黄金再次背叛美元 但它从不错判时代

当消费股基金经理还在面对亘古的「年轻人喝不喝白酒」之问时,金店已经迎来了自己的第一批00后顾客。

作为过去一年为数不多还在大举扩张线下门店的生意,金店的生意的确不错。在德勤2023年奢侈品公司报告里,周大福以超越爱马仕和劳力士的销售额,稳居全球前十。而在另一份《2023中国金饰零售市场洞察》的报告里,18至34岁的年轻人则接棒2013年黄金热潮里的「中国大妈」,成为金饰消费的主力军。

作为一种「顺价格周期」的消费,金饰的需求常常与国际金价的上涨同步。但当国际金价屡创新高,带动国内足金价格3月至今几乎一天一个跳涨,从每克630元逐步逼近每克730元的时候,消费者们逐渐转向观望。

真正的黄金大作手仍然在稳定输出。

4月7日公布的央行数据显示,尽管近期国际金价快速走高,中国央行的增持节奏保持基本稳定,3月末黄金储备7274万盎司,较2月末增加了16万盎司。这是自2022年10月以来,人民银行连续第17个月增持黄金储备,创下增持持续时间之最。

然而,随着上周五美国非农数据大超预期,市场对年内降息路径产生怀疑与分歧之后,围绕国际金价的短期博弈正在剧烈升温。

那么,这场从2022年10月开始走向高潮,但早在2018年就埋下伏笔的黄金大周期,究竟走到了哪里?

背叛利率的锚

自布雷顿森林体系瓦解、 美元黄金脱钩以来,我们正在经历的是继1971-1980、2002-2011后的第三轮黄金牛市。但是细节层面,这次黄金热又有其特殊之处,它事实上是两个小周期的合二为一。

第一阶段,2018年四季度至2020年8月,美联储从正常降息到剧烈放水,驱动了这一轮黄金牛市的起步。

2018年四季度开始,在市场对美联储加息进程已近尾声的猜测中,伦敦金价格开始表现。2019年3月,FOMC会议上美联储暗示年内不会加息,到7月,美联储进行了十年来的首次降息操作,并在随后的9月、10月进行了年内第二、第三次降息。期间,黄金价格从1270美元/盎司快速上行至1530美元/盎司。

12月,美联储表示2020年利率将保持按兵不动,会在1.75%水平维持一段时间,这让黄金价格失去继续上涨的动力。然而,仅仅2个月后,新冠大流行的肆虐蔓延,不仅让美联储维持利率的计划落空,甚至画出了21世纪以来最陡峭的利率下降曲线。

为应对大流行对经济造成的冲击,2020年3月的头两个礼拜,美联储大幅降息150个基点,从1.75%降至0.25%。在美联储降息与避险需求的共同刺激下,伦敦金价格在2020年8月上破2000美元,超越2011年高点创下历史新高。

第二阶段,2020年8月至2022年12月,降息结束,美联储逐渐开启「通胀战士」模式,黄金价格在战争与通胀的阴影下震荡。

进入2020年夏天,人们开始从大流行初期世界末日的恐慌中恢复理性,大部分经济体也在财政政策与疫情防控的积极作用下逐渐复苏,全球GDP增长逐渐回升,走出最低谷。而美联储不会长期维持0利率也成为全球市场的共识。美元指数回升之际,伦敦金价格在整个2021年呈现出震荡下跌的走势。

回调被一场延续至今的热战打断。2022年2月,俄罗斯闪击基辅未遂,在地缘冲突的避险驱动下,黄金短暂回到前高位置。

但美债实际收益率仍然在黄金的定价中,扮演了更为重要的角色——美国经济疫情后的超强复苏,使得2022年3月的通胀数据爆表,8.5%的数字创下40年来的记录。此后,美联储开启了对抗通胀的主线任务,黄金价格在年内7次加息共计425个基点的节奏中节节败退,回吐了前期一半的涨幅。

至此,依然是人们熟悉的模式,收紧的流动性、回落的金价,美债和黄金在天平的两边,称职地扮演自己的角色。但也就是在这一年末,黄金的走势开始出现了微妙的变化,它也不再满足于美元秩序下自己有限的戏份。

