加密暗流涌动 传统资金或进军RWA

A. 市场观点

一、宏观流动性

货币流动性改善。本周美联储会议放鸽,全年计划降息3次,市场上调宽松押注。市场预期美联储将在5月开始放缓量化紧缩,直到明年2月结束,这段时间将对应投资市场的最大红利期。日本央行17年首次加息。美股高位震荡,加密市场跟随美股调整后反弹。

二、全市场行情

市值排名前100涨幅榜:

主线围绕AI、MEME、SOL生态。本周BTC大幅回调,现货ETF出现净流出。市场主线围绕Meme、SOL生态。Solana链类似17年ICO的ETH行情,承接了BTC流出山寨币的资金。这次土狗热是本轮牛市动物园行情的小型预演。

1. BOME:Pepe Meme 艺术家 Darkfarm 所发行的 BOOK OF MEME,上市三天涨幅1000倍上所币安,掀起Solana链上Meme预售热潮。BOME可理解为是一个面向 Meme 的永久储存图库,并将在其基础上扩展一系列 Meme 创作功能。Solana链上土狗跑路增多。Meme如果上不了大所,都会慢慢变成PVP互割模式。

2. JUP:交易量受益Solana链上的土狗交易热潮。Jupiter是建立在Solana链上的交易聚合器,聚合了超过一半的交易量。协议推出了发射平台和孵化器来进行横向扩张。

3. POLYX:贝莱德基金在ETH链上推出首个代币化基金,并计划做房产RWA。Polymesh是一个基于Substrate构建的公链,其专门为证券代币化应用场景而设计,但是面临各国政府极大的监管阻力,难以享受全球流动性的优势。

三、BTC行情

1.链上数据

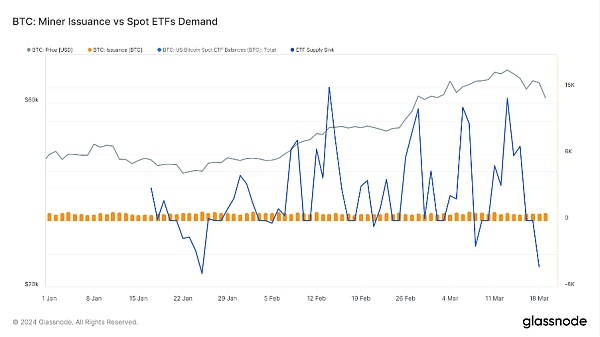

BTC这轮周期有什么不同?随着减半的临近,与ETF不断增长的需求相比,新开采并释放到流通中的BTC的影响变得越来越小。ETF从市场上撤出的数量是每天铸造的BTC数量的几倍。目前矿工每天向市场带来大约900个BTC。减半后将下降至 450个BTC,在过去的市场条件下,这可能会加剧BTC的稀缺性并推高价格。

稳定币市值环比持平,场外资金流入速度放缓。算稳USDE的供应量迅速超过10亿美元,主要因为质押收益率高达60%。

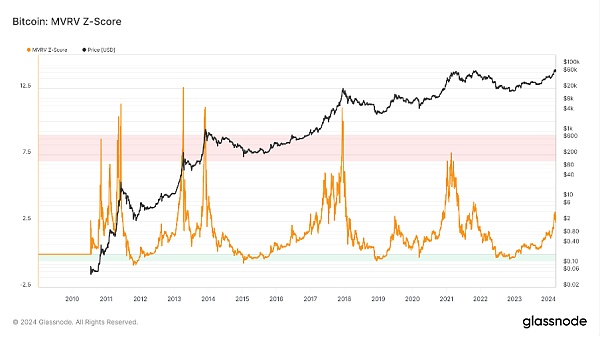

长期趋势指标MVRV-ZScore以市场总成本作为依据,反映市场总体盈利状态。当指标大于6时,是顶部区间;当指标小于2时,是底部区间。MVRV跌破关键水平1,持有者总体上处于亏损状态。当前指标为2.8,进入中间阶段。

