加密世界探索:破顶的比特币还是否需要从 ETN 中获益?

作者:克格莫;来源:奔跑财经

周二,比特币再创新高,价格上涨达7.3万美元的历史高点。

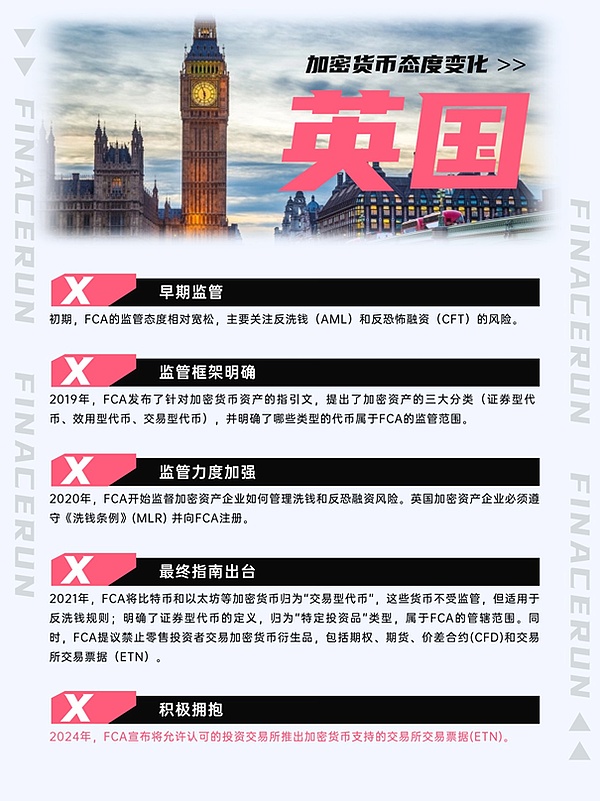

消息面上,英国金融行为监管局(FCA)公开表示,将允许认可的投资交易所推出加密货币支持的ETN。伦敦证券交易所也在当天宣布,将于今年第二季度开始接受比特币和以太坊ETN的申请,具体开放日期将在“适当时候”公布。

这一重大举措背后,是随着投资者对数字资产需求的增加,对传统金融市场的进一步创新探索,还是找寻监管下的加密货币投资新渠道?

什么是ETN?

ETN(Exchange Traded Note),指交易所交易票据,是一种无担保的债券类金融产品,其本质是一种债务融资手段。通俗来讲,发行机构向投资者借债筹措资金,在债券期满时向投资者按一定金额向持有者偿付,到期日通常为10年以上。与普通债券不同的是,投资者持有的是在一段时间内根据投资标的价格指数涨跌兑付资金的承诺,其收益为在此其基础上减去必要的管理费,不在存续期支付利息。

全球第一只ETN是摩根士丹利在2002年3月发行的BOXES,其投资标的是一只生物科技指数的走势。以BOXES示例,设定其面值为1万美金,债券期为30年(即摩根士丹利需要在30年后支付债券持有人与生物科技指数完全相同的报酬)。30年后,这只生物科技指数涨了310%,那么摩根士丹利需要支付投资者4.1万美元(未扣除管理费用)。

ETN的投资标的通常为投资门槛较高的指数,如大宗商品指数、汇率指数、波动率指数等。

从金融产品角度来说,ETN为投资者提供了更为多元的投资选择,且是一些很难接触的产品。从风险角度来说,由于ETN是由发行方担保的金融产品,没有其他资产支撑,投资者或会面临一定的风险敞口。因此,监管部门通常会对ETN发行人设定一定的门槛。

ETN与ETF的区别

对加密世界的影响

比特币ETN并不是一种全新的加密货币衍生品。

早在2015年,比特币ETN就已经获得瑞士监管机构的批准上市。2018年,在当时比特币ETF获批无望的情况下,名为Bitcoin Tracker One的比特币ETN在美国市场上市。这是美元持有者首次可以在不持有比特币的情况下投资比特币。

但是,由于金融产品特征的差异。比特币ETN更多被投资者看作是比特币ETF的「软替代品」,对市场并未形成较大的牵引力。如今,比特币ETF已经获批,新的比特币ETN产品或将更难引发新的市场叙事。

从产品特性角度看。对于加密世界而言,ETN虽然为那些无法直接购买加密货币资产的投资者提供了新的选择,但其本质并不涉及持有相关资产,只是通过追踪价格走势来让用户参与投资,并不能如ETFs一般吸引资金流入,且不会对供需产生影响。对于以太坊ETN产品,虽然监管机构将获批时间推迟,市场对于加密货币产品的投资需求也与日俱增,但由于以太坊ETF本身已属于箭在弦上的状态,市场期望堆积已久,以太坊ETN产品或将不会引发较强烈的市场情绪,仅会存在一些期望声量。

