如何更好捕捉加密交易中的Alpha?

Alpha 和 Edge 的区别

什么是 Alpha,以及如何利用它

如何培养 Edge,并且如何在加密领域建立自己的直觉

何时买入抄底

何时做空暴涨(haram)

在 CT(加密货币社区)中,Alpha 和 Edge 这两个词经常被提及,但它们实际上意味着什么呢?

简单来说,Alpha 就是你可以利用它赚钱的信息。有不同类型的 Alpha,以及利用它赚钱所需的不同 Edge。Edge 是指能够从市场中获利的能力,这是由于参与者具有的理解或技能集,而其他人没有。Edge 和 Alpha 是同一枚硬币的不同面。

Alpha = 可操作的信息

Edge = 能够利用这些信息

这有许多变种,让我们来分解一下。

3 种基本类型的「alpha」

时间敏感的 alpha

这将是新闻交易和投机行为,能够在成功的可能性很高的情况下采取冒险立场。这方面的例子包括在 2022 年离开加密货币做空 Cronje,或者做多最近暴涨的 FTT。

基于大众心理的 alpha

无论是熟悉图标等技术分析,还是知道某些与空投相关的分形,都是一个很好的例子。尽管基本面不佳,购买黑客攻击或破产项目是有利可图的,SOL,FTT,CEL,SRM 都是很好的例子。

看吧,LUNC 在最后的熊市中提供了很好的回报。这也可以延伸到 GCR 在 10 SOL 和 1,000 ETH 以及 15,700 BTC 底部进行大量购买。大众心理在尖叫着传染,更糟的情况即将到来,但它仍然没有到来(至少目前还没有)。

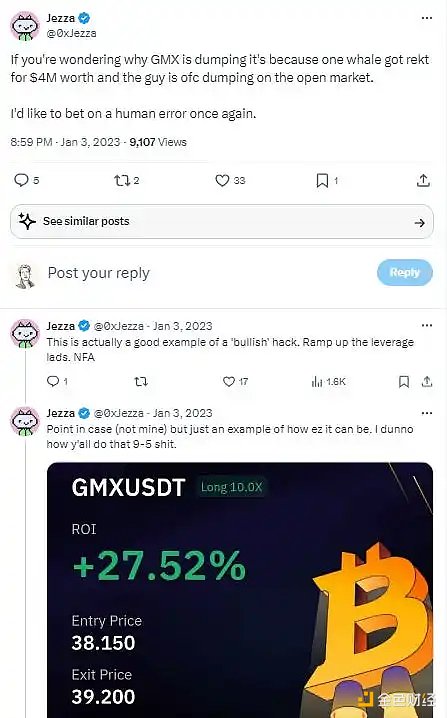

直觉

能够知道、感受和准确预测会发生什么。这是最难发展的,很多人都没有。我在多个 CT(加密货币社区)成员中看到了这一点,比如 @outpxce 和他对游戏的理解能力;@0xJezza 以及他对链上交易的累积、出售和进入的低风险的能力;@smileycapital 对价格、涨幅和市场趋势的预测超前于人群;@ZoomerOracle 发现了市场表现优于市场的新亮点币(TIA,ZETA,BEAM);还有 @GCRClassic 对市场的杀手级观点和预测。

分析 GCR 对市场的看法,你可以开始理解他的直觉是如何形成的:他将谢林点(Schelling points)与单位偏见以及市场和人类心理结合在一起,达到了天才的水平。他有着政治预测背景所建立的直觉,最重要的是,这对他来说很容易。

如果你有正确的直觉,赚钱应该很容易。如果你在这行待得足够久,最好的策略可能就是最简单的策略。无论是在 2023 年市场开始上涨的时候购买 FTT,在看到 SOL 开始复苏时购买 APT,在 BEAM 重新品牌、nodemonke 上市、PANDORA 开始具备逃逸速度时购买,能够迅速改变强烈信念来获胜是正确的方法。让我们举例说明:

