如何看待Bitcoin Magazine对Layer2“约法三章”?

采访者:雾月,极客web3

嘉宾:Kevin He,前Huobi集团Web3技术负责人;Faust,极客web3创始人

两位嘉宾谈到了比特币生态的行业现状、对Bitcoin Magazine提出的Layer2定义的看法、自己心目中的比特币Layer2评判方法。(注:这些言论仅代表嘉宾二人的个人观点,并不涉及到极客web3作为一家媒体机构的价值观念本身)

导语:2024年初堪称比特币Layer2的战国时代,在短短几个月时间内,比特币生态内接连涌现出至少60个自称为Layer2的项目团队,由于这个领域里缺乏权威的声音,人们对于什么该被看做Layer2,什么不该被看做Layer2,没有形成清晰有条理的判断标准。

这种模糊和无序在为开发者与创业团队提供绝对自由的同时,也使得各种编叙事蹭概念的现象肆意弥漫开来。

(图片中文字机翻自Bitcoin Magazine的英文原文)

在这个混乱而浮躁的时间节点下,Bitcoin Magazine依仗自己作为比特币社区内较权威的媒体机构身份,提出了一套简单的比特币Layer2定义标准。不难看出,该标准具有浓重的“比特币特色”,与以太坊社区对Layer2的主流认知大为不同。Bitcoin Magazine的主要观点主要涵盖三条,包括:

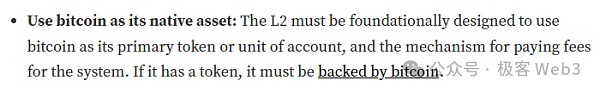

1.使用比特币作为其原生资产: Bitcoin Magazine认为,Layer2应该将比特币作为其主要代币或账户单位(Native Token),以及作为gas费的计量货币。

如果Layer2项目自己发行代币,应该 backed by bitcoin.(这一处解释比较模糊,有人认为Bitcoin Magazine似乎是指BRC-20之类的铭文资产)。

2.使用比特币作为结算层:Layer2 必须为用户预留一个退出机制,使用户能够将自己的资产撤回到Layer1上。这种撤离机制可以是去信任的,也可以存在一定信任假设。

(似乎是在说,Layer2和Layer1之间必须有桥接关系,或者资产在L1和L2之间有映射关系。跨链桥或资产退出的方式可以不Trustless,但他们没有明说,到底该达到怎样的去信任级别。且按照这条标准,铭文协议或链下索引协议、原始的RGB协议,有可能都不被归纳进Layer2的范畴)

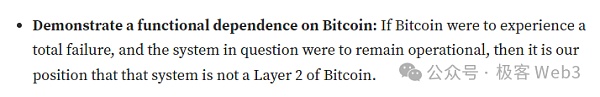

3.对比特币有依赖性:如果比特币彻底故障,Layer2也应该“唇亡齿寒”。假设Layer1停机,所谓的”Layer2”仍然在运转,那么这样的项目必然不是比特币Layer2。

除了上述“约法三章”外,Bitcoin Magazine也提到了CounterParty、Ordinals,指出这类依附于比特币、没有独立区块链结构的资产协议,不属于Layer2的范畴;同时一些“寄生层”协议不满足比特币Layer2的部分条件。

但对于哪些协议属于所谓的“寄生层”(可能包括RGB协议),Bitcoin Magazine没有做出明确解释。这也让大家对Bitcoin Magazine想要表达的观点感到悬而未决。

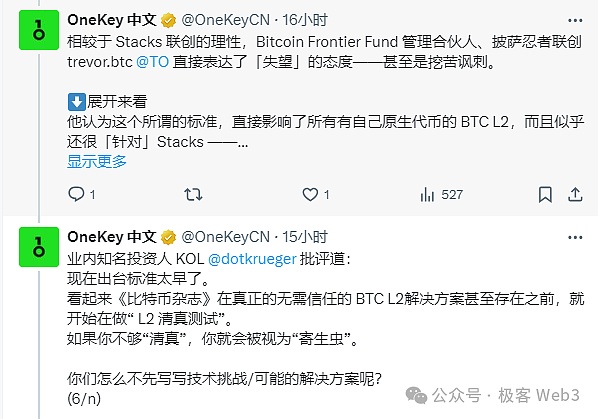

在Bitcoin Magazine的这套标准推出后,很快引来了许多人的讨论,包括Stacks侧链创始人也来表达了自己的看法。Onekey中文官推对这些有话语权的西方KOL进行了观察,很显然大家对于Bitcoin Magazine的观点褒贬不一,甚至多数人表达了反对态度。

