何必要遮遮掩掩的?谁还不是庞氏

最近越来越多的圈外朋友问我加密圈的事情,一会问这个项目,一会问哪个项目,经常还会小心翼翼的问“这是不是庞氏呀?”

我一般都回答:这就是庞氏呀,庞氏怎么了?谁还不是庞氏啦?

庞氏这个名词虽然只是一百年前才喊出来,但是已经运营几千年。

这么顽强的生命力,自有其存在的道理~

庞氏结构和庞氏骗局是有区别的

中国人提到“庞氏”总觉得是骗局,英文原文其实是“庞氏方案”。

“骗局”千万不要参与,一般这种都是血本无归的。

骗局的特点是“伪造收益”,你交出去的钱都给别人了,自己手上什么都没有。

这种情况大部分是会有个比较固定或者承诺的利息,崩盘取决于老板什么时候选择跑路。

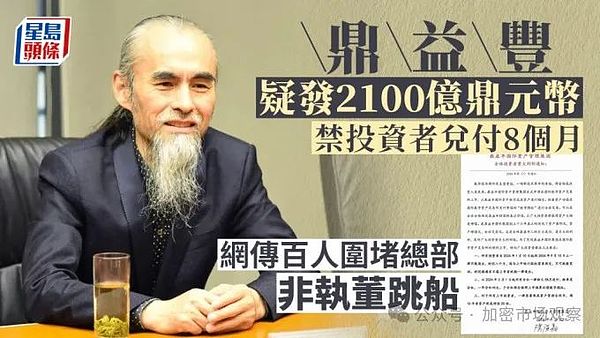

之前提到的鼎益丰,就是妥妥的庞氏玩法:金融圈的人骚起来,搞加密的都嫌辣眼睛

所有不盈利的项目,都是庞氏

盈利项目的资产价格,通常与造血能力相关。基本全世界真正的有钱人(十亿美金以上的那种),持有的资产大部分都是收租模式:现金流稳健的地产(写字楼/酒店或者Reits),债券(国债和高评级债券),和股票(苹果/腾讯这种)。

但是目前世界上大部分的上市公司股票/债券等资产,本质其实也都是庞氏结构:股票依赖投资人持续买单,公司业务获得认可;债券依赖于借新还旧,否则瞬间破产。

无论是美国国债(目前的规模靠税收还债很难了),还是大部分国家的养老金,这些普通人看起来坚不可摧的东西,也都是庞氏结构。

某国的养老金主要就依靠年轻人工作交钱,发给老年人,很大一部分老年人因为历史原因都没怎么交过养老金。

一旦工作的年轻人人数不够(例如生育率低或者失业率高等原因),那这个养老金的盘子就随时会崩。

当然也会有人说政府可以也可以印钱发养老金呀。现在美国政府就是这样,财政部大量借钱发给老百姓,以后再借新还旧。现在美国财政部借债的规模已经三十万亿美金了,可能与中国地方债(含各种隐形负债如国企担保等)的规模差不多了。

这种做法也不是不行,蒋介石就玩得很666,最后通货膨胀退守台湾。美帝国主义这几年老百姓喊得最凶的也是物价飙涨,美联储一口气加息到5%。

庞氏的基本结构

鉴于很多朋友对庞氏不是很了解,基于个人经验给大家科普一下庞氏结构的基本原理:

最顶上的呢,我们成为一层,这一层是整个结构的最早受益者。对于一家公司或者加密项目,就是原始股东;对于养老金,可以认为是领养老金的人。

中间层一般是扩散的主力,对于一个公司而言,可以是后面的投资者,也可以是上市之后的基金或者研报机构。对于加密项目,可以是KOL,也可以是社区活跃者。这一层主要起到承上启下的作用,因为项目方所能触达的用户还是有限。

下层可以认为是接盘侠,上层和中间层的套利退出,本质上都是底层在买单。

但是这里的分层并不是绝对的。例如狗狗币这个项目一开始就很山寨,全套山寨比特币的模式。

狗狗币是13年12月份上线的,项目创始人在项目初期绝对可以说是顶层的角色了。杰克逊·帕尔默和程序开发者比利·马库斯,两人均在2015年先后卖出了所有狗狗币,退出了“狗币江湖”,并认为疯狂上涨是非理性的。

他们并没有意识到meme这个赛道,在2015年的时候就卖出了所有狗狗币,收益应该只有几万美金。

然而后面随着马斯克加持狗狗币,狗狗币迎来暴涨,现在这个项目市值一百多亿美金,流动性比90%的美股都高。

在这个过程中,暴涨前持有狗狗币的人,都算是顶层(获利随时可退出),马斯克其实只算中间层(影响底层),高点冲进去的用户,就是接盘侠。

玩庞氏的关键在于入场时机

所以玩庞氏,入场时机很重要。

例如某国养老金,获利最大的是没交养老金,而领取养老金最多的人(罗斯福新政之前的老兵/公务员等)。而后面交养老金的年轻人在美国政府解决生育率率/失业率问题之前,后面他们领谁交的养老金就会是个很大的问题。

