你没有错过比特币 更不会错过山寨币

在BTC一阵高过一阵的、令人头晕目眩的急速攀升中,我们送走了2024年暴涨的2月,迎来了忐忑不安的3月。

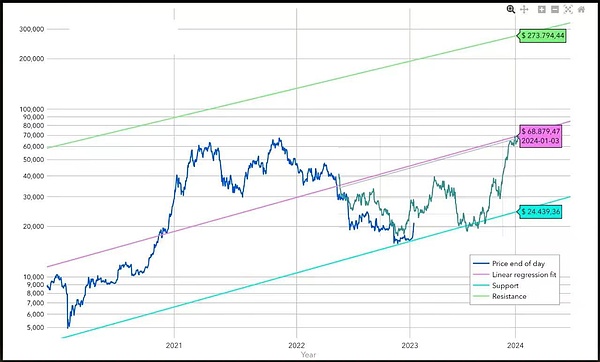

在2月最后一天的内参《急冲前高已近应验,敢问前路又在何方?》中,教链把早在2023年1月16日《比特币2023价格前瞻》文中所画的“比特币呼吸图”翻出来贴上去,就是下面这幅图:

一年过去。尾端向水面急冲,竟果然不出所料。笔者不禁怀疑,这比特币真的仿佛是有生命一般,呼吸,呼~吸~,吸~~呼~~

俗世人间,大抵是鼓吹AI人工智能似乎就要迈向AGI超人智能更多一些。但是在笔者看来,目前的AI,无论效果多么炸裂,终归只是一个冷冰冰的工具,毫无生命的气息;反而是不为常人所理解的BTC,更符合普利高津耗散理论所刻画的生命体的特征。

在深耕行业若干年,小有心得之后,教链在2023年6月7号启动了《八字诀 · 十年之约》。转眼三个季度过去,已是18期。

俗话说,女大18变。18岁,含苞未放的女孩就要出落成娉婷玉立的少女了。18期,按2月收盘价计算,十年之约实盘见证仓位的ROI回报率也随着BTC的骤升而骤升至99%,即接近一倍的浮盈。

三个季度,一倍。自然,第18期继续因2月收涨而不加仓。因此目前就仍有6份备用金用于后续逢跌加仓。

虽然讲过多次,但仍有朋友还是跳不出“看山是山、看水是水”的执迷,即所谓1000、18000、12000这些本金数字,本质上并不是数字,而是比例关系。要跳出来看,1000就是1份本金,18000就是18份本金,12000就是12份本金,如此种种。

在这个模型里,1份本金究竟是多少并不重要。无论它是1000、10万,还是1亿、10亿,无论它是cny,还是usd,都不重要。ROI收益率,也叫投资回报率,都不会变。

打工领工资的思维是关注绝对值。但是投资思维一定要关注百分比,即相对比例,而不要过分执著于绝对值。虽然教链在许多年前就强调过这个思维升级的重要性,具体可温习教链2021年1月18号所写的文章《要关注百分比,而非绝对值》,但是,大量的新同学、新朋友仍然固执于旧思维,会经常问出“怎么这么大、怎么这么小”这一类明显外行的问题。这种错误的思维习惯对于游弋金融市场绝对是百害而无一利的,一定要尽快转变和克服。

当BTC站上6万,冲击前高时,又有很多人开始讲诸如“错过比特币”这一类的话了。

比“错过比特币”更恶劣的话,莫过于另外一句经典话术:“你已经错过比特币了,难道还要错过XXX(山寨币)吗?” 或者 “比特币已经太贵了,XXX(山寨币)还在低位,潜力更大!”

第一种思维害人,害的是人的命运。第二种思维害人,害的是人的钱包。

第一种思维会让你不自觉地养成不懂感恩、自私自利的思维习惯。2022年底从前高6.9万跌回1.6万,你痛不欲生,后悔没有及早跳车,逃离BTC。2024年初涨到6万,你又后悔当初没有趁低价多囤一些。你只考虑自己的感受,永远把BTC当成玩弄的对象,跌了厌弃,涨了恐高,永远后悔 —— 你所后悔的,不过就是BTC没有偏爱你这个负心人罢了!