先抛开众人的主观立场与上述Layer2定义标准的合理性不谈,Bitcoin Magazine作为一家有话语权的比特币生态媒体与研究机构,迈出了具有历史性的一步——在公开场合引发了大量对比特币Layer2定义标准的讨论,并引发了不同立场的人的支持或反对。

观感就好像2023年8月,以太坊基金会的Dankrad在推特高调宣称“不用以太坊做DA层就不算Layer2”一样。不出意外的话,关于比特币Layer2定义方式的公开讨论,将会在未来越演愈烈,直至多数专业人士达成阶段性共识为止。

基于对比特币Layer2乃至模块化区块链技术叙事的浓厚兴趣,极客web3的Research Lead雾月,邀请到了前Huobi集团的Web3技术负责人Kevin He,连同极客web3创始人Faust,进行了一场线上的闭门交流。本文将对此次线上交流的结果进行文字版梳理,帮助大家祛魅比特币Layer2的定义标准。

一

正文:1.雾月:其实,现在的比特币生态很像美国19世纪的狂野西部,许多人把比特币Layer2当做是黄金,各大创业团队就像是狂热的淘金者一样,抱紧了Layer2这个造富噱头不放。在两位嘉宾眼中,比特币Layer2的行业现状是怎样的?对于当前的比特币生态,二位抱有什么样的看法?

Faust:在我个人的眼中,当前的比特币Layer2赛道有一种混乱无序的倾向,就是说大家对于Layer2的定义也好,对Layer2的客观评判标准也罢,整体上缺乏一个共识。就拿中文区的整体观感举例,投资于比特币生态的VC、下场做Layer2的项目团队、经历过多轮牛熊的OG,彼此的观点差异甚大。有一些技术极客认为,只有UTXO编程模型才算继承了比特币的“原教旨”,EVM是异端;也有人认为,不能从比特币那里高度继承安全性,就不算Layer2。

当然,热衷于交易的Trader、专注于技术的极客们,在看待比特币Layer2的方式上有着天壤之别。此前有KOL认为,交易所也算是比特币Layer2,孙哥更是直接高喊:波场也是比特币Layer2。某些KOL则认为,比特币Layer2的评判指标应该和以太坊Layer2不一样,甚至声称:比特币Layer2必将超越以太坊Layer2,然后借此机会推广一套颇具主观色彩的理论。

这些现象只是当前比特币生态的冰山一角,自立标准、自己吆喝的现象普遍存在于大多数人身上。当然,一切所谓的“理论”,最后都要经过专业人士们的评判,目前许多关于比特币Layer2的言论,在逻辑上还不够合理。

此外,东西方社区之间也存在明显的断层,西方社区尤其是欧美国家的从业者之间一直存在着直接而频繁的交流,且技术氛围比东方圈子更浓重。当然更重要的是,比特币社区OG、以太坊基金会、Celestia基金会等专业的人或组织,在西方具有巨大的影响力,远比在东方大的多,这在很大程度上造就了东西方社区的价值观差异。

相比之下,中文社区整体上形成了一定的闭环,大家各自为政、忙于自己那一亩三分地,尚未形成一个或几个有较强专业度、有较强宣传能力的组织作为统一价值观的辐射源头,这既带来了自由,也带来了混乱。

当然,这种事情本质上是好坏参半的,但反映到比特币Layer2的技术认知上,我们可以明显的感受到东方社区相比于西方社区的不同。不过,“技术诚可贵,造富价亦高”,技术是一方面,造富效应是一方面,既然Blast那么多人都可以接受,我觉得就算某些Layer2技术不足,也不能武断否定它,最后还是要看这些项目本身能够为市场乃至于整个行业带来什么样的价值。

Kevin He:感谢主持人问题,Faust 已经表达的比较清晰了。我再补充一些个人观点:当前比特币生态,可以用百花齐放来形容。至于比特币 Layer2,则是群雄逐鹿,百舸争流的阶段。

