香港开启虚拟资产ETF通道:5亿美元规模预期是保守还是乐观?

作者:Hedy Bi

比特币现货ETF获批,已不是新鲜事。据路透社昨日消息,至少三家离岸中国资产管理公司将很快推出香港虚拟资产现货ETF(比特币现货和以太坊现货ETF)。香港政府对Web3的大力支持以及政策利好频出已成了行业的预期共识。欧科云链研究院观察到此次香港比特币、以太坊现货ETF获批并未像美国比特币现货ETF获批时在市场上引起很大轰动,但我们在接受媒体问询时,了解到大家关注更多的问题是其背后所带来多少资金量以及更深远的意义,笔者通过本文从“港股交易员”的角度探讨以下几个问题:

1. 在测算流入资金规模时,为何各机构对南向资金如此看重?

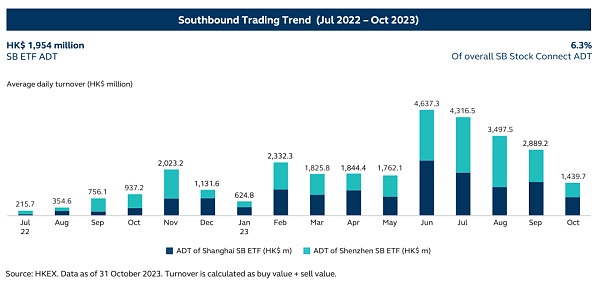

自2022年7月,ETF首次被纳入 "股票通"。该计划允许中国内地和中国香港的投资者通过本国市场的证券交易所和结算所买卖和结算在对方市场上市的股票,也因此有了南向资金(中国大陆至中国香港)和北向资金(中国香港至中国大陆)两个类别。

若南向资金被获批,比特币代表的虚拟资产市场将会成为中美两个国家的新金融市场。据证监会公开数据,截至2023年12月31日,尽管只有8只南向合格ETF可供大陆投资者选择,但它们每日交易量高达1083亿元人民币(约合150亿美元),也就是说5%的可被南向资金交易的合资格ETF吸引了香港交易所16%的资金流入(人民币通道)。

然而,我们也注意到,通过沪港通/深港通渠道进入香港ETF市场的合格ETF数量相当有限。此外,香港证监会在2024年的展望中提出通过「互换通」、「港币-人民币双柜模式」以及双柜台庄家机制来巩固香港作为全球领先离岸人民币中心的地位。考虑到目前大陆对虚拟资产交易的态度,经过与上海和香港的相关金融市场以及Web3业内人士沟通后,欧科云链研究院得出结论:短期内香港比特币和以太坊现货ETF获批向大陆投资者开放的可能性极低。根据各监管机构和业内人士的综合意见,我们认为在目前的情况下,大陆居民无法通过沪港通/深港通方式投资比特币和以太坊的现货ETF。

不过,使用沪/深港通套现后的资金只能在本地结算系统沿原路返回,即通过沪/深港通的人民币资金进出,而不会以其他资产形式留存在香港市场,这也就意味着离岸人民币不在沪/深港通的通道内。

2. 美国比特币ETF vs 香港ETF,香港是否还具有吸引力?

我们留意到彭博社的ETF资深分析师Eric Balchunas认为5亿美元将是一个相当乐观的数字。然而,我们坚信香港虚拟资产ETF市场的潜力远远超过了这个数字。本文将从香港ETF投资者的风险偏好、香港虚拟资产市场在消息公布之前的情况,以及两地ETF设定三个方面展开分析:

Eric Balchunas用ETF市场规模进行比较,确实香港ETF市场整体规模比美国小得多,但我们也发现了一个有趣的现象。在香港排名前十的ETF中,按AUM排名第一的ETF占总AUM的54%,而美国为20%。这也就意味着香港ETF市场投资者分布不均,超过50%的投资集中在头部。

此外,香港市场上AUM排名第一的ETF也是被比特币投资者用作比较的黄金为标的物ETF(SPDR GOLD TRUST),AUM约为698亿美元,而美国ETP市场排名第一的ETF是以S&P500为标的物,AUM约为5187亿美元,SPDR GOLD TRUST AUM占美国第一的13.5%。也因此可以得出香港ETF市场头部效应更为显著的结论,并且对比美国ETF投资者更会想要投资美股(例如S&P500为标的),香港投资者投资黄金的兴趣更大。这说明两个市场的投资者对于风险偏好以及经济周期的理解会存在一定不同。香港市场对于作为“数字黄金”的比特币将会有更大的接受度。

