一文了解BTCFi的现在和未来

原文作者:IGNAS,原文来源:ignasdefi

我们是如何走到这一步的,现在在比特币上该做些什么,以及未来会怎样。

他们声称比特币上的NFT是不可能的。

他们说在比特币上进行DeFi是不可能的。

事实证明,他们错了。

BTCFi是一项从零到一的创新,我对此非常兴奋(并投资了)。

在这篇文章中,我想慢慢来,解释我们是如何走到这一步的,介绍你现在可以使用的协议,分享一些入门技巧,并讨论下一步的工作。

为什么看好BTCFi

直到最近,Ordinals和BRC20还没有满足我对蓬勃发展的生态系统的所有三个标准。这是我用来评估生态系统和代币的框架。

你如何选择投资哪些代币?你是怎么做研究的?你只是在X上寻找alpha吗?有这么多代币和叙事需要考虑,你如何评估哪些代币有潜力跑赢比特币?

Ordinals和BRC20让我很感兴趣,因为它1)创新,2)讲故事的能力很强。

然而,BRC20代币膨胀得太快了,没有任何飞轮效应来遏制通货膨胀。BRC20在“公平发布”中可以自由铸造,但没有任何多样化或用例支持。像Meme币一样。这可能会稀释用户的注意力和进入生态系统的资金。2017-18年ICO ERC20热潮就是这样结束的。

但自那以后,情况发生了变化。

首先,ORDI代币已经巩固了自己作为比特币上第一个在主要交易所上市的Meme币的地位。

其次,在比特币(不是 L2)上启动的真正原生 dApp,它们在某种程度上可用并具有原生代币。

第三,像OKX和币安这样的CEX正在通过推出自己的铭文服务、市场和列出BTCFi资产,对铭文进行大量投资。

第四,空投已经到达比特币,奖励持有特定资产的用户。

最后,一个新的可替代代币标准将在比特币减半区块上推出,以挑战BRC20的主导地位。

现在,BTCFi是一个快速增长的加密类别,拥有一个核心社区,似乎由非西方用户主导!

所有BRC20的总市值达到了28亿美元,这足以引起人们的注意,但也足够低,可以在早期获得100倍的上涨空间。

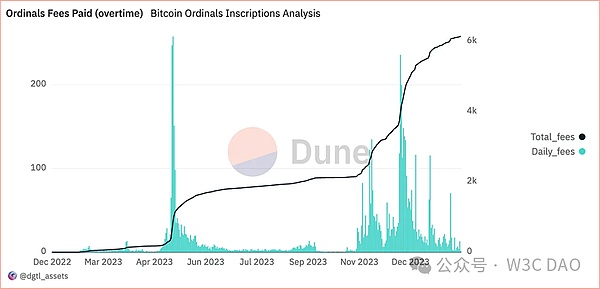

此外,Ordinals铭文是比特币安全的生命线,因为3.06亿美元的比特币费用已经支付给了矿工。

请注意,3月份铭文tx的大幅增加,以及它们如何在2023年底再次出现。

顶级Ordinals NFT系列的销量也很高。Taproot Wizards创作的”Genesis Cat”在苏富比拍卖会上以25.4万美元的价格成交。目前的底价是1.3万美元。在底价排名前20位的NFT中,有3个是比特币NFT。不久将会有更多的人加入这个行列。

但为什么有人会出这么多钱呢?让我们简单回顾一下这一切开始的地方。

这里有一个重要的简短故事。

它始于Casey Rodarmor在2022年12月引入的Ordinals协议,该协议使比特币(BTC的最小单位)的每个satoshi都可以携带独特的数据,包括NFT。

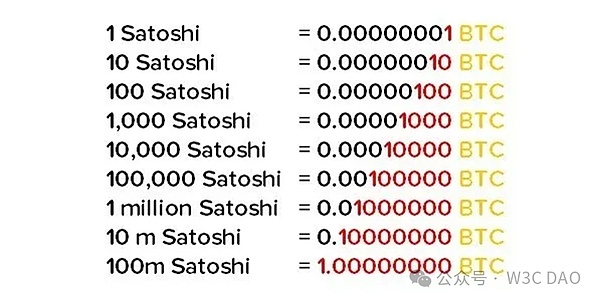

1比特币= 1亿聪。

Ordinals NFT不是你的以太坊NFT,带有链下存储的链接。Ordinal JPEG永远被刻在satoshi上。我认为Ordinals NFT可以成为独家收藏和PFP的终极选择。