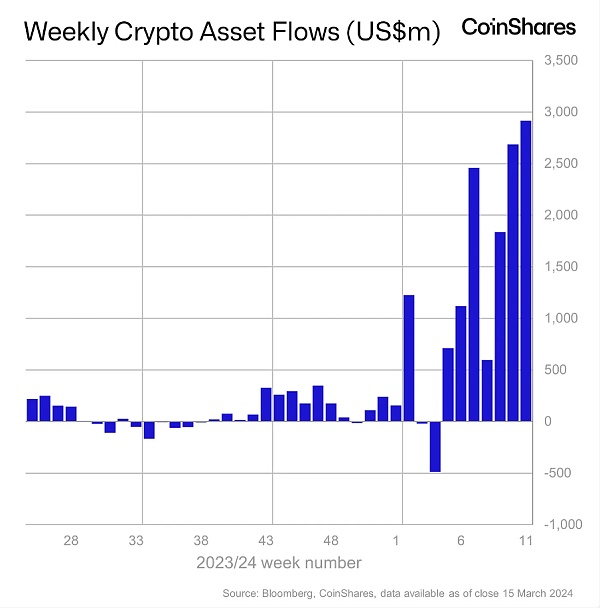

机构资金持续净流入,周净流入创新高。

2.期货行情

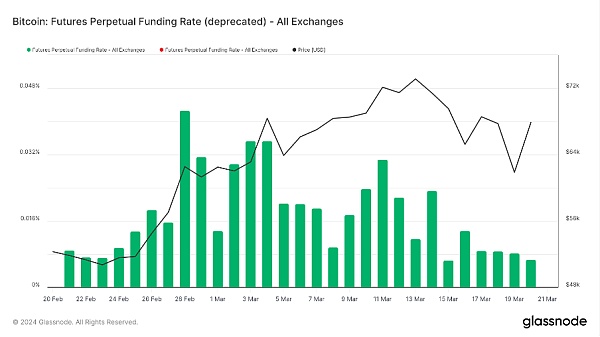

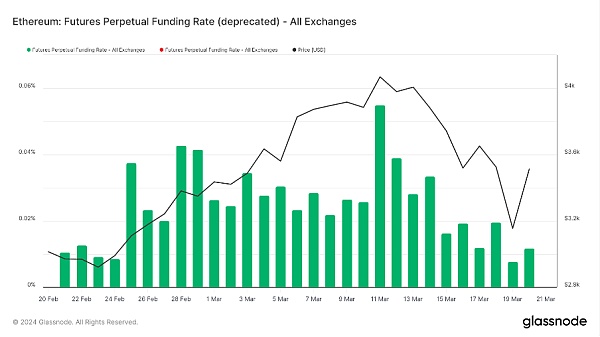

期货资金费率:本周费率恢复正常水平。费率0.05-0.1%,多头杠杆较多,是市场短期顶部;费率-0.1-0%,空头杠杆较多,是市场短期底部。

、

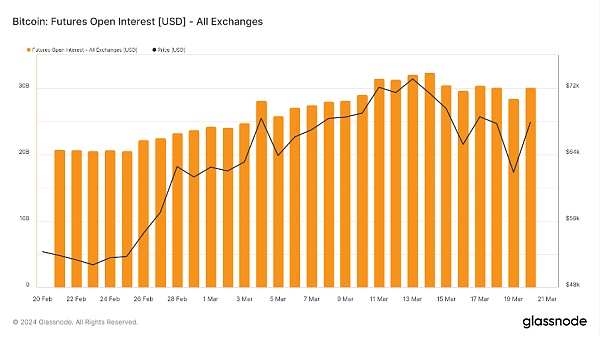

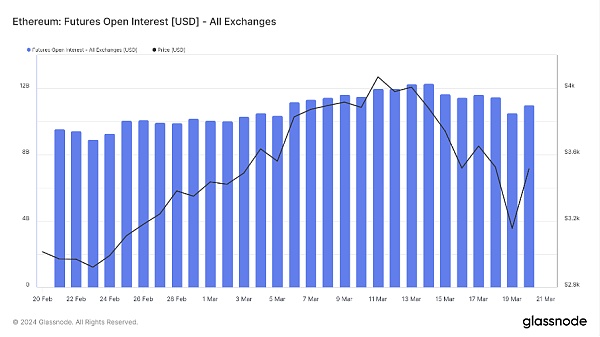

期货持仓量:本周BTC持仓量跟随价格回调。

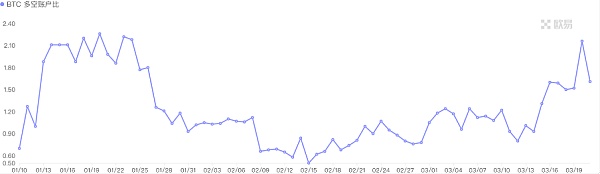

期货多空比:0.8,市场情绪正常。散户情绪多为反向指标,0.7以下比较恐慌,2.0以上比较贪婪。多空比数据波动大,参考意义削弱。

期货多空比:1.2,市场情绪正常。散户情绪多为反向指标,0.7以下比较恐慌,2.0以上比较贪婪。多空比数据波动大,参考意义削弱。

