解析:MakerDAO为何大举发行DAI进入Ethena?

作者:Duo Nine,加密KOL;编译:0xjs@比特币买卖交易网

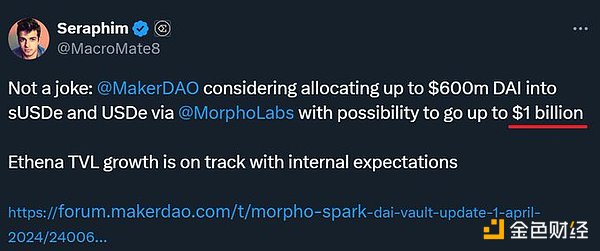

MakerDAO 近日发起提案计划将 6 亿美元的 DAI 分配至 USDe 和 sUSDe 。MakerDAO此举到底怎么理解?加密KOL Duo Nine发文解读。

1、发行 1 亿美元的 DAI 进入USDe获得收益是一回事,发行数十亿美元则意味着要受到伤害。

为什么MakerDAO 计划冒着风险铸造 10 亿美元的DAI来获取 Ethena 收益?当 USDe 不可避免地跌破 1 美元时,DAI 能否脱钩?MakerDAO此举是大胆举动还是其他什么?

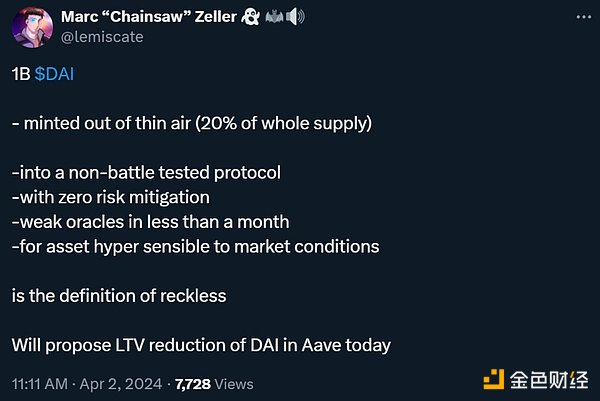

2、这篇文章的灵感来自 AAVEChan 创始人Marc Zeller。他发出了警报。

长话短说:他是对的。 MakerDAO 的行为是鲁莽的并且是由贪婪助长的。但如果你仔细观察 DAI 的风险,就会发现一个新的景象。

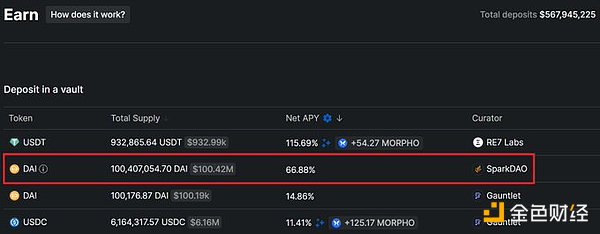

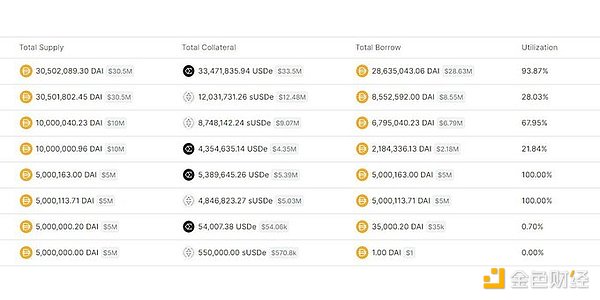

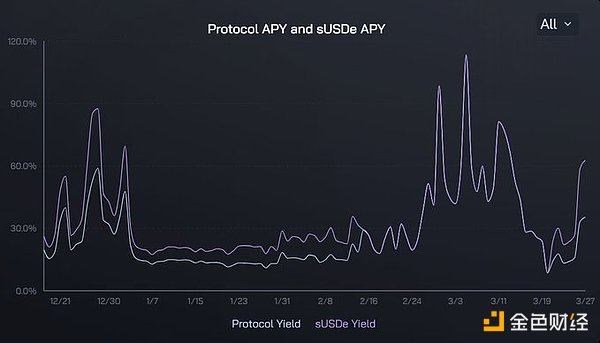

3、MakerDAO 现在正在印制现金,当然费用是由你承担的。他们发行了 1 亿枚 DAI,只能通过以 USDe/sUSDe 抵押品借入才能获得。用户付出巨大成本,而 Maker 获得巨额利润,1 亿美元年化率为 66%!