想想看:一个刻有JPEG的satoshi可能比它的市场价格更值钱。仅凭这一点,整个比特币链的价值就超过了比特币的总市值。(同样的道理也适用于其他链,但让我听起来很聪明)。

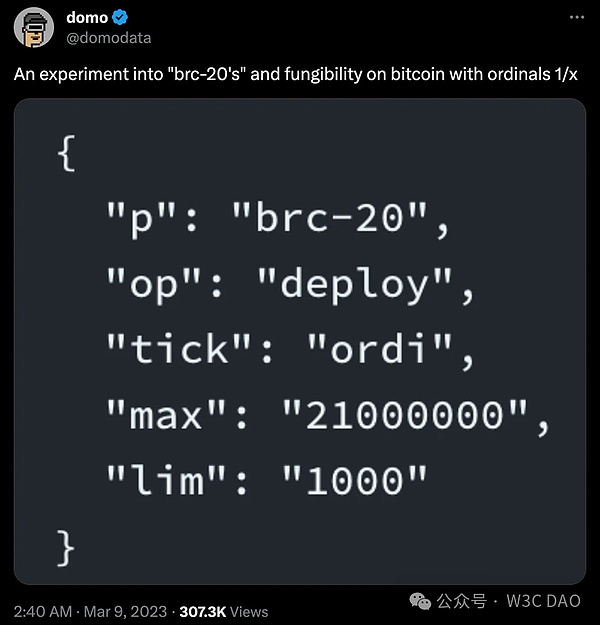

然而,这项创新直到2023年3月8日才被发现,当时一位匿名开发者“domo”推出了BRC-20代币。

BRC-20代币使用刻在satoshi上的JSON数据(基于文本的数据格式)。它们并不完美,更像是可交易的NFT,而不是可替代的代币。例如,你需要先“铭刻”(通过在 BTC 上进行链上交易),然后才能出售或转让这些代币。

无论如何,BRC-20的推出吸引了关注和投机活动,尽管Casey批评该协议偏离了他最初的愿景,使Ordinals空间变得混乱。

几乎与此同时,另一位匿名开发者Beny启动了多个项目,在Ordinals生态系统中引入了一个复杂的治理模型。这是我第一次尝试创建一个具有飞轮效应的统一生态系统,这是我正在寻找的。

其中包括TRAC代币、Tap协议和Pipe协议,每个协议都相互关联并扩展了Ordinals和BRC-20的初始概念。

TRAC代币:用于生态系统的治理代币,包括TAP和PIPE协议。

TAP协议:支持swap、流动性池、空投和比特币质押。

PIPE协议:一种基于UTXO的协议,用于比特币上的代币和NFT,灵感来自RUNES协议(正在开发中)。

为了解决Ordinals的局限性,另一位匿名开发者推出了Atomicals和ARC20代币。Atomicals使用比特币的UTXO模型来铸造代币,其中1个代币= 1个sat。

简单地说,1000个ORDI BRC20代币可以刻在1个sat上。这就是为什么你需要将BRC20代币“分割”到更多的sat上,然后才能出售它们。但一个Atomicals ARC-20总是等于1sat。

Casey似乎并不喜欢BRC-20等协议的增加,他提出了Runes,这是一种基于比特币UTXO技术(与Atomicals相同)的新代币协议,旨在将一种更“正统”的方法整合到比特币的代币发行中。

