从Wintermute做市风格角度思索:STRK要卖吗?

作者:Karen;来源:Foresight News

天道酬勤,力耕不欺,Starknet 空投尘埃落定。

那领了空投之后,该不该抛售 STRK?今天我们将从 STRK 做市商 Wintermute 的做市风格来寻找启示。作为一家在加密货币领域非常活跃的做市商,Wintermute 在 CEX、DEX 以及场外交易平台上创建流动性和高效的市场,为币安、Bybit、Coinbase、Kraken、Bitfinex、Bitstamp、Uniswap、dYdX 等 50 多个交易所和交易平台提供流动性。

根据 Wintermute 官网,截至 2023 年年底,Wintermute 的累计交易量达近 3.7 万亿美元。诸如 OP、ARB、WLD、BLUR、DYDX、APE 等各个领域蓝筹代币的做市商中均存在 Wintermute 的身影。社区认为,Wintermute 的做市风格也以高价开盘、抛售、洗盘、吸筹和再拉盘为特点,同时在做市过程中,除了二级市场的直接交易,还伴随着消息面、市场趋势等多条战线的同时发力。

笔者在交叉查看 OP、ARB、WLD、BLUR、DYDX、APE 以及同类板块下其他非 Wintermute 做市的代币周线图、月线图后发现,Wintermute 的做市风格会受到多种因素的影响,不能仅凭其中几个代币的表现来判定,比如代币所处领域、代币市值、代币发币时所处的牛熊周期、Wintermute 做市的份额占比、交易策略等多个因素。

本文将从 Wintermute 参与做市、同为 Layer2 赛道的 OP、ARB 代币表现来找寻规律,从而帮助用户在做出 STRK 抉择时提供一些参考。

OP

Wintermute 在 OP 的做市过程中,遭到一些挑战和争议。在 OP 发币几天后,Wintermute 披露了一个 FUD 消息,即,在 Wintermute 在初始接收 2000 万 OP(OP 初始供应总量为 2^32 (4,294,967,296) )贷款时,因 Wintermute 团队内部失误,向 Optimism 提供了一个在以太坊主网部署的 Gnosis Safe 多签钱包地址而非事先准备好的 Optimism 地址。随后,Wintermute 同意额外接收 2000 万枚 OP,同时提供 5000 万 USDC 作为抵押品,以及探索资金回收方案。虽在此之后 Wintermute 追回了大部分 OP,但有些观察人质疑 Wintermute 在 OP 上做市的真实动机和目的。

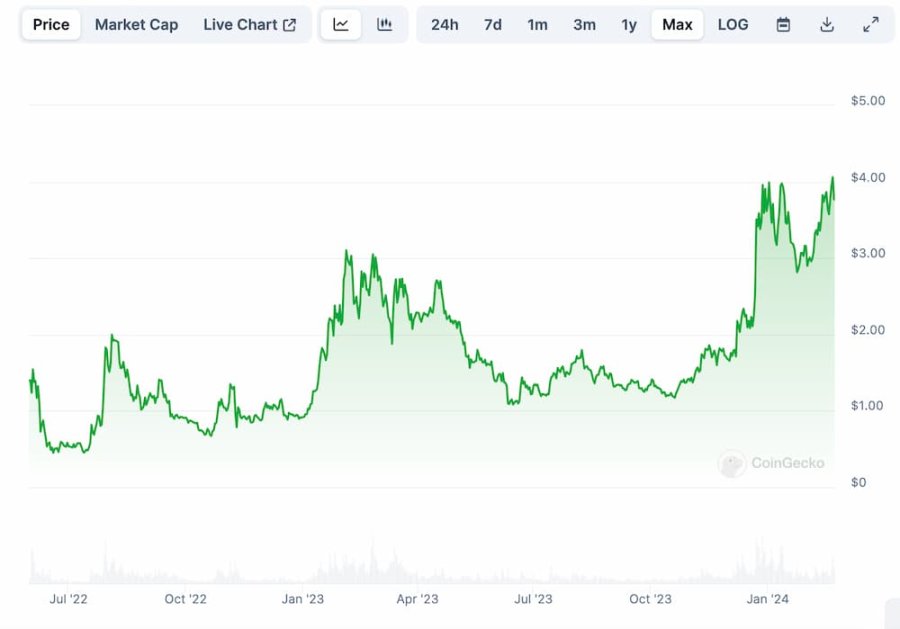

受 Optimism 代币刚启动时的科学家抢跑、空投申领开始后主网和 RPC 出现严重延迟以及 Wintermute 做市发生的失误等影响,OP 价格从刚开盘后的 2 美元左右,20 天之后一度跌至 0.5 美元左右,跌幅达到七成,之后再经过几轮拉升、震荡洗盘后,目前价格处于 3.8 美元左右。三次洗盘时长在 1 个月、4 个月到 6 个月不等。