在比特币持续减半的大背景下,比特币生态应运而生。各类基于比特币的资产协议陆续推出,打破了比特币无法轻易发行资产的固有观念,资产由此大爆发。资产的繁荣必将催生应用需求,而比特币特殊的技术条件(贵且慢)又急迫需要BTC Layer2 来承接这些资产的应用需求。

从市场来看,已经有若干项目跑的比较快,引起了东西方社区的注意。同时,技术上来讲,比特币的 Layer2 的定义,或者安全标准,都是处于缺失的状态,需要更多的有志者一起来推动共识的形成。

二

2.雾月:感谢两位老师的精彩分享。对于近期引起广泛讨论的“Bitcoin Magazine对比特币Layer2约法三章”一事,二位又怎么看?你们觉得Bitcoin Magazine提出的标准合理吗?目前西方社区很多人似乎对此事持批判态度。

Faust:其实Bitcoin Magazine提出的那三大标准,还不太精确,并且一些要点是从意识形态的角度出发的,而不是从技术角度出发,没有得到社区共识,难以作为评判Layer2的客观条件。

我个人认为,他们原本是想提出一些严格的标准,但又发现不同的比特币Layer2差异很大,没办法快速的归纳出一套通用的评估框架,偏偏又想在当前这个时间点推行一套自定义的标准,就简单的“约法三章”(Bitcoin Magazine在文章开头声明了自己推行标准的目的,在于抵制比特币生态的一些乱象)。但这种简单粗暴的方法可能无法客观衡量比特币Layer2。

在这方面,以太坊基金会的做法可能更严谨些,他们是站在技术角度开刀,针对不同的技术方案做区分,把状态通道、Plasma、Rollup等具体的技术方案归纳为Layer2,以太坊社区很多人则把Rollup之外的Validium、Optimium也归纳到Layer2范畴中。

这种先从技术角度来分类的方法,要更清晰,思路更明确。比如,状态通道和Rollup在工作机理上差异甚大,很多特征并不互通,以太坊社区就先把两者都归纳为Layer2类别里,再针对Rollup这个细分类别提出一系列评判标准。这种方法要更成熟些。

但如果硬要像Bitcoin Magazine那样,用一种宏观、通用的指标来评估整个Layer2赛道,会发现很难概括出一套细粒度的普适方法。所以如果是我的话,我会先声明:

侧链、主权Rollup、独立公链(ps:独立公链和侧链有差异)、ZK Rollup和OP Rollup,到底哪些技术类型算是Layer2,然后再落实到不同的细分概念评判上。当然,如果对比特币Layer2直接给出一套粒度不够细、比较模糊的评判方案,也不是不可以,比如我会更倾向于从抗审查性、DA实现方式、状态转换的验证途径 等业界基本有共识的点去评估,也就是先从安全性与功能拓展的角度去审视一切,因为这里面涉及到的评判方法早已成熟化,业界基本都有共识。

而Bitcoin Magazine提出的看法没有被业界共识过,掺杂了强烈的意识形态导向,尤其是第一条:Layer2必须以比特币作为native token。就算发行自己的代币,也要backed by bitcoin。

这一条标准,就连把维护ETH价格作为宗旨之一、具有中心化倾向的以太坊基金会,都不敢如此露骨的表达。对此,可能是Bitcoin Magazine不希望看到太多急功近利的团队匆忙发币,就提出了这一点,但事实上,Layer2就算发币也不影响其Native Token是啥,那句“backed by bitcoin”更是让人摸不着头脑。

至此,我个人的态度很明确:提出标准应该尽可能站在技术角度出发,少掺杂一些纯粹的意识形态。这方面以太坊社区的L2BEAT做的比较好,他们是从抗审查性、DA可靠性、状态转换结果的验证方式、Rollup合约的控制权等技术方面做科学评估,这套标准只要稍加修改,就可以套用在Celestia生态的很多模块化区块链身上,当然大面上也可以评估比特币Layer2的安全性。

但如果像Bitcoin Magazine那样,从意识形态角度定义Layer2,就太主观了。这就好比评价美国与苏联的政治制度究竟哪个更好,最后很容易演变为不同政见者的互相扣帽子。但如果从技术角度出发去评判一切,就要容易很多。

我觉得还是先从争议较少、比较容易得到共识的方向上下功夫,比如评判Layer2的安全风险、功能完备性,评判不同资产协议的隐患,从这些角度去出发,要更客观、更严谨。试图从意识形态层面去下定义,不是Bitcoin Magazine或是任何人和组织该去做的(中本聪除外)。