但我们知道,比特币从不辜负每一个不辜负它的人。每当BTC重回新高度,我们都不禁在心里默默感恩。涨了,我们为它鼓掌,为它喝彩,为它由衷地感到高兴;跌了,我们抄底加仓,与它一同坚守,穿越至暗时刻。是的,若要BTC不负你,你先要做到不负BTC。

借用美国总统肯尼迪的一句话,不要问BTC为你做了什么,而要问问你为BTC做了什么?

撒切尔夫人说:小心你的思维,它会成为你的语言;小心你的语言,它会成为你的行动;小心你的行动,它会成为你的习惯;小心你的习惯,它会成为你的性格;小心你的性格,它会成为你的命运。

为什么有些人命中注定拿不住BTC?根源上在于思维习惯出了问题。

教链写文章,定位从来都不是行业媒体自媒体。行业媒体自媒体们关注的多是外在,是纷纷扰扰、飘忽不定、难以捉摸的变量。教链关注的是内在,是启发心智、交流灵魂,是人性幽微、大道至简、亘古不变的不变量。教链也写外部变量,但目的不同于媒体,不是单纯为了传播、热闹,而是为了解方程,借假修真,从变量中解出不变量,窥知事物之奥妙。

其实,你远远没有错过比特币。

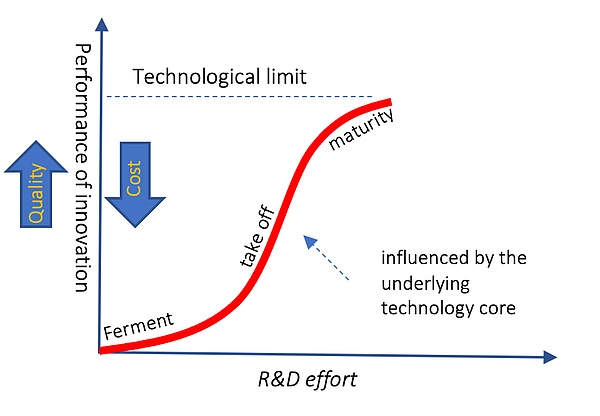

从创新增长S-曲线来看,问世仅仅15年的比特币,目前仍处于S-曲线的左端,即“发酵”阶段,距离采用率爆炸式的增长也就是“起飞”阶段尚有距离。这一点,从你身边有多少人一听说BTC就表示不理解和怀疑,甚至网上股评号下方多少对BTC充满鄙夷和仇视的留言等等,就可以见微知著。按照刘教链早在2020年12月19日文章《好戏才刚刚开始》的介绍,根据Rogers创新接受度曲线,BTC目前也才刚刚进入Early Adopters(早期接受者)阶段而已,应该还远远没到Early Majority(早期大众)的阶段。也就是说,现在进入的人,都是极早期用户。

以前的我以为,改变世界的方法就是做出伟大的产品。现在的我发现,产品无所谓伟大不伟大,最重要的是它能一直活着,特立独行地活着。活到海枯石烂,活到地老天荒,活到所有质疑它、反对它的人都死了再死、死了又死,它依然活着,人们就会被它萨特式的存在主义所征服:存在即合理,活着即伟大,活的足够久,就足以改变世界!

如果说单纯后悔“错过比特币”是自我低认知的“蠢”,那么以错过比特币为论据,引申出不可以再错过某某山寨币、模因币、土狗币的论点,那就是他人耍计谋的“坏”了。

一个初入加密市场的新韭菜,拉黑一切试图用这个逻辑说服你不要BTC、掏钱投资山寨币、模因币、土狗币的人,大概能够逃过90%的坑。

打工领工资的思维是服从,是不懂拒绝,是对别人的话永远说“是”。投资思维恰恰相反,是怀疑精神,是先拒绝再思考,是对别人的话永远先说“不”。

区块链思维把这种怀疑精神提炼地相当到位,每一个小白都应该打印出来,贴在床头:Don't trust, verify.(不要相信,要验证)

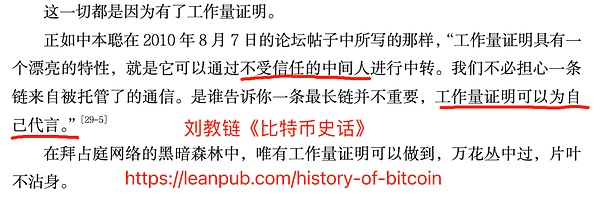

中本聪发明比特币的原点逻辑就是:不要相信任何人。所以,中本聪发明了PoW工作量证明,消除了对不可靠的人类中间方的依赖。

有人可能还是担心万一,万一真的错过了财富密码可怎么办?

