会像UST一样失败?剖析Ethena 和 UST 不同之处

作者:degentrading,加密KOL;翻译:比特币买卖交易网xiaozou

Ethena会在一场UST式的危机中崩溃吗?

我看到有一些帖子的内容存在一些误解,我只是想在本文澄清一下这些误解。(我与他们没有任何关系,也不会因他们的成功或失败获取任何利益。)

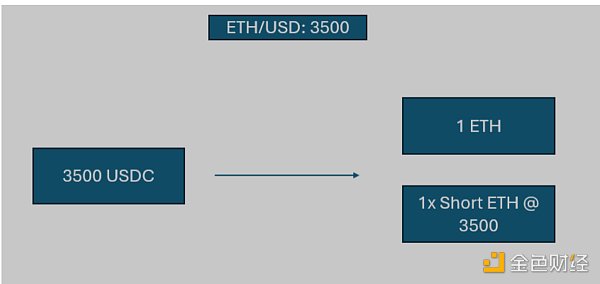

首先,Ethena是什么?它是合成美元协议,以1 ETH合成美元为例,在买入现货ETH(或stETH)的同时会相应地对冲名义等量的ETH空头。

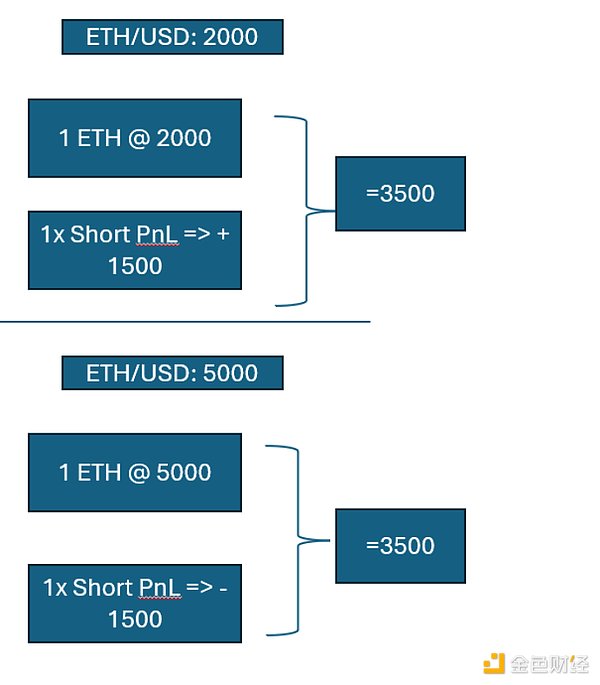

那么为什么是一美元呢?这是因为在任何正常情况下,收益都是固定的。只要远期/期货/永续合约对现货的基差不变,一篮子现货及其相应的空头头寸将保持相同的价值,没有持仓和资金费率。

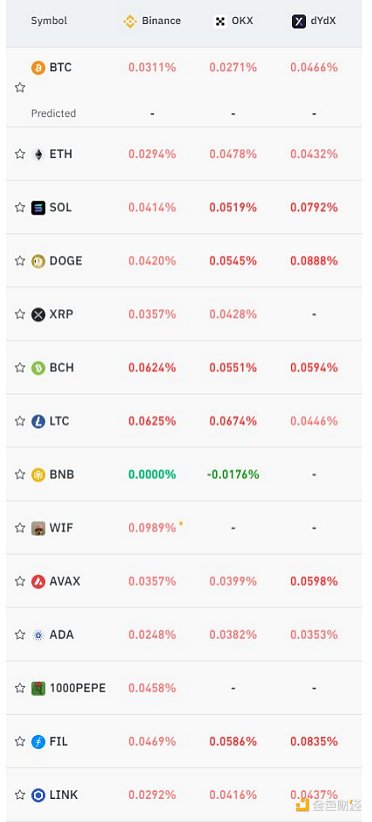

那么,为什么它的吸引力如此之大呢?简言之,因为注资一直非常积极——在牛市里,人人都在寻找杠杆以及廉价美元借款。每8小时5bps?如果市场每天上涨10%,这不是问题。

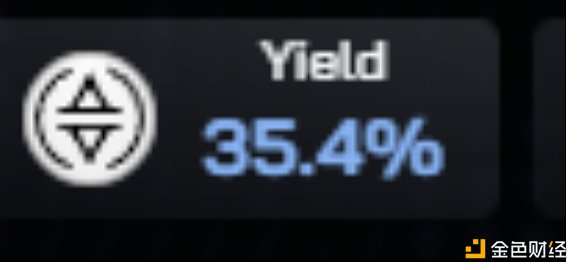

因此,Ethena最近的收益率看起来约为35%。只要这个领域存在着对杠杆的需求,这种情况就可能持续下去。

UST之所以失败,是因为支持已发行的UST的抵押品是原生Luna,随着Luna价格的崩溃,以美元计价的可用抵押品在Luna发行并出售给市场时经历了自我强化的恶性循环。

