涉及7400万美元 一家已倒闭的香港交易所 Atom Asset (AAX) 逃避反洗钱(AML)分析

近期,一家已倒闭的香港交易所 Atom Asset (AAX) 开始将资金从其钱包转移到各种去中心化交易所和中心化平台,据称是为了逃避反洗钱(AML)控制。

在被发现之前,最后一次已知的涉及 AAX 交易所钱包的交易发生在 2023 年 10 月和 2022 年 11 月。在倒闭之前,AAX 是香港最大的加密货币交易所之一,拥有超过 200 万用户。

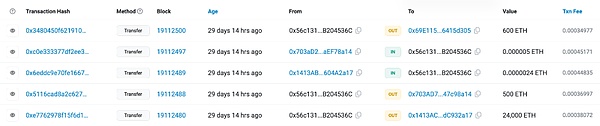

根据Beosin团队的分析,发现自2024年1月29日起,AAX交易所开始将25100枚ETH从其交易所钱包向外转移,其中转移资金共分了三笔,分别是一笔500ETH、一笔600ETH、一笔24000ETH。转移资金根据当前价格换算超7400万美元。究竟是怎么回事,这家交易所还有哪些不可告知的链上数据蹊跷,请和我们继续往下看。

AAX交易所事件来龙去脉

2022 年 11 月 13 日,就在加密货币交易所 FTX 申请破产后两天,AAX 也因交易对手风险暴露而停止提款并清除了所有社交渠道。最初,AAX 将冻结归因于针对涉嫌恶意攻击的安全措施。

2022年11月15日,AAX交易所发布声明表示其平台需要进行维护,除暂停提现外,将对衍生品进行自动清算。此后,AAX停止了平台运行和社交媒体的更新。

而蹊跷的事就在于:沉寂426天后,AAX交易所钱包开始活动,开始有大额资金开始转出至其它地址,尝试躲避AML工具的识别和监控!

link: https://etherscan.io/address/0x56c1319b31a5316a327bd889d58c8633b204536c

AAX交易所事件链上资金分析

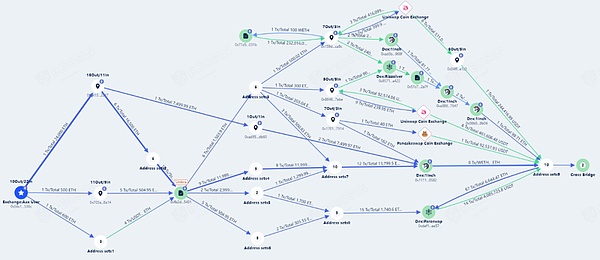

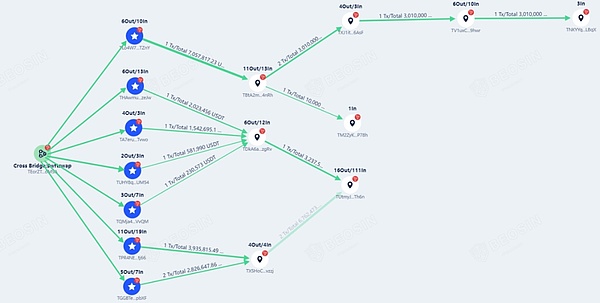

Beosin KYT反洗钱分析平台对AAX交易所钱包近期的链上活动进行了深入研究,发现了一系列风险活动。首先,所有的25100枚ETH已被转移,操作人员采取了各种手段将部分ETH兑换为USDT,然后通过Cross Bridge跨链桥将资金转移到不同的区块链上,以进行资金的清洗。

Beosin KYT反洗钱平台

其中,大部分资金被转移到了Tron区块链上,并通过一些地址进行中转,然后沉淀在某些地址中,未曾转移。这种行为表明了明显的逃避AML的企图,试图掩盖资金的真实来源和去向。

Beosin KYT反洗钱平台

香港警方针对诈骗活动迅速采取行动,逮捕了两名与AAX相关的人员,目前正在努力绘制转移资金的路径并找回受影响用户的资产。

AAX交易所利用去中心化交易所、加密货币兑换和跨链桥等技术手段,试图模糊资金流动的路径和来源。这为监管机构和AML分析平台带来了巨大的挑战。

如何解决加密货币洗钱难题?

由于加密资产的匿名性、便利性和去中心化特性,不法分子会选择使用加密资产转移其非法获利的资金,监管机构与虚拟资产服务提供商(诸如加密货币交易所、加密钱包提供商、加密资产支付处理商等)面临着反洗钱及反恐怖融资等挑战。

对于监管机构而言,相关部门应完善和执行监管政策,确保虚拟资产服务提供商遵守AML和KYC规定,同时加强与各国家和地区监管机构的合作,共同打击跨境洗钱活动。

对于虚拟资产服务提供商而言,以下是防范非法资金的有效措施:

1. 实施严格的KYC和AML规定

交易所应该要求用户进行全面的身份验证,并确保他们符合KYC和AML规定。这包括收集用户的身份信息、地址验证和其它必要的资料。

2. 监控交易活动

虚拟资产服务提供商应该实施实时监控系统,以便检测和分析可疑交易活动。这包括监控交易金额、频率、来源和目的地等信息。交易所可利用 Beosin KYT 对每一笔交易进行定位,对用户进行画像,对交易进行评级,识别链上犯罪行为,从而降低犯罪者利用虚拟资产洗钱的风险。

3. 设立报告机制

虚拟资产服务提供商应建立报告机制,通过风控系统报告任何可疑交易或活动。虚拟资产服务提供商应及时处理这些报告,并与监管机构合作进行调查。Beosin KYT 可为虚拟资产服务提供商出具可疑交易报告(STR),帮助监管机构和执法机构进行取证调查。

