比特币和黄金联手痛击美联储

作者:刘教链

大漠孤烟直,长河落日圆。

4月5日教链内参《研究人员称BTC本周末有望重回7万刀》提到,美联储最近又在进行预期管理(忽悠),对市场的降息期待给予镇压。「周四(4月4日),明尼阿波利斯联储主席尼尔·卡什卡利(Neel Kashkari)表示,如果通胀率保持粘性(sticky),今年可能不需要降息。美联储主席杰罗姆·鲍威尔(Jerome Powell)周三(4月3日)也表示,美联储在降息前需要更多证据证明通胀正持续向2%的目标迈进。」

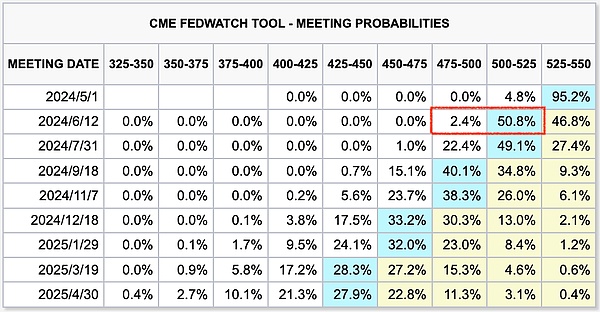

受美联储唱鹰的影响,6月降息预期一降再降,已经从不久前的70%一路降到了50%左右。举棋不定,犹疑不决,左右为难。

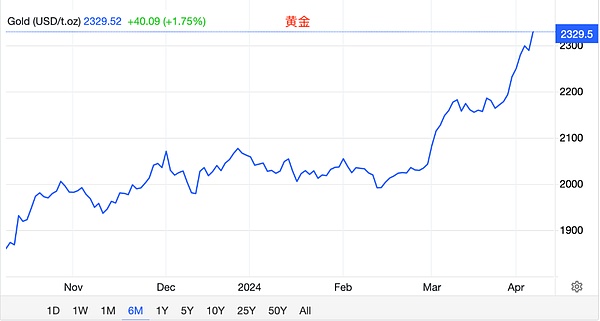

但是黄金却丝毫不给美联储面子,继续突进冲上2300刀/盎司历史新高度,给予美联储的鹰派表态以迎头痛击。

美联储手握降息的开关,这是它说话有人听的主要原因。美联储口头表态,降低降息预期。降息预期降低,流动性宽松预期减弱,理应对黄金和BTC形成压制。但是,黄金和BTC却用上涨回应了这一切。

可是,故事还有另外一种讲法。

市场定价的是预期。而市场的涨跌是预期的导数。

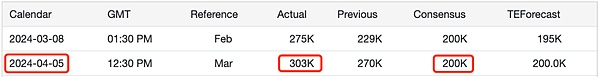

4月5日,美国非农就业数据出台。大幅超出预期。

3月非农就业增加30.3万人,远超预期的20万人。

在如童话般美丽的故事里,美联储提前看到了这份远超预期的就业数据,担心数据突然发布,市场受到惊吓,于是先人一步,在数据发布前2天连续唱鹰,管理预期。

这就好比我们在告知别人一个坏消息的时候,总是会先面露凝重神色。而别人在看到我们的沉重表情之后,心里面对于接下去听到的坏消息就有了提前的准备。

看到美联储如此呵护市场,真的是让人倍感受宠若惊了。

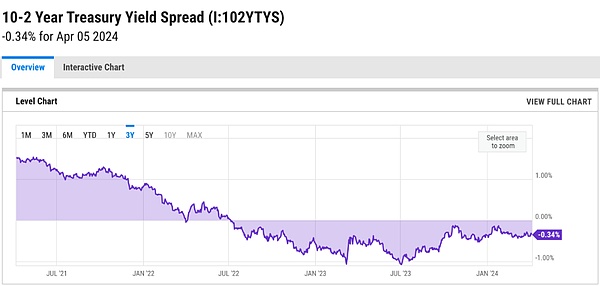

而美债长短期利率倒挂已经1年零9个月了。

在去年(2023年)10月10日教链文章《巴以开战,美联储投降》中,展示了历史上每次美债长短期利率倒挂和经济衰退的先后关系。精准相关,算无遗策。而每一次衰退,又都会逼迫美联储扭转高息政策,转入降息通道。