第三阶段,2023年年初至今,是本轮黄金牛市最特殊的阶段,黄金与美元利率的负相关性出现了历史罕见的背离。

2023年至今,黄金价格与美债实际收益率出现同步的快速上行——在美元利率上涨32个基点的情况下,国际金价也上涨超过20%,打破了以美债实际收益率为核心的黄金分析框架。

而这种背离,在今年以来的行情中更加极致。

一定程度上,市场把今年以来逐渐加速的「黄金热」归结到机构在提前应对此前「美联储年内三次降息」的预期,但就在3月非农数据公布之后,大幅超预期的30.3万新增非农就业,使得降息预期又被扭转。

然而,就在同一天,黄金开盘微跌之后,迅速反弹日内收涨,COMEX黄金价格上涨至2349.10美元/盎司刷新历史纪录。因为降息预期涨上去的黄金,没有因为降息进度的延后而回调,反而攀越了历史高峰。

对冲基金大佬绿光资本创始人大卫·艾因霍恩直言:今年联储可能一次降息的机会都没有[6]。他的后半句则是:「但美联储的政策转变并不会阻碍黄金价格的上涨势头……黄金是我们重要的投资之一……是我们对冲未来可能出现不利局势的一种方式。」

而这也是这一轮「黄金热」发展到今天的一个关键节点:当全球大量的分析师以美债实际收益率的负相关作为黄金的锚时,背离的发生、锚的失效,对黄金投资来说,意味着什么?

时代的黄金

今天的投资者对于黄金与美债实际收益率的反向关系习以为常,但是这种简单的负相关并不是黄金价格的全部。

黄金,作为一种极其特殊,对其价值的认可几乎已经刻入人类DNA的金属,既是商品又是投资品还是一般等价物,其价格由短、中、长期三重因素共同决定[2]。

黄金价格短期受避险情绪与投机交易的共同影响。

2019年以来的世界可以说是风平浪静的反面,席卷全球的新冠疫情,美国政府不断触及的债务上限,俄乌战争与中东乱局让「S3赛季」成为越来越多人的担忧。每一次风险事件都在脉冲式地推动黄金上涨。

与此同时,投机交易也在加速黄金价格的冲刺。3月4日,黄金收盘价创历史新高,而正是此时开始,黄金投机性多头头寸快速增加、空头头寸快速减少[3]。历史上,黄金价格每次突破新高后都会延续一段时间的快速上涨,与本轮表现如出一辙。

当然,大佬一般会更直接地说:怕高都是苦命人。

黄金价格中期受商品供需以及流动性的影响。

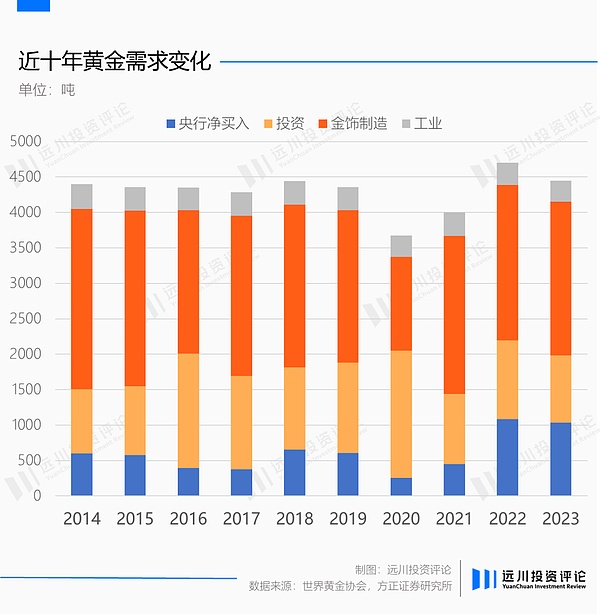

黄金需求主要分为金饰制造、工业、投资、央行净买入四部分。工业用金占比较低且波动不大,金饰需求虽然占比很高,但是由于其需求相对稳定,近十年仅在2020年出现较大幅度下滑,因此影响黄金价格的主要是投资需求与各国央行的净买入行为。