4. 加强合作与交流

虚拟资产服务提供商应积极与安全公司、监管机构和执法机构合作,共同打击洗钱活动。可以预见,犯罪分子会不断调整和改进其洗钱策略,以适应监管措施和AML工具的变化。他们可能采取分散化的交易方式、使用隐蔽的交易路径或利用技术漏洞来隐藏非法资金流动。虚拟资产服务提供商应定期与安全公司进行合作交流,及时识别和应对这些变化。

Beosin注重KYT反洗钱工具的持续更新和优化,我们不断监测行业动态和新的安全威胁,将最新的分析成果和数据应用于Beosin KYT工具的改进中。这种持续的更新和优化确保了 Beosin KYT 在面对不断变化的恶意洗钱行为时能保持高度的敏感性和准确性。

总结

AAX交易所事件再次凸显了反洗钱的重要性。为了更好地应对类似事件,监管机构需要与虚拟资产服务提供商、区块链安全合规公司加强合作,共享信息和最佳实践,引入先进的反洗钱分析工具和平台,如 Beosin KYT 反洗钱分析平台,以加强对链上资金流动的监测和分析能力。

Recently, a closed Hong Kong exchange began to transfer funds from its wallet to various decentralized exchanges and centralized platforms, allegedly in order to avoid anti-money laundering control. Before it was discovered, the last known transaction involving the exchange wallet occurred in June and June, and before it closed down, it was one of the largest cryptocurrency exchanges in Hong Kong with more than 10,000 users. According to the analysis of the team, it was found that the exchange began to transfer money from its exchange wallet on June, and the transferred funds were shared. The three transfers are one at a time, and the funds are converted into more than 10,000 US dollars according to the current price. What is going on in this exchange? What are the unknowable data in the chain? Please continue to look at the ins and outs of the exchange incident with us. On the day of the month, two days after filing for bankruptcy in the cryptocurrency exchange, the withdrawal was stopped and all social channels were cleared. At first, the freeze was attributed to security measures against suspected malicious attacks. On the day of the month, the exchange issued a statement saying that it was flat. The platform needs to be maintained, except for the suspension of cash withdrawal, and the derivatives will be automatically liquidated. Since then, the platform operation and social media update have stopped. The strange thing is that after the silence, the exchange wallet began to move, and a large amount of money began to be transferred to other addresses, trying to avoid the identification and monitoring of tools. The anti-money laundering analysis platform has conducted in-depth research on the recent online activities of the exchange wallet and found a series of risk activities. First, all the money has been transferred to the operator. Members have adopted various means to convert part of the money into money and then transfer it to different blockchains through a chain bridge to clean the money. Most of the money has been transferred to the blockchain and transferred through some addresses, and then deposited in some addresses. This behavior shows an obvious attempt to escape and try to cover up the real source of the money and go to the anti-money laundering platform. At present, the Hong Kong police have taken prompt action against fraud and arrested two related personnel. Efforts are being made to draw the path of transferring funds and retrieve the assets of the affected users. The exchange uses decentralized exchanges, encrypted currency exchange and cross-chain bridges to try to blur the path and source of capital flow, which brings great challenges to regulators and analysis platforms. How to solve the problem of money laundering in encrypted currency? Because of the anonymity, convenience and decentralization of encrypted assets, criminals will choose to use encrypted assets to transfer their illegal profits. Suppliers such as cryptocurrency exchange, cryptowallet provider, cryptoasset payment processor, etc. are facing challenges such as anti-money laundering and anti-terrorist financing. For regulators, relevant departments should improve and implement regulatory policies to ensure that virtual asset service providers abide by and regulations, and at the same time strengthen cooperation with regulatory agencies in various countries and regions to jointly crack down on cross-border money laundering activities. For virtual asset service providers, the following are effective measures to prevent illegal funds. Strict implementation and regulations should be required by the exchange. Users carry out comprehensive identity verification and ensure that they meet the requirements, which includes collecting users' identity information, address verification and other necessary information to monitor transaction activities. Virtual asset service providers should implement real-time monitoring systems to detect and analyze suspicious transaction activities, which includes monitoring transaction amount, frequency, source and destination, etc. Information exchanges can use the positioning of each transaction to image users and identify crimes in the chain, thus reducing criminals' use of virtual. The risk of money laundering of assets to be proposed shall be reported by the virtual asset service provider, which shall report any suspicious transactions or activities through the risk control system. The virtual asset service provider shall promptly handle these reports and cooperate with the regulatory agencies to investigate, and may issue suspicious transaction reports for the virtual asset service provider, help the regulatory agencies and law enforcement agencies to conduct evidence collection and investigation, and strengthen cooperation and exchange. The virtual asset service provider shall actively cooperate with the regulatory agencies and law enforcement agencies of security companies to jointly fight. Combating money laundering can foresee that criminals will constantly adjust and improve their money laundering strategies to adapt to changes in regulatory measures and tools. They may adopt decentralized trading methods, use hidden trading paths or use technical loopholes to hide illegal capital flows. Virtual asset service providers should cooperate and communicate with security companies regularly, identify and respond to these changes in a timely manner, and pay attention to the continuous updating and optimization of anti-money laundering tools. We constantly monitor industry trends and analyze the latest security threats into. Results and data are applied to the improvement of tools. This continuous updating and optimization ensures that we can maintain a high degree of sensitivity and accuracy in the face of ever-changing malicious money laundering. Summarizing the exchange events once again highlights the importance of anti-money laundering. In order to better cope with similar events, regulators need to strengthen cooperation with the virtual asset service provider blockchain security compliance company, share information and best practices, and introduce advanced anti-money laundering analysis tools and platforms such as anti-money laundering analysis platform to strengthen the monitoring and analysis ability of capital flows on the chain. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。