究竟发生了什么?

4、MakerDAO 正在利用用户在 USDe 上追逐更高 APY 的贪婪心理。他们不在乎,他们会用数十亿美元来助长这种贪婪。 Maker 赚取巨额利润,USDe 市值飙升。双赢。但是有一个问题!总有一个问题。

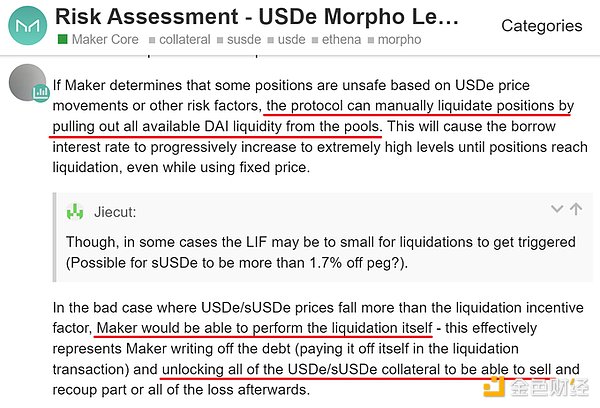

5、即使 Maker 的金库达到数十亿美元,他们也会在受到伤害之前先清算你!这意味着,他们将是第一个出售 USDe 的人,并在 USDe 脱钩时收回资金。用户被清算,Maker 保留利润。不错吧? USDe / Ethena 怎么样?

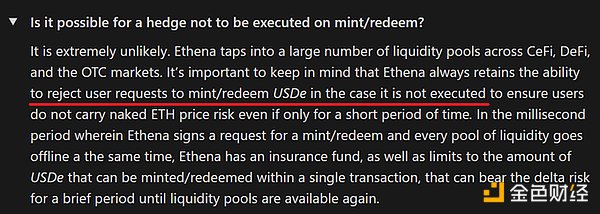

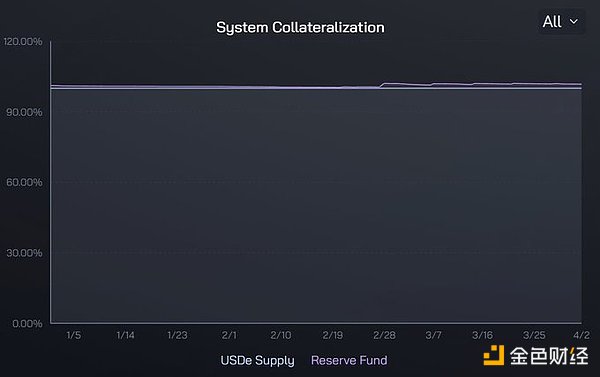

6、USDe脱钩只是时间问题。这个泡沫越大,我就越确定它会发生。想象一下:USDe 的市值约为 100 亿美元,Maker 负责其中的 20 亿美元。这些都是保守数字(请参阅第 12 条原因)。接下来发生什么?

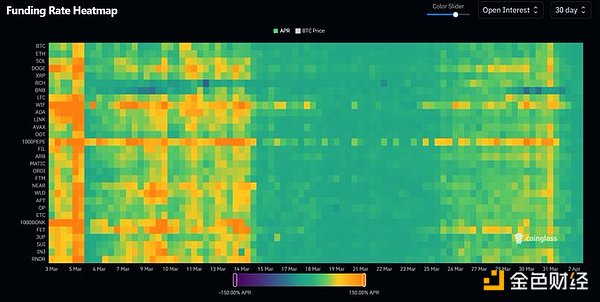

7、市场转为看跌,资金利率为负。USDe与美元挂钩需要它们为正! Ethena 需要数十亿美元的空头来保持 USDe 的稳定并维持其 100 亿的市值。风险增加。快速地。突然,MakerDAO 决定解除其 20 亿美元的风险敞口。接下来是什么?

