灰度:比特币今年将创新高

作者:Grayscale;编译:W3C DAO

近日,灰度发布二月报告,报告指出,比特币或于今年晚些时候创下新的历史高点。以下为报告全文:

报告全文

2 月份,比特币价格上涨 45%,自 2021 年第四季度以来首次突破 6 万美元,仅比历史高点低 9%。

我们认为,价格上涨可能反映了新的美国上市 ETF 的大量资金流入以及对 4 月份比特币发行量减半的预期。

在传统资产喜忧参半的月份中,加密货币市场在 2024 年 2 月产生了稳健的回报,这得益于新现货比特币 ETF 的稳定资金流入以及各种积极的基本面发展。

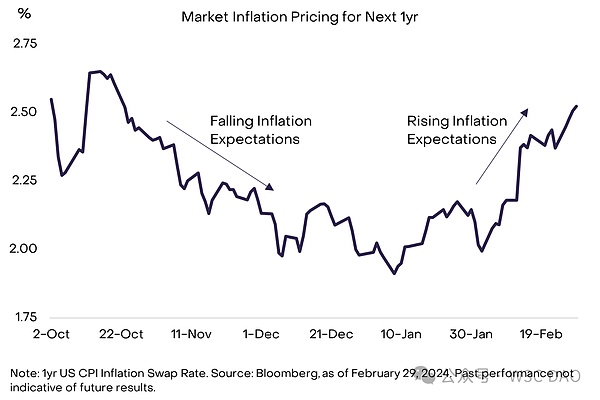

目前,数字资产估值面临的主要风险可能是美联储的货币政策:通胀在 2 月份再次抬头,这可能将降息推迟到今年晚些时候或更长时间。

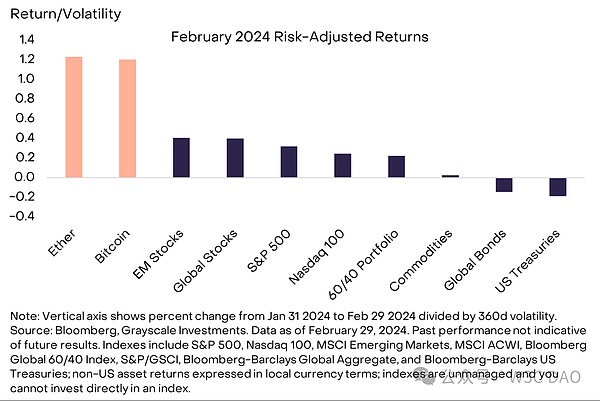

无论从绝对值还是风险调整后(相对于波动性的回报率)来看,比特币和以太币都是 2 月份加密货币和传统金融中表现最佳的资产之一。

由于通胀回升削弱了美国和欧洲央行降息的希望,全球债券市场本月下跌。股市大部分上涨,其中中国和其他新兴市场股市领涨。

尽管近年来加密货币与传统市场的相关性越来越强,但主要代币在 2 月份的表现再次凸显了加密资产类别的多元化优势。

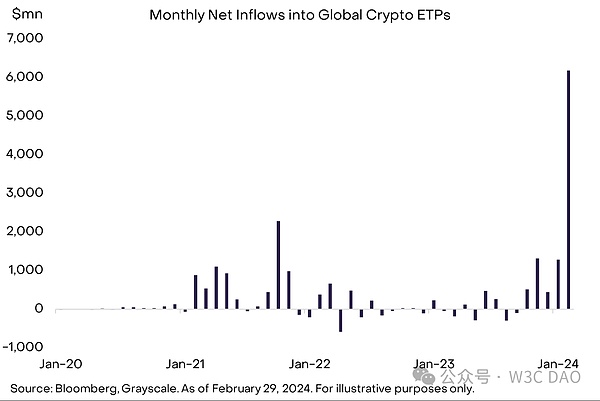

对于比特币而言,稳健的回报可能至少部分反映了新的美国上市现货比特币 ETF 的稳定资金流入。

从1月11日推出到当月月底,10只现货比特币ETF累计净流入14.6亿美元。2月份,净流入大幅加速,全月净流入达60亿美元。对于整个加密货币交易所交易产品 (ETP),我们估计 2 月份净流入总额为 62 亿美元,是 2021 年 10 月以来月度记录的两倍多。