例子 1:在它们没有对协议造成致命打击时购买任何黑客或漏洞 - GMX 一个鲸鱼在 GMX 上被利用了 400 万美元,这是一个看涨的卖出信号。

例子 2:根据市场趋势做空或做多,并利用此来获利。毋庸置疑,去年最容易的交易是 Blackrock ETF 的公告,以及注意到市场对实习生虚假推文的反应(愿他的灵魂得到安息)。

例子 3:等待团队的推动力或骗局 pump(并非所有项目都是骗局,但你明白我的意思)。如果你能找到不会归零的项目,并在交易量减少和卖出放缓时简单地现货购买,当市场条件合适时,团队会利用公告和推动因素刺激积极的价格行为。

在 AVAX 宣布文化激励资助之前对它做研究,研究 Pengus 以及他们是如何慢慢发展成为首选 pfp 的,研究 MC 重塑为 BEAM,还有很多例子。

然而,所有这些背后最重要的原则是要灵活,适应市场提供的一切,也就是要参与当前蓬勃发展的市场领域。NFT,杠杆,Onchain 和 DeFi,你只需进入钱在的地方。知道如何在 CEX 上做空/做多,在那里有资金准备好进行资本化,在每个半合格链和 L2 上有一个 ETH 或几个 band,以在新的机会出现时抓住它们。当你不在电脑旁边时,有一个亲密的朋友可以为你投资等等。

对目前为止的帖子进行总结:

Alpha 是使你赚钱的信息

Edge 是你利用这些信息赚钱的能力

Alpha 可以以多种方式找到,每个人在这个市场上都有不同的优势。找到你的优势,巩固它,取得胜利。

成功的方法会随着季节而变化。因此,取胜的关键是始终适应,并且永远不要忘记关闭中级大脑,要么成为愚蠢的猿人,要么成为巨脑。市场没有第二名。

对于周期、阶段、信念和从市场中获利的一些快速想法

现在,加密货币领域的大多数人手头都有各种小币和主流币,未来价值可达六到七位数,但由于缺乏周期信念,他们会过早出售。

如果你没有对某种形式的疯狂高点即将到来(可能是分布、双顶、单顶等)的信念,你会卖得太早。为了捕捉到只在加密货币中找到的疯狂倍数,你必须能够:

知道何时承担风险

知道何时获利了结以便以较低的价格重新购买

知道何时坚定持有,期待巨大的波动向上

以及知道何时逃之夭夭

想象一下以个位数的价格购买 ETH,然后因为当时没有对 ETH 的信念而在 DAO 黑客事件后出售,或者是听说 Vitalik 的虚假死讯。想象一下以两位数的低价购买 AVAX,然后在 2021 年第二次 FTX 和 3AC 双顶之前出售。或者在第一次疯狂高点后以个位数的价格出售 LUNA,而它在达到峰值时超过 100 美元。

我认识一个家伙,他在 2021 年 NFT 季节真正开始之前,以几个 ETH 的价格卖掉了 20 个无聊猿。

在这个领域真正被毁灭的最简单方法就是借用别人的信念,并且不了解自己在这个地方到底在做什么。当你购买一枚代币时,你应该知道:

它的潜在增值空间是多少,即它能涨多高,其代币经济学、FDV、其有哪些因素能让其大幅上涨。

这项技术到底好不好?好的技术可能成为一个好梗,可能是一种新的 L1 技术,也可能是新的共识,但在入场之后尽量了解一下,这样你就知道自己手中的是什么。

你是故事的早期参与者还是晚期参与者?如果你早期参与,你可以全力以赴,持有大量现货或杠杆头寸,只需监控仓位。如果晚期参与,你可能只能抓住下跌的机会。如果来得早,你可能能在大众到来之前全力以赴,但离场要比你想象的早得多。

你还应该了解代币的竞争对手和持有者,他们是:

是因为真正的信念而永远不会出售的追随者吗?比如 TAO,KAS。

是 meme 币交易者,会在-70% 的蜡烛图中抛售以投资其他代币吗?比如最近的 meme 币抛售。

是机构和风投,正在等待解锁后向零售投资者倾销,或者在此之前推动涨势吗?比如 TIA,SOL 之前的周期

零售投资者会一直竞价,直到他们没有任何积蓄为止吗?