OP 价格走势,来源:CoinGeckoARB

在 ARB 开放空投认领之前,即 2023 年 3 月 23 日,被 Arkham 标记为「Wintermute」的 0xcce30 开头地址从 Arbitrum 基金会收到 4000 万枚 ARB(ARB 总量 100 亿枚)。

在空投之后几天,Arbitrum 基金会发起 AIP-1 提案,建议引入去中心化自治组织结构 ArbitrumDAO,以及申请 7.5 亿枚 ARB 代币资金拨款。然而,Arbitrum 基金会早在 3 月 17 日凌晨就转出 7.5 亿枚 ARB 代币,转出地址为 Arbitrum 在 3 月底 AIP-1 提案中的行政预算钱包。

ARB 开盘价格在 1.5 美元左右,但因这种治理混乱、信任度和透明度不足、回应不及时、代币抛售引发的 FUD 情绪持续发酵,ARB 价格也在这之后的两周内一直在 1.2 美元浮动,随后配合大盘涨至 1.6 亿美元上方后,再次持续下跌,之后七、八个月一直在 1.3 到 0.75 美元之间震荡,然后从去年 12 月份开始稳步上涨,目前价格位于 1.8 美元左右。

ARB 价格走势,来源:CoinGeckoSTRK

Wintermute 在 STRK 空投前获得的做市代币为 200 万枚(STRK 总量为 100 亿枚),Flow Traders、Amber Group 也为 STRK 做市商。代币启动之后,STRK 在币安上线之初最高价格为 7.71 美元,在 OKX 上为 3.5 美元,随后逐步下跌,在 1.6 美元到 2 美元之间震荡。

今日 StarkWare 宣布更新早期贡献者和投资者的锁定时间表,具体为,原计划在 4 月 15 日解锁的 1.34 亿枚代币将调整为仅解锁 6400 万枚代币。此后,每月将解锁 6400 万枚代币,直至 2025 年 3 月 15 日,之后的 24 个月每月将解锁 1.27 亿代币,直至 2027 年 3 月 15 日。早期贡献者和投资者持有的 5.8 亿枚代币将在 2024 年底前解锁,原计划为 20 亿枚。至 2025 年底将有 14 亿枚额外代币逐渐解锁,2026 年底再解锁 15 亿枚,至 2027 年 3 月 15 日将解锁 3.8 亿枚。受此影响,STRK 突破 2.1 美元。

考虑到目前已有近 74% 的 STRK 空投已认领,可以理解为抛售压力应该已经得到了很大程度上的缓解。此外,由于 Wintermute 在 STRK 做市的代币数量相比在 OP 和 ARB 的做市占比较少,可能对市场产生的冲击也较小。

值得注意的是,Three Arrows Capital 清算人地址「Teneo:3AC Liquidation」也在本月收到 1.34 亿枚 STRK ,是 STRK 第 9 大持有者。这也是一个值得关注的事件,可能意味着 Three Arrows Capital 的清算过程中,其资产被重新分配或处理。早在 2021 年 3 月份和 11 月份,Three Arrows Capital 分别参投 StarkWare 7500 万美元融资 B 轮融资和 5000 万美元 C 轮融资。2022 年,Three Arrows Capital 清算人 Teneo 控制了价值 3560 万美元的法定货币和 StarkWare 代币等资产。

总体而言,价格表现方面,OP 和 ARB 在开盘之后 10 到 20 天之内下跌,随后上下震荡,并经历多个小高峰之后大幅上涨。另外两点需要提醒的是,OP 和 ARB 发币后均出现 FUD 危机;而且所处周期是正值大盘熊转牛周期,这一市场条件对他们的整体价格表现产生了一定积极影响。

对于 STRK 代币,如若参考 Wintermute 参与做市的这两个 Layer2 代币表现来看,可能存在一些短线机会。如果之前没有抛售空投代币,当前可能不是一个理想的卖出时机。

当然在做出决策时,还需要关注市场趋势,了解当前市场的热点和资金流向,以及根据自己的风险承受能力、目标来制定合适的投资策略。同时,考虑到加密货币市场的波动性,建议采取长期投资的策略,避免被短期波动所干扰。

如果你错过了 Starknet 空投或者想要探索 Starknet 生态其他机会,可以了解下 Starknet 基金会推出的「Starknet DeFi Spring」计划。该计划为期六到八个月,将向 Starknet 上参与的 DeFi 协议发放 4000 万枚 STRK。参与用户既有机会拿到平台自己的代币空投,也能拿到 STRK 激励,可谓一举两得。