8、USDe 面临抛售压力,其市值正在萎缩。人们意识到出口门只能容纳这么多人。USDe与美元挂钩在负融资利率下波动,然后跌破 1 美元。恐慌和清算开始。

9、第一批受害者?在 Morpho 上使用 USDe 和 sUSDe 借入 DAI 的用户。他们很快就会被清算。随着USDe与美元挂钩的汇率下跌,Maker首先取出资金。总共20亿美元。 DAI 是安全的,并且 Maker 会保留借贷利润直到那时。用户呢?

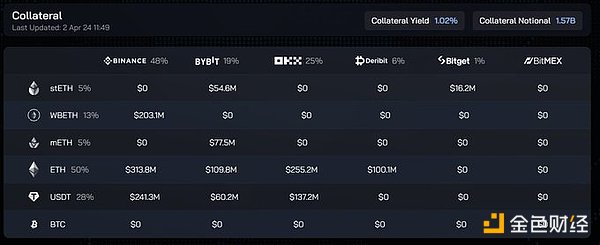

10、他们收到清算消息,其余额为零。USDe 会发生什么?由于 50% 的支持是实物资产,因此其挂钩汇率的跌幅有硬性限制。想想 ETH、stETH 和 BTC(稍后会添加)。但这也是一个问题!

11、当 USDe 市值开始暴跌时,例如从 100 亿美元跌至 50 亿美元,Ethena 必须平仓并赎回抵押品(例如 ETH 或 BTC)。如果赎回过程中出现任何瓶颈,USDe与美元挂钩的汇率也会因此受到影响。但 Maker 并不关心这一切。为什么?

12、他们赚了钱,首先退出,DAI 处于挂钩状态。现在将 MakerDAO 乘以 10 倍。你以为只有 Maker 和 DAI 会这么做吗?不,大家都会做的!他们都会插入 Ethena 并收取你。毕竟这是加密货币赌场。为什么Ethena想要这个?

13、在牛市中,他们会与任何愿意向他们砸钱的人合作。这就是 USDe 市值增长的方式。想象一下 100 亿美元的年化收益为 20%、40% 或 60%!哪怕一个月有效,纯利润也有上亿啊!什么时候结束?

14、当熊市来临时。如今,Ethena 有效地培育了所有在牛市中做多的加密货币交易者,并为此特权支付费用。收益率是真实的,而且主要来自散户的口袋,他们希望在期货市场上获得 100 倍的回报。 Ethena 到底是什么?

15、这是迄今为止最复杂、最智能的加密协议,可以利用这个市场的贪婪。他们基本上是在培养贪婪。他们知道其中的风险,并将其明确化,这是值得的。从这个意义上说,我尊重 Ethena 团队。这很难做到。

但我不确定我是否可以对 MakerDAO 说同样的话。他们只是利用 Ethena,利用它,增加它的风险。所有风险均由 Ethena 及其用户承担。 Maker 在这方面几乎不承担任何风险。 Ethena 对他们表示欢迎,因为目前激励措施是一致的。但是 2 倍!

16、Ethena 变得太大可能会给每个人带来系统性风险。这是真的。不是开玩笑。 USDe 未经熊市考验,当涉及数十亿美元时,它是有风险的。我敦促 Ethena 的所有大玩家如Hayes表现出一些克制,并为长期发展而努力。

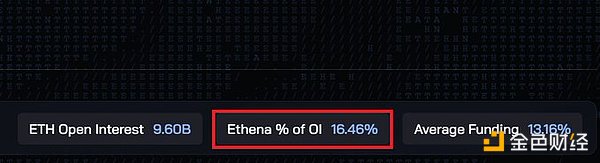

17、如果 Ethena 的 ETH 和 BTC 持仓量达到 25% 以上,那就太巨大了!这意味着 Ethena 将占所有 BTC 和 ETH 期货交易的 1/4 - 在空头方面! ETH 的利率已经是 16%。如果事情变得又大又坏,这可能会变成系统性的。

18、我的建议?当事情变得太大时就离开。当这个牛市接近尾声时就退出。我们不知道什么会首先破坏,但可能破坏的列表相当长。我不会去那里寻找答案。我会边吃比特币包里的爆米花边看节目。你?