其实只要稍微动脑筋思考一下就释然了:拒绝,只会减少一次损失的风险,保住了钱包里的资金,却不会增加任何错过的风险。为什么?因为投资的底层逻辑必然是,世界一定会快速发展和进步。既然在快速发展和进步,那也就等于说,未来一定会出现比刚刚拒绝的这个机会更好的、甚至好10倍、好100倍、好1000倍的机会。拒绝了眼前这个好机会,保住了本金,就保留了未来抓住更好机会的可能性。

反过来推理:如果未来的机会只会更差,不会更好,那么未来进场的人岂不是没机会超越早期进入者了?年轻人不能超越老年人,孩子不能超过父亲,一代不如一代,那么行业的结局就是衰退,人类的命运就是灭亡。只要不相信人类在走向毁灭,那么就完全可以相信世界在快速发展和进步,未来一定会有比当下拒绝的机会更大更好的机会。

只要稍微计算一下数学期望,结论就很明显了:拒绝买入山寨币的提议,避免了损失风险,还获得了未来把握更好机会的收益;接受买入山寨币的提议,承担了损失全部本金的风险,还丧失了未来遇到更好机会时进行把握的可能性。

推理到这里,有聪明人可能会反问了,这个推理对于比特币岂不也是同样?

没错。这恰恰呼应了前文所说的,你不会错过比特币。即使你6万之前,出于谨慎,或者其他任何原因,没有建仓,你也没有错过。即使BTC未来到了10万、100万甚至1000万,那个时点的人,依然不会错过。