但有意思的地方是,Bitcoin Magazine的CEO提到,打算从L2BEAT那里招揽一名员工,来研究比特币Layer2的评判方法。估计很快他们就会把L2BEAT的一些工作成果拿来引用。

Kevin He:首先要非常赞赏 Bitcoin Magazine 的编辑们的勇气和担当,在这种大争之世下提出和践行标准,必然要招致非议,同时落地也是需要很多努力的。然而一个健康的社区,必然需要有人去做这个事情,就像我们在数月之前就尝试在社区推分类标准和安全标准的讨论。

其次,回到这个标准本身,个人认为,

1)它是基于 Ordinals 和 BitVM 的创新提出来的(没有这俩创新,比特币生态可能还是会是一潭死水)

2)个人认为属于一个比较宽泛的标准(已经很努力的尝试去团结尽量多的可团结的力量)

3)个人认为缺乏对更加本质的安全标准讨论(也就是为什么要这三个标准的底层原理)

考虑到我们之前在这方面有比较多的思考和讨论,之前主要是集中在华语圈,接下来会更多的面向更广大的受众来推广我们的草案,我们也欢迎更多的力量(包括Bitcoin Magazine)来一起共建,推动社区对于分类和安全标准共识形成。

三

3.雾月:两位老师的分享都很精彩,那么接下来我想问一个最关键的问题:你们认为,关于比特币Layer2的客观评判标准,应该怎么定义?

Faust:其实前面有表达过,就是先从技术角度,从安全性、Layer2的功能完备性等技术视角出发,少从主观的意识形态出发,多参考业界有共识的点,少自己发明新概念新思想。比特币Layer2本质上是模块化区块链和状态通道、衍生的链下资产协议的延伸,只要顺着关于这三者的既有研究结论出发,就可以了。

那些没有被业界先贤们纳入Layer2评判标准的要素,之所以没有被纳入,必然有其理由,我们应当绕开这些雷区,尽可能走前人已经踩出来的路,不要强行去沼泽地里开辟新路,这样做最后只会越陷越深。

Kevin He:我认为,要做好这套标准的推广,至少要坚持 2 个基本点:

1)尊重比特币的传统和吸取最新的进展(例如 Ordinals/BitVM)

2)吸收其它生态在 Layer2 上的探索和落地经验(例如 Ethereum Layer2)

在这两个基本点之上,形成若干普适性的/客观的/关注安全性/的标准定义,经过充分的讨论,并最终形成社区共识。一切的理论框架,都要经过若干次探讨、经过若干次修正,才可能逐渐成型,对于为比特币Layer2制定标准一事,可能还需要经过很多人和组织的共同摸索,最终市场会逐渐选拔出最合理、最能被多数专业人士乃至有常识的人们所接受的标准。这个过程交给市场自由选择,才能知道最终的答案。