Runes协议旨在为比特币带来更多的交易费用收入、开发者和用户,同时保持区块链的完整性。

但是Rune的协议还没有开发出来,社区已经在猜测4月份第一个比特币减半区块期间会发生什么。

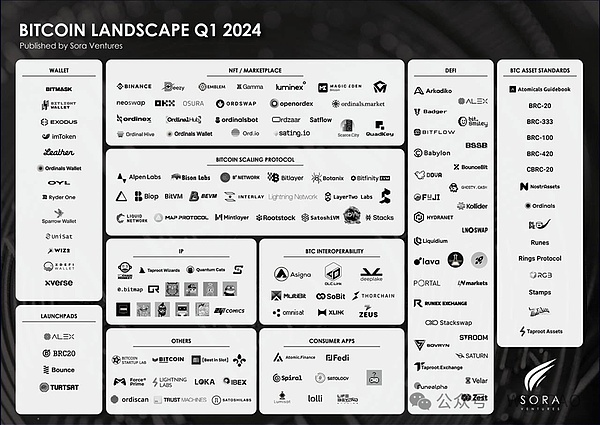

正如你所看到的,比特币生态系统是庞大的,并且随着多种比特币资产标准而不断增长。并非上面提到的所有DeFi应用程序都是真正的原生比特币dApp。

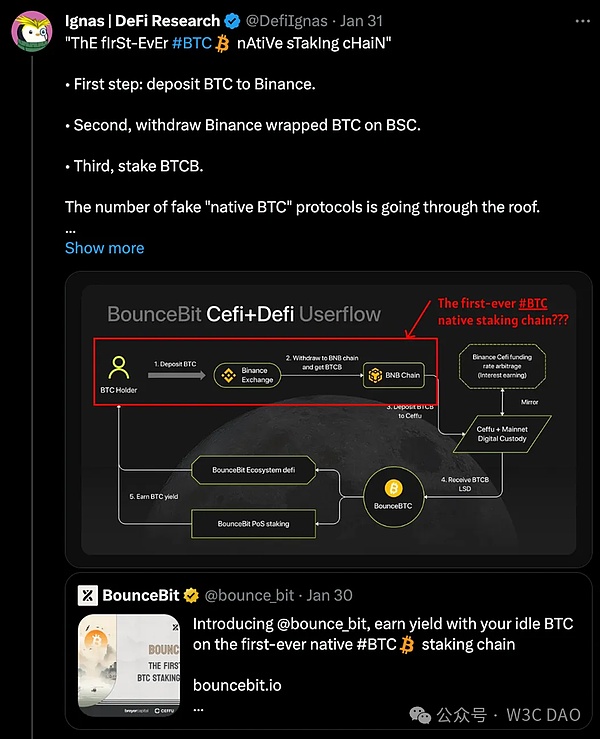

在比特币上构建需要特定的知识,只有少数协议能够实现。在Wazz的这条推文中,所有提到的协议都是ERC20代币。随着大量假比特币或BTC L2继续推出,它们也会声称是在比特币上,即使它们不是。

让我们开始探索比特币世界。

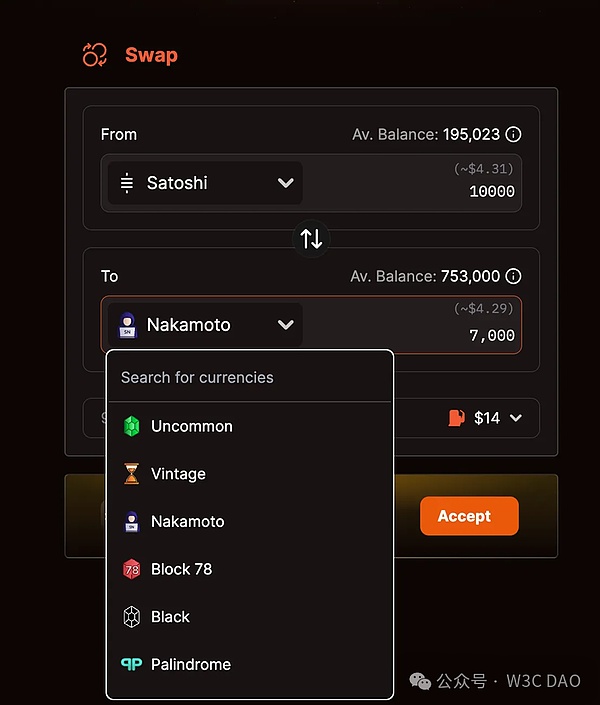

稀有聪

稀有聪因其独特的特征和历史意义而吸引了收藏家的兴趣,并按稀有程度分类。

这种迷恋是一个不断增长的利基市场,狂热者(或degens)热衷于获得具有独特故事或价值的sat,而不仅仅是货币价值。

稀有的或外来的sat:

