美联储议息会议笔记:通胀别慌 利率会降(2024年3月)

来源:智堡

摘要

本次会议,美联储保持利率水平不变。

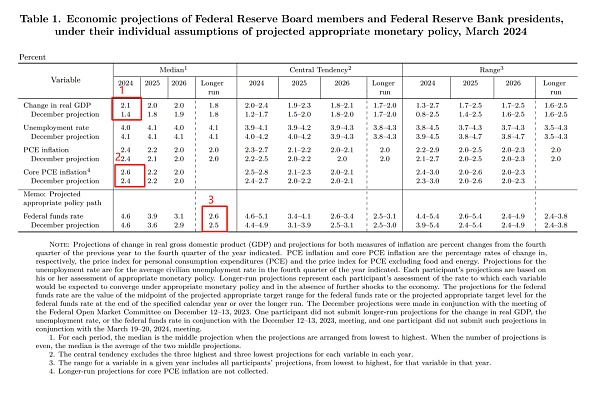

会议公布了新的经济预测,上调了对本年度的GDP增长预测与通胀预测。

点阵图变化焦灼,预计2024年降息3次(10位委员),未来两年的降息次数亦下降,但符合预期。

发布会鲍威尔重申本轮周期利率已经触顶,确认了在今年启动降息是合适的。

1月和2月的CPI数据并未改变鲍威尔对去通胀进程的乐观态度,他强调FOMC本就预期通胀回落不会一帆风顺(bumpy)。

对就业市场的强势表现,鲍威尔显得“毫无保留”,并强调就业过强不会影响降息决定。

有关长期利率预测近5年内的首次上行,鲍威尔表态“不知道具体水平在哪”但不会像疫情前那么低了。

对于QT Taper,联储已经开始讨论资产负债表的结构问题,鲍威尔强调了流动性的“分布”问题。

从观感上看,本次会议几乎没有展露出任何的鹰派信号,市场在会议前所担忧的二次通胀风险并未进入FOMC的视野。

笔者认为联储在开年会议上奠定的“风险管理”和“平衡风险”的姿态在本次会议上出现了bias,淡化了通胀风险,深化了对增长的乐观预期。

风险资产持续走高,10年期美债收益率冲高回落,美元跌。

声明原文(仅第一段有可忽略的小幅变化)

Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.

最近的指标表明经济活动以稳健的速度扩张。就业增长保持强劲,失业率保持低位。通胀在过去一年有所放缓,但仍然居高不下。

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. The Committee judges that the risks to achieving its employment and inflation goals are moving into better balance. The economic outlook is uncertain, and the Committee remains highly attentive to inflation risks.

委员会致力于实现在长期内充分就业和2%的通胀率。委员会认为实现就业和通胀目标的风险正在朝着更好的平衡方向发展。经济前景不确定,委员会对通胀风险保持高度关注。

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. In considering any adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks. The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in its previously announced plans. The Committee is strongly committed to returning inflation to its 2 percent objective.

为了支持其目标,委员会决定将联邦基金利率的目标区间维持在5.25%至5.5%之间。在考虑对联邦基金利率目标区间进行任何调整时,委员会将仔细评估最新数据、不断变化的前景和风险平衡。委员会预计在获得更大信心,即通胀朝着2%的可持续增长方向发展之前,降低目标区间将不合适。此外,委员会将继续按照其先前公布的计划减持国债、机构债务和机构抵押支持证券。委员会坚决致力于将通胀恢复到2%的目标水平。

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

在评估货币政策的适当立场时,委员会将继续监测经济前景的相关信息。如果出现可能阻碍委员会目标实现的风险,委员会将准备适时调整货币政策的立场。委员会的评估将考虑到广泛的信息,包括劳动力市场状况、通胀压力和通胀预期以及金融和国际发展情况。

点阵图与经济预测细节

At this meeting, the Federal Reserve kept the interest rate level unchanged. The meeting announced a new economic forecast, and raised the growth forecast and inflation forecast for this year. The bitmap changes were anxious. It is expected that the number of interest rate cuts by the second Committee members in the next two years will also decrease, but it is in line with expectations. Powell reiterated that the current cycle interest rate has peaked and confirmed that it is appropriate to start interest rate cuts this year. The monthly and monthly data have not changed Powell's optimism about the process of deflation. He stressed that inflation will not fall back. Smooth sailing Powell showed no reservations about the strong performance of the job market and stressed that too strong employment would not affect the decision to cut interest rates. Powell expressed his position on the first upward trend of long-term interest rate forecast in recent years, but he did not know where the specific level was, but it would not be as low as before the epidemic. Powell emphasized the distribution of liquidity. From the perception, this meeting hardly showed any hawkish signals about the secondary inflation that the market was worried about before the meeting. The risk has not entered the field of vision. The author believes that the attitude of risk management and risk balance laid by the Federal Reserve at the opening meeting has played down the inflation risk at this meeting, deepened the optimism about growth, and expected the risk assets to continue to rise. The yield of one-year US bonds has surged and fallen, and the dollar has fallen. The original statement only has a negligible small change in the first paragraph. Recent indicators show that economic activities have expanded at a steady rate, employment growth has remained strong, and the unemployment rate has remained low. Inflation has slowed down in the past year, but it is still high. No less than the Committee is committed to achieving full employment and inflation rate in the long run. The Committee believes that the risk of achieving employment and inflation targets is developing in a better balance direction. The economic outlook is uncertain. The Committee is highly concerned about inflation risks. In order to support its goals, the Committee decided to maintain the target range of the federal funds interest rate at between and. When considering any adjustment to the target range of the federal funds interest rate, the Committee will carefully evaluate the changing prospects and risk balance Committee with the latest data. It is expected that it will be inappropriate to lower the target range before gaining greater confidence that inflation is developing in the direction of sustainable growth. In addition, the Committee will continue to reduce the debt of government bonds and institutional mortgages according to its previously announced plan, and the Securities Committee is firmly committed to restoring inflation to the target level. When evaluating the appropriate position of monetary policy, the Committee will continue to monitor the relevant information of the economic outlook. If there are risks that may hinder the realization of the Committee's goals, the Committee will be prepared to adjust the currency in a timely manner. The evaluation of the policy stance Committee will take into account a wide range of information, including labor market conditions, inflation pressure and inflation expectations, as well as financial and international development, bitmap and economic forecast details 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

经济预测上调,这都快跟高盛(乐观派)的预测差不多了

通胀预测小幅上调,体现去通胀并非坦途。

长期利率预测小幅上升10bp,疫情以来的首次。

从点阵图来看,实际上认为降息两次内的委员是9位,而认为降息两次以上的为10位,降息次数有进一步调降的风险。

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。