近两年央行净买入激增,但从黄金需求的整体变化上看,显然解释不了这轮黄金牛市,以及更普遍于大宗商品里的贵金属大宗牛市、资源品牛市。

这是一种流动性泛滥的结果。2020年,美联储与美国政府一同,用最激进的财政与货币政策避免了美国经济陷入衰退,但这并非没有代价,暴涨的商品价格与居高不下的通胀,不仅是美国的头号敌人,也让全世界焦头烂额。

伦敦期铜从2020年3月至2022年3月上涨超过1倍,WTI原油从2020年4月至2022年5月更是上涨了惊人的20倍。相比之下,金价的涨幅只能配得上温和二字。

实际上,中期因素常常是驱动一轮黄金牛市的重要支撑,也常常是打破黄金与美债实际收益率负相关的推手。

上一次黄金与美债实际收益率发生背离,出现在上一轮黄金牛市的初期。2002年至2012年的黄金十年中,金价上涨超过5倍,在金融危机爆发导致美元走低前,2005年至2007年,美国实际利率在繁荣中走高,但金价却也同步吹响了牛市的号角——全球大宗商品牛市叠加黄金产量连续下跌推动了金价的走高。

影响黄金价格的长期因素,亦即信用对冲,是一个慢变量,它并不是短期价格的主要决定者,但此时此刻正在发生的微妙变化,会在一个更漫长的兑现过程中反应到黄金的定价中。

2018年以来,贸易保护主义再次兴起,全球价值链出现回缩的趋势,地缘政治成了企业选择供应链布局的重要依据[4]。

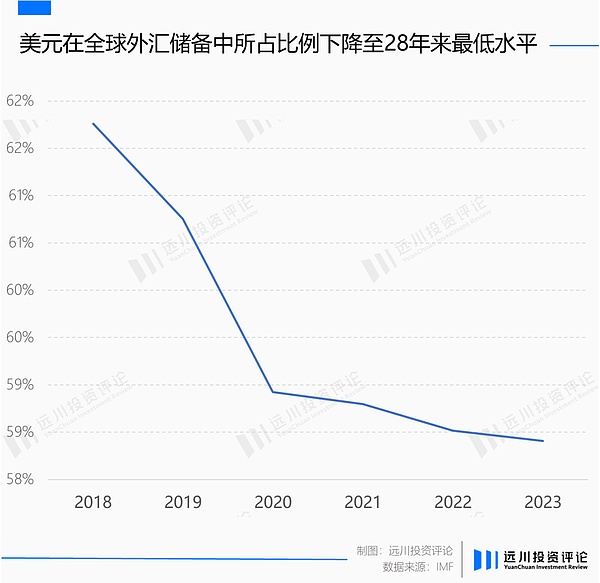

美元体系的心脏同样不平静。美元结算体系的武器化——制裁伊朗、俄罗斯等国家,让过度依赖这种法币不再是一个最好的选择。仅公开报道中,就有巴西、东盟、印度、马来西亚、沙特等国家积极开展多元化贸易结算工具。与此同时,2018年以来美元在全球外汇储备中所占的比例也逐年下降。

根据世界黄金协会2023年的调研,57家受访央行中超过一半的央行五年后会降低美元在总储备中的比例,新兴经济体降低美元储备的意愿尤其强烈。62%的受访央行表示未来5年将提高黄金在总储备中的占比,而2022年这一数字只有42%[1]。

而非农数据之下的再通胀幽灵,让所有法币未来的购买力显得可疑,留给各国央行的选项也就不剩下多少,黄金正是其中最显然的那个。2022年,各国央行净买入黄金相较2021年翻倍有余,强劲的净买入持续至今,贡献了黄金需求的最大边际变化。

当短中长期因素交汇在金价的走势上时,未必是黄金的时代,却一定是时代的黄金。

与命运对冲

周期天王周金涛用他最经典的康波视角总结过黄金的投资:黄金的走势可以看作经济增长的反面,以长波衰退期为起点,黄金资产将步入长期牛市,并且在萧条期的5-10年的超级行情中获取显著的超额收益。

在这种基于超长康波周期的持有视角下,ALL IN梭哈黄金对于普通人来说并不是个好主意。事实上,从期货与期权的持仓情况看,目前黄金做多交易已经达到新冠以来的最拥挤水平,后续随着多头止盈与空头的停止入场,可能出现「多杀多」式的下跌。

