标准普尔全球警告以太坊 ETF 现货对质押集中度的影响

标准普尔全球评级在最近的一份分析中强调,美国可能批准现货以太坊(ETH )交易所交易基金(ETF),其中包括质押计划,可能会放大以太坊网络内的集中风险。

据报道,SEC 最早可能在 5 月份批准 ETH ETF。然而,随着金融巨头争夺这一新兴领域的股份,ETF的进入可能会极大地影响以太坊验证者权力的平衡,带来新的挑战和机遇。

SEC 必须在 5 月 23 日之前对VanEck 的申请做出决定,并可能在该截止日期之前对其他 ETH ETF 申请做出裁决。

1、集中度风险

Ark Invest和Franklin Templeton提出的现货以太坊 ETF 提案旨在通过质押 ETH 来产生额外收益。然而,标准普尔全球分析师写道,如果这些支持质押的 ETF 看到足够高的资金流入,它们可能会影响以太坊验证网络的参与率。

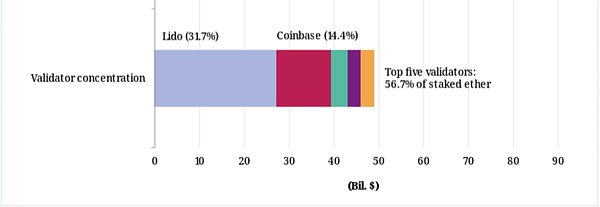

根据该报告,Lido目前占质押 ETH 的比例略低于三分之一,是最大的以太坊验证者。然而,该报告对这些 ETF 选择 Lido 等去中心化质押协议的可能性表示怀疑。

相反,对机构加密货币托管人的偏好似乎更有可能,这表明根据发行人的多元化策略对验证者集中度产生不同的影响。

通过 S&P Global 验证 ETH 浓度

该报告还强调,作为某些基金托管人的Coinbase如果代表美国 ETF 接收新的 ETH,也可能会带来集中风险。

该交易所目前负责大约 15% 的 ETH 质押,使其成为第二大验证者。它还担任四个最大的非美国质押以太坊 ETF 中三个的托管人。

该报告表示,这些问题至关重要,因为对单一实体或软件客户端的依赖可能会带来验证器中断和攻击的风险。它呼吁加强对集中风险的监控并强调其重要性。

新数字资产托管人的出现可以为 ETF 发行人更广泛地分配其股份提供途径,这也可以减轻集中风险。

2、摩根大通也表达了担忧

标准普尔全球的报告呼应了摩根大通最近在对以太坊 ETF 现货的类似分析中提出的担忧。该贷款机构的报告还得出结论,Lido 和 Coinbase 的主导地位对生态系统构成了重大的集中风险。

摩根大通认为,验证者数量集中可能会成为单点故障,从而危及网络的稳定性和安全性。这种集中化还为恶意攻击提供了利润丰厚的目标,从黑客攻击到网络运营的协调中断。

此外,摩根大通的分析师警告称,主要验证者之间可能存在勾结。验证者的寡头垄断可以操纵网络的治理和运营参数以达到自身优势,但会牺牲以太坊更广泛的用户群。

这可能表现为审查交易、对某些操作给予优惠待遇或抢先交易——这些做法会削弱人们对以太坊公平性和透明度的信任。

确保以太坊仍然是一个强大、安全和去中心化的平台,需要集体努力来减轻集中风险,并营造一个环境,让任何一个验证者或一组验证者都无法行使不成比例的权力。

In a recent analysis, Standard & Poor's Global Rating stressed that the United States may approve the spot Ethereum exchange-traded fund, including the pledge plan, which may amplify the concentration risk in the Ethereum network. It is reported that it may be approved as early as May. However, with the entry of financial giants vying for shares in this emerging field, it may greatly affect the balance of power of Ethereum verifiers, bringing new challenges and opportunities. It is necessary to make a decision on the application before May and possibly before the deadline. He applied to make a ruling on concentration risk and the proposed spot Ethereum proposal is aimed at generating additional income through pledge. However, global analysts of Standard & Poor's wrote that if these pledge supporters see enough capital flowing into them, the participation rate of Ethereum verification network may be affected. According to the report, the proportion of pledge is slightly less than one third, and it is the largest Ethereum verifier. However, the report expressed doubts about the possibility of these options and decentralized pledge agreements, and instead encrypted goods by institutions. The preference of the currency custodian seems to be more likely, which indicates that the concentration of verifiers varies according to the issuer's diversification strategy. By verifying the concentration, the report also emphasizes that if the custodian of some funds receives new ones on behalf of the United States, it may also bring concentration risks. The exchange is currently responsible for about the pledge, making it the second largest verifier, and it also serves as the custodian of three of the four largest non-American pledge ethereum. The report indicates that these issues are crucial because of the single entity or The dependence of software client may bring the risk of verifier interruption and attack. It calls for strengthening the monitoring of concentration risk and emphasizes its importance. The emergence of new digital asset custodians can provide a way for issuers to distribute their shares more widely, which can also reduce the concentration risk. JPMorgan Chase also expressed concern. Standard & Poor's global report echoed the concerns raised by JPMorgan Chase in a similar analysis of Ethereum spot recently. The report of the lending institution also reached a conclusion and its dominant position was opposite. State system constitutes a major concentration risk. JPMorgan Chase believes that the concentration of verifiers may become a single point of failure, thus endangering the stability and security of the network. This concentration also provides a lucrative target for malicious attacks, from hacking attacks to the interruption of network operation coordination. In addition, analysts in JPMorgan Chase warned that there may be an oligopoly among the main verifiers, which can manipulate the governance and operation parameters of the network to achieve its own advantages, but at the expense of Ethereum. User groups, which may be manifested in reviewing transactions, giving preferential treatment to certain operations or preempting transactions, will weaken people's trust in the fairness and transparency of Ethereum, and ensure that Ethereum remains a strong, secure and decentralized platform, which requires collective efforts to reduce the concentration risk and create an environment where any verifier or a group of verifiers cannot exercise disproportionate power. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。