代币经济学、持有者、故事情节,研究这三者的结合,以了解你刚刚发现的代币是否能赚钱。这个代币的市值是多少?它与其他代币相比如何?这个代币的上限市值可能是多少?

有些代币永远不会超过 1 亿美元。另一些注定成为数十亿美元的代币。其他一些尽管有着很好的 PMF,但注定只能达到 1000 万美元,因为人们只会对故事情节进行竞价。你必须既要对你的代币能提供的倍数保持现实,又要足够乐观地看待它是否能超越表现。这是一个棘手的平衡。

接着,这个代币的流动性和购买过程是怎样的呢?当 RLB 还只是几分钱的时候,SOL 似乎已经死掉了,但只要你看到了产品的收入和用户,然后像坚守钻石一样持有下去,不去理会恐慌和波动,你就可以捕捉到这枚代币甜美的 20-50 倍收益。通常情况下,越早买入一个代币,其购买难度越大。

TAO 当时 OTC 市场在 10 至 25 美元之间,购买过程相当复杂,只有真正的信仰者才能进入。现在,它的交易价格是当初的好几倍,早期购买者得到了回报。

在牛市中,有无数种获得巨额收益的方法,也有无数种在市场下跌时一败涂地的方式。你的任务是跟随牛市,观察几乎每个人都已经入场的时机,然后迅速开始出局,以免流动性消失,图表变红,人们像饥饿的恶魔一样互相攻击,渴望找回他们的钱。

停止考虑如何在下一个市场变动中获胜,开始思考如何在整个周期中取得成功。加密市场中会有无数的代币可供投资,无数的 NFT,以及新的创新将会涌现,你所需要做的就是倾听市场并密切关注。即使现在,加密领域的下一个独角兽正在诞生,当它们的代币推出时,你必须做好准备。但你必须深入了解自己以及你对市场的认知,才能采取正确的行动获胜。有些人会通过杠杆交易赚取数百万美元,有些人会通过链上持有的代币,有些人只需拥有正确的现货代币、正确的 NFT 铸造品等等。找到适合你的路径,但也要知道如何利用市场上的其他路径取得成功。

如果历史重演,我们现在已经进入了大约 18 个月的牛市,但这将是困难的。你可能会想要早点卖出,或者,在顶峰时你会相信这一次不同,我们终于创造了金融的未来。你会想在派对结束之前退出,但你可能不会在它结束之前从这个橙子上榨出足够的果汁。

没有一个周期是真正不同的。泡沫的驱动因素可能与通货膨胀、末世和现代化有所不同,但行为是相同的。一群人相信一个新的资产、股票或商品是下一个大事件,信贷扩张使价格不断攀升,直到泡沫破裂,市场将资金从众多人的手中转移到少数人手中。就像还会有另一个牛市周期一样,还会有另一个熊市。