要么领取的养老金太少不够生活,要么就一把年纪继续要出去打工。

现在美国和日本,随处可见老年人在餐馆打工/开出租车。

股票和加密的投资也是一样,要在一个业务模式在被广泛认可前买入,充分认可后退出。(如果业务实现造血能力,可以不退出)。

这就是为什么公司融资希望可以找明星机构背书,而加密的项目则很看重社区活跃。因为明星机构和活跃的社区,都是CX能力很强的。

而业务模式一旦证伪,那对项目而言几乎是死刑。传统公司的业务模式证伪的原因有很多,有技术落后/市场被友商占领/资金流断裂等各种原因。

加密的项目则好很多,因为大部分加密的业务都不赚钱,发币之后也不用维护,就连FTX这种骗子项目的代币,交易量也还可以。

对于加密项目而言,只要不是项目方跑路,庞氏的游戏一直可以玩下去。Filecoin/ICP这些上个周期暴跌百倍的老项目,这几个月不是又活过来了么?

而一个项目如果可以升级到meme的段位(类似FTT),就算项目方被抓,也不影响币价继续涨。

FTT现在市值5亿多美金,每天换手率5%,也秒杀80%的港股了。

只许州官放火,不许百姓点灯?

在加密行业出来之前,庞氏的游戏可以说只允许权贵玩,不允许普通人玩。

美股号称全球最NB的股市,70%的股票也是会在上市后的10年内归零的。

大家看美股好像天天在涨,其实就是那几十个美股龙头在涨,带动了大盘的指数一直创新高。

看这个比例,是不是和加密行业差不多?

加密行业的币虽然多,头部几个币的市值还是很坚挺的。

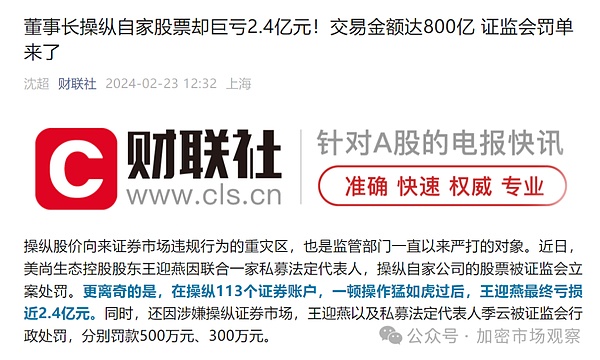

其实全世界除了中国,大部分国家(包括美国)是没有传销这个罪的。因为他们自己也心知肚明很多东西就是庞氏结构。但是美国打击的是“诈骗”/“内幕交易”/“市场操纵”。就算保护底层的投资者不能随便被中上层收割。