神话:创世区块的第一个sat。

史诗:每个减半纪元的第一个sat。

披萨:从2010年开始,sat就参与了著名的pizza交易。

杀手:sat参与了罗斯·乌布利希特(Ross Ulbricht)雇用杀手的交易。

丝绸之路:2014年6月27日,美国法警从丝绸之路查获并拍卖了这些sat。

例如,一颗黑色稀有sat以16.5万美元(3.9BTC)的价格售出,成为有史以来稀有sat的最高售价。

当你读到这篇文章的时候,你有没有感到一种奇怪的Meme币潜力?

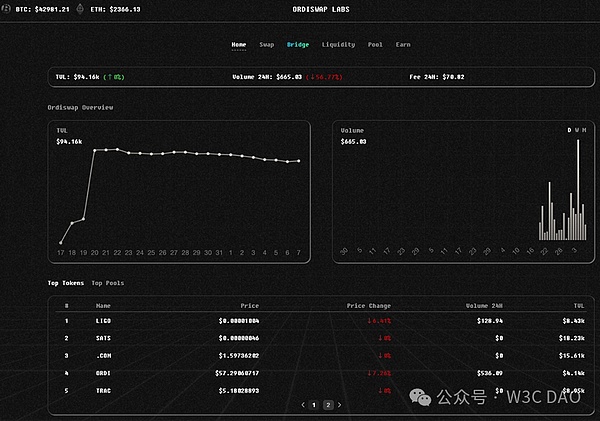

DEX:以Ordiswap为例

它就像Uniswap,但用于BRC20代币。你可以交换,增加流动性和桥接BRC20

正如你所看到的,流动性非常低(9.4万美元),交易量目前还很低。

BitSmiley -比特币的MakerDAO

bitSmiley允许铸造一种超额抵押的稳定币:bitUSD(基于其bitRC-20标准),由OKX Ventures投资。

但这还不是全部。他们还将推出:

