解读 Eigenlayer 首个竞品 Karak 最具争议的 Restaking 龙二?

作者:陈默,BV DAO创始人 来源:X,@cmdefi

全角度解读一下最近被市场追捧的 Eigenlayer 首个竞品 Karak,以及扒一扒背后团队与 LUNA 的爱恨情仇,为什么被fud在 UST depeg 期间 rug 了700万美金。

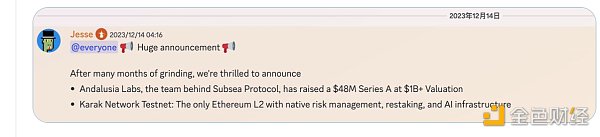

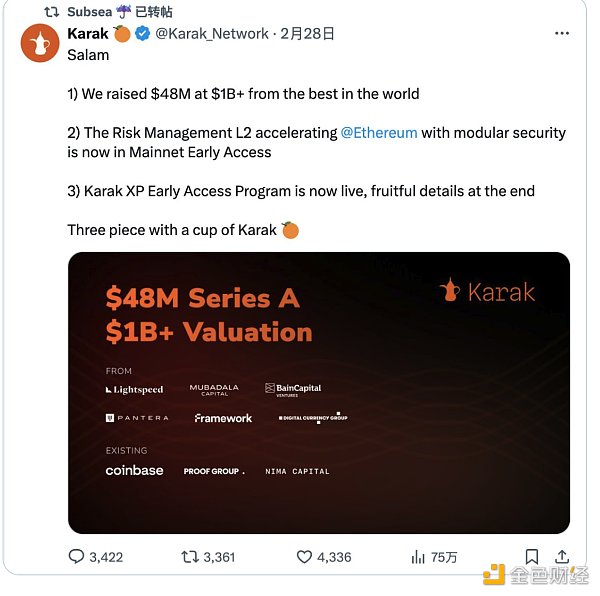

1. 融资48M被视为核心圈的复仇

最近被关注到的是官推置顶的4月9日推文,内容中提及了融资 48M 美金,且阵容强大来自于Coinbase、DCG、Famework等,被视为核心圈的复仇。

但实际这个消息早在2月28日,官方就已经发表过一个非常相似的推文,如果再向前追溯,官方discord中在2023年12月就宣布了项目背后的团队 AndalusiaLabs 以10亿美金的估值完成A轮融资48M,所以基本上这笔融资就是在2023年官宣的项目团队融资。

2. 项目特性总结

➤ Restaking Layer - EVM兼容的L2

➤ 支持在不同的链上存入LST、LRT

➤ 与Points极致类似,存款赚取XP

➤ 支持稳定币质押,比如sDAI

➤ 与Celestia建立了合作伙伴关系

➤ 5重激励结构 - Earn Staking Rewards + Restaking Rewards + Eigenlayer Points + LRT Points + Karak XP

3. 团队“rug”争议

其团队目前共运营2个项目:

- Karak

- Subsea

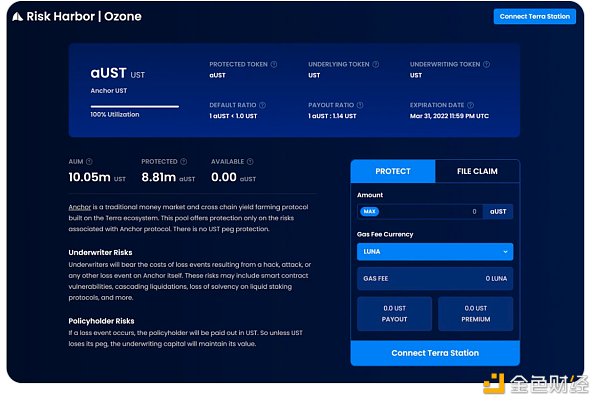

其中 Subsea 的前身是 Risk Harbor,这是一个保险协议,主要为 Terra 的稳定币 UST 进行承保,并且在2021年11月接管了Terra 生态去中心化保险协议 Ozone Protocol。