3.现货行情

BTC经历了动荡的一周,到新高后出现大幅回调。合约费率回到了更健康的水平,因为清算了过多的杠杆资金。历史上牛市平均大回调7次,平均20-30%。BTC在经历第一次大回调后,资金通常会从BTC流出到山寨币,未来山寨币表现可望更佳。

B. 市场数据

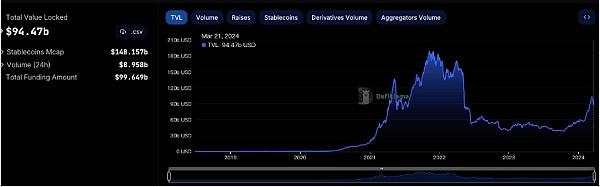

一、公链总锁仓量情况

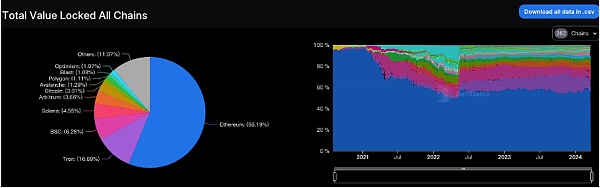

二、各公链TVL占比情况

本周总TVL为945亿美金,整体下跌84亿,下跌幅度为8.2%。BTC本周回调幅度接近20%,成功在60000的位置撑住,向上力度也比较强势。本周主流公链TVL除了SOLANA链以外全部大跌。最近最火热的公链一定属于SOLANA链,过去一周上涨6%,过去一个月暴涨85%。除此之外,ETH链最近表现比较低迷,本周ETH链下跌14%,POLYGON链下跌15%,OP链,BLAST链,ARB链,均下跌9%左右。BSC链下跌7%,TRON链下跌8%。

