaction data at the whole exchange level are surprisingly false. According to the crime research report of the famous third-party cryptoasset crime platform, the real transaction data as early as 2000 was only about 800% of its public data, but even after its amazing fraud rate was exposed, it was still able to continue to go online frequently due to the lack of strong regulatory measures. The way of making the market by running water attracted a large number of retail investors. Sister Sa's team also noticed that the platform actually had obvious signs before it ran away. Just two days before it ran away, the transaction data began to fall off a cliff, and the transaction data on March even fell off a right angle on the chart. The whole transaction data was extremely abnormal, just like a patient who had been taking drugs for a long time was suddenly unplugged. The picture came from a third-party data company, and a small-scale exchange like this was flowing. After the plunge in water, it was not an accident to run away with a bucket, but what everyone didn't expect was that this company ran so fast that it directly withdrew $10,000 from its online encrypted asset wallet on March, and then closed its website. The encrypted community customer service directly deleted the number and disappeared. According to the report, the wallet flowed out of $10,000, including $10,000 and $10,000. How can ordinary retail investors stay away from the pheasant exchange and the eighteen-line pheasant exchange in the complicated bull market? My sister's team has said it for 180 times on countless occasions and numerous articles on popularizing the law, and has been tirelessly committed to spreading this iron rule to all places related to the education of crypto-asset investors. I believe that for all rational and intelligent partners, the reasons and reasons for staying away from the pheasant exchange need not be repeated. However, as a professional criminal defense team, I still want to remind you that no matter how advanced the deception is, it will be seen through. There are also people who are deceived by the level of deception. It is very important for investors to learn to use third-party data tools to distinguish the false from the true. It is very important for investors to use third-party data tools reasonably and correctly. Reasonable reference to various data can effectively help investors identify the flat. The abnormal behavior of Taiwan and the possible absorption of transactions. For example, if investors use third-party tools to check the standardized transaction data during the period from March to March, and add the actual traffic of the platform network as a parameter to the algorithm to identify whether there is statistical data of market manipulation on the platform, they can find that the actual transaction volume is extremely large, and the real transaction volume is only about 10 million US dollars, far from the public billion US dollars. In addition, it is also the chain data commonly used by Sister Sa's team. Monitoring and analysis tools: The virtual asset reports regularly published by many platforms not only have a wide range of data sources, but also have certain authenticity and objectivity, which can be used as investment reference. Focus on personnel changes of the exchange. For the encrypted asset trading platform that lacks effective supervision, investors need to pay special attention to whether there are major personnel changes in the platform in the near future, shareholder changes, etc. According to Sister Sa's team's handling experience, large-scale or significantly abnormal personnel changes in the encrypted asset platform often mean that the platform may have changed. The owner either changed the normal business strategy to prepare for running away or wanted to realize disguised liquidation. According to the case, the preliminary investigation results show that the CEO resigned suddenly on the day of the month, and the reason for his resignation was that the new leadership team would join the exchange to a higher level. At present, in addition to the problem of fraudulent resume, Sister Sa's team has not found a causal relationship between his departure and running away with money, but it still reminds everyone that it is necessary to pay close attention to this kind of information and how mainland residents are cheated to survive in Hong Kong. As far as the case is concerned, the Hong Kong Securities and Futures Commission (hereinafter referred to as the Hong Kong Securities Regulatory Commission) has issued an announcement on the suspected fraudulent transactions of cryptocurrency exchanges. Although it is headquartered in Hong Kong, it does not have the license required by the regulatory framework of digital asset operators in the country. From this, it can be seen that the judicial organs in Hong Kong have jurisdiction over the fraud case. If mainland residents suffer huge losses due to fraud, they need to consider safeguarding their legitimate rights through the Hong Kong judicial system. Sister Sa explained to the partners before that the design of the system of recovering and recovering losses in criminal cases in Hong Kong is very different from that in mainland China. In short, the judicial interpretations and administrative regulations of the criminal law and criminal procedure law in mainland China require the judicial organs to recover the stolen money and recover the losses for the victims according to their functions and powers. The parties to criminal cases in mainland China can supervise the judicial organs' work of recovering and recovering losses, but they are not allowed to directly participate in related work. The scope of functions and powers of the judicial organs in Hong Kong to deal with economic criminal cases is limited to handling criminal cases. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。