值得注意的是,自现货比特币 ETF 推出以来,在美国上市的黄金 ETF 出现了净流出,这或许表明投资者从一种“价值储存”资产转向另一种资产。

从现货比特币 ETF 流入的角度来看,按照当前的区块奖励率,比特币网络每天会生产约 900 个新币,即价值约 5400 万美元的比特币(假设每枚币的平均价格为 6 万美元)。

到 2024 年 4 月,比特币发行量将下降一半——这一事件每四年安排一次,被称为“减半”——届时每日发行量将降至 450 个比特币,即价值约 2700 万美元的比特币 。

2 月份,美国上市现货比特币 ETF 的净流入量平均每天为 2.08 亿美元,甚至在减半之前也远远超过新增供应的速度。我们认为,新需求与有限的新发行之间的不平衡可能导致了估值的上升。

尽管比特币在 2 月份带来了稳健的回报,但它还是被市值第二大加密资产以太坊 (ETH) 击败,后者在当月上涨了 47%。

市场似乎正在期待定于 3 月 13 日进行的以太坊网络关键升级。以太坊正在追求模块化设计理念,随着时间的推移,连接到第 1 层主网的第 2 层区块链上将发生更多活动。

即将到来的升级将通过为 Layer 2 提供以太坊上的指定存储空间来适应这种增长,旨在降低其数据成本,从而期望提高其运营利润。以太坊还可能受益于其他有利因素,包括对“重新抵押”技术的关注 —— 该领域的领导者 Eigenlayer 在本月从风险投资公司 a16z 筹集了 1 亿美元——以及对未来的预期ETH 丹佛会议,以及 ETH ETF 监管部门批准的前景。

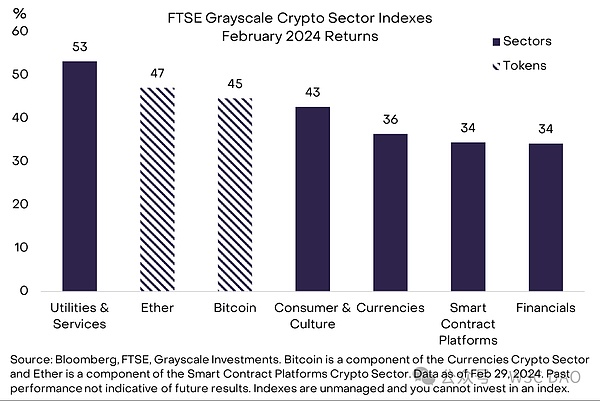

2 月份表现最好的细分市场是 公用事业和服务加密货币领域,上涨了 53%。该产品类别包括与人工智能(AI)技术相关的代币,其中一些技术获得了巨大的收益。

虽然最初设计时并未考虑人工智能应用,但我们预计 Filecoin (FIL) 已受益于市场对此主题的兴趣。该项目最初侧重于去中心化存储,但现在包括智能合约和计算基础设施,这可能会与基于区块链的人工智能应用程序带来协同效应。2 月 16 日,Filecoin 宣布与 Solana 集成,为网络提供去中心化的区块历史记录。Filecoin 目前在去中心化数据存储领域占据主导市场份额(~99%)。

另一方面,金融加密货币行业上涨了 34%。升值的部分原因是去中心化交易所(DEX) Uniswap的治理代币激增。该平台通过交易费用产生收入,当用户访问前端网站时,其中一部分将转入 Uniswap 基金会。然而,目前没有任何收入直接流向 UNI 治理代币的持有者。

2 月 23 日,Uniswap 基金会的治理负责人提议将费用收入直接分配给 UNI 持有者,这些持有者将代币质押在平台上并委托投票权。如果实施,UNI 代币将从交易量最大的去中心化金融应用程序之一中获得部分交易费用。

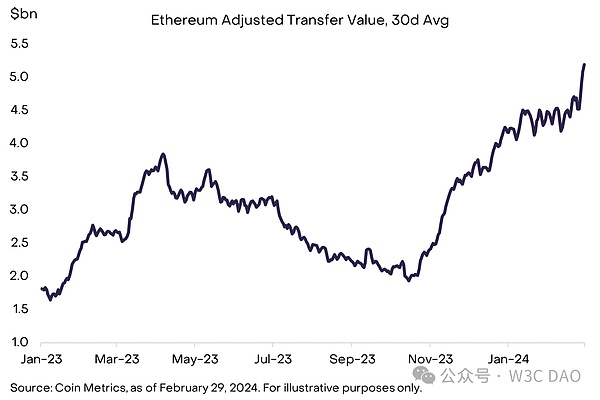

二月份估值的上涨伴随着交易量的增加和各种链上指标的上升,尤其是以太坊。例如,根据 Coin Metrics 数据,2 月份 ETH 日均现货交易量达到 58 亿美元,为 2021 年 9 月以来的最高水平。以太坊网络上所有转账的价值也增至 2022 年 6 月以来的最高水平。