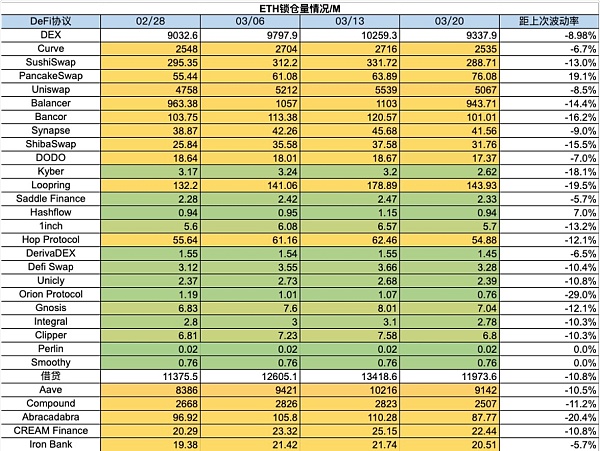

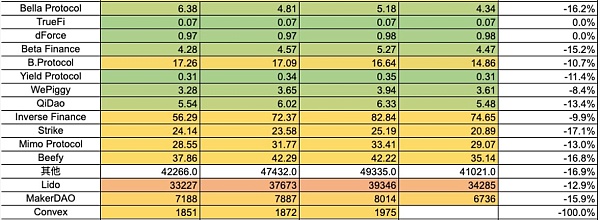

三、各链协议锁仓量情况

1.ETH锁仓量情况

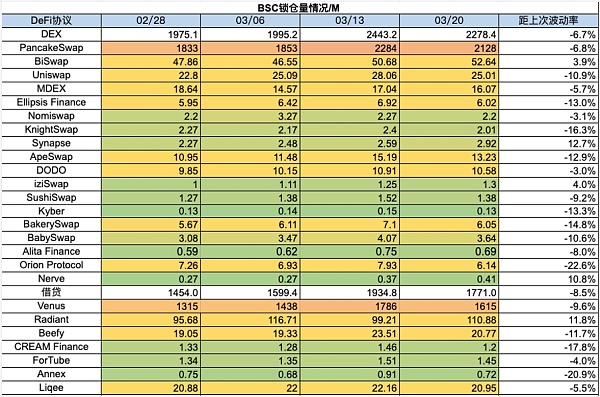

2.BSC锁仓量情况

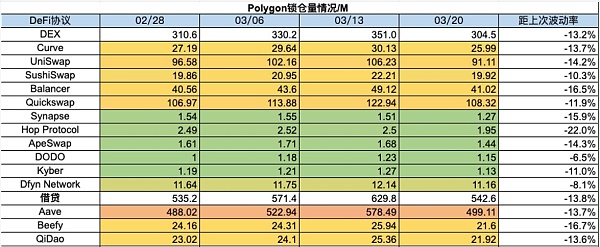

3.Polygon锁仓量情况

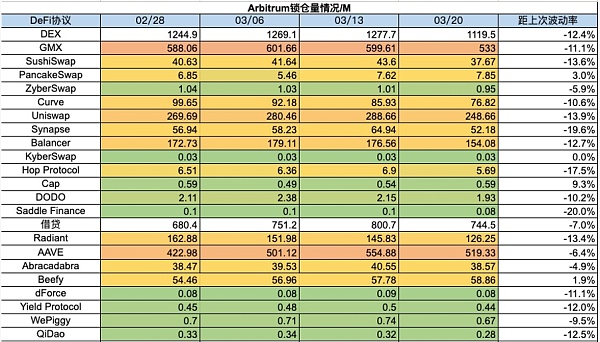

4.Arbitrum锁仓量情况

5.Optimism锁仓量情况

6.Base锁仓量情况

7.Solana锁仓量情况

四、NFT市场数据变化

1.NFT-500指数

2.NFT市场情况

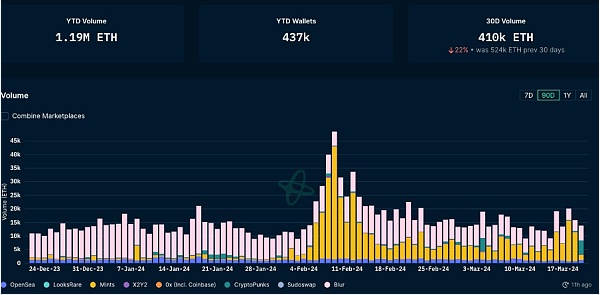

3.NFT交易市场占比

4.NFT买家分析

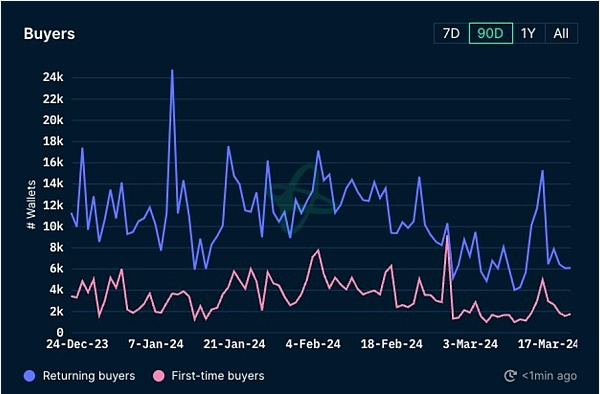

本周NFT市场蓝筹项目地板价有涨有跌,但波动幅度不大。.BAYC下跌4%,MAYC上涨2%,CryptoPunks上涨7%,Azuki上涨近3%,Pandora下跌2%,Milady上涨6%。本周NF市场大盘继续下跌,并且已经跌到过去一年最低点。本周NFT市场总交易量有小幅回升,但首次购买NFT买家和复购买家数量依旧没有任何起色。伴随牛市的到来,NFT市场的低迷还在持续。