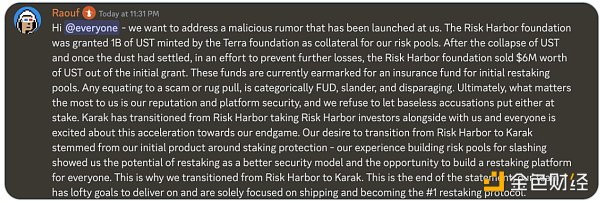

但是在LUNA崩盘期间,Risk Harbor 未经过社区投票即通过“后门”直接出售了保险池内的UST,换回金额约700万美金,这是市场主要fud的点。

团队回应则表示这部分UST是Terra基金会mint and grant给risk pool的抵押品,在UST脱锚期间出售是为了止损,并且这部分资金将用于Restaking项目。

4. 总结

作为从投资背景来看确实可能与Eigenlayer掰掰手腕的项目,我确实花了一些时间仔细做了研究。坦白讲,先不说团队 UST depeg rug 的事,从项目的社区和文档资料来说,并没有太多“技术层面”的内容,简单粗暴地就是告诉你应该存什么币,收益有哪些,如何赚取XP,甚至画饼的内容也少,目前我只能理解为准备不充分。(但项目从2023年底就开始运作了)

另外就是 UST 卖币这个事,首先我不反对DeFi项目在不够成熟的时期给予团队一些特殊权限,以应对突发情况。但是无论这部分 UST 来源哪里,直接利用权限把risk pool的抵押品卖掉我无法赞同,再退一万步说,即使卖掉了,这部分钱难道应该用于团队的下一个新项目吗?

虽然这么说,但可以预见的是,至少在目前,市场更加认可机构的背书,以及主流叙事。

只能说好的团队可遇不可求,不犯错的项目更加难得可贵,只摆事实,没有fud,在巨大的草台班子世界中且行且珍惜。

The author Chen Mo, the founder of the company, interprets the first competing product that has been sought after by the market recently and the love, hate and hatred of the team behind it from all angles. Why is it that the financing of 10,000 US dollars is regarded as the revenge of the core circle during the period? Recently, what has been paid attention to is that the content of the monthly tweet pushed by the official mentions the financing of US dollars and the strong lineup comes from the revenge of the core circle, but in fact, the news has been published by the official as early as June. If we go back to the official in June, It was announced that the team behind the project completed the round of financing with a valuation of US$ 100 million, so basically this financing was based on the summary of the characteristics of the project team financing announced by the government in, and the compatible support was deposited in different chains to earn support for the stable currency pledge, such as the dispute with the team that established the partnership and re-encouraged the structure. At present, its team operates a total of projects, the predecessor of which is an insurance agreement, which mainly underwrites the stable currency and took over the ecological decentralization in. However, during the crash, the insurance agreement was directly sold through the back door without community voting, and the exchange amount in the insurance pool was about 10,000 US dollars. This is the main point of the market. The team responded that this part was the collateral given by the foundation, which was sold to stop loss during the anchoring period, and this part of the funds will be used for the project summary. As a project that may really be wrestling from the investment background, I did spend some time carefully studying it. Frankly speaking, let's not talk about the team, from the community and documents of the project. Generally speaking, there is not much technical content, which simply and rudely tells you what kind of money you should deposit, what kind of income you should earn and even how to draw cakes. At present, I can only understand that the preparation is not sufficient, but the project has been in operation since the end of the year. In addition, there is the matter of selling money. First of all, I don't object to the project giving the team some special rights to deal with emergencies in an immature period, but no matter where this part comes from, I can't agree to sell the collateral by directly using the rights. Should the sale of this part of the money be used for the team's next new project? Even so, it is foreseeable that at least in the current market, the endorsement of institutions and the mainstream narrative are more recognized. It can only be said that a good team can encounter projects that are indispensable and make no mistakes, and it is even more rare and valuable. It is only a matter of fact that it is not feasible and cherished in the huge world of grass-roots teams. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。