黄金从来也不是一个博弈短期波动的好品种。黄金整体波动性略低于沪深300,但是由于黄金受宏观经济影响会多年连续向下波动,因此高点买入黄金的回本周期并不短,比如2013年跟风买入黄金的投资者,解套要到7年以后。

另一方面,黄金短期博弈的参与者面对着一个几乎无所不能的强大对手盘。除去专业资管机构外,黄金市场上的另一大买家是各国央行。2023年,央行净买入黄金超过1000吨,已经成为仅次于金饰制造的需求来源。

也就是说,在一定程度上可以通过调节名义利率决定以本币计价的黄金价格走势的各国央行,同时也是黄金市场的最大玩家。这让试图从裁判手里赢钱的小散看起来并不明智。

但当我们跳出短期博弈的视角,用长期资产配置的维度来考察黄金时,它又成为了大多数普通人为数不多的「命运对冲工具」。

一方面,对于许多将跑赢通胀作为财富管理需求的家庭来说,虽然黄金的价格有一定波动性,但是从50年的时间尺度上看,黄金价格一直在稳步上台阶。有研究发现,黄金价格的涨幅约是通货膨胀水平的3.2倍[2]。

而从更宏大的角度看,如果我们注定经历衰退转向萧条的康波尾声,那么黄金在这种环境下历来的超额收益,有可能对冲掉命运中的些许无奈;当然,如果我们有幸可以迎来一个新周期,在技术奇点中重新找到一条经济繁荣的快车道,不生息的黄金只会让我们的人生损失有限的持有成本。

这就是迷雾时代里黄金的魅力:在每一个短期里,交易者都在以一己之力和各个国家的央行角力;但在更长期的经济规律里,康波周期已经写下了一代人的财富命运。

参考资料

[1] 金价为何创新高:黄金分析框架与全球去美元化,泽平宏观

[2] 涛动周期论,周金涛

[3] 本轮黄金大涨的复盘与展望,国盛宏观

[4] 经济逆全球化:现象、困境与对策,张广婷 刘涛

[5] 美元在全球外汇储备中所占比例降至25年低点,IMF BLOG

[6] David Einhorn thinks inflation is reaccelerating and has made gold a very large position, CNBC