然而,总的来说,对于Ethena而言,支持已发行USDE的抵押品是一篮子资产,通常会在整个价格区间内保值。只要现货/永续合约或现货/期货合约的基差没有暴涨。

加密货币通常会表现出下行凸性。价格下跌的速度比上涨的速度要快。在我看来,这个设计实际上对Ethena非常有利。

随着价格不断下跌,在没有平仓的情况下,Ethena持有的美元现金比例实际上增加了。在下面的例子中,你可以看到ETH下跌到1k时会导致3.5k的抵押品篮子里有2.5k是现金……

这其中是否存在风险?如果有风险的话,那就是使用stETH作为抵押品。与ETH相比,stETH的现货流动性要小得多。然而,在Shapella升级之后,stETH/ETH折扣IMO触底了。

在Shapella之前,stETH卖方受制于买方。在Shapella之后,如果stETH/ETH汇率上涨严重,卖家可以选择更长的等待时间(1-5天),然后提取stETH兑换为ETH。

屋子里的另一头大象将是交易对手/交易所风险。如果一家交易所因危机破产,Ethena可能会经历重大减值。不过,他们的交换清单看起来相当不错。

还剩下最后一个风险——操作风险。Ethena概念应该行得通。它相当巧妙。然而,它也在一定程度上依赖具有不确定性的智能交易、执行和风险管理。

在信心危机中,只要Ethena的执行完美,USDe就会有一个触底价,因为一篮子资产将保持其价值。然而,我注意到的是,一般来说,危机情况会让我们出现失误——交易员可能会受到诱惑或被迫退出基差交易,从而产生delta风险。然而,总的来说,Ethena的基本概念应该是可行的。

Ethena还可能改变市场机制,带来新的价格关系——然而,这方面我们只能在未来进行评估。

我认为,Ethena实际上会为牛市再添助力。目前的做市商通常不会用现货多头对冲他们的永续合约空头(除非他们正在打磨基差),它们希望看到的是delta普遍消失。

尽管Ethena是delta中性的,但它无意中创造的现货需求将造成更多的上行价格滑点,同时对基差施加压力。

总之,Ethena概念好,功能好。如果它失败了,那将是因为在边缘情况下的执行和风险问题。

Will the bitcoin trading network collapse in a crisis? I see that there are some misunderstandings in the contents of some posts. I just want to clarify these misunderstandings in this article. I have nothing to do with them and I will not get any benefits from their success or failure. First of all, what is it? Take the synthetic dollar agreement as an example. When buying spot or at the same time, it will hedge the nominal amount of short positions accordingly. So why is it a dollar? This is because it is collected under any normal circumstances. The profit is fixed, as long as the basis of the perpetual contract of forward futures against the spot remains unchanged, a basket of spot and its corresponding short positions will maintain the same value, and there is no position and capital rate, so why is it so attractive? In short, because capital injection has been very active in the bull market, everyone is looking for leverage and borrowing in cheap dollars every hour. If the market goes up every day, this is not a problem, so the recent rate of return seems to be about as long as there is a demand for leverage in this field. It is possible to continue, but it fails because supporting the issued collateral is original. With the collapse of the price, the available collateral denominated in US dollars has gone through a vicious circle of self-reinforcement when it is issued and sold to the market. However, generally speaking, supporting the issued collateral is a basket of assets, which usually keeps its value in the whole price range, as long as the basis of spot perpetual contracts or spot futures contracts does not skyrocket, cryptocurrencies usually show downward convexity, and the price falls faster than that of others. In my opinion, this design is actually very beneficial. As the price keeps falling, the proportion of US dollar cash held without liquidation actually increases. In the following example, you can see that there will be cash in the collateral basket when it falls. Is there any risk? If there is any risk, it is that using it as collateral is much less liquid than the spot. However, after the upgrade, the discount bottomed out. Before, the seller was subject to the buyer's remittance. The rate of increase is serious. Sellers can choose a longer waiting time of days and then withdraw and exchange it for another elephant in the room. It will be the risk of a counterparty exchange. If an exchange goes bankrupt due to the crisis, it may experience significant impairment, but their exchange list looks quite good, leaving the last risk. The concept of operational risk should work. It is quite clever, but it also depends on the intelligent transaction execution and risk management with uncertainty to some extent. In the crisis of confidence, as long as the execution is perfect. There will be a bottom price because a basket of assets will maintain its value. However, I have noticed that generally speaking, crisis situations will make us make mistakes, and traders may be tempted or forced to withdraw from the basis trading, thus creating risks. However, in general, the basic concept should be feasible, and it may also change the market mechanism and bring new price relations. However, in this respect, we can only evaluate it in the future. I think it will actually help the bull market. Current market makers usually do not hedge with spot bulls. Their perpetual contracts are short unless they are polishing the basis. What they want to see is a general disappearance. Although it is neutral, the spot demand it inadvertently creates will cause more upward price slippage and put pressure on the basis. In short, the concept is good and the function is good. If it fails, it will be because of the implementation and risk problems in the marginal situation. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。