最后,本月稳定币总市值又增加了 55 亿美元。相关新闻中,稳定币发行商 Circle 宣布将停止支持 Tron 区块链上的 USDC。约 80% 的 USDC 流通在以太坊网络上,只有约 1% 在 Tron 上(其中 Tether 是主要的稳定币)。

在比特币 ETF 流入和各种基本面积极因素的支持下,加密货币市场今年表现强劲。然而,上一个加密周期的一个重要教训是,美联储货币政策和经济状况等宏观因素可能会严重影响加密资产估值。

如果宏观市场前景保持乐观,该行业的许多有利因素——包括比特币减半和以太坊即将升级——可能会导致代币价格在今年进一步上涨。比特币的价格目前仅比历史高点低 9%,因此今年晚些时候可能会创下新的历史高点。

相比之下,不太有利的宏观前景可能会抑制估值。2023 年第四季度,比特币可能受益于 美联储从加息转向降息的转变。

如果央行确实在未来几个月降息,可能会削弱美元并支撑与美元竞争的资产(包括比特币)的估值。但在 1 月份,美国通胀的稳步下降似乎在某些措施上放缓或暂停,市场开始对通胀前景走高。如果通胀仍然居高不下,美联储官员可能会考虑将降息推迟到今年晚些时候或 2025 年。一般来说,美国利率上升可能对美元价值有利,对比特币可能不利。

我们认为,最有可能的结果是美国消费者价格通胀将继续下降,从而促进美联储最终降息。但加密货币投资者应关注即将发布的通胀报告以及美联储在 3 月 20 日下次会议上更新的政策利率指引。