透过现象看本质,加密货币本身价格波动频繁,这与ETF所具备的市场规模和流动性更为匹配。ETN体量小,市场号召力不足,并且投资者会面临市场和发行方的双重风险。

从监管角度来看,英国金融监管机构允许认可的投资交易所推出加密货币ETN,是英国加密货币领域监管前进的一大步。在欧盟通过MiCA(Markets in Crypto Assets Regulation bill)法规后,英国一直致力于将加密货币纳入其现有监管框架。2022年4月,英国政府发布了一项愿景,旨在将英国打造成全球加密货币投资中心,并承诺为加密世界的发展创造适宜条件。然而,这一目标的实施难度较大,需要积极探索如何在金融创新和监管之间取得平衡。

作为全球金融中心之一,英国面临着加密货币的去中心化、匿名性和跨境特性所带来的挑战,这些特点对传统金融体系具有颠覆性的影响。在这种情况下,ETN作为一种加密货币金融产品的创新形态,可以为构建完善的监管措施提供实践案例参考。同时,ETN不会直接影响加密市场,从而避免了可能引发较大震荡的风险。

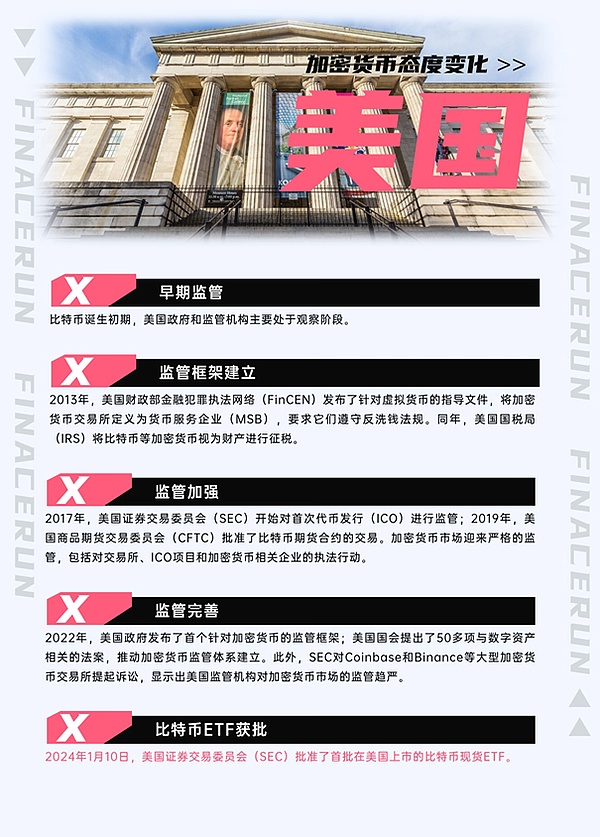

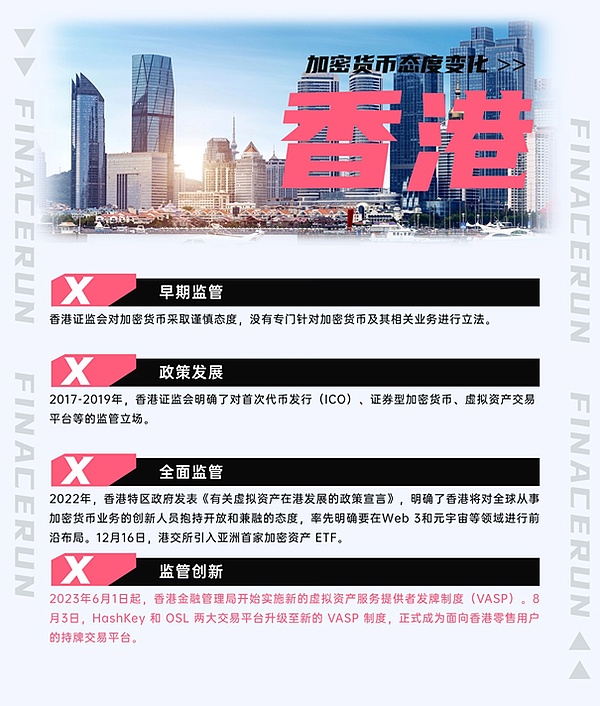

监管环境对于不断成熟的加密货币市场发展有着至关重要的影响。从全球范围来看,世界各国对待加密货币的态度各有不同,但不难发现,近几年各国家和地区对于加密货币的态度正逐渐转变为积极。

比特币ETF在美国获批之后,主流金融市场对比特币等加密货币的认可进一步提升,对全球其他国家的监管态度也一定产生影响。而此次英国金融行为监管局(FCA)允许推出加密货币支持的ETN,再一次释放了全球加密世界整体向上发展的积极信号。