When the fund managers of consumer stocks are still facing the question of whether young people drink white wine or not, the gold shop has already welcomed its first batch of post-customers. As one of the few businesses that have been expanding offline stores in the past year, the business of the gold shop is really good. In the Deloitte luxury goods company report, Chow Tai Fook ranked among the top ten in the world with sales exceeding Hermes and Rolex, while in another report on the insight of China gold jewelry retail market, the young people aged to 18 took over the Chinese aunt in the gold boom in 2008 and became gold. The main force of jewelry consumption, as a kind of consumption along the price cycle, the demand for gold jewelry is often synchronized with the rise of the international gold price. However, when the international gold price has hit record highs, the domestic gold price has jumped almost every day from RMB per gram to RMB per gram, and consumers have gradually turned to wait and see. The real gold master is still steadily exporting. The central bank data released on March shows that despite the recent rapid rise of the international gold price, the pace of the increase of the Bank of China's holdings has remained basically stable, with a gold reserve of 10,000 ounces at the end of the month. At the end of last month, it increased by 10,000 ounces, which is the third consecutive month that the People's Bank of China has increased its holdings of gold reserves, which has been the longest. However, with the US non-agricultural data exceeding expectations last Friday, the short-term game around the international gold price is heating up sharply after the market has doubts and differences on the path of interest rate cuts during the year. So, where did this golden cycle, which began to reach its climax in June but was foreshadowed as early as 2000, betray the anchor of interest rate, break down the Bretton Woods system, and decouple the dollar from gold? In recent years, we are experiencing the third round of gold bull market, but the gold fever in detail has its own special features. It is actually a combination of two small cycles. The first stage, from the fourth quarter of 2008 to the month of 2008, the Fed drove the start of this round of gold bull market from normal interest rate cuts to severe water release. In the fourth quarter of 2008, the market began to speculate that the Fed's interest rate hike process was coming to an end, and the London gold price began to show. At the meeting in May, the Fed hinted that it would not raise interest rates during the year, and it had been going on for ten years. The interest rate was cut for the first time, and the second and third interest rate cuts were made in the following month. During the period, the gold price rose rapidly from USD ounce to USD ounce. The Federal Reserve said that the annual interest rate would remain unchanged and would remain at the level for some time, which made the gold price lose the motivation to continue to rise. However, only a few months later, the rampant spread of the COVID-19 pandemic not only failed the Fed's plan to maintain interest rates, but even drew the steepest interest rate decline curve in the century to cope with the impact of the pandemic on the economy. In the first two weeks of June, the Federal Reserve cut interest rates sharply by 1 basis point, which was stimulated by the Federal Reserve's interest rate cut and the demand for hedging. London gold prices broke the US dollar in June, surpassing the annual high and reached a record high. In the second stage, the interest rate cut ended from June to June, and the Federal Reserve gradually opened the inflation warrior mode. In the summer of 2008, people began to recover from the panic of the end of the world in the early days of the pandemic. Most economies were also actively engaged in fiscal policy and epidemic prevention and control. With the gradual recovery of global growth, it has become the consensus of the global market that the Federal Reserve will not maintain interest rates for a long time. When the US dollar index rebounded, the price of London gold fluctuated and fell throughout the year. The callback was interrupted by a hot war that has continued to this day. In September, Russia failed to strike Kiev. Driven by the hedging of geopolitical conflicts, gold temporarily returned to its previous high position, but the real yield of US debt still played a more important role in the pricing of gold. After the recovery, the inflation data of June and off the charts set a record in recent years. Since then, the Federal Reserve has started the main task of fighting inflation. In the rhythm of raising interest rates by a total of 10 basis points during the year, the price of gold has gradually retreated, giving up half of the increase in the previous period. So far, it is still a familiar pattern. The price of gold, US debt and gold have played their roles competently on both sides of the scale, but at the end of this year, the trend of gold began to change subtly, and it is no longer satisfied with the dollar rank. Since the beginning of this year, the third stage has been the most special stage of this gold bull market. The negative correlation of gold and the dollar's interest rate has shown a rare deviation in history. Since the beginning of this year, the gold price and the real yield of US debt have shown a synchronous and rapid upward trend. In the case that the interest rate of the US dollar has risen by 10 basis points, the international gold price has also risen more than breaking the gold analysis framework with the real yield of US debt as the core, and this deviation has become more extreme in the market since this year. The gradual acceleration of the gold fever comes down to the fact that the organization responded to the Fed's expectation of cutting interest rates three times in advance during the year, but after the release of monthly non-agricultural data, 10,000 new non-agricultural jobs greatly exceeded expectations, which made the interest rate cut expectation reversed. However, on the same day, after the gold opened slightly, it quickly rebounded and closed up in the day, rising to US dollars ounces, setting a new record. Because the gold expected to cut interest rates did not adjust back because of the delay in the progress of interest rate cuts, it climbed over the historical peak of hedge fund boss Green Capital. David einhorn, the founder, bluntly said that the Fed may not have a chance to cut interest rates once this year, but the policy change of the Fed will not hinder the upward trend of gold prices. Gold is one of our important investments and a way for us to hedge against possible unfavorable situations in the future, which is also a key node in the development of this round of gold fever today. When a large number of analysts around the world take the negative correlation of the real yield of US bonds as the anchor of gold, the failure of the anchor will occur. What time does gold investment mean for gold? Today's investors are accustomed to the inverse relationship between gold and the real yield of US debt, but this simple negative correlation is not the whole price of gold. As an extremely special recognition of its value, gold has almost been engraved into human metal, which is both a commodity and an investment or a universal equivalent. Its price is determined by three factors: short-term, medium-term and long-term factors, and the short-term price of gold is jointly affected by risk aversion and speculative trading. It is said that the COVID-19 epidemic sweeping the world is the opposite of calm. The debt ceiling that the U.S. government keeps touching on, the-Ukraine war and the chaos in the Middle East have made the season a concern for more and more people. Every risk event is pushing gold up in pulses, and at the same time, speculative trading is also accelerating the sprint of gold prices. At this time, the speculative long position of gold has increased rapidly, and the short position has decreased rapidly. In history, the price of gold will continue to rise rapidly for a period of time after breaking through a new high, which is exactly the same as this round. Of course, the bosses will generally say that they are afraid of 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。