Author's source: Heaven rewards hard work and does not bully airdrops. When the dust settles, should we sell them after receiving airdrops? Today, we will seek enlightenment from the market-making style of market makers. As a market maker who is very active in the field of cryptocurrency, we will create liquidity and efficient markets on and off-exchange platforms to provide liquidity for many exchanges and trading platforms such as Currency Security. According to the accumulated trading volume of official website by the end of the year, it has reached nearly one trillion US dollars, and there are figures in the market makers of blue-chip tokens in various fields. The market-making style considered by the community is also characterized by high-priced opening, selling, washing, sucking and re-selling. At the same time, in the process of market-making, in addition to the direct transactions in the secondary market, there are also many fronts such as news market trends. The market-making style found by the author after cross-checking the weekly and monthly charts of other non-market-making tokens in the same sector will be affected by many factors, and it is impossible to judge the market value of tokens in their fields and the cattle in which they are issued only by the performance of several tokens. Bear cycle market-making share ratio trading strategy and other factors, this paper will find the law from the token performance of participating in the market-making as well as the track, so as to help users provide some reference when making a decision. In the process of market-making, there are some challenges and disputes. A few days after issuing the currency, a message was revealed that when the initial total supply of 10,000 yuan was a loan, due to internal mistakes of the team, a multi-signature wallet address deployed in the main network of Ethereum was provided instead of a pre-prepared address, and then an additional address was agreed. Although most of the money was recovered after that, some observers questioned the real motivation and purpose of market making, which was influenced by the scientists who rushed to the main network after the token was first started, the serious delay and the mistakes in market making. The price once fell from about US$ just after the opening, and then fell to about US$ 70%. After several rounds of ups and downs, the current price was around US$ after three washes. The duration of the offer varies from month to month. Think about whether to sell it from the perspective of market-making style. The source of the price trend is that before the open airdrop claim, that is, the initial address marked as month, month and day, 10,000 pieces were received from the foundation. A few days after the airdrop, the foundation initiated a proposal to introduce a decentralized autonomous organization structure and apply for a grant of 100 million tokens. However, the foundation transferred out 100 million tokens as early as the morning of month and the transfer address was at the end of the month. The opening price of the administrative budget wallet in the proposal was around US dollars, but Due to this kind of governance confusion, lack of trust and transparency, the emotion caused by untimely token selling continued to ferment, and the price also kept floating in the US dollar for the next two weeks, and then continued to fall again with the broader market rising above US$ 100 million, and then fluctuated between US dollars for seven or eight months, and then rose steadily from last month. At present, the price is around US$. Think about whether to sell it from the perspective of market-making style. The source of price trend is 10,000 market-making tokens obtained before airdropping, and the total number is 100 million. After the launch of the city merchants' tokens, the highest price was US dollars at the beginning of the currency online, and then it gradually fell between US dollars and US dollars. Do you want to sell from the perspective of market-making style? Today, it was announced that the lock-up schedule of early contributors and investors would be updated, specifically, the 100 million tokens originally planned to be unlocked on January will be adjusted to only unlock 10,000 tokens, and then 10,000 tokens will be unlocked every month until the next month after January, and 100 million tokens will be unlocked every month until the 100 million tokens held by contributors and investors in the early days. Tokens will be unlocked before the end of the year. The original plan is to unlock hundreds of millions of additional tokens by the end of the year, and then unlock hundreds of millions by the end of the year. It will be affected by this to break through the US dollar. Considering that there are nearly airdrops that have been claimed, it can be understood that the selling pressure should have been greatly alleviated. In addition, because the number of tokens in the market is relatively small compared with that in the market, the impact on the market may be smaller. It is worth noting that the address of the liquidator also received hundreds of millions this month, which is the largest holding. Some people think that this is also a noteworthy event, which may mean that their assets were redistributed or handled during the liquidation process. As early as January and February of, they participated in the $10,000 financing round and the $10,000 financing round respectively. The liquidators controlled the legal tender and tokens worth $10,000. On the whole, the price performance and price fell within days after the opening, then fluctuated up and down and rose sharply after experiencing several small peaks. The other two points that need to be reminded are that both in crisis and where they are. The market condition that the cycle is just when the market bears turn to cattle has a certain positive impact on their overall price performance. If we refer to the performance of the two tokens participating in the market making, there may be some short-term opportunities. If we have not sold the airdropped tokens before, it may not be an ideal selling opportunity at present. Of course, we need to pay attention to market trends, understand the current market hotspots and capital flows, and formulate appropriate investment strategies according to our own risk tolerance goals when making decisions. At the same time, considering the volatility of the cryptocurrency market, it is suggested to adopt a long-term investment strategy to avoid being disturbed by short-term fluctuations. If you miss the airdrop or want to explore other opportunities in ecology, you can learn about the plan launched by the foundation. The plan will last for six to eight months and distribute 10,000 participating users to the participating agreements. It can be said that both the platform's own tokens can be airdropped and incentives can be obtained. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。