写在最后

The author compiled the recent February report on the release of gray scale, which pointed out that bitcoin may hit a new historical high later this year. The following is the full text of the report. The price increase of bitcoin in January exceeded 10,000 US dollars for the first time since the fourth quarter of 2008, which was only lower than the historical high. We believe that the price increase may reflect the massive capital inflow of the new US listing and the expectation of halving the circulation of bitcoin in January. In the month of mixed traditional assets, the cryptocurrency market produced a steady return in June. This is due to the stable capital inflow of new spot bitcoin and various positive fundamental developments. At present, the main risk faced by digital asset valuation may be that the Fed's monetary policy inflation rose again in January, which may postpone the interest rate cut until later this year or longer. Both bitcoin and ethereum are one of the best performing assets in monthly cryptocurrency and traditional finance in terms of absolute value and risk-adjusted return rate. Due to the rebound of inflation, the United States and China have weakened. The European Central Bank hopes to cut interest rates. The global bond market fell this month, and most of the stock markets rose, led by China and other emerging markets. Although the correlation between cryptocurrencies and traditional markets has become stronger in recent years, the performance of major tokens in January once again highlighted the diversified advantages of cryptoassets. For bitcoin, the steady return may at least partially reflect the stable capital inflow of the new US-listed spot bitcoin from the launch on June to the cumulative net inflow of spot bitcoin at the end of the month. The monthly net inflow of US$ 100 million has greatly accelerated, reaching US$ 100 million. For the products traded on the whole cryptocurrency exchange, we estimate that the total monthly net inflow is US$ 100 million, which is more than twice the monthly record since January. It is noteworthy that there has been a net outflow of gold listed in the United States since the launch of spot bitcoin, which may indicate that investors have switched from one value storage asset to another. From the perspective of the inflow of assets from spot bitcoin, according to the current block reward rate, bitcoin networks will produce every day. Suppose that the average price of each coin is $10,000, and the circulation of bitcoin will be reduced by half every four years, which is called halving. At that time, the daily circulation will be reduced to $10,000, and the net inflow of spot bitcoin listed in the United States will be $100 million on average every day, even before halving, it will far exceed the speed of new supply. We believe that the imbalance between new demand and limited new issuance may lead to Although bitcoin brought a steady return in January, it was defeated by Ethereum, the second largest encryption asset by market value, which rose in the month. The market seems to be looking forward to the key upgrade of Ethereum network scheduled for June. Ethereum is pursuing the modular design concept. As time goes by, more activities will occur in the first-tier blockchain connected to the first-tier main network. The upcoming upgrade will adapt to this growth by providing designated storage space on Ethereum, aiming to reduce it. Data cost, so as to expect to improve its operating profit, Ethereum may also benefit from other favorable factors, including the concern about remortgage technology. The leaders in this field raised $ billion from venture capital companies this month, as well as the expectation of the future Denver conference and the prospect approved by the regulatory authorities. The market segment with the best performance in the month is public utilities and services, and the cryptocurrency field has risen. This product category includes tokens related to artificial intelligence technology, and some technologies have gained huge profits, although. The original design did not consider the application of artificial intelligence, but we expect to have benefited from the market's interest in this topic. At first, the project focused on decentralized storage, but now it includes smart contracts and computing infrastructure, which may bring synergy with the application of artificial intelligence based on blockchain. The announcement and integration on March provide decentralized block history for the network, which currently occupies a dominant market share in the field of decentralized data storage. On the other hand, the financial cryptocurrency industry has risen and appreciated. The reason is that the governance tokens of decentralized exchanges have surged, and the platform generates revenue through transaction fees. When users visit the front-end website, some of the revenue will be transferred to the foundation. However, at present, there is no direct flow of revenue to the holders of governance tokens. The head of governance of the foundation proposed to distribute the fee income directly to the holders, who pledged the tokens on the platform and entrusted the voting rights. If the tokens are implemented, they will get part from one of the decentralized financial applications with the largest transaction volume. The increase in the valuation of transaction costs in February is accompanied by the increase in transaction volume and various indicators on the chain, especially in Ethereum. For example, according to the data month, the daily average spot transaction volume reached US$ billion, the highest level since June, and the value of all transfers on Ethereum network also increased to the highest level since June. Finally, the total market value of stable currency increased by US$ billion this month. In related news, the issuer of stable currency announced that it would stop supporting the circulation of contracts on the blockchain, and only about one of them was on Ethereum network. The main stable currencies are supported by the inflow of bitcoin and various fundamental positive factors. The cryptocurrency market has performed strongly this year. However, an important lesson of the last cryptocurrency cycle is that macro factors such as the Federal Reserve's monetary policy and economic situation may seriously affect the valuation of cryptoassets. If the macro market prospects remain optimistic, many favorable factors in the industry, including the halving of bitcoin and the upcoming upgrade of Ethereum, may lead to a further increase in token prices this year. At present, the price of bitcoin is only higher than history. The high point is low, so it may hit a new all-time high later this year. In contrast, the unfavorable macro outlook may inhibit the valuation. In the fourth quarter of the year, Bitcoin may benefit from the Fed's shift from raising interest rates to cutting interest rates. If the central bank does cut interest rates in the next few months, it may weaken the dollar and support the valuation of assets competing with the dollar, including Bitcoin. However, the steady decline in inflation in the United States seems to slow down or suspend in some measures, and the market will start to rise to the inflation outlook if inflation remains. High Fed officials may consider postponing interest rate cuts until later this year or 2008. Generally speaking, the rise in US interest rates may be beneficial to the value of the dollar and unfavorable to Bitcoin. We believe that the most likely result is that consumer price inflation in the United States will continue to decline, thus promoting the Fed to finally cut interest rates. However, cryptocurrency investors should pay attention to the upcoming inflation report and the policy interest rate guidelines updated by the Fed at its next meeting on March. 比特币今日价格行情网_okx交易所app_永续合约_比特币怎么买卖交易_虚拟币交易所平台

灰度发布二月市场报告指出比特币价格 2 月上涨约 45%,自 2021 年第四季度以来首次突破 6 万美元。

注册有任何问题请添加 微信:MVIP619 拉你进入群

打开微信扫一扫

添加客服

进入交流群

1.本站遵循行业规范,任何转载的稿件都会明确标注作者和来源;2.本站的原创文章,请转载时务必注明文章作者和来源,不尊重原创的行为我们将追究责任;3.作者投稿可能会经我们编辑修改或补充。