数据来源:HKEX,ETFdatabase

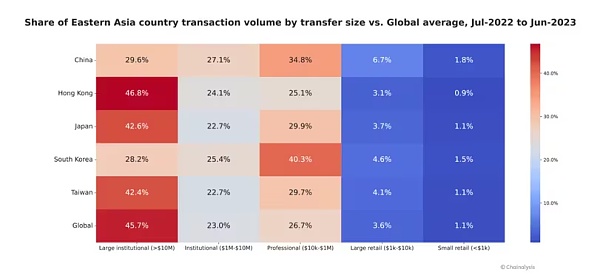

对于比特币的热情,香港民众似乎也有更高的热情。在去年年底欧科云链研究院深入香港虚拟资产OTC市场进行实地调研时发现,香港虚拟资产市场截至今年1月,至少有200家实体加密OTC找换店(exchange shop)。据我们测算,就找换店这一渠道,年平均交易额在100亿美元以上。在没有ETF这个渠道之前,Chainalysis也对香港市场进行了估算:尽管香港人口对比美国少很多,但去年熊市行情(2022年6月至2023年6月)下,香港活跃的场外加密货币市场推动了640亿美元的交易量。与亚洲其他地区相比,香港在大型机构加密货币交易中占据主导地位。在香港每年的虚拟资产交易中,46.8%是超过1千万美元的机构交易,高于全球同类型交易的平均水平。

数据来源:Chainalysis

此外,在赎回机制上,由于香港在虚拟资产市场方面有全面的监管体系,实物赎回机制会更加利好「Crypto-native」的投资者。币进钱出、币进币出、钱进币出和钱进钱出四种方式是比美国的现金赎回机制(最后一种)要更为灵活,也存在套利空间。此外,我们认为对于已经持有BTC和ETH的香港投资者,更大程度上减少了用比特币兑换法币时获得非法资金的概率,从而保护投资者的资产。

而对于以太坊现货ETF来说,尽管目前以太坊市值为3717亿美元,相比市值为1.25万亿的比特币市场,作为发行方来说更有动力去推动。因为以太坊现货ETF除了价格涨幅所带来的收益外,还有质押带来的额外收益率。早在当地时间2024年2月7日,Ark Invest提交了一份更新的S-1修订申请表中新增“发起人可能会不时地将信托资产的一部分质押于一个或者更多的可信第三方质押平台”。

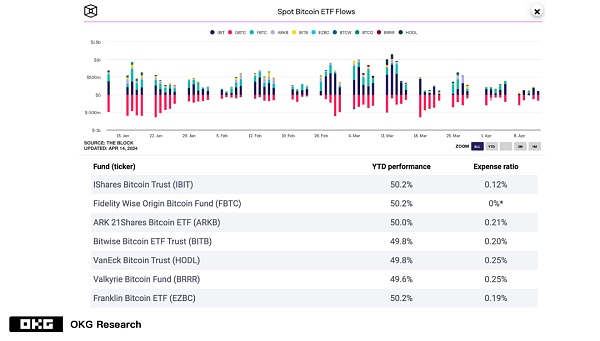

对于香港合格投资者来说,尤其是大额交易投资者,目前为止据我们了解香港的管理费并不占优势。不过对于资金流入情况,还有其他因素需要考量。对于当前基金费率为0的FBTC在资金流入情况下并不是排名第一的,这也许与FBTC选用的是自托管形式,而非第三方(coinbase,gemini)托管形式有关。

数据来源:The Block, Public Info

而香港布局Web3,并开放大众更为熟知的ETF通道更有深意,这不仅是对金融机构因整体资产“缩水”的资产负债表一次利好调整,更是留在“牌桌”甚至是组局新金融牌桌的主导者战略之策。伴随着比特币减半等基本面的利好,就香港此次虚拟资产现货ETF的未来潜力,我们拭目以待!