19、 不要忘记 Ethena 和许多收益协议都有锁定时间。 7天、14天、21天。

当你等待锁定时间结束时,聪明的钱就会离开。

The author has recently launched a proposal to allocate billions of dollars to Bitcoin Trading Network. How do you understand this move? It is one thing to encrypt and issue a document to interpret the entry of billions of dollars to gain income. Issuing billions of dollars means getting hurt. Why do you plan to risk casting billions of dollars to gain income? When it inevitably falls below the dollar, can it be decoupled? Is this a bold move or something else? The inspiration of this article comes from the founder. He issued an alarm. To make a long story short, he is right. Our behavior is reckless and encouraged by greed, but if you carefully observe the risks, you will find a new scene. Of course, cash is being printed now, and the cost is borne by you. They have issued hundreds of millions of pieces, and they can only get huge profits by borrowing with collateral. The annualized rate of hundreds of millions of dollars is what is happening. They don't care that they will use billions of dollars to encourage this greed and earn huge profits. Soaring win-win, but there is always a problem. Even if the vault reaches billions of dollars, they will liquidate you before being hurt. This means that they will be the first to sell and recover the funds when decoupling. The users will be liquidated and keep the profits. How to decouple is only a matter of time. The bigger this bubble is, the more sure it will happen. Imagine that the market value is about hundreds of millions of dollars. These are conservative figures. Please refer to the first reason. What happens next? In order to bear the negative interest rate of funds linked to the US dollar, it is necessary for them to be positive. It needs short positions of billions of dollars to maintain stability and maintain its market value. The risk increases rapidly and suddenly, it is decided to lift its exposure of billions of dollars. What is the next step? Its market value is shrinking. People realize that the exit door can only accommodate so many people linked to the US dollar, fluctuate under the negative financing interest rate, and then fall below the US dollar panic and liquidation begins. The first batch of users who use and borrow on the Internet will soon be Liquidation: With the decline of the exchange rate linked to the US dollar, it is safe to take out funds totaling US$ 100 million at first, and will keep the loan profit until then. What will happen when users receive the liquidation message and their balance is zero? Because the support is physical assets, there is a hard limit to the decline of the linked exchange rate. Think about it and add it later, but it is also a problem. When the market value starts to plummet, for example, from US$ 100 million to US$ 100 million, they must close their positions and redeem the collateral, for example, or if there are any bottlenecks and beauty in the redemption The exchange rate linked to the yuan will also be affected, but I don't care why they made money first and quit the linked state. Now they will be multiplied. Do you think that only people will do this? Everyone will do it. They will insert and charge you. After all, this is a cryptocurrency casino. Why do they want this? In a bull market, they will cooperate with anyone who is willing to throw money at them. This is the way of market value growth. Imagine that the annualized income of hundreds of millions of dollars is or even if it is effective for one month, there will be hundreds of millions of net profits. When will it end? When the bear market comes, all cryptocurrency traders who are long in the bull market have been effectively cultivated and paid for this privilege. The rate of return is real and mainly comes from the pockets of retail investors. What is it that they hope to get double returns in the futures market? This is by far the most complicated and intelligent encryption protocol that can take advantage of the greed in this market. They are basically cultivating greed. They know the risks and make them clear. In this sense, it is worthwhile for me. It's hard to respect the team, but I'm not sure if I can say the same thing to them. They just use it to increase its risk. All the risks are borne by its users. In this respect, they hardly take any risks. I welcome them because the current incentives are consistent, but it may bring systemic risks to everyone. This is really not a joke. It is risky when billions of dollars are involved. I urge all big players to show some grams. It would be huge if the total amount of money and positions reached above, which means that the interest rate on short positions in all futures trading is already high. If things get big and bad, it may become systematic. My suggestion is to leave when the situation becomes too big. We don't know what will be destroyed first, but the list that may be destroyed is quite long. I will not go there to find the answer. I will watch the program while eating popcorn in the Bitcoin bag. Don't forget that many income agreements have lock-in time every day. When you wait for the lock-in time to end, you will have smart money. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。