1.bitLending:比特币原生的点对点借贷协议。

2.信用违约Swap(CDS)这需要捆绑类似的贷款,并根据违约率评估信用违约。

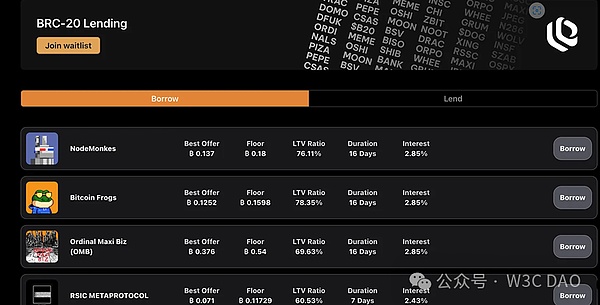

Liquidium - Ordinal 借贷场所

Liquidium也很容易理解。如果你持有昂贵的Ordinals,你可以借比特币。或者借“昂贵的”NFT做空它们。

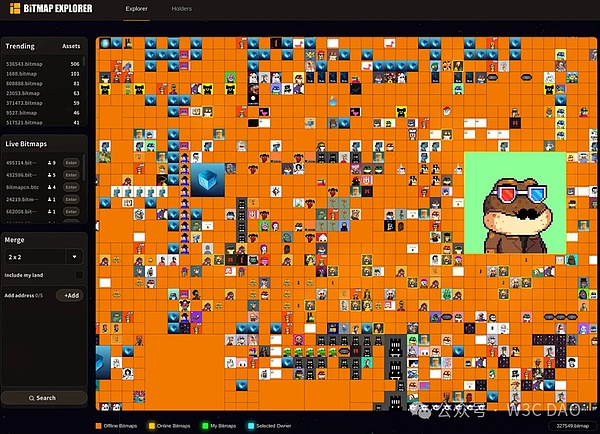

Bitmap 和 Bitmap 技术 - 元宇宙 和 L2

你一定在Magic Eden上,甚至在比特币浏览器上看到过下面的Ordinals。

Bitmap将比特币的区块链数据转换为空间土地。所以,它把它们变成了一个虚拟的土地,就像沙盒在以太坊上做的那样。

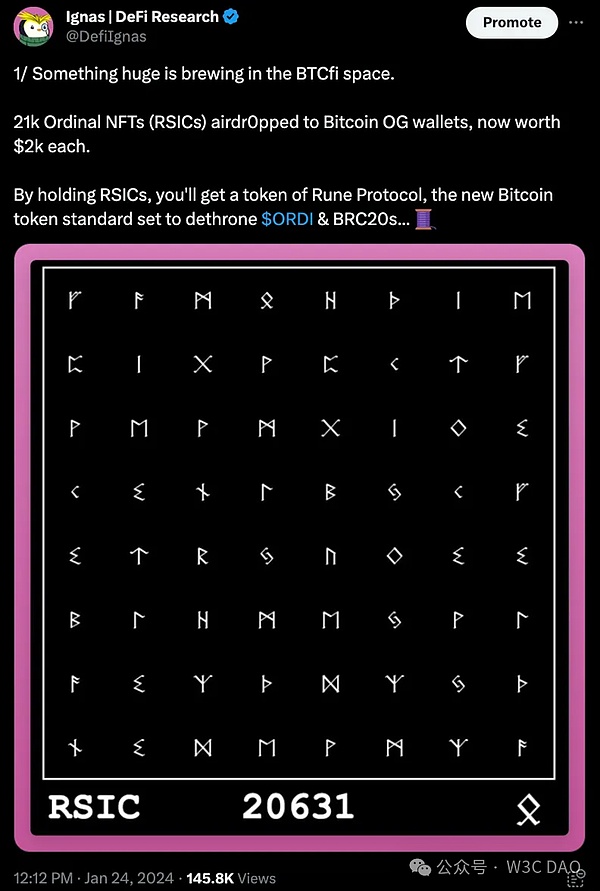

Runes协议 —— 比特币的下一个大事件

在这次采访(推荐观看)中,Casey(Ordinals理论的创造者)说:“Runes试图将投机、赌博和乐趣带入比特币。”所以,欢乐时光即将到来。

该协议将于4月份的某个时候在第一个比特币减半区块上线。但猜测已经开始了。

最后,OrdFi/BTCFi的复杂性为那些愿意学习的人提供了许多机会!