总会有一个时机再次称一切都是虚幻的,但在当前时刻,对于现在留在这里的加密原住民来说,这一切都是闪闪发光的新物体。

你必须做好准备,你必须相信。

What is the difference between the original title, the original author's original compilation and how to use it, how to cultivate and how to establish one's own intuition in the field of encryption? When to buy the bottom and when to short and skyrocket are often mentioned in the cryptocurrency community, but what do they actually mean? Simply put, there are different types of information that you can use to make money and the differences needed to make money with it refer to the ability to profit from the market, which is due to the understanding or skills of participants. Set and others don't have the information that can be operated on different sides of the same coin. There are many variants. Let's break down a basic type of time-sensitive. This will enable news transactions and speculation to take an adventurous stance when there is a high possibility of success. Examples of this include leaving cryptocurrency to short in 2008 or doing more recent technical analysis based on public psychology, whether familiar with icons or knowing some fractal related to airdrops. It is a good example. Although the fundamentals are not good, it is profitable to buy hacking or bankruptcy projects. It is a good example. See, in the last bear market, it provided a good return. This can also be extended to making a large number of purchases in and at the bottom. The public psychology is screaming and infecting, and the worse situation is coming, but it has not yet arrived. At least, there is no intuition to know the feelings and accurately predict what will happen. This is the most difficult thing to develop. Many people have not done it in many cryptocurrency communities. The clerk saw this, for example, with his understanding of the game and his ability to sell and enter the chain with low risk. He predicted the price increase and market trend ahead of the crowd, and found the new bright spot coins with better market performance than the market, as well as the killer view and predictive analysis of the market. You can begin to understand how his intuition was formed. He combined Schelling's point with unit prejudice, market and human psychology to reach the level of genius. He has The most important thing is that it is easy for him. If you have the right intuition, it should be easy to make money. If you stay in this business long enough, the best strategy may be the simplest strategy, whether it is to buy when the market starts to rise in 2008, to buy when you see the beginning of recovery, to buy when you re-brand and start to have escape speed. Let's give examples to illustrate that strong beliefs are the right way to win. Buy any hacker or loophole when hitting. A whale has been used for $10,000 in the world. This is an example of a bullish selling signal. It is undoubted that the easiest transaction last year was the announcement and the notice of the market's reaction to the intern's false tweet. May his soul rest in peace. Example: Waiting for the team's motivation or scam. Not all projects are scams, but you know what I mean. If you can find projects that will not go back to zero and reduce the transaction volume. When selling slows down, simply buy in cash. When the market conditions are right, the team will use announcements and push factors to stimulate positive price behavior. Before announcing cultural incentive funding, we will do research on it and how they slowly develop into the first choice. There are still many examples. However, the most important principle behind all this is to be flexible and adapt to everything provided by the market, that is, to participate in the current booming market sector, and you only need to enter the place where money is and know how to short on the market. Do more, there are funds ready to be capitalized, and there are one or more in each semi-qualified chain and chain to seize new opportunities when they appear. When you are not at the computer, there is a close friend who can invest for you, etc. Summarizing the posts so far is the information that makes you make money, and the ability to make money by using this information can be found in many ways. Everyone has different advantages in this market, and the way to consolidate your advantages and win success will vary with the season. The key to success is to always adapt to change and never forget to turn off the intermediate brain, or become a stupid ape or a giant brain market. There is no second place. Most people in the cryptocurrency field now have all kinds of small coins and mainstream coins with a future value of six to seven figures, but they will sell them prematurely because of the lack of cyclical belief. If you don't have a belief that some form of crazy high point is coming, it may be a double-top order. Top-class beliefs you will sell too early. In order to capture the crazy multiples found only in cryptocurrency, you must be able to know when to take risks, when to take profits, when to buy again at a lower price, when to hold fast and expect huge fluctuations, and when to escape. Imagine buying at a single-digit price and then selling it after a hacking incident or hearing about a false death. Imagine buying at a double-digit low price and then in. I know a guy who sold a boring ape for a few dollars before the season really started. The easiest way to really be destroyed in this field is to borrow other people's beliefs and not know what you are doing in this place. When you buy a token, you should know what its potential value-added space is, that is, how high it can rise. Learn what factors can make it rise sharply. Whether this technology is good or not may become a good stalk, a new technology or a new consensus, but try to know what you are in after entering the venue, so that you can know what you are in your hands. Are you an early participant or a late participant in the story? If you participate early, you can go all out to hold a large number of spot or leveraged positions, just monitor your positions. If you participate late, you may only seize the opportunity of falling. If you come early, you can. You may be able to go all out before the arrival of the public, but you should leave much earlier than you think. You should also know the competitors and holders of tokens. Are they followers who will never sell because of their true beliefs? For example, will currency traders sell in the candle chart to invest in other tokens? For example, is the recent currency selling that institutions and venture capitalists are waiting to unlock it and dump it to retail investors or push the rally before? For example, in the previous cycle, retail investors will bid until they have no savings? A study of the storyline of token economics holders to understand the combination of the three to understand what you just found. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。