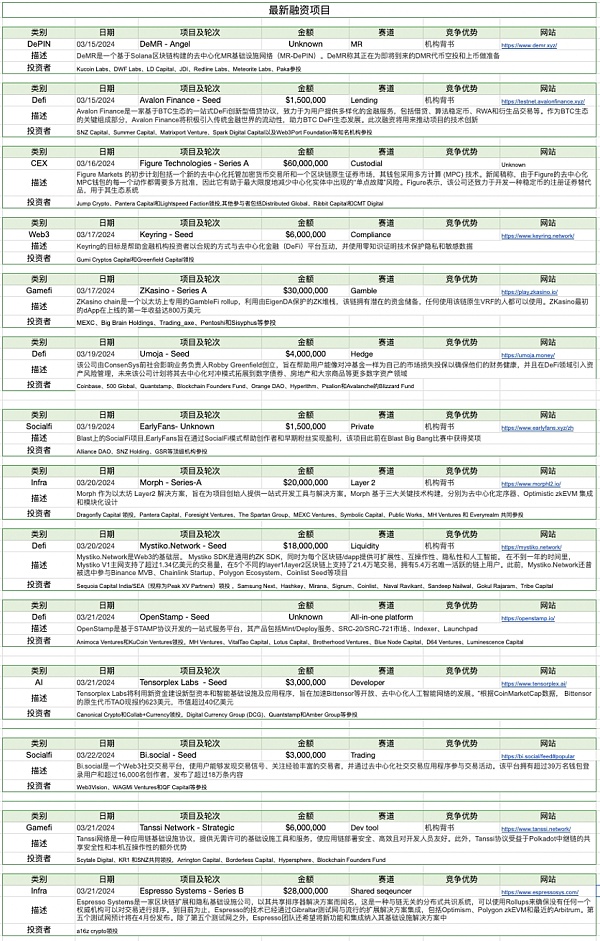

五、项目最新融资情况

六、投后动态

1.Space Nation — GameFi

太空主题 Web3 MMORPG 游戏 Space Nation 发布链游《Space Nation Online》预告片,游戏将包含四个主要派系,由 Unity 引擎提供支持,并拥有 PvE(玩家对环境)和 PvP(玩家对玩家)功能。

《Space Nation Online》预计将于今年 4 月 1 日在 PC 上推出封闭测试版,并在今年夏天晚些时候在 PC 上软发布,计划于今年秋季在 PC 和移动设备上全球发布。

《Space Nation Online》此前表示,计划在未来一年进行一系列发展,其中包括加强 AI+Web3 宇宙,重新定义玩家与 MMO 的连接,使用 AI 来创建个性化故事,为玩家提供沉浸式互动体验。

2.Node Guardians — 基础设施

SNode Guardians v1 即将推出,并为经验丰富的智能合约开发人员提供了全面的游戏化体验,帮助他们掌握 Solidity 和 Zero Knowledge DSL。

Node Guardians已与Starknet、Aztec、Optimism和Arbitrum等L2密切合作,已经帮助数百名开发人员提高了开发技能。

3.Ether.fi — 非托管流动性质押协议

ETHFI 已开发空投申领,并上线币安。据披露的ether.fi 代币经济模型,ether.fi 代币 ETHFI 总供应量为 10 亿枚,流通供应量为 1.152 亿枚,代币分配中 2% 用于 Binance Launchpool、11% 将分配给空投、32.5% 分配给空投投资者和顾问、23.26% 分配给团队、1% 分配给 Protocol Guild、27.24% 分配给 DAO Treasury、3% 用于提供流动性。