加密市场的未来并非只有价格的高点,同时也还需要监管政策的进步。相信通过ETN金融创新产品的经验,英国有望在加密货币领域取得进一步的发展,以此带动全球加密世界的持续发展。

Author Kemmo Source Running Finance On Tuesday, bitcoin hit a new high and the price rose to an all-time high of 10,000 US dollars. On the news, the British Financial Conduct Authority publicly stated that it would allow recognized investment exchanges to launch cryptocurrency support. The London Stock Exchange also announced on the same day that it would start accepting applications for bitcoin and Ethereum in the second quarter of this year. The specific opening date will be announced at an appropriate time. This major move is behind the increasing demand for digital assets by investors for traditional financial markets. Further innovation and exploration or finding new channels for cryptocurrency investment under supervision? What does it mean that exchange-traded bills are unsecured bond financial products, and their essence is a means of debt financing? Generally speaking, issuers borrow money from investors to raise funds. When bonds expire, they pay investors a certain amount. The maturity date is usually more than years. What is different from ordinary bonds is that investors hold a promise to pay the funds according to the price index of the investment target within a period of time. The income is based on this, and the necessary management fees are deducted, and interest is not paid during the duration. The world's first is that Morgan Stanley issued its investment target in June, and its investment target is a biotechnology index. Take the example to set the bond period with a face value of US$ as the year, that is, Morgan Stanley needs to pay the bondholders exactly the same remuneration as the biotechnology index after the year, and then Morgan Stanley needs to pay investors US$ 10,000 for the investment target without deducting management fees. Indices with high investment threshold, such as commodity index, exchange rate index and volatility index, provide investors with more diversified investment choices from the perspective of financial products, and some products are difficult to contact. From the perspective of risk, because financial products guaranteed by issuers have no other assets to support investors or will face certain risk exposure, the regulatory authorities usually set certain thresholds for issuers. The impact of Bitcoin on the encrypted world is not a brand-new addition. Secret currency derivatives were approved by Swiss regulators as early as 2008. In the year of listing, Bitcoin named was listed in the US market when there was no hope of being approved. This is the first time that dollar holders can invest in Bitcoin without holding it. However, due to the differences in the characteristics of financial products, Bitcoin is more regarded as a soft substitute for Bitcoin by investors, which has not formed a great traction for the market. Now Bitcoin has been approved for new bitcoin products, or it will be more difficult to trigger. From the perspective of product characteristics, the new market narrative provides a new choice for investors who can't directly buy cryptocurrency assets, but its essence does not involve holding relevant assets. Just tracking the price trend to let users participate in investment can't attract capital inflows as usual and will not have an impact on supply and demand. For Ethereum products, although the regulatory authorities will postpone the approval time, the market demand for cryptocurrency products is also increasing, but because of Ethereum's capital, The market expectation has been piling up for a long time. Ethereum products will not cause strong market sentiment, but there will be some expectation. Through the phenomenon, the price of cryptocurrency itself fluctuates frequently, which is more in line with the market size and liquidity. The market appeal is small and investors will face the dual risks of the market and issuers. From the regulatory point of view, the British financial regulator allows recognized investment exchanges to launch cryptocurrency, which is British cryptocurrency. A big step forward in the supervision of the currency field. After the European Union passed the regulations, Britain has been committed to bringing cryptocurrency into its existing regulatory framework. In June, the British government issued a vision to make Britain a global cryptocurrency investment center and promised to create suitable conditions for the development of the cryptocurrency world. However, it is difficult to implement this goal, and it is necessary to actively explore how to strike a balance between financial innovation and supervision. As one of the global financial centers, Britain is facing the decentralization, anonymity and anonymity of cryptocurrency. Challenges brought by cross-border characteristics have a subversive impact on the traditional financial system. In this case, as an innovative form of cryptocurrency financial products, it can provide practical case reference for building perfect regulatory measures without directly affecting the cryptocurrency market, thus avoiding the risk that may cause great shocks. The regulatory environment has a crucial impact on the development of the mature cryptocurrency market. From a global perspective, countries around the world have different attitudes towards cryptocurrency. At the same time, it is not difficult to find that in recent years, the attitudes of various countries and regions towards cryptocurrencies are gradually changing into positive ones. After the approval of Bitcoin in the United States, the recognition of cryptocurrencies such as Bitcoin in the mainstream financial market has been further enhanced, which will certainly have an impact on the regulatory attitude of other countries in the world. The British Financial Conduct Authority's permission to launch cryptocurrency support has once again released a positive signal that the global cryptocurrency world as a whole is developing upwards. The future of the cryptocurrency market is not only a high price, but also needs it. It is believed that through the experience of financial innovation products, Britain is expected to make further development in the field of cryptocurrency, so as to drive the sustainable development of the global cryptocurrency world. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。