BTCFI起步较晚,叙事由华人主导,但我实话实说,比特币DeFi生态系统处于早期阶段,漏洞百出,不容易使用,机会就在这里。

Original author Original source How did we get to this point? What should we do now on Bitcoin and what will happen in the future? They claim that it is impossible on Bitcoin. They say that it is impossible to do it on Bitcoin. Facts prove that they are wrong. It is a zero-to-one innovation, and I am very excited about it and invested in it. In this article, I want to explain how we got to this point slowly, introduce some protocols you can use now, share some introductory skills and discuss the reasons for the next step. Until recently, I haven't met all three criteria for the booming ecosystem. This is the framework I use to evaluate ecosystems and tokens. How do you choose which tokens to invest in? How do you do your research? Are there so many tokens and narratives to consider? How do you evaluate which tokens have the potential to outperform Bitcoin and interest me? Because of its strong ability of innovative storytelling, tokens are expanding too fast, but there is no flywheel effect to curb inflation. Fair release can be cast freely, but there is no diversification or use case support, like coins, which may dilute users' attention and enter the ecosystem. This is how the annual upsurge of funds ended, but since then, the situation has changed. First, tokens have consolidated their position as the first currency listed on the main exchange on Bitcoin. Second, bitcoin is not really native. They are available to some extent and have native tokens. Third, coins like Wo An are passing. Launching its own inscription service market and listing its assets, investing heavily in inscriptions. The fourth airdrop has arrived in Bitcoin to reward users who hold specific assets. Finally, a new alternative token standard will be launched in the bitcoin half block to challenge the dominant position. Now it is a fast-growing encryption category with a core community, which seems to be dominated by non-western users. The total market value of all has reached hundreds of millions of dollars, which is enough to attract people's attention, but it is also low enough to gain twice the upside in the early stage. In addition, the inscription is the lifeline of bitcoin security, because the bitcoin fee of $100 million has been paid to miners. Please pay attention to the sharp increase of monthly inscriptions and how they reappear at the end of the year. The top series sold well. The creation was sold at Sotheby's auction for $10,000. At present, the reserve price is $10,000, and one of them is bitcoin. More people will join the ranks soon, but why will someone pay so much money? Let's briefly review this. Where it all started, here is an important short story, which started with the agreement introduced in June, which enabled each of the smallest units of Bitcoin to carry unique data, including Bitcoin Yicong, not your Ethereum, with the link stored under the chain forever engraved on it. I think it can be the ultimate choice for exclusive collection and sum. Think about it, an engraved one may be more valuable than its market price. Just for this reason, the value of the whole bitcoin chain exceeds the total market value of Bitcoin. It also applies to other chains, but it makes me sound smart. However, this innovation was not discovered until, at that time, an anonymous developer introduced tokens, using the text-based data format of engraved data. They are not perfect, but more like tradable rather than replaceable tokens. For example, you need to engrave online transactions before you can sell or transfer these tokens. Anyway, the launch attracted attention and speculation, although criticizing the agreement for deviating from his original vision. Almost at the same time, another anonymous developer started several projects and introduced a complex governance model into the ecosystem. This is the first time I tried to create a unified ecosystem with flywheel effect. This is what I am looking for, including token protocols and protocols. Each protocol is interrelated and extends the initial concept of sum. Tokens are used for ecosystem governance, including the sum protocol, which supports liquidity pool airdrop and bitcoin pledge protocol, which is based on. The tokens used in Bitcoin are inspired by the limitations of the protocol under development. In order to solve the limitations, another anonymous developer has introduced a model of using Bitcoin with tokens to cast tokens. In short, one token can be engraved on one token, which is why you need to divide the tokens into more places before you can sell them, but one always seems to dislike the increase of the protocol. He proposed a new token protocol based on Bitcoin technology and aimed to make a more. The orthodox method is integrated into the token issuance of Bitcoin. The protocol aims to bring more transaction costs to Bitcoin and income to developers and users while maintaining the integrity of the blockchain. However, the protocol has not yet been developed. The community has been speculating about what will happen during the first bitcoin halving block in January. As you can see, the bitcoin ecosystem is huge and growing with various bitcoin asset standards. Not all the applications mentioned above are truly native bitcoins. The construction of bitcoin requires specific knowledge, and only a few protocols can be implemented. All the protocols mentioned in this tweet are tokens. As a large number of fake bitcoins are launched or continue to be launched, they will also claim to be in bitcoin, even if they don't let us start exploring the world of bitcoin. Rare and rare have attracted collectors' interest because of their unique characteristics and historical significance, and classified according to the degree of rarity. This fascination is a growing niche market enthusiast or keen to obtain unique stories. Or the value, not just the monetary value, is rare or exotic. The first epic of the Creation Block, the first pizza in every halving era, has participated in the famous trading killer in Ross Ubud Licht since 1998. The Silk Road, the US marshals seized and auctioned these from the Silk Road. For example, a black rare was sold for 10,000 US dollars, which became the highest price ever. Did you feel strange when you read this article? Take the currency potential of Bitcoin as an example. It is like but used as a token, you can exchange it to increase liquidity and bridge it. As you can see, the liquidity is very low, and the transaction volume of 10,000 dollars is still very low. Bitcoin is allowed to cast a stable currency with excessive mortgage based on its standards, but this is not all. They will also launch the original peer-to-peer lending agreement of Bitcoin, which requires bundling similar loans and evaluating the credit default according to the default rate. It is also easy to understand that if you hold expensive ones, you can borrow Bitcoin or borrow expensive ones to short them and the technical meta-universe, and you must watch it on the Bitcoin browser 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。