Interviewer Wu Yue geek guest former group technical director geek founder two guests talked about the industry status of bitcoin ecology and their views on the proposed definition. Note: These remarks only represent the personal views of the guests and do not involve the values of geeks as a media organization. The introduction itself was called bitcoin at the beginning of the Warring States Period. In just a few months, at least one self-proclaimed project team emerged in the bitcoin ecology. Due to this field, There is a lack of authoritative voice, and people have not formed a clear and orderly judgment standard about what should be regarded as and what should not be regarded as. This ambiguity and disorder not only provide absolute freedom for developers and entrepreneurial teams, but also make various phenomena of making up narrative concepts spread freely. It is not difficult to put forward a set of simple bitcoin definition standards by relying on their status as an authoritative media organization in the bitcoin community under this chaotic and impetuous time node. It can be seen that the standard has strong bitcoin characteristics, which is quite different from the mainstream cognition of the Ethereum community. The main viewpoints mainly cover three aspects, including using bitcoin as its original asset, thinking that bitcoin should be used as its main token or account unit, and as the measurement currency of fees. If the project issues tokens by itself, the explanation here should be vague. Some people think that it seems to refer to the inscription assets such as using bitcoin as the settlement layer, and an exit mechanism must be reserved for users to enable them to Their assets are withdrawn to the top. This withdrawal mechanism can be untrusted or there can be a certain trust assumption. It seems that there must be a bridging relationship between saying and saying, or there must be a mapping relationship between assets and. The way to cross the chain bridge or withdraw assets can be not only that they don't say exactly what level of distrust they should achieve, but also that according to this standard inscription protocol or offline indexing protocol, the original protocol may not be classified into categories that are dependent on Bitcoin. If Bitcoin fails completely, it should be lip-synched. Assuming that the so-called downtime is still running, then such a project must not be bitcoin. In addition to the above three chapters of the contract, it is also mentioned that such asset agreements that are attached to Bitcoin and have no independent blockchain structure do not belong to the category. At the same time, some parasitic layer protocols do not meet some conditions of Bitcoin, but there is no clear explanation about which protocols belong to the so-called parasitic layer, including protocols, which also makes everyone feel undecided about the views they want to express. It has attracted many people's discussions, including the founders of the side chain, to express their views. Chinese officials have observed these western countries with the right to speak. Obviously, everyone has different opinions, and even most people have expressed their opposition. Let's put aside everyone's subjective position and the rationality of the above definition standards. As a bitcoin ecological media and research institution with the right to speak, it has taken a historic step, which has triggered a lot of discussions on bitcoin definition standards in public and triggered The perception of people with different positions' support or opposition is just like the Ethereum Foundation's high-profile announcement on Twitter in September that it is not necessary to use Ethereum as a layer. Not surprisingly, the public discussion on the definition of bitcoin will intensify in the future until most professionals reach a phased consensus. Based on the strong interest in bitcoin and even the technical narrative of modular blockchain, the geek's foggy month invited the technical director of the former group and the geek founder to have an online closed-door exchange. In this paper, the results of this online communication will be sorted out in text to help you disenchant the definition standard of Bitcoin. In fact, the current bitcoin ecology is very similar to the wild west of the American century. Many people regard Bitcoin as gold, and the major entrepreneurial teams hold this stunt of making money like fanatical gold diggers. What is the current situation of Bitcoin industry in the eyes of the two guests? What do you think of the current bitcoin ecology in my personal eyes? There is a tendency of chaos and disorder in the coin track, that is to say, there is no consensus on the definition of the coin track or the overall lack of a consensus. Take the overall perception of the Chinese area as an example. The project team has experienced many rounds of bull and bear, and their views are very different. Some technical geeks think that only programming models can inherit the fundamental principle of Bitcoin, which is heresy, while others think that if they can't inherit security from Bitcoin, they are not keen on trading. Geeks who focus on technology have a very different way of looking at Bitcoin. Previously, it was thought that the exchange was just the tip of the iceberg of the current bitcoin ecology, and Sun Ge shouted directly that the wave field was also bitcoin. Some people thought that the evaluation index of Bitcoin should be different from that of Ethereum, and even claimed that Bitcoin would definitely surpass Ethereum, and then took this opportunity to promote a set of subjective theories. These phenomena are just the tip of the iceberg of the current bitcoin ecology, and the phenomenon of self-reliance and self-drinking is common to most people. Of course. All the so-called theories have to be judged by professionals in the end. At present, many comments about Bitcoin are not logical enough. In addition, there is an obvious gap between the eastern and western communities. There has always been direct and frequent communication between practitioners in western communities, especially in Europe and the United States, and the technical atmosphere is stronger than that in the eastern circles. Of course, what is more important is that professional people or organizations such as Bitcoin Community Ethereum Foundation have great influence in the west than in the east. To a great extent, the differences in values between the eastern and western communities have been created. In contrast, the Chinese community as a whole has formed a certain closed loop. Everyone is busy with their own affairs, and one or several organizations with strong professionalism and strong propaganda ability have not yet formed as the radiation source of unified values. This has brought both freedom and chaos. Of course, this kind of thing is mixed in nature, but we can clearly feel that the eastern community is compared with the west in terms of technical cognition of Bitcoin. The difference between the communities is that the technology is valuable and the price is high. On the one hand, the wealth-making effect is acceptable to so many people. On the other hand, I think even if some technologies are insufficient, we can't arbitrarily deny it. Finally, it depends on what value these projects can bring to the market and even the whole industry. Thanks to the host, the question has been expressed more clearly. I will add some personal views. As for Bitcoin, the current bitcoin ecology can be described as a hundred flowers blooming. As for Bitcoin, it is a stage of competing with each other. Under the background that Bitcoin continues to be halved, various bitcoin-based assets have 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。