Market Viewpoint 1 Macro Liquidity Monetary Liquidity Improvement This week, the Fed's meeting puts pigeons on the plan to cut interest rates throughout the year. The market is expected to slow down the quantitative tightening in January until the end of next year, which will correspond to the biggest dividend period of the investment market. The Bank of Japan will raise interest rates for the first time in the year, and the US stock market will fluctuate at a high level. The encrypted market will rebound after the adjustment of the US stock market. The main line of the market value ranking of the whole market will be around the ecology. This week, there will be a sharp correction in the spot, and the main line of the market will be around the students. The market of similar years in the state chain undertook the funds flowing out of the cottage currency. This local dog craze is a three-day increase issued by a small preview artist of this bull market zoo market. The pre-sale craze on the chain can be understood as an oriented permanent storage gallery, and a series of creative functions will be expanded on its basis. If it fails to reach the metropolis, it will gradually become a mutual cutting mode. The local dog trading craze on the benefit chain is a polymerization of trading aggregators built on the chain. More than half of the trading volume agreements have launched launch platforms and incubators for horizontal expansion. BlackRock Fund has launched the first token fund in the chain and plans to make real estate. It is a public chain based on construction, which is specially designed for the application scenario of securities token, but it is difficult to enjoy the advantage of global liquidity in the face of great regulatory resistance from governments. What is the difference between the data cycle in the market chain and the impact of new exploitation and release into circulation with the approaching of half compared with the increasing demand? The amount of withdrawal from the market is several times that of casting every day. At present, miners bring about half to the market every day, and then it will drop to one. Under the past market conditions, this may aggravate the scarcity and push up the price stability. The market value of the currency is flat, and the speed of the inflow of funds outside the market is slowing down. The stable supply quickly exceeds 100 million US dollars, mainly because the pledge yield is as high as the long-term trend index, which reflects the overall profitability of the market. When the index is greater than, it is the top zone. Occasionally, when the indicator is less than, the bottom interval falls below the key level, and the holders are generally in a state of loss. The current indicator is the continuous net inflow of institutional funds into the intermediate stage, and the weekly net inflow into the new high futures market. The futures fund rate returns to the normal level this week, and the long leverage is the short-term top rate of the market, and the short-term bottom futures position is the short-term bottom futures position of the market. The short-term futures position follows the price correction this week, which is more panic than the normal retail sentiment. Weakening futures long and short is more important than data fluctuation. Weakening futures long and short is more important than normal market sentiment. Retail sentiment is more negative than panic. Weakening spot market is more important than data fluctuation. After a turbulent week, there is a sharp correction after a new high. The contract rate has returned to a healthier level because of the liquidation of too much leveraged funds. In the history of bull market, the average big correction times are average. After the first big correction, the funds usually flow from the outflow to the future mountain of shanzhai currency. The performance of Zhaizi currency is expected to be better. Market data 1. The total lock volume of public chains 2. The proportion of public chains 2. This week, the total decline was $100 million. The decline rate was close to the success of this week's callback. The upward strength was also relatively strong. This week, the mainstream public chains all fell sharply except the chain. The hottest public chain must belong to the chain that rose in the past week and soared in the past month. In addition, the chain's recent performance was relatively low. This week, the chain fell, the chain fell, the chain fell, and the chain fell, On the lock volume, the lock volume, the lock volume, the lock volume, the lock volume, the lock volume, the market data change index, the market share of buyers' analysis this week, the floor price of blue-chip projects in the market has risen and fallen, but the fluctuation is not large, but it has risen and risen, and it has fallen to the lowest point in the past year. The total market transaction volume has rebounded slightly this week, but the number of first-time buyers and re-buyers remains the same. There is no improvement with the arrival of the bull market, and the market downturn is still going on. The latest financing situation of five projects is six. After the launch, the dynamic space theme game will be released. The trailer game will include four main factions supported by the engine and have the functions of player-to-environment and player-to-player. It is expected that a closed beta version will be launched on the Internet on March this year, and it will be released on the soft platform later this summer. It is planned to be released globally on mobile devices this fall. Previously, it was said that it planned to carry out a series of development in the coming year. These include strengthening the universe, redefining the connection between players and creating personalized stories, providing players with an immersive interactive experience, and providing a comprehensive gamification experience for experienced smart contract developers, helping them master and have worked closely with them, and helping hundreds of developers improve their development skills. An unmanaged liquidity pledge agreement has been developed, and airdrops have been applied and put online. The disclosed token economic model has a total supply of 100 million tokens in circulation, and the distribution of 100 million tokens is used to allocate airdrops to airdrops investors and consultants, and to allocate them to teams to provide liquidity. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。