加密行业从技术上其实更有利于打击“内幕交易”和“市场操纵”,因为每个钱包地址的交易数据都在链上。

无法证伪的模式,最持续

以前无论是证券交易,还是养老金的运营,都需要一笔不小的开支来养活中间服务的人。

上市公司需要养财务/审计/董秘这些成本,养老金还要给基金管理人交管理费。

而加密代币则什么成本都没有,现在很多加密项目也都是分布式办公,业务数据全在链上,中间服务完全可以由几行代码执行。

而meme这种代币则是连业务都没有,完全不用担心业务风险。只要这个meme能够传播出去深入人心,那上涨的空间也是无上限。

今年北美已经跑出来巨魔Troll和Trump,去年跑出了Pepe

Troll和Trump这两个北美meme如果在两个月前持有的话,都有几百倍的收益。

不知道华人能不能干出一个我们自己的meme

Recently, more and more friends outside the circle have asked me about the encryption circle. I will ask this project for a while and which project for a while, and I will often ask carefully if this is Ponzi. I usually answer that this is Ponzi. What happened to Ponzi? Who is not Ponzi? Although the term Ponzi was only shouted a hundred years ago, it has been in operation for thousands of years. Such a tenacious vitality has its own reasons. There is a difference between Ponzi structure and Ponzi scheme. People in China always think that Ponzi is a scam. Never participate in the Ponzi scheme scam. Generally, this kind of scam is characterized by fraudulent income. All the money you hand over is given to others, and there is nothing in your hand. Most of this situation will have a relatively fixed or promised interest collapse, depending on when the boss chooses to run away. Ding Yifeng mentioned before is a proper Ponzi game. People in the financial circle are too spicy to engage in encryption. All unprofitable projects are Ponzi profit-making projects. The asset price is usually related to hematopoietic energy. Basically, the real rich people in the world hold assets of more than one billion dollars, most of which are real estate, office buildings, hotels or bonds with stable cash flow, high-rated bonds and stocks such as Apple Tencent, but at present, most of the listed companies in the world are actually Ponzi-structured stocks, stocks and other assets, which depend on investors to continue to pay for the company's business, and bonds depend on borrowing the new and returning the old, otherwise they will go bankrupt instantly, regardless of the current size of US Treasury bonds. It is difficult to pay off debts through taxes, or the pensions of most countries. These seemingly indestructible things of ordinary people are also Ponzi structures. The pensions of a certain country mainly rely on young people to work and pay money to the elderly. For historical reasons, a large number of elderly people have not paid much pensions. Once the number of young people working is insufficient, such as low fertility rate or high unemployment rate, the pension plate will collapse at any time. Of course, some people will say that the government can also print money to pay pensions. Now it is beautiful. That's what the Chinese government does. The Ministry of Finance lends a lot of money to the people, and then borrows the new and repays the old. Now the size of the US Treasury's borrowing has reached 30 trillion US dollars, which may be similar to the size of China's local debt containing various invisible liabilities, such as state-owned enterprise guarantees. This practice is not impossible. Chiang Kai-shek finally played badly. Inflation retreated to Taiwan Province and US imperialism. In recent years, the most fierce cry of the people is that prices have soared, and the Federal Reserve has raised interest rates to Ponzi's basic structure in one breath. Understand the basic principle of Ponzi structure based on personal experience. At the top, we become a layer. This layer is the earliest beneficiary of the whole structure. For a company or encryption project, it is the original shareholder. For pensions, it can be considered as the pensioner. Generally, the middle layer is the main force of diffusion. For a company, it can be the investor behind, or the fund or research institute after listing. For encryption projects, it can be the main one of community activists. It plays the role of connecting the preceding with the following, because the users that the project can reach are still limited. It can be considered as the arbitrage withdrawal of the upper and middle layers of the receiver. Essentially, the bottom layer is paying the bill, but the stratification here is not absolute. For example, dogecoin was a cottage bitcoin model from the beginning. dogecoin was the founder of the project launched in January, and at the beginning of the project, it can be said that Jackson Palmer and program developer Billy Marcus were both top-level roles. Having sold all of dogecoin's money, they think that the crazy rise is irrational. They don't realize that this track sold all of dogecoin's income in 2000, and the profit should only be tens of thousands of dollars. However, with Musk's blessing to dogecoin and dogecoin, the market value of this project is now more than 10 billion dollars, and the liquidity ratio of US stocks is higher. Before the surge in this process, those who hold dogecoin are considered as top-level profits, and they can withdraw at any time. In fact, Musk is only the middle layer that affects the bottom high point. The user who rushes in is the pick-up man. The key to playing Ponzi is the time to enter, so it is very important to play Ponzi. For example, the person who earns the most from a country's pension is the veteran civil servant before Roosevelt's New Deal, while the young people who pay the pension later will be a big problem until the US government solves the problem of fertility rate and unemployment rate. Either they receive too little pension to live on or they will continue to leave at an age. Nowadays, it can be seen everywhere in the United States and Japan that the elderly work in restaurants, drive taxis and invest in encryption. It is also the same to buy a business model before it is widely recognized and then quit. If the business achieves hematopoietic capacity, it can not quit. This is why the company hopes to find endorsement from star institutions, while encrypted projects attach great importance to community activity, because star institutions and active communities are very capable, and once the business model is falsified, it will almost be the death penalty for the project. There are many reasons why the business model of traditional companies is falsified, such as backward technology, the market occupied by friends, broken capital flow and other reasons. The encrypted projects are much better because most of the encrypted businesses don't make money and don't need to be maintained after issuing coins. Even the token trading volume of this scam project can be played for encrypted projects, as long as it is not the project side that runs away, Ponzi's games can always be played. Didn't these old projects, which plummeted a hundred times in the last cycle, come back to life in recent months? The level that can be upgraded is similar, even if the project party is arrested, it will not affect the currency price to continue to rise. Now, Hong Kong stocks with a market value of more than 100 million US dollars and a daily turnover rate are also spiked. Only state officials are allowed to set fire to prevent people from lighting up. Before the encryption industry comes out, Ponzi's game can be said that only dignitaries are allowed to play, but ordinary people are not allowed to play. The stocks of the US stock market, which is known as the world's most popular stock market, will also return to zero within the year after listing. As you can see, US stocks seem to be rising every day Look up to see if this ratio is similar to that of the encryption industry. Although the market value of the coins in the encryption industry is still very strong, in fact, most countries in the world except China, including the United States, do not commit pyramid schemes because they know that many things are Ponzi structures, but the United States is cracking down on fraud, insider trading and market manipulation. Even if the bottom investors are not protected from being harvested by the middle and upper classes, the encryption industry is actually technically more conducive to cracking down on insider trading and market manipulation because the transaction data of every wallet address is in the chain, and the pattern of fraud can not be falsified until the last. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。