The author's approval of bitcoin spot is nothing new. According to Reuters's news yesterday, at least three offshore China asset management companies will soon launch Hong Kong virtual assets, bitcoin spot and ethereum spot. The strong support of the Hong Kong government and the frequent favorable policies have become the expected consensus of the industry. Ou Ke Yunlian Research Institute observed that the approval of bitcoin ethereum spot in Hong Kong did not cause a great sensation in the market like the approval of bitcoin spot in the United States, but we learned that it was big when we were interviewed by the media. Economists pay more attention to the amount of funds behind it and its far-reaching significance. Through this paper, the author discusses the following questions from the perspective of Hong Kong stock traders. Why do institutions attach so much importance to southbound funds when measuring the scale of inflow of funds? Since it was first included in the stock market in January, the plan allows investors in China mainland and China and Hong Kong to buy and sell and settle stocks listed in the other market through the stock exchanges and clearing houses in their own markets, and thus has southbound funds from Chinese mainland to China. Hong Kong and northbound funds: China, Hong Kong and Chinese mainland. If southbound funds are approved, the virtual asset market represented by Bitcoin will become the new financial market of China and the United States. According to the public data of the China Securities Regulatory Commission, as of March, although only southbound funds are available for mainland investors to choose from, their daily trading volume is as high as 100 million yuan, or about 100 million US dollars. That is to say, the eligibility of southbound funds transactions has attracted the funds of the Hong Kong Stock Exchange to flow into the RMB channel. However, we have also noticed that. The number of qualified people entering the Hong Kong market through the Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect channel is quite limited. In addition, the Hong Kong Securities Regulatory Commission proposed in the outlook of 2008 to consolidate Hong Kong's position as the world's leading offshore RMB center by exchanging the dual-counter mode of connecting Hong Kong dollars and RMB and the dual-counter banker mechanism. Considering the current attitude of the mainland towards virtual assets trading, after communicating with relevant financial markets and insiders in Shanghai and Hong Kong, Ou Ke Yunlian Research Institute concluded that Hong Kong Bitcoin and Ethereum will be approved in the short term. The possibility of opening up to mainland investors is extremely low. According to the comprehensive opinions of various regulatory agencies and industry insiders, we believe that under the current circumstances, mainland residents cannot invest in the spot of Bitcoin and Ethereum through the Shanghai-Shenzhen-Hong Kong Stock Connect, but the funds cashed out through the Shanghai-Shenzhen-Hong Kong Stock Connect can only be returned to the local settlement system along the original route, that is, the RMB funds entered and exited through the Shanghai-Shenzhen-Hong Kong Stock Connect, and will not remain in the Hong Kong market in the form of other assets, which means that the offshore RMB is not in the channel of the Shanghai-Shenzhen-Hong Kong Stock Connect. Is the US Bitcoin Hong Kong still attractive? We have noticed that senior analysts of Bloomberg think that $ billion will be a fairly optimistic figure. However, we firmly believe that the potential of Hong Kong's virtual asset market far exceeds this figure. This paper will analyze the risk preference of Hong Kong investors, the situation of Hong Kong's virtual asset market before the news was announced and the setting of the two places. It is true that the overall size of Hong Kong's market is much smaller than that of the United States, but we also found that. An interesting phenomenon is that among the top ten in Hong Kong, the number one accounts for the total, while that in the United States means that investors in the Hong Kong market are unevenly distributed and more than the investment is concentrated in the head. In addition, the number one gold in the Hong Kong market is also used by bitcoin investors for comparison, and the number one gold in the US market is about $100 million, so it can be concluded that the head effect in the Hong Kong market is more significant and compared with American investors. More likely to want to invest in US stocks, for example, Hong Kong investors who are the target are more interested in investing in gold, which shows that investors in the two markets will have different understandings of risk preferences and economic cycles. The Hong Kong market will have greater acceptance of Bitcoin as digital gold, and the data sources seem to have higher enthusiasm for Bitcoin. At the end of last year, when Ou Ke Cloud Chain Research Institute went deep into the virtual asset market in Hong Kong, it was found that the virtual asset market in Hong Kong had closed. According to our estimation, there was at least one physical crypto-exchange shop in January this year. The average annual transaction volume of this channel was more than US$ 100 million. Before this channel, the Hong Kong market was estimated. Although the population of Hong Kong was much smaller than that of the United States, the active OTC crypto-currency market in Hong Kong promoted the transaction volume of US$ 100 million from January to December last year. Compared with other parts of Asia, Hong Kong played a leading role in crypto-currency transactions of large institutions, and it was one of the annual virtual assets transactions in Hong Kong. Institutional transactions with more than 10 million dollars are higher than the average level of similar transactions in the world. In addition, in terms of redemption mechanism, due to Hong Kong's comprehensive supervision system in the virtual asset market, the physical redemption mechanism will be more favorable to investors. The four ways of money in and money out and money in and out are more flexible than the last one of the cash redemption mechanism in the United States, and there is also arbitrage space. In addition, we think that the use of bits is reduced to a greater extent for Hong Kong investors who have already held money. The probability of obtaining illegal funds when the currency is converted into legal tender, thus protecting investors' assets. For Ethereum spot, although the current market value of Ethereum is US$ 100 million, compared with the bitcoin market with a market value of trillion, it has more incentive to promote it as an issuer, because Ethereum spot not only has the income brought by price increase, but also has the additional yield brought by pledge. As early as June, local time, an updated revised application form was submitted, and new sponsors may pledge part of trust assets from time to time. Betting on one or more trusted third-party pledge platforms is not an advantage for qualified investors in Hong Kong, especially large-value transaction investors. However, as far as we know, there are other factors to be considered for the inflow of funds. For the current fund rate, it is not the first in the inflow of funds. This may be related to the choice of self-hosting rather than third-party hosting, and Hong Kong has laid out and opened channels that are more familiar to the public. It is meaningful. This is not only a favorable adjustment to the balance sheet of financial institutions due to the shrinking overall assets, but also a leader's strategic plan to stay at the table or even organize a new financial table. With the fundamental benefits such as halving bitcoin, we will wait and see the future potential of the virtual asset spot in Hong Kong. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。