对BTC而言,任何买点都是合理的买点,任何时刻都是可以进场的时刻,任何时候进入,都不会是一种“错过”。

原因只有一条,就是BTC活得够久,活得比任何个人、任何组织、任何国家都要更久,活出了存在即合理,活出了伟大,活到足以改变这世界。

中本聪设计比特币的核心思想,也就是这一点 —— 活着,永远活下去。

永恒存续,用投资的专业术语讲就叫做,永不退出。永不退出,所以可以拥抱未来无限时间之内的全部机会,那些好10倍、好100倍、好1000倍的所有机会。

爱因斯坦称赞,21世纪最伟大的发现是复利。而复利的核心要旨恰恰在于:永不退出。

永不退出,所以才有无限可能。

当你坐拥未来无限可能,你就永远不会错过。当你深知你永远不会错过,你就有足够底气拒绝眼下一切诱惑。

持有BTC,坐拥未来无限可能。

In a dizzying rapid climb, we sent away the soaring month and ushered in an uneasy month. On the last day of the month, the internal reference rushed forward, and the high level was nearly fulfilled. I dare to ask where the road ahead is. Turn over and post the bitcoin breathing map drawn in the bitcoin price forecast article as early as the year. The following picture shows that the end of the year rushed to the surface, but as expected, I can't help but wonder that this bitcoin really seems to be breathing like life. It is generally advocated that artificial intelligence seems to be moving towards superhuman intelligence, but in my opinion, no matter how the effect is cracked, it is only a cold tool with no life breath, but it is not understood by ordinary people, which is more in line with the characteristics of life described by Puligaozin's dissipation theory. After several years of deep cultivation in the industry, the teaching chain started the eight-character tactic on October, and it has been three quarters in the blink of an eye. As the saying goes, a girl who is old and has not put her bud will come out. The girl who has completed a graceful demeanour has completed her ten-year contract at the monthly closing price, and the rate of return of the firm witness position has also soared to nearly double the floating profit with the rapid rise. In the third quarter, the natural period has continued to increase due to the monthly increase, so there is still a reserve fund for subsequent ups and downs. Although it has been said many times, some friends still can't jump out of the obsession of seeing the mountains and seeing the water, that is, the so-called principal figures are not numbers in essence, but proportional relations. A principal is a principal, and so on. In this model, it doesn't matter how much the principal is, whether it is trillions or billions, whether it is or not, the rate of return is also called the rate of return on investment. The thinking of working and getting paid is to pay attention to the absolute value, but the investment thinking must pay attention to the percentage, that is, the relative proportion, and don't be too obsessed with the absolute value. Although the teaching chain emphasized the importance of this thinking upgrade many years ago, we can review the articles written in the month and month of the teaching chain. Instead of absolute value, a large number of new classmates and friends are still stubborn in the old thinking, and they often ask such obvious amateur questions as how so big and so small. This wrong thinking habit is absolutely harmful to cruising the financial market, so we must change and overcome it as soon as possible. When the station is high before the impact, many people start to say things like missing Bitcoin. The worse thing than missing Bitcoin is another classic saying: You have already missed Bitcoin. Do you want to? Did you miss the counterfeit currency or bitcoin is already too expensive? The counterfeit currency is still at a low level, and the potential is even greater. The first kind of thinking harms people's fate. The second kind of thinking harms people's wallets. The first kind of thinking will make you unconsciously develop the habit of not being grateful and selfish. At the end of the year, you fell back to 10,000 from the previous high. You regret that you didn't jump out of the car early and rose to 10,000 at the beginning of the year. You only consider your own feelings, and you will always be the object of playing. Fear of heights will always make you regret that you are not partial to you, a ungrateful person. But we know that Bitcoin never fails to live up to everyone who lives up to it. Whenever we return to a new height, we can't help but feel grateful in our hearts. We applaud it and cheer for it. We are sincerely happy that it has fallen. We bargain-hunting and add positions with it to stick to the dark moment. Yes, if we want to live up to you, we must first live up to it. Ask not what we have done for you, but what you have done. What did Mrs Thatcher say? Be careful with your thinking. It will become your language. Be careful with your language. It will become your action. Be careful with your action. It will become your habit. Be careful with your character. It will become your destiny. Why are some people doomed to fail? The root cause is that there is something wrong with thinking habits. The teaching chain has never been an industry media. The media in the industry pay attention to the outside world. It is always confusing and unpredictable. The teaching chain of touching variables pays attention to the inside, enlightens the mind to communicate, and the soul is the eternal invariable road of human nature. The teaching chain also writes external variables, but the purpose is different from that of the media, not simply to spread excitement, but to understand the equation, to fix the truth and solve the invariants from the variables, and to get a glimpse of the mystery of things. In fact, you are far from missing Bitcoin. From the innovation growth curve, Bitcoin, which has only been around for a year, is still at the left end of the curve, that is, the distance from the adoption rate in the fermentation stage is exploding. There is still a long way to go in the flying stage. How many people around you express their incomprehension and doubt when they hear about it? Even how many messages full of contempt and hatred are left under the online stock review number, etc., which can be seen. According to the introduction of Liu Jiaolian's article as early as March, the drama has just begun. According to the innovation acceptance curve, it has just entered the early stage of acceptance, and it should be far from the early stage of mass, that is to say, the people who are now entering are very early users. I thought it had changed the world. The way is to make a great product. Now I find that the product doesn't matter whether it is great or not. The most important thing is that it can always live, live maverick, live until the seas run dry and the rocks crumble, live until the end of time, and all those who question it and oppose it die, then die and die. It is still alive, and people will be conquered by its Sartre-style existentialism, that is, living reasonably means living great long enough is enough to change the world. If simply regretting missing bitcoin is stupid with low self-awareness, then missing bitcoin is considered as missing bitcoin. The argument leads to the argument that you can't miss a certain fake coin meme coin, that is, someone else's tricks have broken a new leek that has just entered the encryption market. Everything tries to persuade you not to pay for the fake coin meme coin, that is, people who can probably escape the pit to work and get paid. The thinking is obedience, that is, they don't know how to refuse, that is, they always say investment thinking. On the contrary, they are skeptical, that is, they refuse before thinking, and that is, they always say no to others. Blockchain thinking puts this. The spirit of doubt is quite refined. Every little white should be printed and pasted on the bedside. Don't believe that the logic of the origin of Satoshi Nakamoto's invention of Bitcoin is not to trust anyone. So Satoshi Nakamoto invented the workload certificate to eliminate the dependence on unreliable human intermediaries. Some people may still worry that 111 really missed the wealth password. In fact, as long as you think a little, you will be relieved. Rejection will only reduce the risk of one loss, but keep the funds in your wallet without increasing the risk of missing. Why is it because the underlying logic of investment must be that the world will develop and advance rapidly? 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。