而对于BTC的长期持有者而言,只需要静静等待,胜利的必然到来。

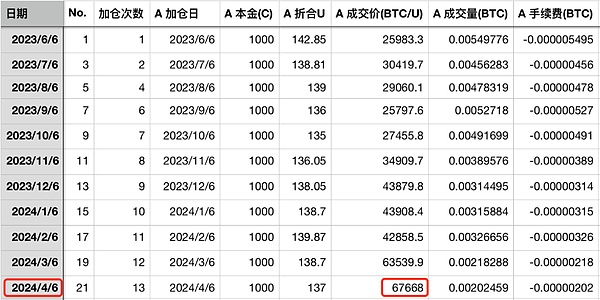

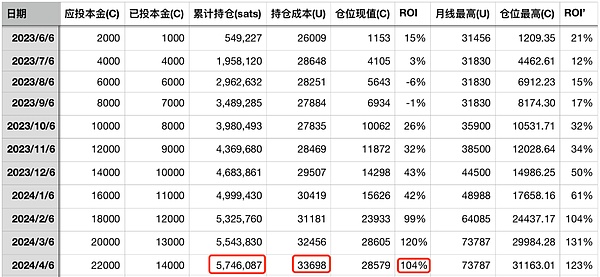

启动于2023年6月6日的《八字诀 · 十年之约》实盘见证计划,今天(2024年4月6日)迎来了第21次记录和第13次加仓。本次加仓价格67668刀。

加仓后,持仓量已累积至574.6万聪,平均成本33698刀,ROI(收益率)104%。

帘外雨潺潺,春意阑珊。

罗衾不耐五更寒。

梦里不知身是客,一晌贪欢。

独自莫凭栏,无限江山。

别时容易见时难。

流水落花春去也,天上人间。

The author Liu Jiaolian, a lonely desert with a long river and a long sunset, said that it is expected to return to Wandao this weekend. He mentioned that the Fed has recently been conducting expected management and bluffing about the market's interest rate cut, expecting to suppress it. On April 4, Minneapolis Fed President nilca Shikali said that if the inflation rate remains sticky, it may not be necessary to cut interest rates this year. On March 3, Federal Reserve Chairman Jerome Powell also said that the Fed needs more evidence to prove that inflation is moving towards the goal of being affected by the United States. The influence of the eagle on the monthly interest rate cut has dropped from a short time ago to indecision. However, gold has not given the Fed any face. It has continued to rush to a new historical height, giving the Fed a hawkish stance to bash the Fed head-on with the switch of interest rate cut. This is the main reason why some people listen to it. The Fed verbally stated that it would lower its interest rate cut expectations, lower its liquidity easing expectations, and it should suppress gold, but gold and it did. But there is another way to tell the story: the market price is expected, and the market rise and fall is the derivative of expectations. On March, the US non-farm employment data was released, which greatly exceeded expectations, and the monthly non-farm employment increased by 10,000 people, far exceeding expectations. In a fairy-tale beautiful story, the Federal Reserve saw the employment data far exceeding expectations in advance, fearing that the data would suddenly be released, and the market was frightened, so it was like we were telling others that we were singing eagle management expectations the day before the data was released. When there is bad news, people will always look dignified first, and others will be prepared in advance for the next bad news after seeing our heavy expression. It is really flattering to see that the Fed cares so much about the market, and the long-term and short-term interest rates of American debt have been upside down for years and months. In last year's teaching chain article, the Palestinian-Israeli war, the Federal Reserve surrendered, it showed that every time in history, the relationship between the long-term and short-term interest rates of American debt upside down and the economic recession was precisely related. Every recession will force the Federal Reserve to reverse the high interest rate policy and turn to the interest rate reduction channel. For long-term holders, they just need to wait for the inevitable arrival of victory. The firm witness plan of the ten-year contract started on March, today ushered in the first record and the first position increase. After this position increase, the position has accumulated to the average cost of Wancong, the knife yield, the rain is gurgling outside the curtain, and the spring is fading. I don't know if I'm a guest, and it's easy to see the water when I'm alone. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。